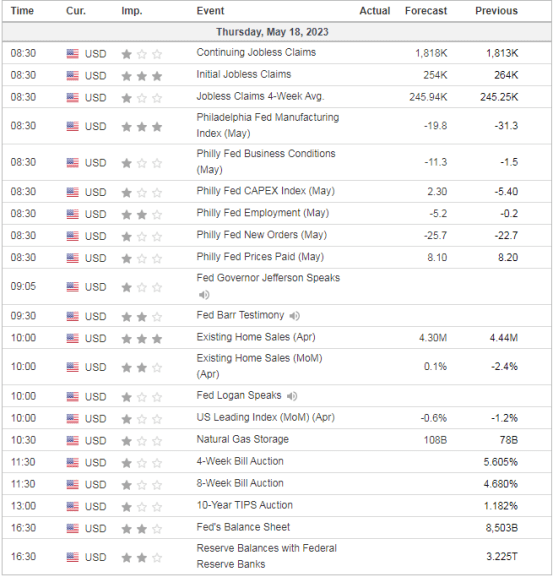

JOBLESS CLAIMS 8:30 AM ET

Mixed Markets

- Hong Kong: Hang Seng closed down +0.85%

- China CSI 300 -0.10%

- Taiwan KOSPI +0.83%

- India Nifty 50 -0.26%

- Australia ASX -0.47%

- Japan Nikkei +1.20%

- All European bourses all in positive territory so far this morning

- US indices in positive territory so far in pre-market, USD +0.24%

Overnight Data/News

- China PBoC Sets Yuan Mid-Point At 6.9967 / Dollar VS Last Close 6.9944

- China Jan-April Fiscal Revenue +11.9% Y/Y; Fiscal Expenditure +6.8% Y/Y – MoF

- Australia Employment Change Apr: -4.3K (est 25.0K; prev 53.0K; prevR 61.1K) – Unemployment Rate Apr: 3.7% (est 3.5%; prev 3.5%) – Participation Rate Apr: 66.7% (est 66.7%; prev 66.7%; prevR 66.8%) – Full Time Employment Change Apr: -27.1K (prev 72.2K; prevR 82.5K)

- Tokyo Condominiums For Sale (Y/Y) Apr: -30.3% (prev -2.1%)

- Spanish House Transactions (Y/Y) Mar: -5.7% (prev -6.6%)

- Spanish Trade Balance Mar: -€0.158B (prev -€2.465B)

- New Zealand Treasury Now Expects Economy To Avoid Recession

- China To Resume Imports Of Australian Timber, Chinese Ambassador Says – SCMP

- Short Sellers Up Regional Bank Bets Even As Lender Concerns Ease – BBG

- China’s Commodities May Find Weaker Yuan A Price Worth Paying – BBG

- Global Chipmakers To Expand In Japan As Tech Decoupling Accelerates – FT

- Chips At Centre Of G-7 Discussion Of How To Counter China’s Rise – WSJ

- Global Oil Demand Rose By 3.0 MB/D Month-On-Month In March To Highest Level Ever Recorded By Jodi-Reporting Countries – IEF Citing Jodi

- Walmart Lifts Annual Sales, Profit View On Resilient Consumer Spending – RTRS

US DATA TODAY