WAGNER REBELLION

Wagner rebellion crisis in Russia averted!

Who is the Wagner Group?

The Wagner Group officially known as PMC Wagner ‘Wagner Private Military Company’, is a Russian paramilitary organization. It is seen as a private military company (PMC), a network of mercenaries and a de facto private army of Yevgeny Prigozhin, a businessman formerly with close ties to Russian President Vladimir Putin. It operates in support of Russian interests, receives equipment from the Russian Ministry of Defense (MoD) and has used MoD installations for training. (Wikipedia)

They have operations across the globe, most notably in Ukraine, Syria, and Africa, protecting Russian interests.

Timeline of events via Alijazzera

June 23

- Prigozhin releases a video stepping up his feud with Russia’s military top brass and for the first time, rejects Putin’s core justification for invading Ukraine.

- In a series of subsequent audio recordings posted on Telegram, Prigozhin says the “evil” of Russia’s military leadership “must be stopped” and his Wagner mercenary force will lead a “march for justice” against the Russian military.

- Russia’s FSB security service responds by opening a criminal case against Prigozhin, announcing the 62-year-old called for armed mutiny against the state.

- The deputy commander of Russia’s Ukraine campaign, General Sergey Surovikin, urges Wagner’s forces to give up their opposition to the military leadership and return to their bases.

June 24

- Prigozhin says his men crossed the border from Ukraine into Russia and are ready to go “all the way” against the Russian military.

- Wagner fighters entered the southern Russian city of Rostov-on-Don, Prigozhin said in an audio recording posted on Telegram.

- The governor of southern Russia’s Rostov region adjoining Ukraine tells residents to remain calm and stay indoors as it becomes clear that Wagner forces have taken control of the city.

- Prigozhin says his fighters captured the army headquarters in Rostov-on-Don “without firing a single shot” and claims to have the support of locals.

- Russian’s defence ministry issues a statement appealing to Wagner fighters to abandon Prigozhin, saying they have been “deceived and dragged into a criminal adventure”.

- Putin makes a televised address promising to crush what he calls an “armed mutiny“. He accuses Prigozhin of “treason” and a “stab in the back”.

- Russian military helicopters open fire on a convoy of rebel mercenaries already more than halfway to Moscow in a lightning advance after seizing Rostov overnight.

- Sergei Naryshkin, head of Russia’s SVR foreign intelligence service, says it is clear that Prigozhin’s attempt to destabilise society and ignite a fratricidal civil war has failed, TASS news agency reports.

- Chechen leader Ramzan Kadyrov, a Putin ally, says his forces are ready to help put down the revolt by Prigozhin and to use harsh methods if necessary.

- Russian soldiers set up a machine gun position on the southwest edge of Moscow, according to photographs published by the Vedomosti newspaper.

- The White House says US President Joe Biden has spoken with the leaders of France, Germany and the United Kingdom, and that they have affirmed their support for Ukraine.

- Ukrainian President Volodymyr Zelenskyy called the armed uprising led by Wagner a clear sign of the weakness of Putin and his invasion of Ukraine.

- Putin signs a law permitting 30-day detentions for breaking martial law in places where it has been imposed, the RIA news agency reports.

- Wagner mercenaries are promised an amnesty if they lay down their weapons “but they should do it fast”, the TASS news agency cites lawmaker Pavel Krasheninnikov as saying.

- The Russian foreign ministry cautioned Western countries against using the “internal situation in Russia for achieving their Russophobic goals”.

- The office of Belarusian President Alexander Lukashenko says he brokered a deal with Prigozhin who has agreed to de-escalate the situation.

- Prigozhin and all of his fighters vacate Russia’s military headquarters in Rostov-on-Don.

- Russian government spokesman Dmitry Peskov says a mutiny attempt by Wagner will not affect the military offensive in Ukraine.

- Prigozhin will now go and live in Belarus and no charges will be brought against him. Wagner fighters who did not participate in the march on Moscow will be offered military contracts.

