HAPPY CPI DAY EDITION

Mixed Markets

- Hong Kong: Hang Seng closed UP +1.07%

- China CSI 300 +0.21%

- Taiwan KOSPI +0.39%

- India Nifty 50 -0.46%

- Australia ASX +0.06%

- Japan Nikkei -0.87%

- European bourses in MIXED territory so far this morning

- USD -0.32%

TOP STORIES OVERNIGHT

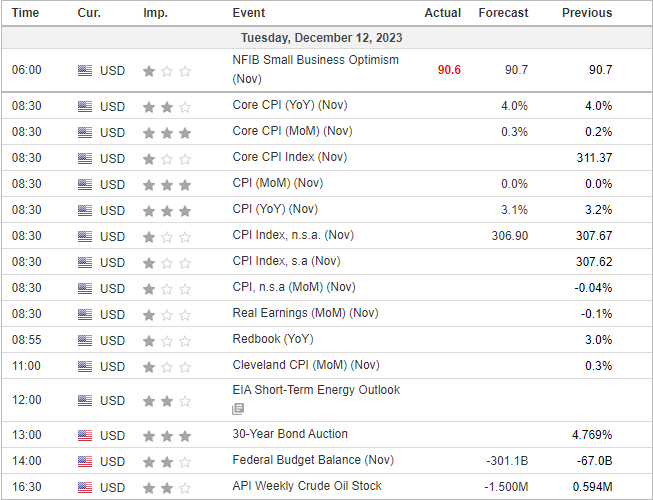

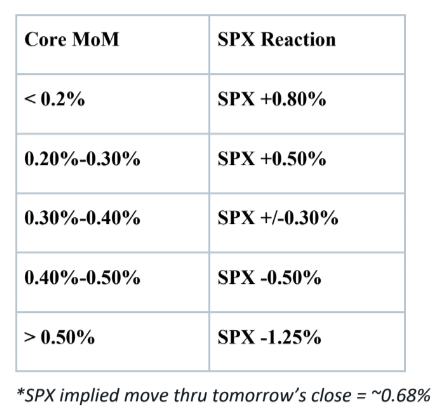

November CPI day cheatsheet via Goldman Sachs

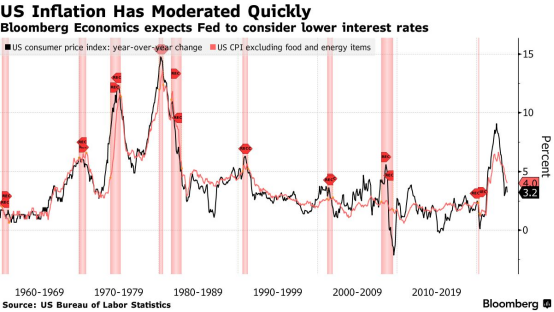

US CPI Expected to Stay Flat and Give Fed Room for Cuts-BBG

A monthly Bureau of Labor Statistics report due Tuesday is set to show consumer prices were unchanged again in November, giving the Federal Reserve room to consider lower interest rates in the months ahead, according to Bloomberg Economics.

The consumer price index should benefit from a decline in energy prices last month, even if prices excluding food and energy rose faster than in October, Bloomberg economists Anna Wong and Stuart Paul said Monday in a preview of the figures.

“Short-term inflation expectations have come down sharply on lower energy prices in recent months,” Wong and Paul said. “That makes more room for the Fed to consider rate cuts as downside risks for activity and upside inflation risks become more balanced.”

Bonds Gain Before CPI-BBG

Treasury yields and the dollar fell before a crucial US inflation report.

Equity markets posted moderate moves, with investors reluctant to make big bets in the buildup to this week’s economic data and interest-rate decisions. European stocks and US equity futures were little changed. Oracle Corp. fell as much as 8.8% in US premarket trading after the software company’s second-quarter revenue disappointed amid slowing cloud sales momentum.

Tuesday’s consumer price index will give Wall Street a sense of whether the disinflation trend is continuing, a day before the last scheduled Federal Reserve decision of 2023. The US central bank is widely expected to hold rates, with most market focus on whether it will try to temper policy easing expectations after investors’ aggressive dovish repricing.

“Central banks will certainly affirm the message this week that they remain data dependant, that they need more confirmation that inflation and core inflation will decelerate further,” said Georgios Leontaris, chief investment officer for Switzerland and EMEA at HSBC Global Private Banking and Wealth. “It’s getting harder to convince markets — and central banks know that — so they will look to maintain that data dependancy mode going forward.”

COMMENTS: Hopium on rate cuts are abound…I think markets will be very disappointed next year when they do not come. Traders stay nimble today on this number

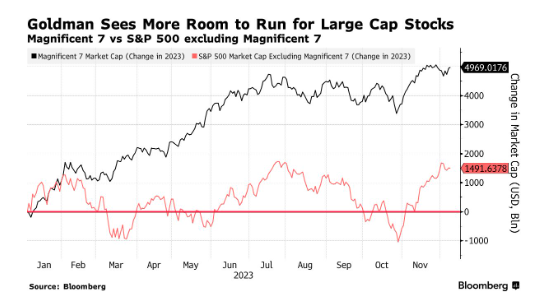

Goldman Says ‘Buy the Dip’ If Stocks Drop After Repricing Fed Cuts-BBG

Wilson-Elizondo, deputy chief investment officer of multi-asset solutions at GSAM, advised that any pullback under that premise would be deemed a head fake, with prices moving in one direction before quickly reversing.

“If the market trades down, it is a good opportunity to rebalance or buy the dip” she said in a phone interview. “It’s too early to be underweighting the risk premium of equities.” GSAM has $2.7 trillion in assets under management.

Economists at Goldman Sachs expect the Fed to start cutting rates in the second half of 2024 and forecast growth with less inflation, which should be supportive for markets, particularly large cap stocks.

“We do believe in the quality factor and large cap will tend to outperform in these types of environments and despite the valuations seeming tight we do believe that there is a room for upside,” Wilson-Elizondo said.

COMMENTS: I feel like this is becoming a very crowded trade

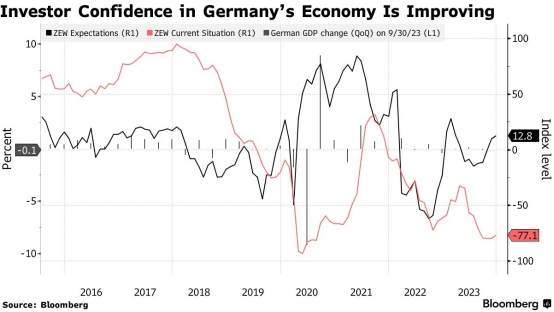

German Investors’ Outlook Unexpectedly Rises for Fifth Month-BBG

Germany’s investor outlook unexpectedly improved for a fifth month, signaling hope that Europe’s biggest economy may be stabilizing as inflation retreats.

An expectations index by the ZEW institute rose to 12.8 in December from 9.8 in November — defying economists’ prediction for a drop. A measure of current conditions also increased.

“Despite the current budget crisis, the assessment of the situation and economic expectations for Germany have once again increased slightly,” ZEW President Achim Wambach said in a statement. “That’s helped by the fact that the proportion of respondents who expect the ECB to cut rates in the medium term has doubled.”

COMMENTS: A lot of hopium on possible rate cuts, helping to buoy the DAX today

US DATA TODAY