Pretty RED out there!

- Hong Kong: Hang Seng closed down -1.03%

- China CSI 300 -0.24%

- Taiwan KOSPI -0.79%

- India Nifty 50 +0.03%

- Australia ASX -0.81%

- Japan Nikkei -0.99%

- European bourses all in negative territory so far this morning

- USD -0.17%

TOP STORIES OVERNIGHT

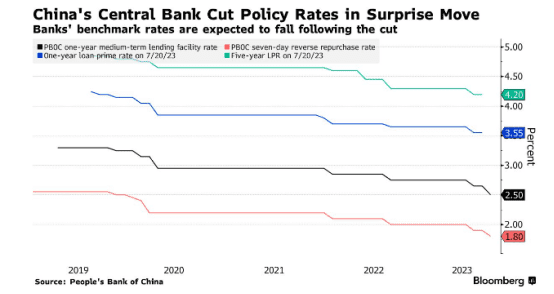

China Cuts Rate by Most Since 2020 as Economic Woes Deepen-BBG

PBOC lowers one-year policy interest rate by 15 basis points

Economic activity in July weakens as retail sales growth slows

China’s central bank unexpectedly reduced a key interest rate by the most since 2020 to bolster an economy that’s facing fresh risks from a worsening property slump and weak consumer spending.

The People’s Bank of China lowered the rate on its one-year loans — or medium-term lending facility — by 15 basis points to 2.5% on Tuesday, the second reduction since June. All but one of the 15 analysts surveyed by Bloomberg had predicted the rate would stay unchanged. A short-term policy rate was also cut by 10 basis points.

The surprise move came shortly before the release of disappointing economic activity data for July showing growth in consumer spending, industrial output and investment sliding across the board and unemployment picking up.

The National Bureau of Statistics said domestic demand remains “insufficient” and the “economy’s recovery foundation still needs to be strengthened.” China needs to “step up macroeconomic policy adjustment, and focus on expanding domestic demand, lifting confidence and preventing risks,” the NBS said in a statement.

Onshore and offshore Yuan weakened even further, at the time of writing this USD/CHN is 7.31. Negative sentiment is rippling across Asia and European markets.

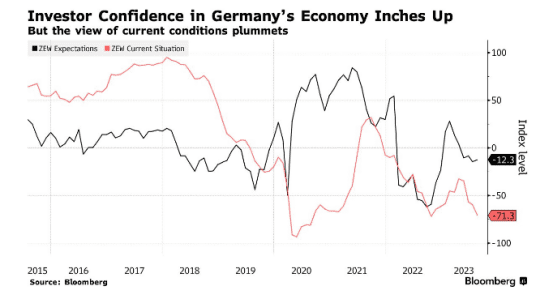

German Investor Outlook Improves Though Struggles Persist-BBG

Investor confidence in Germany’s economy improved only slightly, underlining its struggles to regain momentum after a recession.

The ZEW institute’s gauge of expectations increased to -12.3 in August from -14.7 in July, better than economists in a Bloomberg survey had estimated. An index of current conditions fell substantially, however, to its lowest since October 2022.

“These heightened expectations need to be viewed in the context of a significantly worsened assessment of the current economic situation in Germany,” ZEW President Achim Wambach said Tuesday in a statement

ZEW current conditions (woozer):

Actual: -71.3

Expected: -63.0

Previous: -59.5

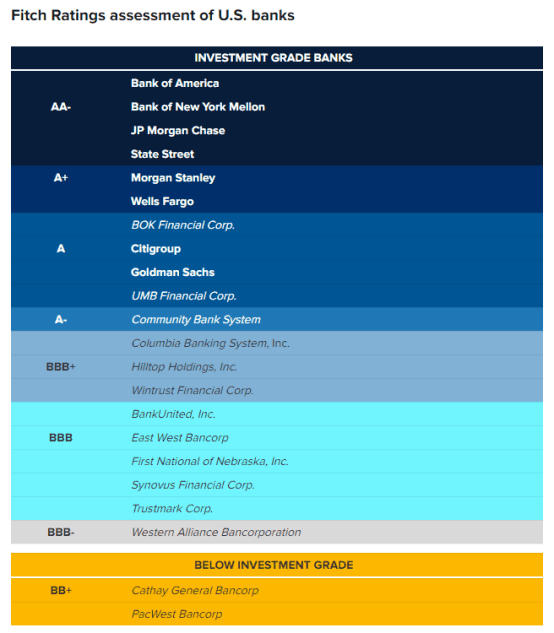

Fitch warns it may be forced to downgrade dozens of banks, including JPMorgan Chase-CNBC

A Fitch Ratings analyst warned that the U.S. banking industry has inched closer to another source of turbulence — the risk of sweeping rating downgrades on dozens of U.S. banks that could even include the likes of JPMorgan Chase.

The ratings agency cut its assessment of the industry’s health in June, a move that analyst Chris Wolfe said went largely unnoticed because it didn’t trigger downgrades on banks.

But another one-notch downgrade of the industry’s score, to A+ from AA-, would force Fitch to reevaluate ratings on each of the more than 70 U.S. banks it covers, Wolfe told CNBC in an exclusive interview at the firm’s New York headquarters.

“If we were to move it to A+, then that would recalibrate all our financial measures and would probably translate into negative rating actions,” Wolfe said.