While the Western media and Twitter went off the reservation with conspiracy theories that Putin’s days were numbered and an all out civil war was about to ensue, let us take a look at what a highly respected geopolitical strategist said about the situation as this unfolded. (link to bio)

Per VelinaTchakarova (@vtchakarova) in a series of tweets before a deal was even brokered between Moscow and Wagner:

This is not a coup by Prigozhin. This is an inner war between the St Petersburg gang of Putin and the Moscow gang of Gerasimov and Shoigu. This is the beginning of Putin‘s election campaign to become reelected on March 17, 2024. His lapdog Prigozhin is masquerading a coup to put the blame on Gerasimov and Shoigu for losing the war against Ukraine. Prigozhin can always be scapegoated if he fails like this has happened in the past

What do you need to pay attention to?

Putin approved Prigozhin‘s actions

This is a power struggle between the inner circle of Putin (St Petersburg) and the MoD in Moscow

Who controls Moscow, controls RF

No one wants to stop the war against Ukraine as of now

Prigozhin runs the African operations of Russia under the command of Putin. It’s the new scramble for raw materials & rare earths in Africa amid the Fourth Industrial Revolution & energy transition, and Russia has a pole position thanks to Wagner. He’ll be sent back to Africa.

Then end result?

The Wagner group chief, Yevgeny Prigozhin, will move to Belarus under a deal to end the armed mutiny he led against Russia’s military leadership, the Kremlin said on Saturday night. The deal was brokered by the Belarusian president, Alexander Lukashenko. Kremlin spokesman Dmitry Peskov said Lukashenko had offered to mediate, with Vladimir Putin’s agreement, because he had known Prigozhin personally for about 20 years. Peskov said the criminal case that had been opened against Prigozhin for armed mutiny would be dropped, and that the Wagner fighters who had taken part in his “march for justice” would not face any action, in recognition of their previous service to Russia, Guardian reported. Although Putin had earlier vowed to punish those who participated in the mutiny, Peskov said the agreement had had the “higher goal” of avoiding confrontation and bloodshed. Prigozhin and all of his fighters vacated the military headquarters in the southern city of Rostov-on-Don that they had previously taken over, the RIA news agency reported.

Why does this matter to us as traders?

Short answer: Commodities! Russia is rich in commodities, everything from oil and gas, to gold, to palladium, coal, and platinum

Crisis seems to be adverted at this point, but keep an eye on this

I covered in this tweet (you can substitute the above list for “oil”)>

EARLY LOOK AT SECTOR PERFORMANCE Q3

Going into 3rd Quarter, some interesting findings via Factset

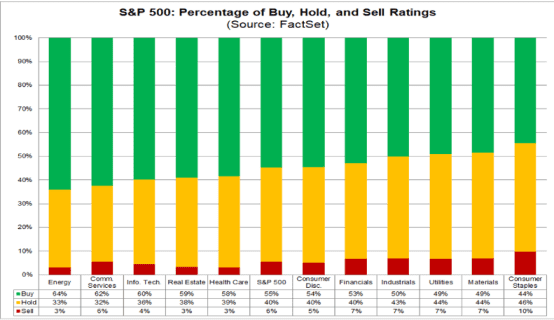

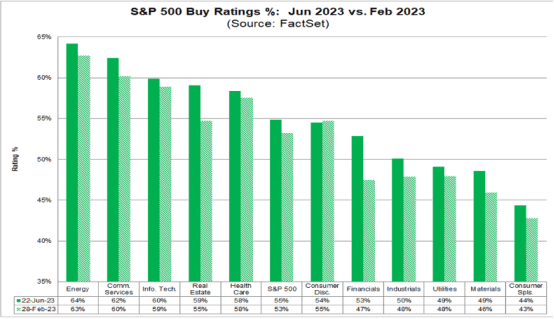

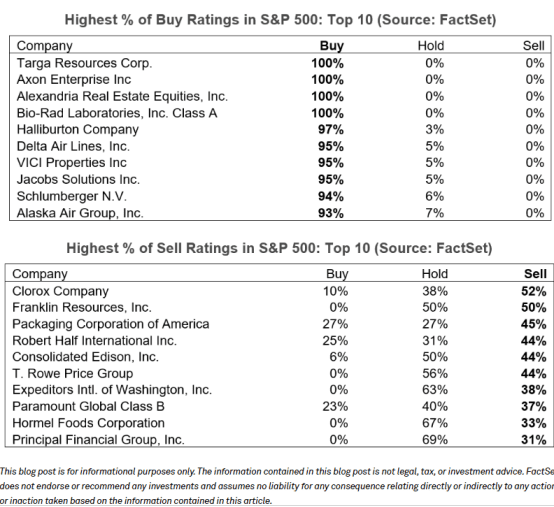

With the start of the third quarter approaching, where are analysts most optimistic and pessimistic in terms of their ratings on stocks in the S&P 500?

