Jackson Hole next week: Powell keynote is on Friday at 10:05 AM ET (check my X stream @chigrl as I will post a live stream link that day)

Not much data last week so let us look at some overall trends this month.

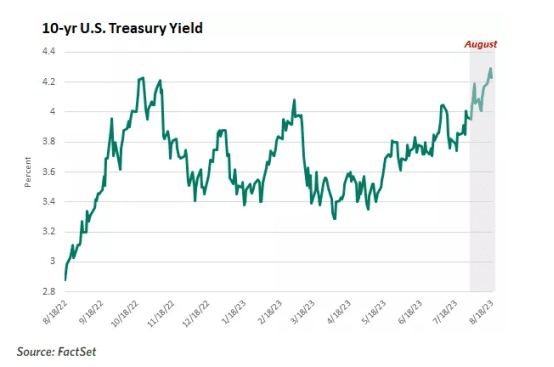

Interest rates back to cycle highs

Via Edward Jones:

- The sharp rise in interest rates through 2022 was well-documented and thoroughly felt by investors, as both stock- and bond-market performance suffered last year. Coming into 2023, our outlook was for the sharp and steady rise in rates to abate as the central focus shifted from high inflation to lower growth. While this did play out for much of the year so far, we’ve seen longer-term rates climb materially in recent weeks, with the 10-year Treasury yield hitting a new high for the year last week.

- We attribute the bulk of this run in rates to an update in consensus expectations around Fed policy. We’ve long held the view that the market was too optimistic about the Fed’s approach to stamping out inflation. Our assessment is that the resiliency in economic growth is prompting markets to accept that the Fed will keep its policy rate higher for longer, which is now showing up in longer-term yields.

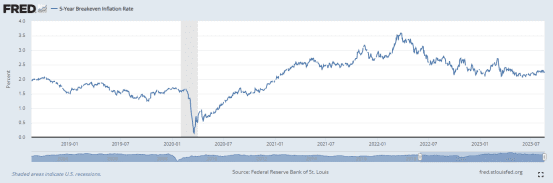

COMMENTARY: What is interesting is the 5 year break-even inflation rate has not budged.

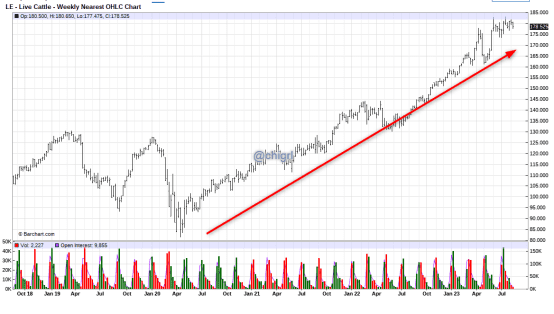

But, with rising crude prices, and rising food prices I am not sure that this can or will last much longer.

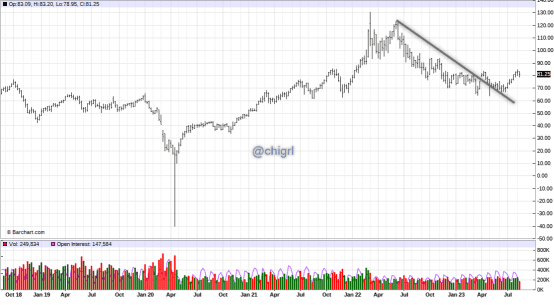

Crude Oil

Check live cattle prices since 2020

Keep an eye on 5 year breakevens ..higher energy costs will mean higher food costs and higher goods costs as energy is the main input for all of these things.

Markets may be sussing this out right now with this recent pullback.

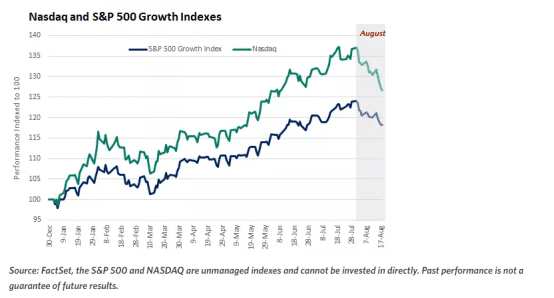

Momentum in Growth Has Changed

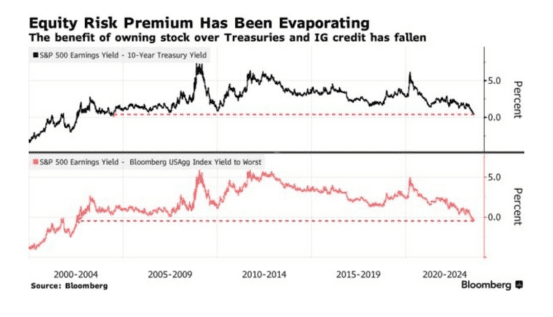

COMMENTARY: The AI frenzy seems to be subsiding, generally when we see a rather large pullback in tech, it signals a rotation into value, but we are seeing an overall exodus in equities right now.

