Pretty RED out there

- Hong Kong: Hang Seng closed down -1.26%

- China CSI 300 -0.30%

- Taiwan KOSPI closed for holiday

- India Nifty 50 -0.84%

- Australia ASX -0.12%

- Japan Nikkei -1.43%

- European bourses mostly in negative so far this morning

- USD -0.24%

TOP STORIES OVERNIGHT

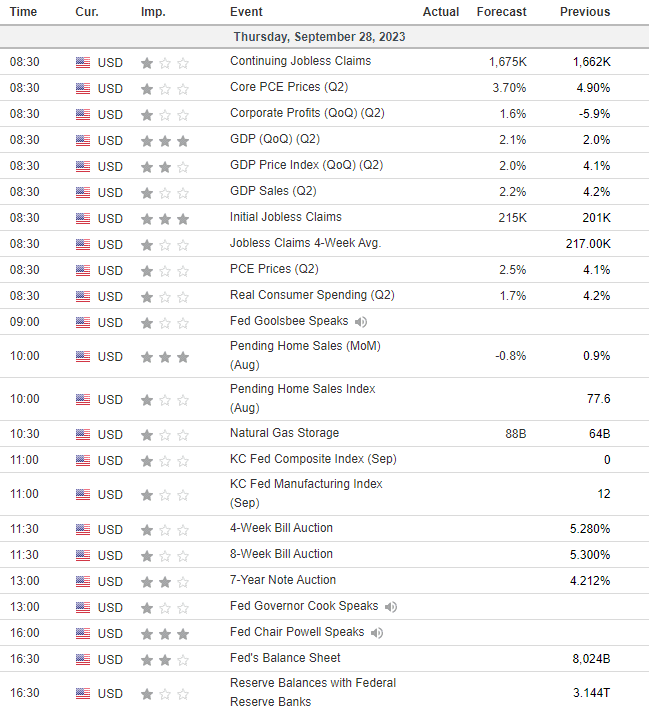

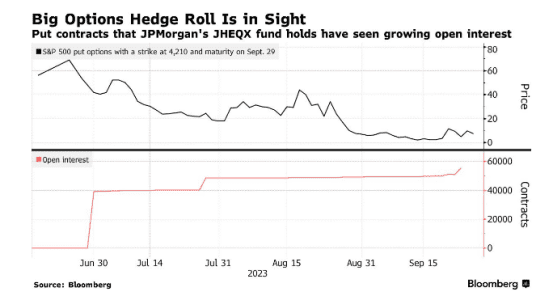

JPMorgan ‘Options Whale’ Worries Resurface as Stocks Extend Drop-BBG

The strike price of the JHEQX puts is 4,210.

The $16 billion JPMorgan Hedged Equity Fund (JHEQX), a long-stock product that uses derivatives to protect its portfolio from declines and volatility, holds tens of thousands of protective put contracts expiring Friday with a strike price not far below the current level of the S&P 500.

That matters because dealers on the other side of the trade risk unwanted exposure as the expiration nears and the index threatens to drop below the strike price. Should that happen, they’d effectively end up with a long stock position. To hedge that risk, they deploy trades that short the market in order to get back to neutral.

“The gravitational pull of it is getting stronger and stronger,” said Dave Lutz, head of ETFs at JonesTrading. “If we don’t retake 4,400, it’s the target for Friday.”

The fund’s derivatives position consists of a put-spread collar that involves buying puts as well as selling bullish calls and even more-bearish puts. At the end of each quarter these positions are often rolled over without incident. Yet the market is particularly susceptible to influence when the S&P 500’s trading level approaches the strike price of any of the legs of the trade around the time of expiry.

COMMENTS: Friday could be a WILD trading day!

4210 is the level to keep an eye on for $SPX

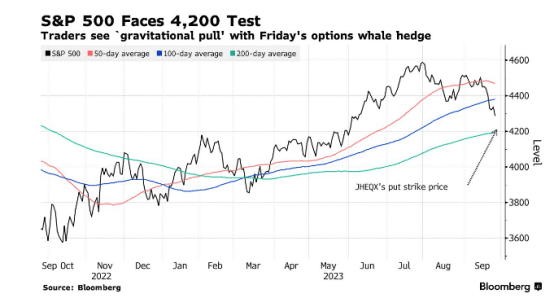

China Gold Prices Plunge the Most Since 2020, Curbing Record Premium-BBG

Gold in China dropped the most in three years after Beijing permitted more imports, all but closing the gap with international prices that’s persisted for weeks.

