Very quiet data week last week ….everyone is watching for inflation numbers this next week

So lets look over some charts

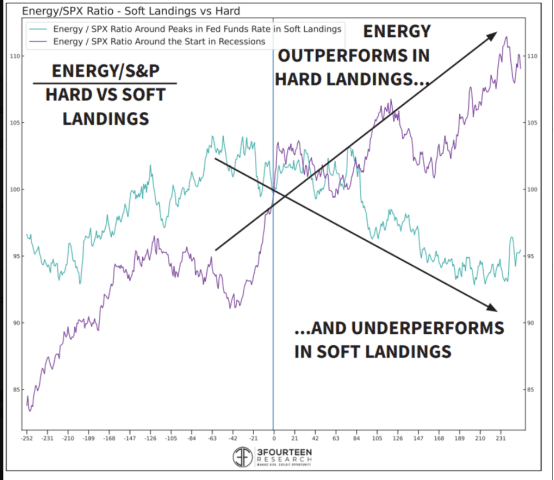

From Three Fourteen Research:

Late-cycle Energy performance is much different around hard and soft landings. Heading into a recession, the Energy Sector leads the S&P. Around soft landings, Energy lags significantly. Oil’s late-cycle performance can cause a recession or facilitate a soft landing.

COMMENTS: With oil prices on the rise, does this mean a soft landing is off the table? Interesting question and something to pay close attention to (past performance is not indicative of the future)

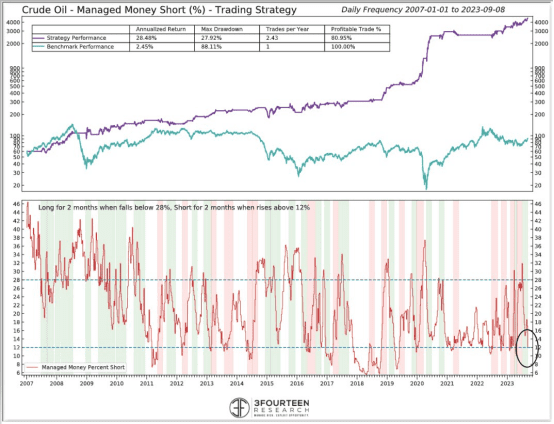

While we are on the subject of crude oil…..

OIL: Hedge Fund Capitulation. Saudis have won the fight against speculators. Managed Money short positioning falls to 12%.-Three Fourteen Research

COMMENTS: This market is very over bought, and Kirby this weekend at the G20 meeting eluded to the fact they may use the SPR again.

SEE my post HERE

Will this news be a catalyst for a much needed pullback? This is up for debate, but something to keep in mind.

That said the problem here is going to be that what they can pull out at these levels is negligible. Incredible short-sidedness if they do, and that would then place Saudi Arabia (defacto OPEC+) in even a larger power position.

In addition this weekend, Libya is preparing for a Mediterranean cycle, and closing their ports for three days.

Via S&P Global Platts:

Libya has shut four oil ports as a precautionary measure while state-owned National Oil Corp. declared a state of maximum alert on Sept. 10, before a possible hurricane headed for the country. Ras Lanuf, Zueitina, Brega and Es Sidra ports will be shut for at least three days, a source familiar with the matter said. A senior NOC official confirmed the port closings.

That is 1.12M barrels off the market for three days.

A lot of moving fundamental parts in the oil market this week, stay nimble!

Moving on….

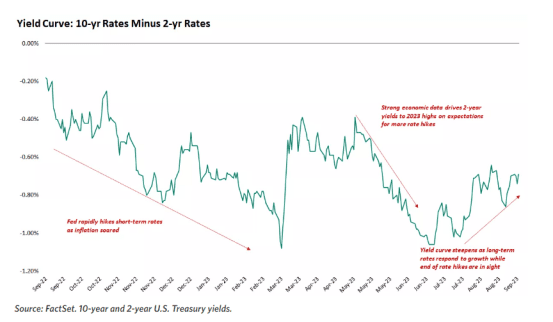

From Edward Jones:

Steepening yield curve reflects potential for a soft landing

- Data out last week showed productivity rose by 3.5% last quarter, the strongest since 2020, and when excluding the distortions from the pandemic, the highest reading since the third quarter of 2017.

- Stronger productivity should provide upward support to GDP, particularly if accompanied by growth in the labor force, which was particularly evident in the most recent jobs report. Expansions in the late-1990s and after the 2008 financial crisis saw rising productivity, which, if replicated ahead, would be a source of sustained GDP growth that could help the economy weather the headwinds of tighter monetary policy.