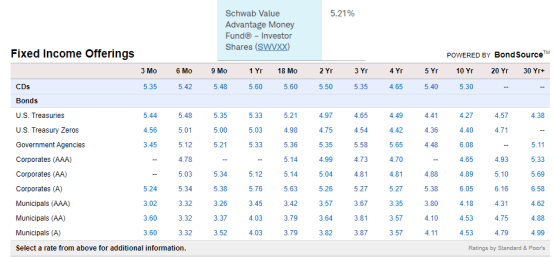

This makes sense if you look at it from the perspective that you can get an almost “risk free” returns in short term treasuries and money markets right now.

Per BBG:

Investors Are Leaving Stocks for the Allure of Risk-Free Payouts in Bonds

Equity buyers went on strike this week with stock funds seeing outflows of $2.1 billion and breaking a three-week inflow streak, according to Bank of America Corp. citing data from EPFR Global. At the same time, Treasuries saw $3.9 billion of inflows in the week through Wednesday. Investors also flocked to money market funds with year-to-date cash inflows reaching $925 billion as of this week.

Money Market Accounts have caught up to CD’s and Bonds

Crude oil trends

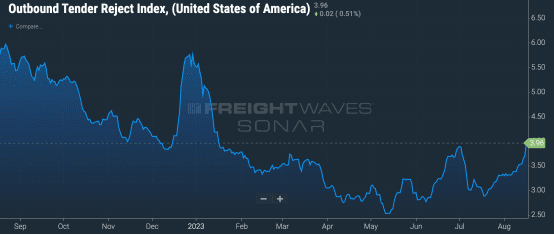

Per Craig Fuller from Freightwaves

Trucking capacity is finally reacting to higher freight volumes. Tender rejections are at the highest levels all year at 3.96%. This suggests that the bottom is in the freight market and things may firm from here.

COMMENTARY: We may have turned the corner for freight, which means even HIGHER demand for oil/products. I actually brought this possibility up in the @placeyourtrades Wednesday spaces in July. If you missed that episode you can find it HERE. Looks like I was correct as retailers were draining excess inventories all year long and Christmas season is coming.

I am extremely bullish on diesel and on refiners heading into fall.

The underlying issue in refining, that remains unresolved, is a lack of capacity. Unlike upstream production, this has not been due to only under-investment itself, but also to significant disruptions and large-scale closures over the last 7 years. As a result, refiners in the US have been having to run over 90% utilization rates all year. Fall is refinery maintenance season, that means rolling weeks of refinery downtime. This will only further exacerbate the supply issue we already have. Gasoline inventories remain 6% below the 5 year average and distillates are 16% below the 5 year average.

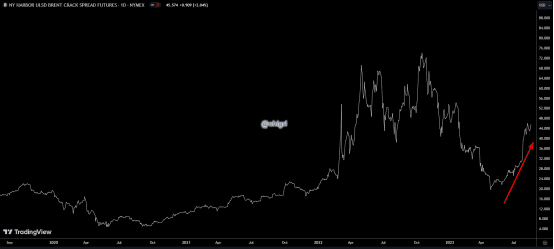

The crack spreads surging again are showing global tightness in the diesel (heavier distillate) market, and it is not even winter yet when distillate usage is higher.

