Looking pretty RED out there

- Hong Kong: Hang Seng closed down -1.54%

- China CSI 300 -0.17%

- Taiwan KOSPI -0.18%

- India Nifty 50 +0.41%

- Australia ASX +0.51%

- Japan Nikkei -0.59%

- European bourses in negative territory so far this morning

- USD -0.09%

TOP 5 STORIES OVERNIGHT

- China cuts two more key lending rates as economy sputters -CNBC

The People’s Bank of China cut two more key lending rates on Tuesday for the first time in 10 months to prop up growth in the world’s second largest economy.

The Chinese central bank cut the one-year loan prime rate by 10 basis points from 3.65% to 3.55%, and trimmed the five-year loan prime rate by 10 basis points from 4.3% to 4.2% — for the first time since August.

“On their own, 10bps cuts are too small to make a great deal of difference to monetary conditions, especially since market interbank rates are already below policy rates,” Capital Economics’ Julian Evans-Pritchard and Zichun Huang wrote in a note.

“But the PBOC tends to use changes in policy rates as signaling tool, with the heavy lifting being done by other tools such as adjustments to reserve requirements and bank loan quotas,” they added. “The latest round of rate cuts suggests that these tools will be deployed too.”

This failed to get the global markets excited overnight, they will have to do more

- Wild Weather in China Poses New Threat to Country’s Grain Crops -BBG

China is bracing for more extreme weather in coming days, bringing further risks to grain production across the nation.

While high temperatures in northern areas could affect corn planting and harm wheat crops, heavy rains are likely to hurt rice in key southern growing regions, according to a report from the National Meteorological Center.

The weather woes in the top importer of wheat, corn and soybeans come as drought threatens US crops, and heat waves melt glaciers and kill people in Asia. More disruption is looming from El Niño later this year. In China, heavy rains have already damaged wheat fields, while sweltering heat has stretched power grids, and the country is preparing for risks from widespread flooding.

Lots of global headwinds for grains recently which could keep that sector bid.

- China Signs 27-Year Qatar LNG Deal to Boost Energy Security -BBG

China agreed another decades-long liquefied natural gas deal with Qatar in a further move to safeguard its energy security.

China National Petroleum Corp. signed a 27-year LNG purchase agreement for 4 million tons annually with QatarEnergy on Tuesday. Supply will begin in 2026 and CNPC will take a 5% equity stake in a production train at Qatar’s North Field East expansion project, the country’s energy minister and boss of QatarEnergy Saad al-Kaabi said at a signing ceremony in Doha.

Looks like China does not expect nat gas/LNG to be fazed out anytime soon.

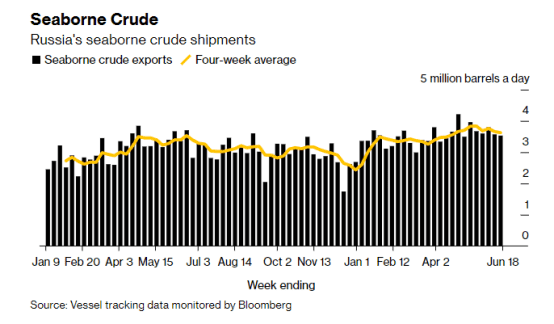

- Russian Oil Flows Edge Lower -BBG

Four-week average seaborne shipments, which smooth out some of the volatility in weekly numbers, edged down in the period to June 18 to 3.63 million barrels a day from 3.66 million in the period to June 11.

On that basis, flows are now down by 212,000 barrels a day from the peak they reached in the period to May 21, but are still 250,000 barrels a day higher than they were in the four weeks to Feb. 26. February was the baseline month for production cuts promised by the Kremlin.

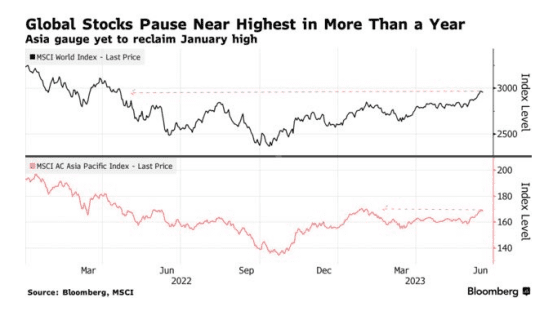

- Stocks Slip as Investors Face Gut Check on Rally-BBG

Investors caught between fear of missing out and concerns markets have run too far, too fast are contending with overblown valuations and economic headwinds. Bullish positioning in US equity futures grew last week, taking it to the most extended levels for the S&P 500 and Nasdaq 100 in data going back to 2010, according to Citigroup strategists.

The path of US monetary policy is another wild card. Federal Reserve Chair Jerome Powell will give his semi-annual report to Congress on Wednesday. Policymakers at the Fed kept interest rates unchanged at their latest meeting but warned of more tightening ahead. Investors also await the outcome of policy meetings in Turkey, the UK and Switzerland.

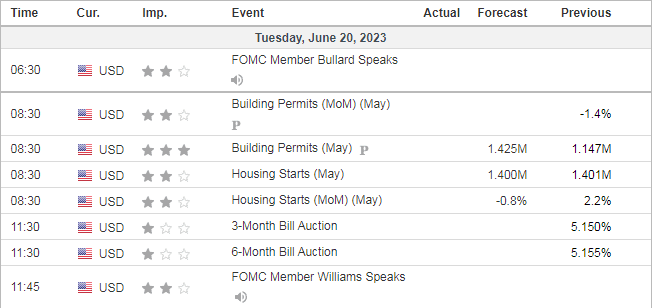

US DATA TODAY