BROADER MARKETS

Markets continue to move sideways

When Fed pivot?

Edward Jones view:

“Given ongoing inflationary pressures, market expectations for Fed rate hikes have notably increased since the start of the year. Market forecasts now call for three additional rate hikes in 2023 (in March, May and June FOMC meetings), which would bring the fed funds rate to around 5.5%. Given the recent strength in the labor market, we would expect the Fed to raise rates at least twice more, in 0.25% increments, but a third or fourth rate-hike in our view will be largely dependent on the incoming jobs and inflation data.”

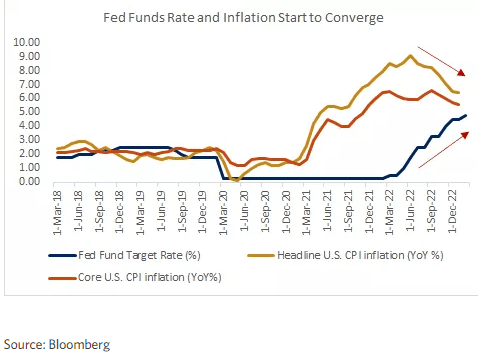

The fed funds rate and inflation rates are converging, with the fed funds rate perhaps poised to exceed inflation in the months ahead

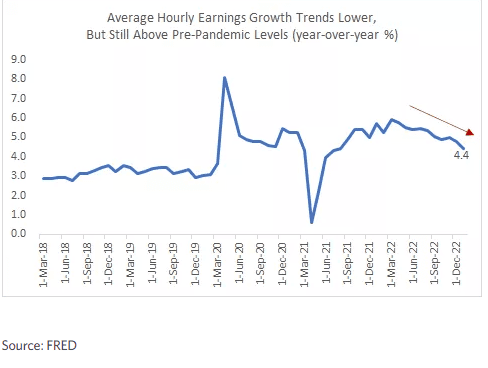

Annual wage gains remain elevated around 4.4%. The Fed would like to see this figure trend lower to around 3.5%, which would support their overall 2.0% inflation target.

COMMENTARY: I believe markets continue to move sideways, frustrating, both the bears and the bulls. Data this week was mixed, with Dallas Fed retail sales looking dire, while services data across the board still looking very strong. That said this is a terrific environment for traders, not so much for investors.

ENERGY

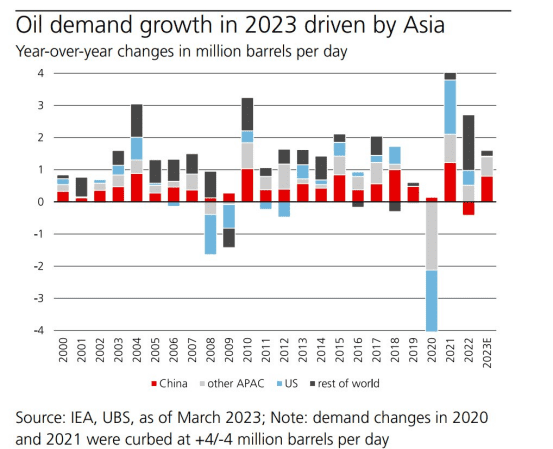

Crude continued to move higher this week on China reopening narratives, upward revisions to global demand, and the “big oil dilemma” concerning renewables. Big oil, in particular, BP and Shell have decided to cut back on renewables as that sector has offered little returns when compared to oil and gas. BP issued a dire warning on oil and gas this week.

China Demand

From Bloomberg

IEA

The International Energy Agency raised its forecast for global crude oil demand for 2023 in its Oil Market Report for February. Citing the re-opening of China’s economy as the main driver of rising demand, IEA analysts raised the 2023 forecast to 101.9 million barrels per day (bpd), an increase of 200,000 bpd from the agency’s January report

BP

Bernard Looney, CEO of oil and gas giant BP warned countries against being hasty with rolling out net zero measures, arguing that it could trigger another energy crisis. Looney urged a “cautious” approach for countries to transition away from fossil fuels like oil and gas into renewable forms of energy.

