Asia Green…Europe RED

- Hong Kong: Hang Seng closed UP +0.04%

- China CSI 300 +1.01%

- Taiwan KOSPI -0.55%

- India Nifty 50 +0.63%

- Australia ASX +0.62%

- Japan Nikkei +0.16%

- European bourses in NEGATIVE territory so far this morning

- USD -0.02%

TOP STORIES OVERNIGHT

Vilified Zero-Day Options Blamed by Traders for S&P Decline-BBG

This year’s hottest derivatives trade, and perhaps also its most divisive, stole the limelight one final time for 2023 as market watchers cast zero-day options as the villains behind Wednesday’s rally-ending slump in US equities.

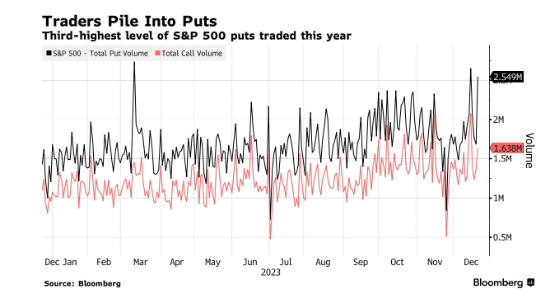

With the S&P 500 Index in overbought territory and turnover curtailed by looming holidays, observers suggested hefty volumes in put options that expire within 24 hours, known as 0DTE options, were sufficient to spark a pullback on the market, the sharpest in almost three months. Such trades would prompt market makers on the other side of the transactions to hedge their exposure, pushing the market lower, the argument goes.

“We have been wary of 0DTE options for quite some time,” Matthew Tym, the head of equity derivatives trading at Cantor Fitzgerald LP, wrote in a note with colleague Paolo Zanello. “Today we saw a late day selloff that, we believe, could have been caused by or certainly exacerbated by 0DTE SPX options. Certainly the market environment was ripe for it.”

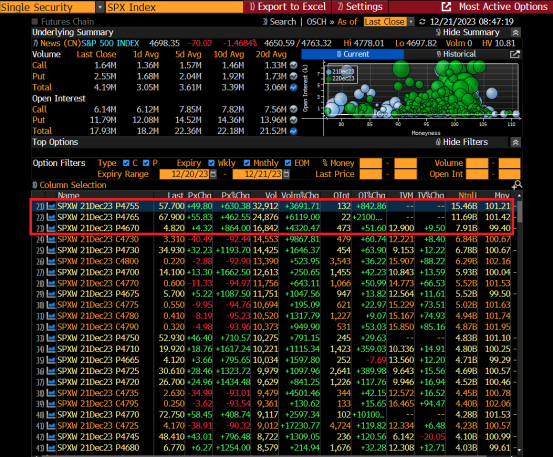

It was trades in put options, which give buyers the right but not the obligation to sell an underlying asset, around the 4,755-4,765 area that drew attention, they said. Data tracked by Bloomberg shows that puts on the S&P 500 with strike prices of 4,755 and 4,765 and expiring on Dec. 21 had notional value of $15.4 billion and $11.7 billion, by far the biggest value among put options as of last close. Wednesday’s total put volume on the S&P 500 was the third-highest of 2023.

Options analysis firm SpotGamma said in a post on social media platform X that 0DTE options drove the decline in the US equity benchmark. Rocky Fishman, founder of derivatives analytical company Asym 500, pointed out that the daily 0DTE volume was the highest since early October — $900 billion — which was noteworthy given the lack of specific economic news during the day.

COMMENTS: Remember yesterday, that Proshares launched its 0DTE ETF writing daily call options against the underlying index. The term covered call refers to a financial transaction in which the investor selling call options owns an equivalent amount of the underlying security. I wonder if this was a major contributor to the sell off yesterday, rather than those OTM put options.

US Considering Hiking Tariffs on China EVs, Solar Products, WSJ Reports-BBG

The US is considering raising tariffs on Chinese electric cars and other goods as it tries to limit reliance on Asia’s biggest economy and shield its own green industry, the Wall Street Journal reported

While officials in President Joe Biden’s administration have largely left in place Trump-era tariffs on around $300 billion of Chinese goods, the White House and other agencies are debating the levies again, the people said, with an eye on completing a review of the tariffs early in the new year.

Chinese electric vehicles are currently subject to a 25% levy in the US, limiting their ability to enter the market.

COMMENTS: This would not help inflation. Keep an eye on this in the new year as it could add fuel to the inflation fire making the Federal Reserve’s job more difficult.