Overall, there are 10,981 ratings on stocks in the S&P 500. Of these ratings, 54.8% are Buy ratings, 39.6% are Hold ratings, and 5.6% are Sell ratings. The percentage of Buy ratings is above the 5-year (month-end) average of 54.2%, while the percentages of Hold ratings and Sell ratings are below their 5-year (month-end) averages of 39.7% and 6.1%, respectively.

At the sector level, analysts are most optimistic on the Energy (64%), Communications Services (62%), and Information Technology (60%) sectors, as these three sectors have the highest percentages of Buy ratings. On the other hand, analysts are most pessimistic on the Consumer Staples (44%) sector, as this sector has the lowest percentage of Buy ratings. The Consumer Staples sector also has the highest percentage of Hold ratings (46%) and the highest percentage of Sell ratings (10%)

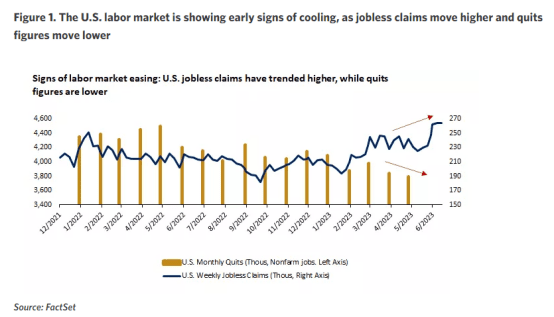

EMPLOYMENT DATA

Looking at last week’s employment data

Via Edward Jones:

The U.S. economy has defied expectations and ongoing calls for a recession, even as the Fed has raised rates aggressively over the past 16 months and as the yield curve has been inverted since last July. This is in large part due to the resilience of the labor market, which still boasts an unemployment rate of 3.7% – near multi-decade lows – and healthy wage growth of 4.3%1. As we know, consumers are generally more comfortable spending when they are fully employed and feel secure in their jobs. And the strength we see in the labor market is also partly a result of a pandemic distortion – many left the labor force during this period, and certain industries still struggle to find workers, especially those in sectors that require in-person and frontline workers.

However, we are starting to see early signs that the labor market, and the economy, may be cooling. Some leading indicators of the labor market point to a pending softness, including rising jobless claims, lower quits rates, and falling job openings. In addition, leading economic activity indicators, like the ISM manufacturing and services indexes, and particularly the new orders components, are all moving lower. In fact, the manufacturing components are already well into contraction territory. And traditional U.S. leading economic indicators, including indexes from the Conference Board and OECD, have all moved south.

TECHNICALS

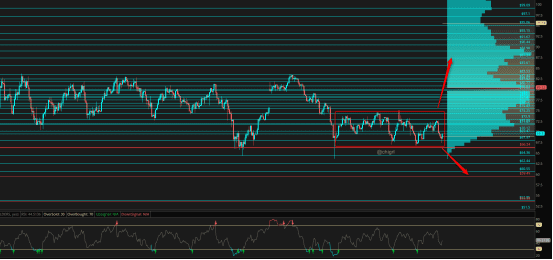

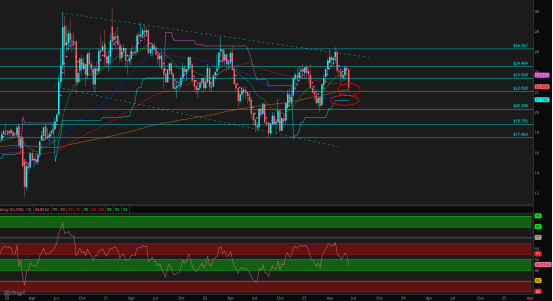

Crude Oil

This market has been consolidating since November 2022, in a tighter and tighter range.

