HAPPY FOMC DAY! MARKET HAS FULLY PRICED IN A 25bps HIKE

Mixed Markets Overnight

- Hong Kong: Hang Seng closed down -0.31%

- China CSI 300 -0.21%

- Taiwan KOSPI -1.67%

- India Nifty 50 +0.47%

- Australia ASX +0.50%

- Japan Nikkei – 0.31%

- European bourses all in negative territory so far this morning

- USD -0.28%

TOP STORIES OVERNIGHT

- BANKS COMMENTARY ON FOMC -VIA PIQ

UBS on FOMC:

We expect a 25 bp rate hike at the July FOMC meeting. We expect the Chair to say more may be needed but that will depend on the economic data, and decisions will be made meeting-by-meeting.

The policy guidance wording may or may not change, but that’s where the action could be.

We expect the next two rounds of data releases would have much more bearing on future policy decisions than any language coming out of the July FOMC meeting.

How convicted the Chair appears about another hike being needed will be important for interpreting the message, and momentum for more hikes after July.

Step toward sufficiently restrictive should show meaningful progress, not only from the expected rate hike, but because core inflation may finally do some of the work.

Deutsche Bank on FOMC:

We expect the Fed to undertake an eleventh (and final on our forecast) rate increase at next week’s July FOMC meeting. While changes to the statement are likely to be made at upcoming meetings — including to language around banks, inflation and higher for longer — we expect only minimal edits to the post-meeting communique.

Chair Powell’s presser could skew somewhat more optimistic given encouraging economic newsflow, particularly related to inflation, but we continue to see limited downside from a hawkish-leaning message. Powell is likely to emphasize that further evidence is needed to have confidence inflation will be tamed and that, as the June dot plot showed, the Committee anticipates some further tightening is likely to be needed. With two key employment and CPI reports ahead of the September meeting – as well as the Jackson Hole gathering to course correct as needed – Powell is unlikely to provide strong guidance about the outcomes of upcoming meetings. Data dependency will remain a key theme for the Chair.

In line with our recent report, Powell may note that soft landing prospects have improved, while also acknowledging that risks of a recession remain elevated (see “Recession or soft landing: Is disinflation different this time?”). Finally, we will be holding a USD rates outlook webinar on Monday ahead of the FOMC meeting.

TD Securities on FOMC:

The Fed is widely expected to resume policy rate increases following its decision to pause in June. While we anticipate that July will bring the Fed’s last rate increase of this cycle, we do not think the Fed is comfortable signaling that shift just yet. Policymakers appear more comfortable maintaining a hawkish stance for now.

Rates: The Fed’s tone on recent inflation slowing will be key. Continued hawkishness could keep the curve bear flattening in the near-term as the market keeps penciling out 2024 cuts.

FX: Though the Fed will try to talk tough, it won’t resonate with the USD much. As a result, fade any Fed-inspired rallies tomorrow, especially as soft ECI and PCE reports this week could reinforce the bearish USD disinflation theme.

Bank of America on FOMC:

We expect the Fed to hike by 25bp to 5.25-5.50% at the July meeting.

Most Fed speakers appeared to endorse action at the July meeting during the intermeeting period.

We expect the FOMC statement will keep existing policy rate guidance and the Chair will not rule out further policy tightening, albeit in a data dependent approach.

For now, we expect another 25bp hike in September for a terminal rate of 5.5-5.75%, though the Fed could decide that the last hike should come in November

Standard Chartered on FOMC:

We expect a 25bps policy rate hike on 26 July, but no further hikes.

The FOMC is likely to adopt a hawkish tone for fear the market overinterprets any inflation optimism.

FOMC hawkishness may strengthen USD, but soft inflation/activity data should reignite USD pressures.

CITI on FOMC:

July OIS rates price a small, hawkish premium to the expected 25bp hike.

Some participants may be anticipating a hawkish lean from Fed Chair Powell, though Citi Economics does not anticipate strong guidance on hikes beyond July.

Language on ending the hiking cycle is also unlikely, especially with upside risks remaining to the medium-term inflation outlook.

However, with downside risks on the near-term inflation outlook, we may hear an uptick of dovish sentiment during and after July FOMC.

Dovish revisions may emerge in the July statement. Our economists expect language, like “inflation remains elevated” and “holding policy rates unchanged allows for additional information to accumulate”, to be removed or revised dovish.

Fed Chair Powell’s press conference is more of a mixed bag:

Dovish if Powell more strongly guides away from a rate hike in September or deemphasizes “dots” that implied one further 25bp hike.

Hawkish if Powell emphasizes the resilience of activity and broaches the topic of a potentially higher neutral real interest rate.

Goldman Sachs on FOMC Cuts:

Starting date: 2024Q2

Speed: 25bp/quarter (every other meeting)

Terminal point: 3-3.25% (above FOMC’s 2.5% longer run dot)

CME Group Fed Watch Tool

- Deutsche Bank braces for spike in bad loans –FT

German lender’s provisions for credit losses balloon 72% in second quarter

Deutsche Bank is bracing for a spike in bad loans, with the German lender ramping up provisions for credit losses as it reported a less severe fall in profit that had been expected.

In second-quarter results released on Wednesday the group said it had raised loan loss provisions to €401mn, a 72 per cent rise on a year earlier, with the bulk of the hits coming from commercial real estate and German midsized companies.

Net profit attributable to shareholders was 27 per cent lower than a year earlier, driven by a 9 per cent drop in its bond trading revenue and a 15 per cent rise in costs. Return on tangible equity was 5.4 per cent, against 7.9 per cent a year ago and a medium-term target of more than 10 per cent.

The bank’s pre-tax profit in the first six months of the year still reached its highest level in 12 years, with Citi analyst Andrew Coombs praising a “good set of results”.

However, shares in the German lender fell 1.5 per cent in early morning trading on Wednesday, underperforming the wider German market.

Deutsche said full-year loan loss provisions would be at the upper end of its previous guidance of 25 to 30 basis points of average loans because of “the uncertain macroeconomic backdrop and lower loan balances”.

Germany is in deep trouble…explains why European stocks are down this morning

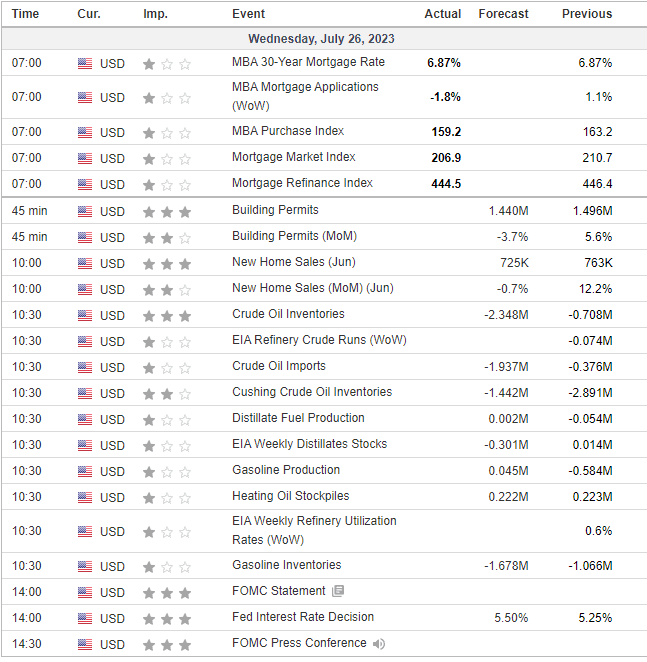

US DATA TODAY