BP CEO Says More Oil and Gas Investment Is Good for the Climate Fight

“Reducing supply without also reducing demand inevitably leads to price spikes, price spikes lead to economic volatility, and there’s a risk that volatility will undermine popular support for the transition,” he said at London’s International Energy Week. “We avoid that outcome by investing in today’s energy system, as well as investing in the transition.”-BBG

METALS -COPPER

ING

Metals markets eye key China meeting that might drive demand

“The metals markets are awaiting the outcome of China’s ‘Two

Sessions’ political meeting in Beijing this weekend that might drive

demand. “

COMMENTARY: Two Sessions or Lianghui are the annual meetings of China’s parliament and political advisory body that started on Saturday. They are significant as the country sets its economic and policy goals for the year. Xi Jinping will likely secure a third term as president this time

So far what we know is that there will be a BIG increase in military spending. Good news for copper and it is used as an electrical conduit in weapons and military vehicles.

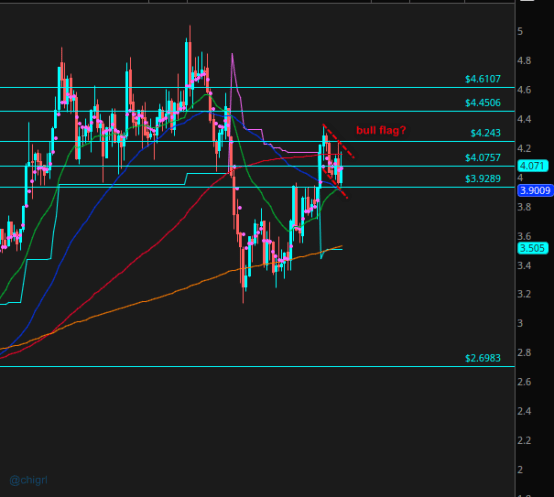

Just from a technical standpoint looking at the weekly chart…possible bull flag (?)

Looks like there could be a lot of opportunities in this market this week.

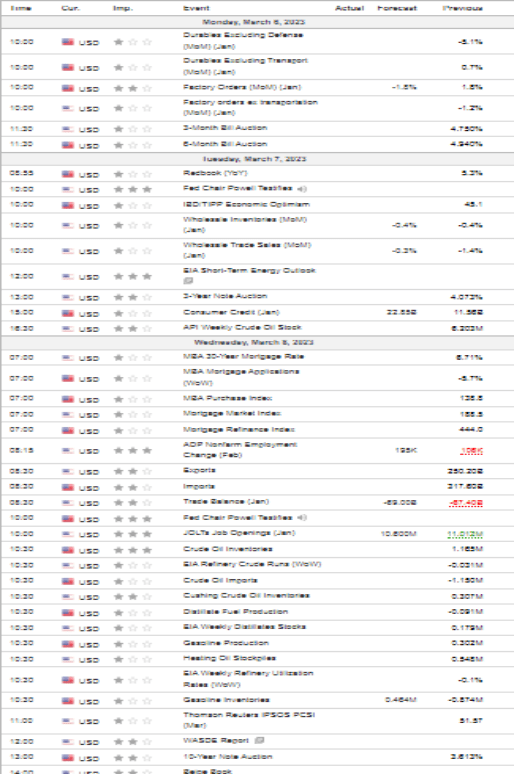

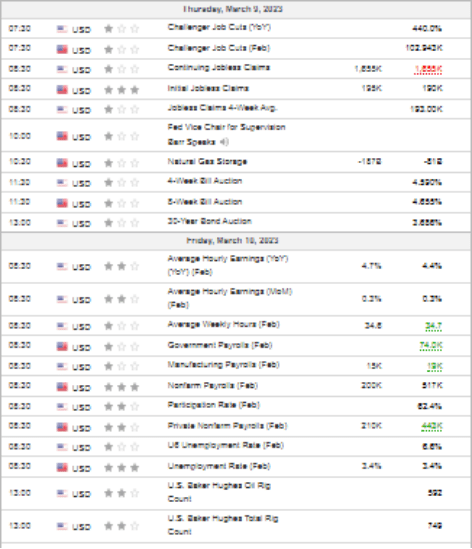

US DATA THIS WEEK

Ridiculously packed week

THINGS TO KEEP AN EYE ON THIS WEEK

(yes I am a broken record on this but risk assets continue to be governed by moves in the dollar intraday)

