Mixed Markets again

- Hong Kong: Hang Seng closed down -2.09% !!

- China CSI 300 -0.45%

- Taiwan KOSPI +0.58%

- India Nifty 50 -0.49%

- Australia ASX -0.49%

- Japan Nikkei +1.48%

- All European bourses all in positive territory so far this morning with the exception of France, German tech, Italy, and Switzerland

- US indices in positive territory so far in pre-market, USD +0.33%

Overnight Data/News

- China PBoC Sets Yuan Mid-Point At 6.9748 / Dollar VS Last Close 6.9783

- China New Home Price (M/M) Apr: 0.32% (prev 0.44%)

- Japan Industrial Production (M/M) Mar F: 1.1% (prev 0.8%) – Industrial Production (Y/Y) Mar F: -0.6% (prev -0.7%) – Capacity Utilisation (M/M) Mar: 0.8% (prev 3.9%)

- EU27 New Car Registrations Apr: 17.2% (prev 28.8%)

- Italian Trade Balance Total (EUR) Mar: 7.541B (prevR 2.095B) – Italian Trade Balance EU (EUR) Mar: -0.916B (prevR -1.902B)

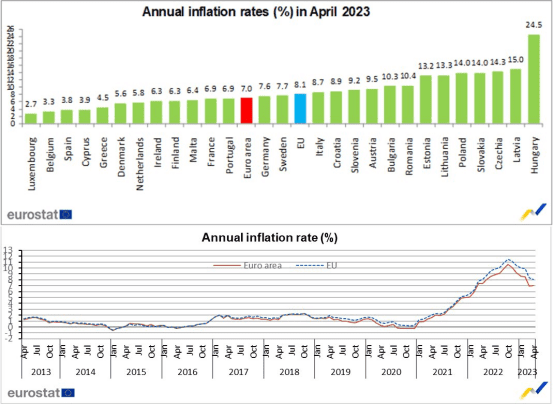

- Eurozone CPI (M/M) Apr F: 0.6% (est 0.7%; prev 0.7%) – Eurozone CPI (Y/Y) Apr F: 7.0% (est 7.0%; prev 6.9%) – Eurozone CPI Core (Y/Y) Apr F: 5.6% (est 5.6%; prev 5.6%)

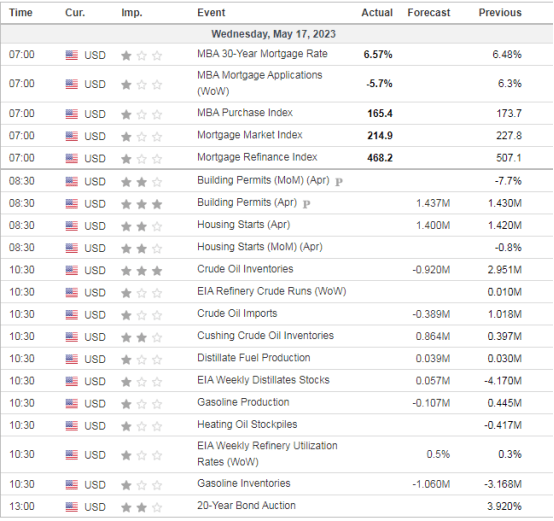

- US MBA Mortgage Applications May 12: -5.7% (prev 6.3%) – US 30-Yr MBA Mortgage Rates May 12: 6.57% (prev 6.48%)

- China’s yuan is weakening toward the key psychological 7-per-dollar level after disappointing economic data

- Japan’s Biggest Banks Add $27 Billion To Foreign Bond Holdings – BBG

- Pimco’s Schneider Says Debt-Cap Fear May Push Bill Yields To 10% – BBG

- Europe Car Sales Up In April As Output Gains On Better Supply – BBG

- JPMorgan Asset: Markets Are Right To Bet Fed Cuts Are Coming – BBG

- Nomura Cuts China 2023 GDP Growth Forecast To 5.5% From 5.9%

- ECB’s De Cos: ECB Getting Closer To End Of Tightening Cycle

- Target Forecasts Gloomy Second-Quarter As Consumers Turn Cautious – RTRS

- China’s Tencent Marks Return To Revenue Growth In First Quarter – RTRS

- Euro area annual inflation at 7.0% in April 2023, up from 6.9% in March

US DATA TODAY