The precious metal fell 3.8% on the Shanghai Gold Exchange, with losses accelerating toward the end of the trading day. It follows a months-long rally in local prices, which created a record premium to gold outside of the country.

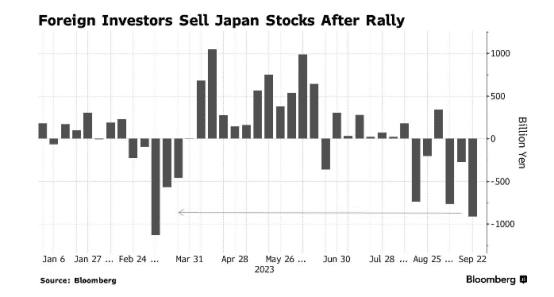

Foreign investors sold the largest amount of Japanese stocks since March last week amid signs of risk aversion.

They dumped ¥913 billion ($6.1 billion) of equities, more than three times as much as the previous week, data from Japan Exchange Group Inc. showed. It was the biggest sales on a net basis since the week ended March 10, when the collapse of Silicon Valley Bank shook markets globally. Japan’s Topix index fell 2.2% last week, while in the US, the S&P 500 Index lost 2.9%.

The increased selling is a sign that appetite from foreign investors has waned, after a massive ¥6.1 trillion of purchases last quarter, as the market become more expensive after a strong rally.

“A rise in US interest rates is hurting sentiment,” said Toshiya Matsunami, chief analyst at Nissay Asset Management. “Foreign investors tend to reduce risk exposure and take profits on assets that have done well when US stocks are falling.”

Taking into account futures contracts, overseas investors sold ¥1.25 trillion yen of equities, also the most on a weekly basis since March. In the other side of the equation Japanese individual investors bought a net ¥661 billion, the most since late March.

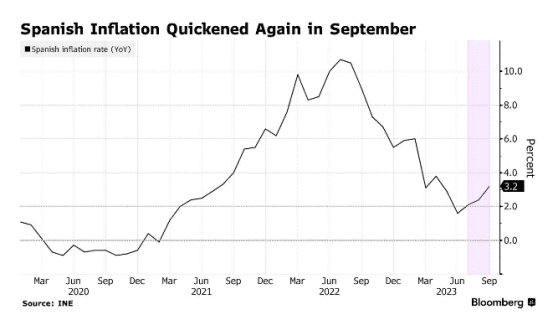

Spain Inflation Jumps, Backing Higher-for-Longer ECB Rates-BBG

Spanish inflation accelerated for a second month, demonstrating the persistent price pressures that the European Central Bank’s higher-for-longer approach to interest rates is seeking to stamp out.

September’s reading of 3.2% was due to electricity and fuel costs, the national statistics institute said Thursday. That compares with 2.4% a month earlier is just shy of the 3.3% median estimate in a Bloomberg survey of economists.

Bloomberg Economics’ nowcast suggests that another jump to 3.6% is due for October and the Bank of Spain predicts it will continue to quicken next year.

COMMENTS: This is perking up EUR this morning. All eyes on German inflation up at 8:00 AM ET …if it runs hot, we could see further gains in EUR and an easing of USD

Russian oil sold to India at 30% above Western price cap, traders say-Reuters

Russia is selling oil to India at nearly $80 per barrel, some $20 above the Western price cap, traders said and Reuters calculations showed, as tight global oil markets help Moscow generate strong appetite for its exports.

Russia’s main export grade Urals has been trading above the $60 per barrel Western price cap since mid-July amid output cuts by OPEC+ producers, including Saudi Arabia and Russia.

Russian Urals oil typically gives higher yields of diesel, which accounts for about two-fifths of India’s overall refined fuel consumption.

Meanwhile, Russia’s decision to ban diesel and gasoline exports added to the appeal of Urals crude, amid a looming shortage of the products globally.

COMMENTS: They have been since June, but If you have been following my PYT twitter spaces…you already knew this!

This one was of particular interest if you missed it

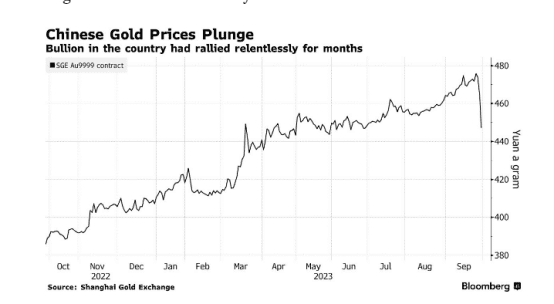

US DATA TODAY