HAPPY WITCHING DAY! (see article below)

Another pretty GREEN day

- Hong Kong: Hang Seng closed up +0.75%

- China CSI 300 -0.66%

- Taiwan KOSPI +1.10%

- India Nifty 50 +0.32%

- Australia ASX +0.50%

- Japan Nikkei +0.43%

- European bourses all in positive territory so far this morning

- USD -0.18%

TOP STORIES OVERNIGHT

United Auto Workers Go On Strike After Contract Talks Break Down-BBG

The United Auto Workers began an unprecedented strike at all three of the legacy Detroit carmakers, kicking off a potentially costly and protracted showdown over wages and job security.

After the midnight deadline for a new contract passed, workers walked out on a Ford Motor Co. plant in Michigan that makes Bronco SUVs, a General Motors Co. factory in Missouri that assembles Chevrolet Colorado pickups and a Stellantis NV plant in Ohio that builds Jeep Wrangler SUVs. The union and automakers are still far apart after weeks of talks.

The strategy is designed to methodically cut production of profitable vehicles while minimizing the impact on the UAW’s strike fund. The union said it will add strike locations depending on how bargaining progresses.

“Tonight, for the first time in our history, we will strike all three of the Big Three at once,” UAW President Shawn Fain said late Thursday. “This strategy will keep the companies guessing. It will give our national negotiators maximum leverage and flexibility in bargaining. And if we need to go all out, we will. Everything is on the table.”

COMMENTS: Sam Fiorani the Vice President of Global Vehicle Forecasting at AutoForecast Solutions estimates that strike action would stop production of about 24,000 vehicles a week. Depending on how long this last, this could add to inflation woes with an automobile shortage. We all know how that worked out during the Covid shutdowns in 2020.

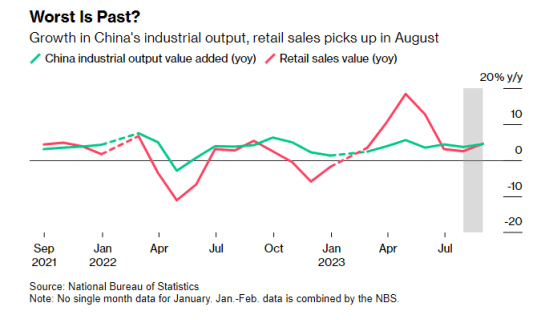

China Economy Shows More Signs of Stability on Policy Boost-BBG

China’s economy picked up steam in August as a summer travel boom and a heftier stimulus push boosted consumer spending and factory output, adding to nascent signs of stabilization.

Industrial production and retail sales growth jumped last month from a year earlier, blowing past expectations, while the urban jobless rate eased slightly. That improvement came as the government has in recent weeks beefed up pro-growth measures, including plans to spur more spending on home goods and ease curbs on some housing purchases.

“Perhaps the peak pessimism is behind us,” said Ding Shuang, chief economist for greater China and North Asia at Standard Chartered Plc. “August’s data indicates that the economy is unlikely to suffer from a persisting, deeper downturn going forward even though there might still be some volatility ahead — especially if we take into account the policy factor.”

COMMENTS: Commodities and global markets getting a boost overnight with this news, particularly energy

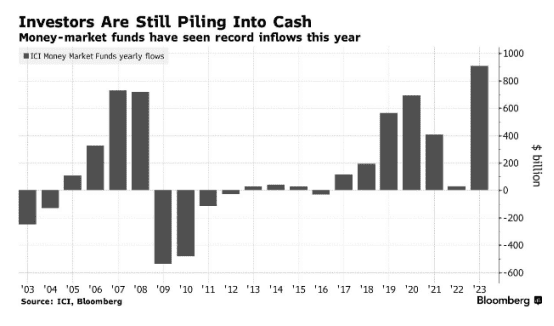

BofA’s Hartnett Says Equity Inflows Surge on Soft Landing Hopes-BBG

Equity funds saw the biggest weekly inflow in 18 months amid growing investor confidence the US economy is headed for a soft landing, according to Bank of America Corp.

That’s in stark contrast, however, to BofA strategist Michael Hartnett’s view: “Nothing screams ‘bear market in conviction’ more than money-market funds seeing $1 trillion of inflows year-to-date,” Hartnett and his team wrote in a note on Thursday. The strategist correctly predicted the US stock slump last year, and has remained bearish in 2023 even as the S&P 500 rallied.