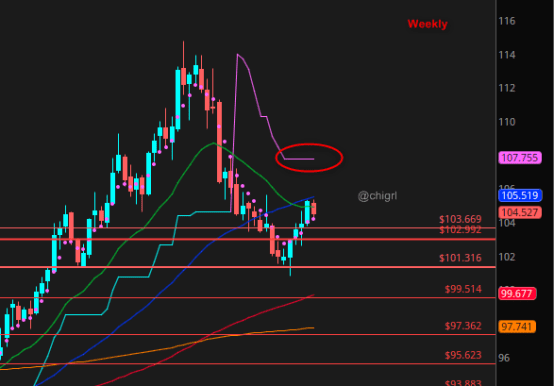

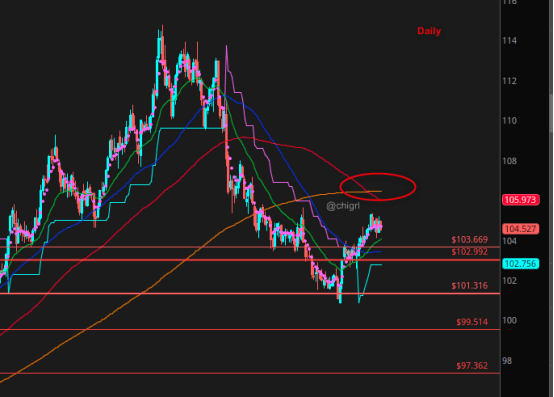

$DXY (USD)

$DXY (USD)

$DXY (USD)

World’s Riskiest Markets Stumble Into Crisis With Dollars Scarce

Vulnerable economies suffer hard-currency shortages, debt risk

Wall Street opts for a cautious approach in developing assets

“In some of the world’s most vulnerable developing nations, the situations on the ground are dire. Shortages of dollars are crimping access to everything from raw materials to medicine. Meanwhile, governments are struggling with their debts as they chase rescue packages from the International Monetary Fund.

It’s forcing a rethink of the bullish emerging-market consensus that swept Wall Street just a few months ago. Granted, few expected the challenges facing certain frontier economies to be remedied this year, but pain has deepened alongside a rebound in the greenback.

While trouble at the fringes of the developing world is unlikely to drag down the asset class as a whole, some say it will force money managers to be increasingly tactical in their investment allocations in the months to come.” -BBG

Technicals

Continue to watch that 106/107 area

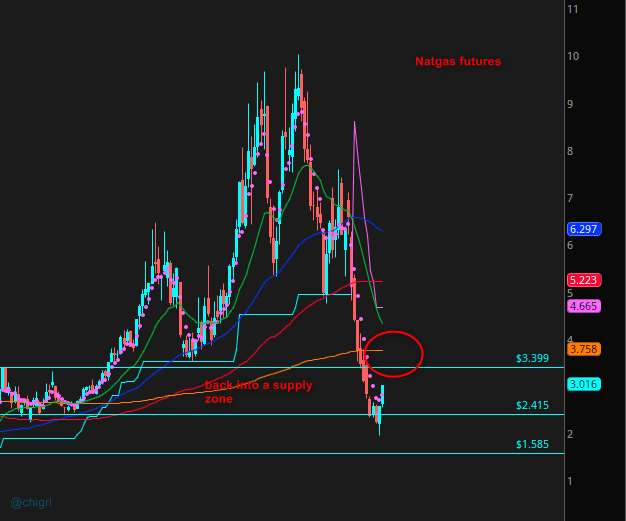

Last but not least Nat gas

We rallied this week on SUPER oversold conditions, that said, I maintain what I wrote last week:

I know a lot will be asking about NatGas. I just do not see a bullish case at this juncture until at least these four items are met:

- Freeport fully re-opens (supposedly may)

- We see a meaningful decline in US production (at $2 nat gas is not feasible for most producers…Cheniere mentioned production cuts in their earnings call…lets see what comes to fruition. As of Friday’s rig count, we did see a decline of rigs)

- We see a meaningful uptick in European consumption (would have to be weather-related as industry is fleeing)

- We see a meaningful uptick in Asian demand (primarily from China)

Technicals

I want to see a clear break over $3.40/75 for the futures or over $11.70 in UNG to get structurally bullish this market over the longer term …we are heading into hard resistance on both. Stay nimble this week.

Financial Disclaimer: This material has no regard for specific investment objectives, financial situations, or particular needs of any user. This material is presented solely for informational and entertainment purposes and is not to be construed as a recommendation, solicitation, or an offer to buy or sell / long or short any securities, commodities, or any related financial instruments. Nor should any of its content be taken as investment advice. The views expressed here are completely speculative opinions and do not guarantee any specific result or profit. Trading and investing are extremely high risk and can result in the loss of all of your capital. Any opinions expressed here are subject to change without notice. We may have an interest in the securities, commodities, and/or derivatives of any entities referred to in this material. We accept no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this material. We recommend that you consult with a licensed and qualified professional before making any investment or trading decisions.