The credit rating firms relied upon by bond investors have roiled markets lately with their actions. Last week, Moody’s downgraded 10 small and midsized banks and warned that cuts could come for another 17 lenders, including larger institutions like Truist and U.S. Bank. Earlier this month, Fitch downgraded the U.S. long-term credit rating because of political dysfunction and growing debt loads, a move that was derided by business leaders including JPMorgan CEO Jamie Dimon.

This time, Fitch is intent on signaling to the market that bank downgrades, while not a foregone conclusion, are a real risk, said Wolfe.

This may spook banks today

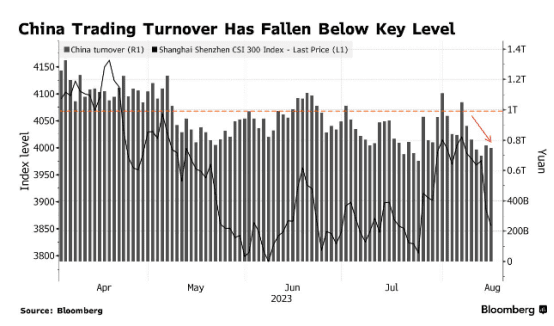

China Mulls Stamp Duty Cut to Revive Slumping Stock Market-BBG

Chinese authorities are considering cutting the stamp duty on stock trades for the first time since 2008, people familiar with the matter said, in what would be a major attempt to revive confidence in the world’s second-largest equity market.

Under the guidance of the State Council, regulators including the Ministry of Finance are discussing a draft proposal, said the people, asking not to be identified discussing a private matter. The details on timing and the size of a potential cut have yet to be determined and there’s no guarantee the proposal will be approved by senior leaders, the people added. The finance ministry and the China Securities Regulatory Commission didn’t respond to requests seeking comment.

Any reduction in China’s 0.1% stamp duty on stock trades has the potential to trigger a knee-jerk rally in the nation’s $9.9 trillion equity market, which is highly sensitive to policy shifts that impact market liquidity. A cut would be a boon for Chinese brokerages as well as quantitative hedge funds who use rapid-fire trading strategies. More broadly, a rising equity market would help Xi Jinping’s government boost consumer and business confidence — seen as key to a sustainable rebound in the world’s second-largest economy.

Oil’s Push Toward $90 Lifted From Physical Markets All Over-BBG

As headline oil prices edge ever closer to $90 a barrel, there’s little sign of a let up in the day-to-day demand that’s underpinned the rally.

Across the global market, record crude demand has driven up the premiums that traders pay to get cargoes.

The differentials for spot cargoes from the Middle East have surged in recent days as buyers in China grab supplies. In the North Sea, a vital window has seen a spate of bidding, while Asian buyers have also bought millions of barrels of US crude. Those are all signs that the latest cycle is off to a strong start, even as Chinese data highlight its economic challenges remain potent.

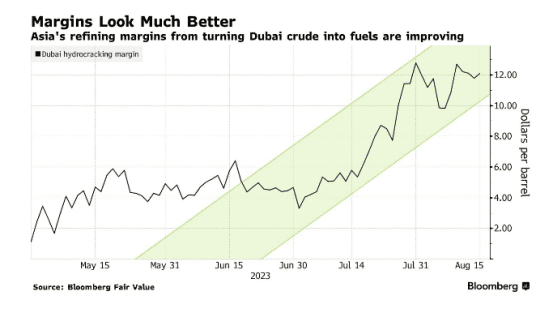

The move comes as refining margins — the profit processors make from buying crude and making fuels — have increased in recent weeks. The International Energy Agency said on Friday that global oil consumption surged to a record in June and should rise further on average later in the year.

Chinese mega-refiner Rongsheng Petrochemical Co. secured millions of barrels from the spot market last week. That’s in addition to the nation’s refiners having been given about 40% more crude from the Saudis month-on-month for September loading after asking for extra barrels.

Across Asia, plants already snapped up about 40 million barrels from US crude for November arrival this month in what’s seen as a robust pace of purchasing following the previous month’s massive buying spree.

Asia orders A LOT of barrels from the US again on better refining margins (my alternate title)

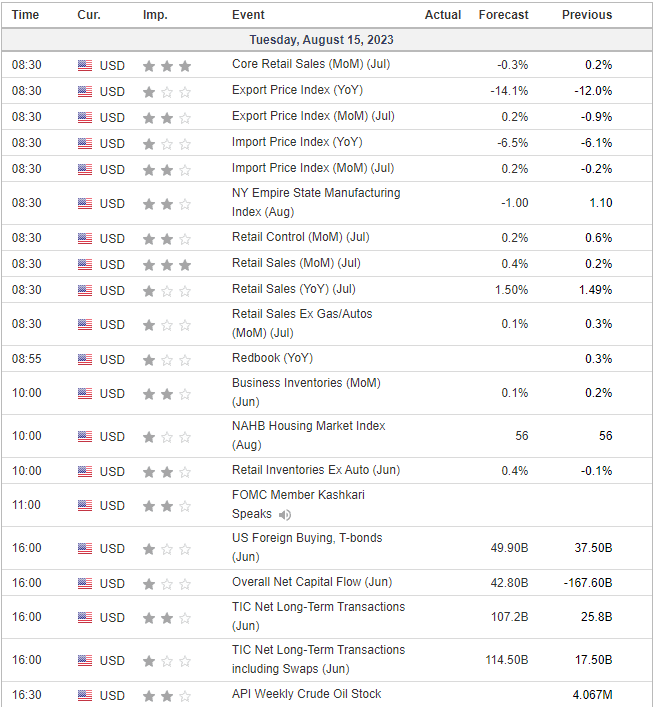

US DATA TODAY