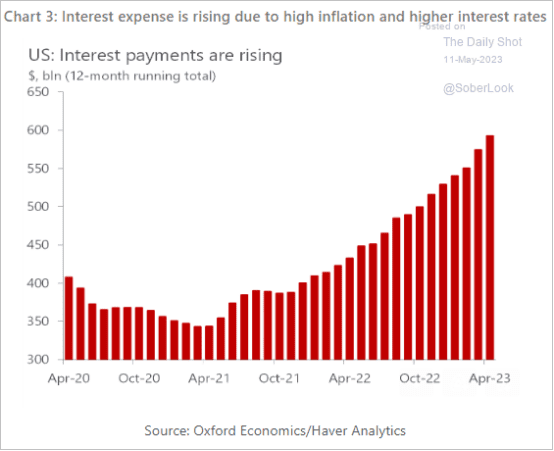

Chart of the day below!

Asia mostly RED….Europe Green….again

- Hong Kong: Hang Seng closed down -0.59%

- China CSI 300 -1.33%

- Taiwan KOSPI -0.63%

- India Nifty 50 +0.08%

- Australia ASX -0.03%

- Japan Nikkei +1.34%

- All European bourses all in positive territory so far this morning

- US indices in positve territory so far in pre-market, USD flat

Overnight Data/News

- PBoC Sets Yuan Mid-Point At 6.9481 / Dlr VS Last Close 6.9495

- UK GDP Q/Q Q1P: 0.1% (est 0.1%, prev 0.1%) – UK GDP Y/Y Q1P: 0.2% (est 0.2%, prev 0.6%)

- UK Industrial Production M/M Mar: 0.7% (est 0.0%, prevR -0.1%) – UK Industrial Production Y/Y Mar: -2.0% (est -2.9%, prevR -2.7%) – UK Manufacturing Production M/M Mar: 0.7% (est 0.0%, prevR 0.1%) – UK Manufacturing Production Y/Y Mar: -1.3% (est -2.5%, prevR -1.9%)

- Norway GDP Q/Q Q1: 0.2% (est 0.2%, prev 0.2%) – Norway GDP Mainland Q/Q Q1: 0.2% (est 0.1%, prevR 0.6%)

- French CPI (Y/Y) Apr F: 5.9% (exp 5.9%; prev 5.9%) – CPI EU Harmonised (Y/Y) Apr F: 6.9% (exp 6.9%; prev 6.9%) – CPI (M/M) Apr F: 0.6% (exp 0.6%; prev 0.6%) – CPI EU Harmonised (M/M) Apr F: 0.7% (exp 0.7%; prev 0.7%)

- Spanish CPI (Y/Y) Apr F: 4.1% (exp 4.1%; prev 4.1%) – CPI EU Harmonised (Y/Y) Apr F: 3.8% (exp 3.8%; prev 3.8%) – CPI (M/M) Apr F: 0.6% (exp 0.6%; prev 0.6%) – CPI EU Harmonised (M/M) Apr F: 0.5% (exp 0.5%; prev 0.5%)

- U.S. Treasury Yields To Rise Amid Debt Ceiling Standoff – RTRS Poll

- Goldman Sees Opportunity In Hong Kong Banks Amid Surging Hibor – BBG

- Japan Core CPI Likely Re-Accelerated In April Despite Energy Subsidies – RTRS

- ECB’s Push To Raise Borrowing Costs Runs Up Against Wall Of Cash – BBG

- Apple To Open First Online Shop In Vietnam In A Push To Emerging Market – RTRS

- Fed’s Bowman Signals Doubts Over Pause In US Rate Rises – FT

- Tesla To Recall Over 1.1Mln Foreign And China-Made Cars – RTRS

- ECB’s Nagel: ECB Tightening Might Be Required After The Summer Break

- Record US Crude Exports, Rising Shale Output Boosts Oil Flow To Houston – RTRS

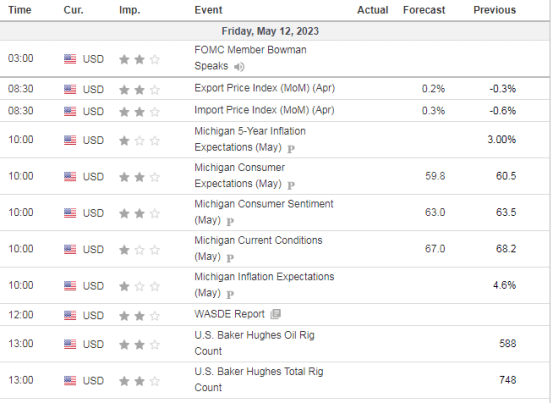

US DATA TODAY