Global stocks attracted $25.3 billion in the week to Sept. 13, the most since March 2022, according to EPFR Global data cited by BofA. But amid the renewed optimism on the US economy, Hartnett and his team see a bearish broader picture, with cash and Treasuries having attracted the bulk of inflows and both asset classes on track for a record year.

US equities have outperformed global peers this year, with the S&P 500 Index rising 17%. The Federal Reserve’s policy-tightening has cooled inflation while managing to keep the economy growing at just over 2%, and the buzz around artificial intelligence drove tech shares to record.

COMMENTS: Seems the analysts are still waiting for a market crash/hard landing, but fund managers betting on a soft landing

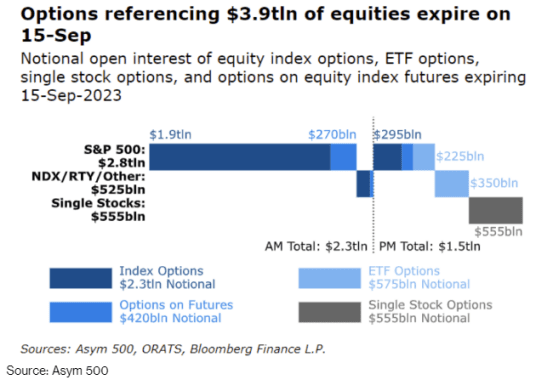

A $4 Trillion ‘Triple Witching’ Event Endangers Stock Market Calm-BBG

All week, stock traders have shrugged off everything from hot inflation data in the US to another recession-threatening hike in interest rates over in Europe.

Now comes a $4 trillion options event that has historically stoked turbulence, just as equities are mired in the most subdued trading in two years.

In a quarterly episode ominously known as triple witching, piles of derivatives contracts tied to stocks, index options and futures are scheduled to mature Friday — compelling traders en masse to roll over their existing positions or to start new ones. This time, it coincides with the rebalancing of benchmark indexes including the S&P 500, another catalyst for more share transactions.

Though the risk is sometimes overblown by Wall Street players, the options event has a reputation for causing sudden price moves. And the one in September has typically been followed by an equity swoon the ensuing week.

One player to watch: Dealers on the other side of options transactions who are obliged to buy and sell stocks to maintain a market-neutral stance. A shift in their stock exposure, known by esoteric concepts like gamma, was cited as fueling the August selloff and is now blamed for this month’s inertia.

COMMENTS: Be careful out there today!

Euro Set for Record Run of Losses as ECB Seen Done Raising Rates-BBG

The euro was headed for the longest streak of losses since its inception on bets the European Central Bank is done raising interest rates.

The currency fell for a ninth straight week, the biggest run of declines since it was created over two decades ago. It’s down 5.6% against the dollar after peaking in mid-July and currently trading close to the lowest levels since March.

COMMENTS: This is what is really causing the spike in the dollar and EUR is the heaviest weighted currency in the basket. I suspect that is why equities do not seem to be bothers by the rising dollar

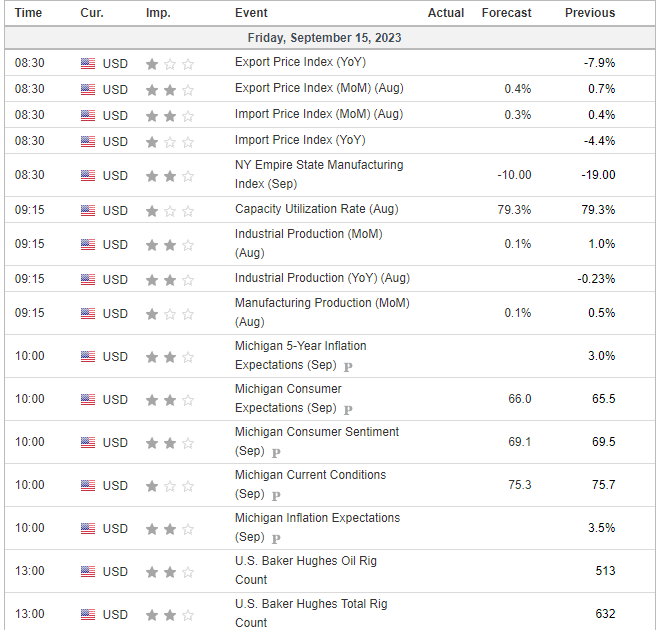

US DATA TODAY