Pretty RED out there

- Hong Kong: Hang Seng closes down -0.4%

- China CSI 300 -0.22%

- Taiwan KOSPI -0.73%

- India Nifty 50 +0.22%

- Australia ASX -0.21%

- Japan Nikkei +0.43%

- European bourses in mostly in negative territory so far this morning

- USD -0.13%

TOP STORIES OVERNIGHT

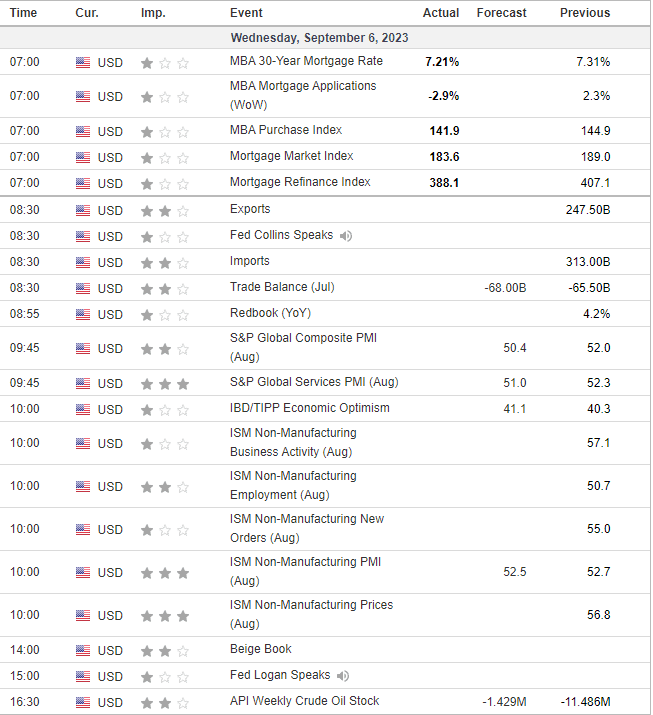

Soaring US Dollar Raises Alarm as China, Japan Escalate FX Pushback-BBG

The renewed advance in the US dollar is sending Asian currencies to multi-month lows and keeping the euro under pressure, while prompting authorities in Japan and China to step up defense of their beleaguered exchange rates.

Japan on Wednesday issued its strongest warning in weeks against rapid declines in the yen, with its top currency official saying the nation is ready to take action amid speculative market moves. Shortly after, China’s central bank offered the most forceful guidance on record with its daily reference rate for the yuan, as the managed currency weakened to a level unseen since 2007.

COMMENTS: “If these moves continue, the government will deal with them appropriately without ruling out any options,” Masato Kanda, vice finance minister for international affairs, said on Wednesday.

BOJ meets this month, possible they tweak rates if this continues, which will send ripples throughout the global bond and FX markets.

China’s Distressed Developers Soar in Wave of Speculative Buying-BBG

Speculative bets that Chinese authorities will widen support for its property sector sent some of the country’s ailing developers surging by the most on record.

A Bloomberg Intelligence gauge tracking Chinese builders gained nearly 10% Wednesday, the most in more than a month. Heavily indebted developers with depressed valuations were among those to rally the most, with Sunac China Holdings Ltd. soaring 68% alongside a spike in trading volume. China Evergrande Group closed up 83% — capping the biggest gain since its 2009 listing.

The magnitude of the rally suggests some investors see a glimmer of hope from the government’s latest efforts, though whether the measures will succeed in reviving the sector remains in doubt.

The surge in home sales in Beijing and Shanghai over the weekend shows sentiment improving. Investors also took note of looser restrictions in Shenyang, which was cited by the Securities Times as an example that should be followed by other cities. The capital of northeast China’s Liaoning province has removed home-purchasing curbs in its city center.

COMMENTS: Keep an eye on base and industrial metals, particularly copper if this sector has indeed bottomed and we see improvement in the property market.

Orsted Ready to Abandon US Wind Projects as It Asks for Help-BBG

Orsted A/S said it’s prepared to walk away from US projects unless the White House guarantees more support, highlighting the myriad challenges facing wind-energy developers in the country.

“We are still upholding a real option to walk away,” Orsted Chief Executive Officer Mads Nipper said in an interview in London. “But right now, we are still working toward a final investment decision” on projects in America.

While offshore farms are seen as critical to ridding the US power grid of fossil fuels and avoiding the worst effects of climate change, they’re also extremely capital- and labor-intensive. In order for the industry to bring future projects to fruition, it’s “inevitable” that consumer prices for energy will increase, Nipper said.

“And if they don’t, neither we nor any of our colleagues are going to build more offshore,” Nipper said. “It’s very simple.”

COMMENTS: The never ending money pit of wind continues. Wind stocks and related ETFs likely to have a bad day today.

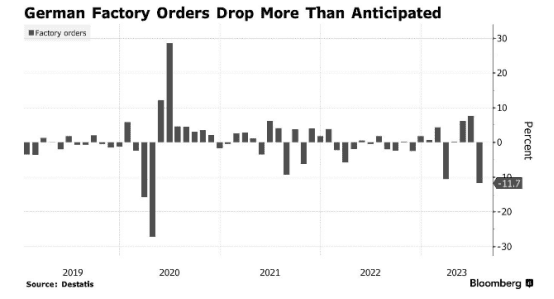

Germany Factory Orders Slumped 11.7% at Start of 3rd Quarter-BBG

German factory orders plummeted in July, a sign that the woes of Europe’s biggest economy continued into the third quarter.

Demand decreased by 11.7% from June, far worse than the 4.3% drop expected by economists in a Bloomberg survey. That decline was due to major orders, without which the gauge would have increased by 0.3%.

A fresh estimate for Germany from the Kiel Institute on Wednesday also was more negative. The economy is now set to see a contraction of 0.5% this year, worse than the 0.3% decline previously forecast. The prediction for next year’s rebound was also lowered. The institute expects output to shrink 0.3% in the current quarter.

COMMENTS: Deindustrialization of Germany continues. This is due to their energy policies and companies shift to the US and China. This is weighing on indices in Europe this morning.

Pound Loses Momentum Before BOE’s Bailey Speaks-BBG

- The pound is losing momentum against the dollar in a busy month for central bank decisions, though hedge funds are still optimistic

- Bank of England Governor Andrew Bailey testifies to Parliament after lunch, one former rate-setter says the BOE is “pretty much done”

COMMENTS: It seems ECB and BOE are likely done raising rates, at least for this year.

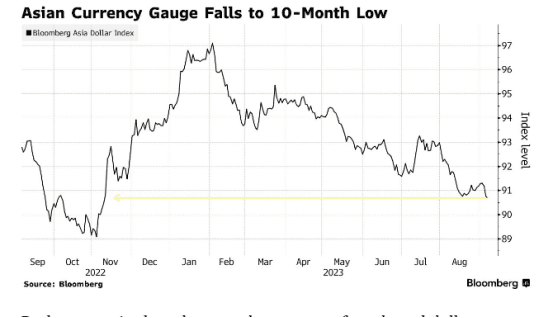

US DATA TODAY