Mixed markets in Asia…Europe Red

Japan hits a 33 year high!!!!!! (looks like Buffett was right again)

- Hong Kong: Hang Seng closed down -0.05%

- China CSI 300 -0.94%

- Taiwan KOSPI +0.54%

- India Nifty 50 +0.13%

- Australia ASX +0.95%

- Japan Nikkei +1.06%

- European bourses in all in negative territory so far this morning

- US indices pretty flat so far in pre-market, USD up +0.15%

Overnight Data/News

- China May Cut Rates Further In H2, Government Researcher Says – RTRS

China will likely further cut banks’ reserve ratio and interest rates in the second half of this year to support the economy, the China Securities Journal reported on Tuesday, citing policy advisors and economists.

China needs to boost its economy as recovery is slowing.

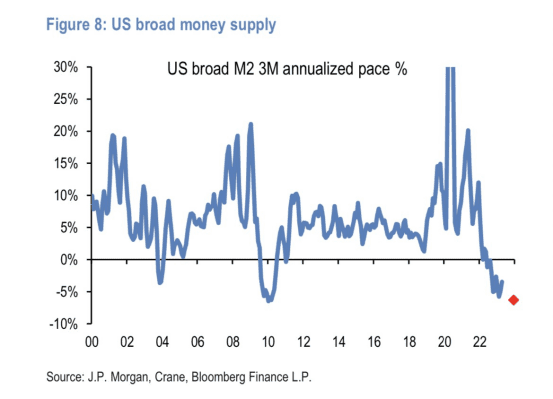

JPMORGAN: “We retain a cautious stance on risk assets .. as a looming liquidity contraction is added to recession concerns. .. broad liquidity in the US .. will contract by another $1.1tr from here .. the worst US broad liquidity contraction since .. after the Lehman crisis.” -Carl Quintanilla

- Germany

German Factory Orders (M/M) Apr: -0.4% (est 2.8%; prev -10.7%) – German Factory Orders WDA (Y/Y) Apr: -9.9% (est -8.4%; prev -11.0%)

Germany is already in a technical recession, and manufacturing is fleeing the country.

- UBS Expects Fed To Raise Rates By 25bps In July, Taking Terminal Rate To 5.25% – 5.50%

Looks like they think they will take a pause in June.

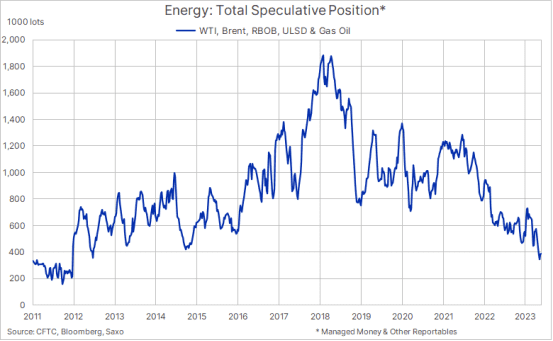

- CFTC Crude Oil Speculators

Via SAXO: Overall, the total net long, as per the chart below, is near the lowest level in more ten years, and it highlight how the market is already close to pricing in a worst-case scenario, and from here we see an increased risk of length starting to rebuild. But as mentioned, speculators are not those selling the peak or buying the through, and it would take a change in the mentioned technical and/or fundamental outlook for that to change. According to this assumption speculators will eventually become a supportive driver for prices and once that happens help support Saudi Arabia’s quest for higher prices.

As I have been saying there is just no interest in this contract