- To that end, further productivity gains could actually help the Fed insofar as rising productivity can have a dampening impact on inflation, especially in a moderating wage-growth environment, which is currently the case.

Comments: The softer landing narrative seems prevalent from most bank analysts . Time will tell. Watch energy IMHO, it could derails this whole deflation narrative . The Biden administration is running out of bullets, and it might be our their fault in part…..

Why do I say this?

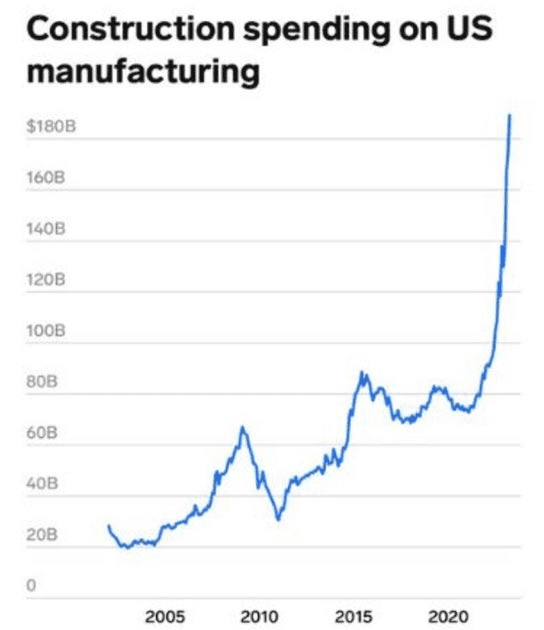

Let us look at Construction Manufacturing in the US

Comments: As I have stated before fiscal policy is negating monetary policy, much of this due to the IRA Act. Going into an election year, the Biden administration can not have a recession, the conundrum here is that we now have both fiscal and monetary policy forcing energy prices higher

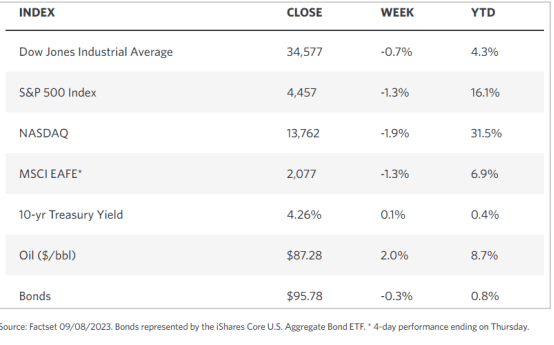

MARKET STATS LAST WEEK

TECHNICALS

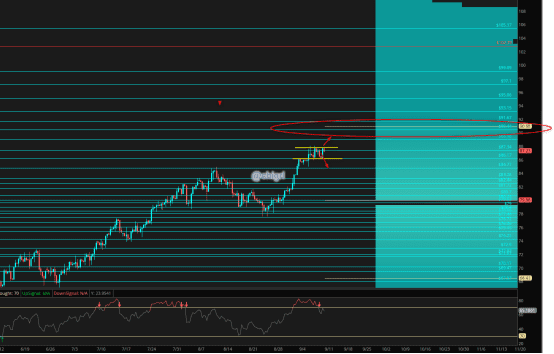

Crude Oil

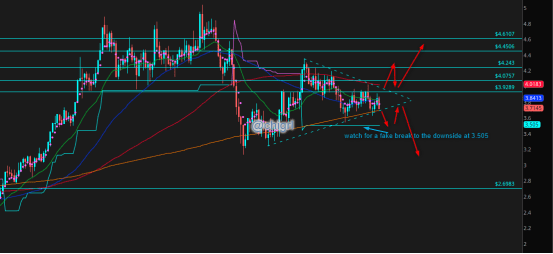

This market has been consolidating all week ..this likely sees explosive move relatively soon

Notable we are still overbought, but the market has been working this off a bit over the last week