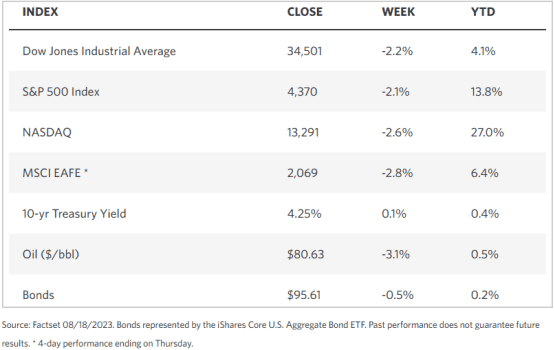

MARKET STATS THIS WEEK

TECHNICALS

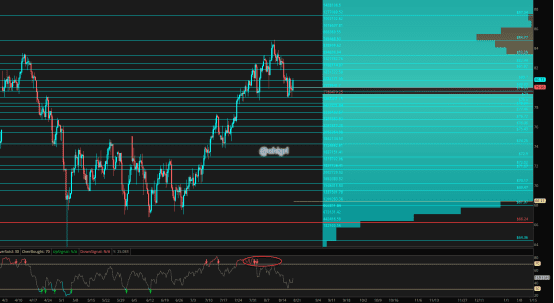

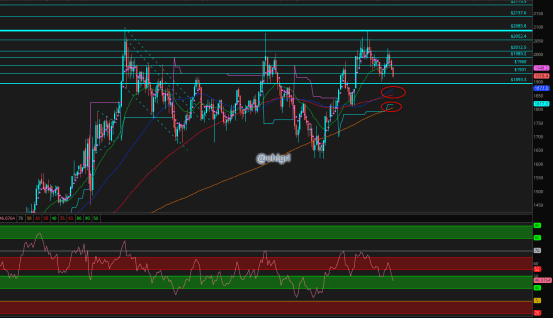

Crude oil

We have been working off overbought territory nicely.

The week ended up over the yearly POC, chart remains bullish

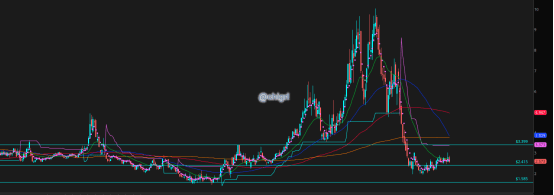

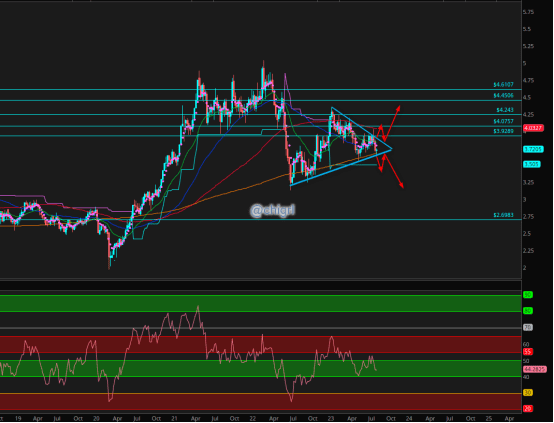

Nat Gas

Same thoughts as last week

I want to see a clear break over $3.40/75 for the futures or over $11.70 in UNG to get bullish this market over the longer term, we just are not even close yet.

If you are a long term investor, might not be a bad time to start a position here as I think that this winter will be much different than last for Europe due to El Nino.

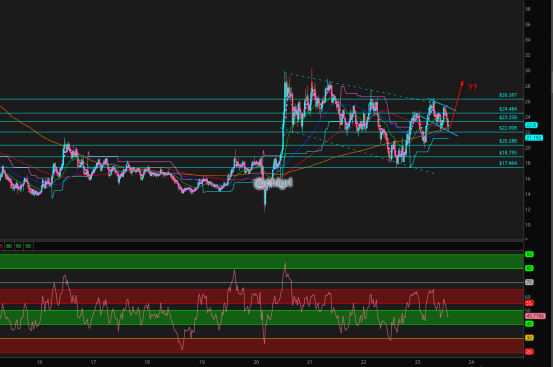

Copper

Copper is still under pressure from China data.

There are two ways this could go …I lean toward the upside BUT being that this could consolidate further ..I think the best option here is to wait for a break and retest either way before initiating a trade for the best r/r

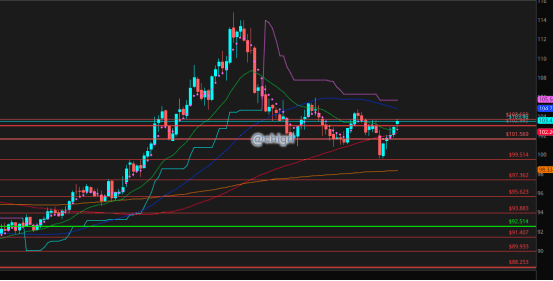

Gold

I am kind of agnostic here on gold again this week, we are still in no mans land..I just do no see an edge here.

Levels of interest noted.

Silver

In all honesty there is not a huge edge here either, that said, for a multitude of fundamental and technical reasons, I remain bullish.

USD $DXY

Make or break here …same as last week

Still lower lows and lower highs.

Financial Disclaimer: This material has no regard for specific investment objectives, financial situations, or particular needs of any user. This material is presented solely for informational and entertainment purposes and is not to be construed as a recommendation, solicitation, or an offer to buy or sell / long or short any securities, commodities, or any related financial instruments. Nor should any of its content be taken as investment advice. The views expressed here are completely speculative opinions and do not guarantee any specific result or profit. Trading and investing are extremely high risk and can result in the loss of all of your capital. Any opinions expressed here are subject to change without notice. We may have an interest in the securities, commodities, and/or derivatives of any entities referred to in this material. We accept no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this material. We recommend that you consult with a licensed and qualified professional before making any investment or trading decisions.