Israel-Hamas headlines dominating markets overnight

Pretty RED out there

- Hong Kong: Hang Seng closed down -0.23%

- China CSI 300 -0.79%

- Taiwan KOSPI +0.10%

- India Nifty 50 -0.73%

- Australia ASX +0.41%

- Japan Nikkei -0.61%

- European bourses in negative territory so far this morning

- USD +0.07%

TOP STORIES OVERNIGHT

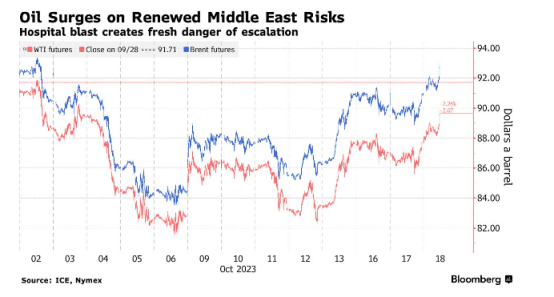

Oil Jumps as Iran Steps Up Rhetoric Against Israel-BBG

Oil surged as Iran called for an embargo against Israel by Muslim countries, following a deadly explosion at a Gaza hospital that raised the risk of a further escalation of hostilities in the Middle East.

Brent futures rose 3% to trade near $93 a barrel. Following the blast, leaders of Jordan, Egypt and the Palestinian Authority canceled a summit with US President Joe Biden, complicating his push to ensure the Israel-Hamas conflict doesn’t widen across the region. Biden arrived in Israel early Wednesday.

Iran’s foreign minister subsequently called for a full and immediate boycott of Israel by Muslim countries, and an oil embargo against the country. The comments were made in a meeting with head of the Organisation of Islamic Cooperation in Jeddah.

COMMENTS: Gold and USD ripped on this headline as well

China’s Growth Beats Forecasts as Consumer Spending Improves-BBG

China’s economy gained momentum last quarter as people ramped up spending on everything from restaurants and alcohol to cars, offsetting a drag from the property crisis and putting Beijing’s annual growth goal well within reach.

Gross domestic product for the three months ended September expanded 4.9% year-on-year and 1.3% from the previous quarter, far exceeding economists’ expectations as government stimulus efforts appeared to take root. The figures got a boost from bumper retail sales growth last month, which recorded the biggest jump since May. The jobless rate was the lowest in nearly two years.

“For the short term, at least one thing is clear: China’s growth has largely bottomed out,” said Zhou Hao, chief economist at Guotai Junan International in Hong Kong. “While the risk of slower growth for next year remains on the table, the short-term economic momentum has at least cleared some of the clouds over the economy.”

Chinese Refiners Shrink Fuel Exports as Domestic Demand Jumps-BBG

Chinese refiners reined in overseas gasoline and diesel sales last month as they prioritized robust domestic demand amid a halt to export quotas.

Gasoline exports in September dropped 21% from an eight-month high to 1.09 million tons, while diesel cargoes eased 6.4% from a five-month high to 1.18 million tons, according to customs data released on Wednesday.

Exports weakened just as domestic consumption jumped amid a peak season for demand and signs of economic recovery more broadly. Apparent oil demand in China surged 17% from a year ago to a record 15.24 million barrels a day in September.

COMMENTS: This is going to tighten the global diesel market further

Annual inflation down to 4.3% in the euro area-Eurostat

The euro area annual inflation rate was 4.3% in September 2023, down from 5.2% in August. A year earlier, the rate was 9.9%. European Union annual inflation was 4.9% in September 2023, down from 5.9% in August. A year earlier, the rate was 10.9%. These figures are published by Eurostat, the statistical office of the European Union.

The lowest annual rates were registered in the Netherlands (-0.3%), Denmark (0.6%) and Belgium (0.7%). The highest annual rates were recorded in Hungary (12.2%), Romania (9.2%) and Slovakia (9.0%). Compared with August, annual inflation fell in twenty-one Member States, remained stable in one and rose in five.

COMMENTS: ECB may pause

JGB yields calm after BOJ steps in but remain near fresh multi-year highs-Reuters

The 10-year Japanese government bond (JGB) yield hit a new decade high on Wednesday, leading a jump across yields that propelled the Bank of Japan (BOJ) to announce an emergency bond-buying operation.

The 10-year JGB yield rose to a peak of 0.815%, its highest since August 2013, before sliding slightly lower to 0.805%.

The two-year JGB yield sat 1 basis point (bps) higher at 0.065%, a level not seen since February 2015.

The Bank of Japan intervened in the Asian morning to calm the market, offering to buy bonds with maturities of five-to-10 years and 10-to-25 years.

“The BOJ was probably afraid they would see the super-long end just sell off”, catalysed by the overnight U.S. yield spike and a knock-on effect after weak demand at Tuesday’s 20-year JGB auction, said Shoki Omori, chief Japan desk strategist at Mizuho Securities.

COMMENTS: Everything is about currencies, KEEP AN EYE ON THE YEN, it could cause the carry trade to wobble which will reverberate in markets globally

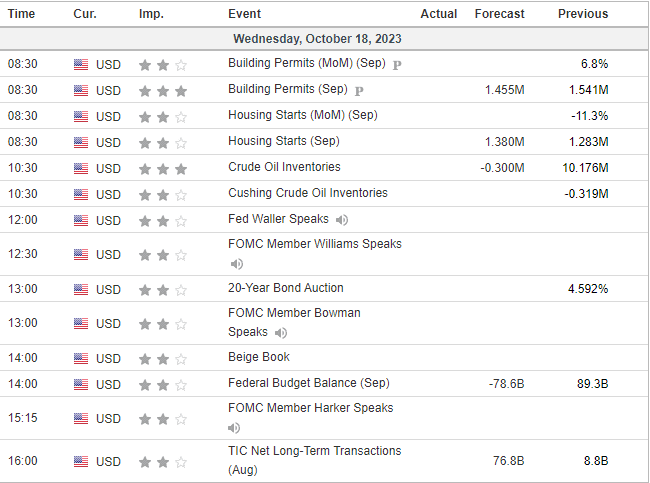

US DATA TODAY

‘