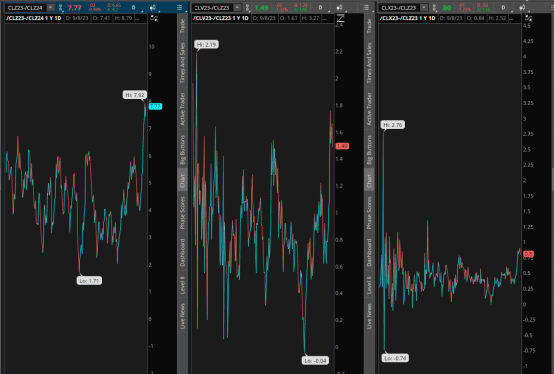

Calendar spreads still remain strong, especially on the longer end

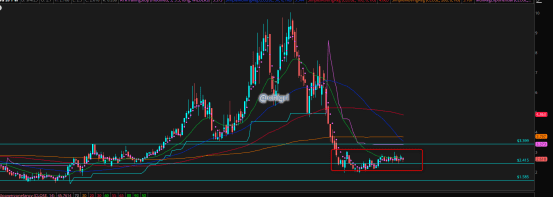

Nat Gas

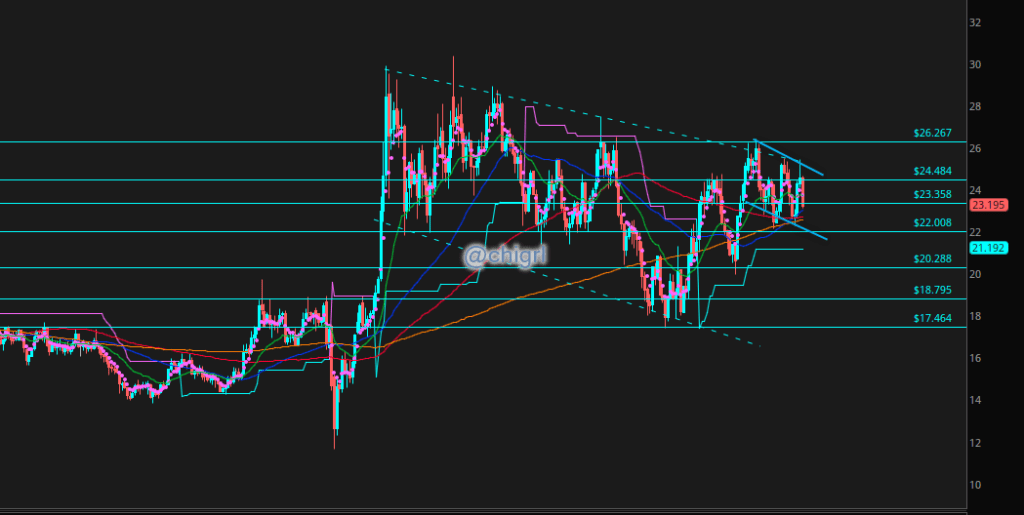

This market is still in consolidation, August 20th I noted: If you are a long term investor, might not be a bad time to start a position here as I think that this winter will be much different than last for Europe due to El Nino. (I still like this play)

This could break either way, but I lean toward the upside. This market may not move much until we get closer to winter, meaning, I am not expecting much during September.

This market has not moved in over a year, bigger picture

Copper

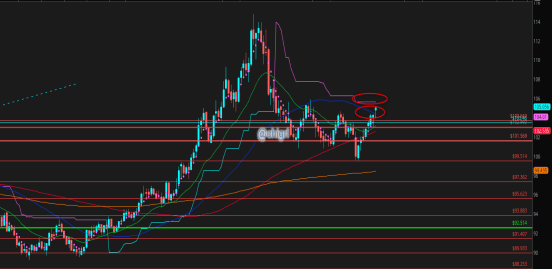

Same view as last week :

We could see more consolidation in this triangle until we have a clear understanding of China markets/stimulus.

Technically to play this, one would wait for the break and retest to initiate a trade.

That said, I am partial to an upside break given the fundamentals of this market.

Gold

Again I am kind of agnostic here on gold again this week, we are still in no mans land, but the fact that it is holding up so well is amazing.

There are a couple ways to look at this.

That said, longer term, I think this moves higher..but when is the question.

I could definitely see scenario where we consolidated in this pattern for weeks longer, but it it is a bullish pattern.

Silver

This market could continue to waffle in this bullish wedge (have said this for weeks now).

That said, I remain bullish this market not only for technical reasons, but fundamental reasons at well. In my opinion, it is not *if* but when will this market break higher.

$DXY USD

Last week I warned of upside potential to USD to 104.26 (which we surpassed) and above that is 105.661

With rising energy prices, lets see if Yellen will let the dollar continue to move higher in an effort to negate inflation in the US , a move over 106 suggests that the down trend is over for now

Financial Disclaimer: This material has no regard for specific investment objectives, financial situations, or particular needs of any user. This material is presented solely for informational and entertainment purposes and is not to be construed as a recommendation, solicitation, or an offer to buy or sell / long or short any securities, commodities, or any related financial instruments. Nor should any of its content be taken as investment advice. The views expressed here are completely speculative opinions and do not guarantee any specific result or profit. Trading and investing are extremely high risk and can result in the loss of all of your capital. Any opinions expressed here are subject to change without notice. We may have an interest in the securities, commodities, and/or derivatives of any entities referred to in this material. We accept no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this material. We recommend that you consult with a licensed and qualified professional before making any investment or trading decisions.