Which ever way this goes, the breakout/down will likely be huge.

Russian crisis averted for now

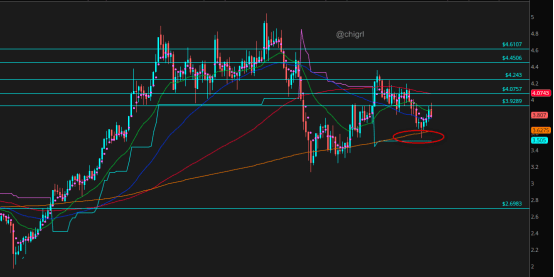

Nat Gas

Do I still need to cover this?

This market has not changed for weeks

Copper

No mans land …watch China for clues (although I can argue that China is really no longer the barometer, it does not matter what I think)

Recession fears and horrible data from Europe last week are weighing on this metal in the near term.

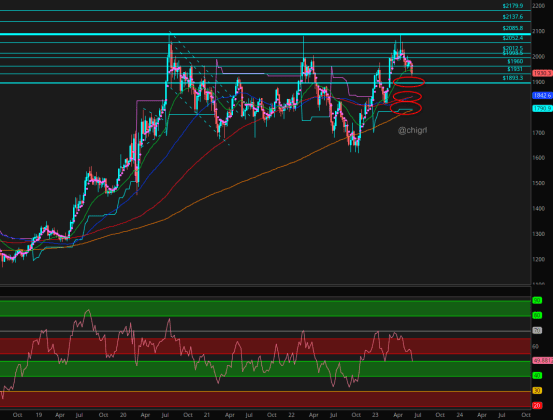

Gold

Gold is more a function of rate than anything

I am a longer term bull, watch support areas noted (and no I am not saying we see 1790 again…I am just noting MAJOR support areas)

Silver

We are at a major support area.

Many do not think of the green economy when you mention silver, but in fact, silver has many uses in renewables- Industrial buyers were 51% of global demand in 2022

Led by end-uses in the green economy, industrial demand is forecast to rise yet again, by 4% to a new record high this year.

The drivers behind these gains include investment in PV, EV’s ,just as an example, In hybrid vehicles, silver use is around 18-34 grams per light vehicle, while battery electric vehicles (BEVs) consume in the range of 25-50 grams of silver per vehicle.

In addition silver is used in battery storage, power grids and 5G networks, and consumer electronics.

Keep this in mind. Support areas noted.

(I spoke about this in depth last week at a conference if interested, you can find the link here)

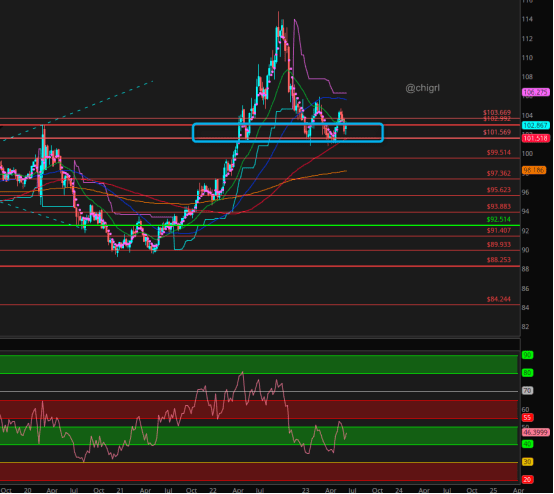

$DXY

USD

Keep an eye on this area

Financial Disclaimer: This material has no regard for specific investment objectives, financial situations, or particular needs of any user. This material is presented solely for informational and entertainment purposes and is not to be construed as a recommendation, solicitation, or an offer to buy or sell / long or short any securities, commodities, or any related financial instruments. Nor should any of its content be taken as investment advice. The views expressed here are completely speculative opinions and do not guarantee any specific result or profit. Trading and investing are extremely high risk and can result in the loss of all of your capital. Any opinions expressed here are subject to change without notice. We may have an interest in the securities, commodities, and/or derivatives of any entities referred to in this material. We accept no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this material. We recommend that you consult with a licensed and qualified professional before making any investment or trading decisions.