Gold range-bound as market focuses on US economic data-Reuters

Gold prices crept higher on Thursday, but traded in a relatively tight range as investors looked to U.S. economic data for further clarity on the Federal Reserve’s next monetary move.

Spot gold was up 0.2% at $2,033.98 per ounce, as of 1035 GMT, trading in a narrow $9 range in the session so far. U.S. gold futures fell 0.1% to $2,045.70.

If US data this week reinforces the view that the Fed will soon start cutting rates, then gold will gain but in the case of stronger data then the Fed is likely to keep rates higher for longer, said Ricardo Evangelista, senior analyst at ActivTrades.

“We will see the unwinding of the restrictive monetary policies of the major central banks, so 2024 will be a positive year for gold.”

COMMENTS: Technically gold looks strong, keep an eye on data today we cave PCE at 8:30 AM ET along with jobless claims

Why Europe’s Biggest Asset Manager Is Shorting the Pound-BBG

Europe’s biggest asset manager is shorting the pound on the conviction that the Bank of England will start cutting interest rates in the first half of 2024.

Amundi SA anticipates that the UK currency will tumble more than 4% against the dollar as inflation slows and the economy shows the pain of policy tightening, according to Federico Cesarini, head of developed FX at Amundi Investment Institute, the asset management company’s research arm.

“We expect the pound to fall apart,” Cesarini said.

The BOE insisted last week that it still had a way to go to fight inflation and warned that it may even hike rates again. The pound has rallied over the past few weeks on expectations that the central bank will cut rates less aggressively than major peers, with net long positions in the currency at the highest in nearly three months, according to weekly CFTC data.

Amundi expects the currency to fall as low as $1.21 in the first quarter, compared to this month’s high of near $1.28 and analyst forecasts of $1.25 by end-March, according to a Bloomberg poll.

COMMENTS: Notable for you currency traders

China’s Mega Banks Cut Deposit Rates Further to Boost Growth-BBG

China’s biggest state-owned banks are launching a third round of deposit rate cuts in a year, as lenders work to maintain profitability amid shrinking margins and government policies aimed at boosting consumption and demand.

Industrial & Commercial Bank of China Ltd. said it will lower deposit rates as much as 25 basis points on some tenors starting Dec. 22. After the adjustment, the lender will pay an annual 1.45% for one-year deposits, down from 1.55%, and 1.65% on two-year deposit, down from 1.85%. It will pay 1.95% and 2% on three-year and five-year deposits, down from 2.2% and 2.25%, respectively.

China’s escalating push to have its banking behemoths backstop struggling property firms is adding to a maelstrom of woes for the $57 trillion sector. Banks’ net interest margins slumped to a record low of 1.73% as of September, data showed. That’s below a 1.8% threshold regarded as necessary to maintain reasonable profitability. Bad loans meantime have hit a new high, and a revenue growth streak since 2017 for some of the nation’s largest state banks may snap this year.

COMMENTS: This boosted China stock market today, all eyes still on China particularly for commodities

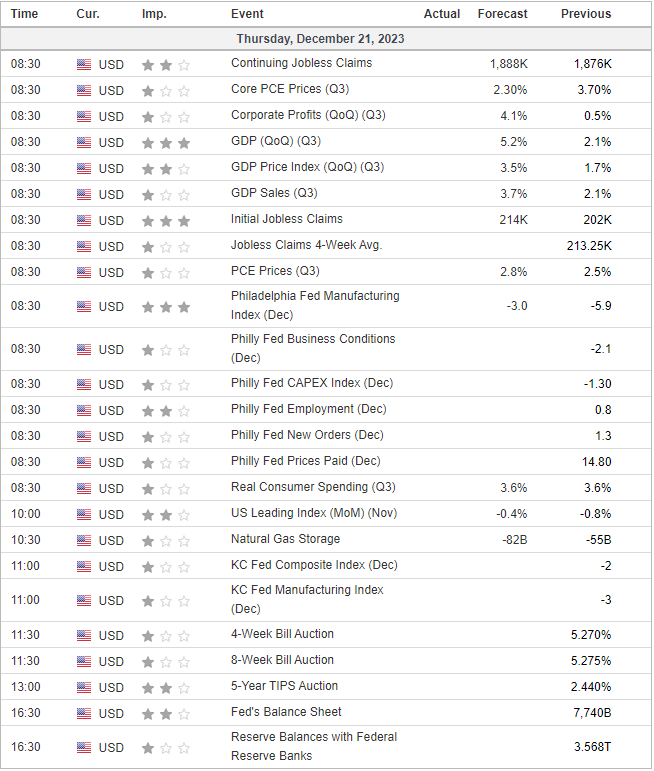

US DATA TODAY