Not much data last week all eyes on CPI and FOMC next week.

Crude Oil

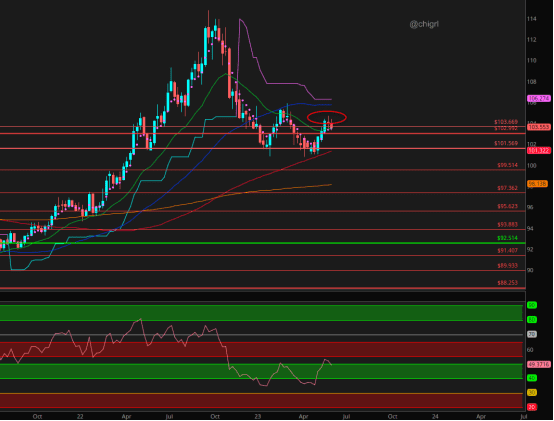

Crude oil fails to hold the rally after the OPEC meeting and additional cut announcement from Saudi Arabia in July of 1M barrels per day.

Let’s look at some data via Oilytics:

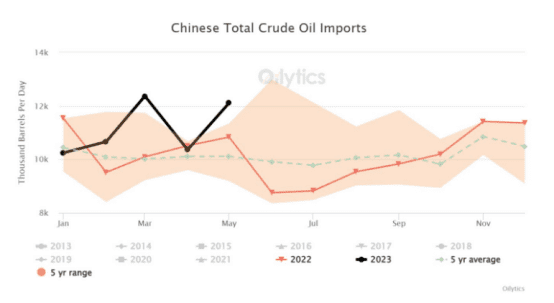

Chinese crude imports surged above 12MMBD to reach the 3rd highest on record. With refinery runs expected to keep hitting record highs, Chinese crude imports continue to remain elevated. With Saudi cuts coming in July, it remains to be seen whether China displaces these barrels or uses its vast inventories to keep its refinery runs elevated. (Source: China customs)

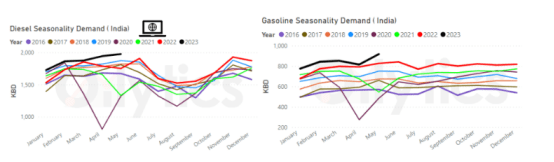

Demand in Asia continues to hold strong. India reported very strong demand numbers in May as strong economic growth and cheap Russian crude are leading demand to record highs. Road fuels like Gasoline and Diesel continue to outperform showing y/y growth of 11% and 13% respectively. (Source: PPAC)

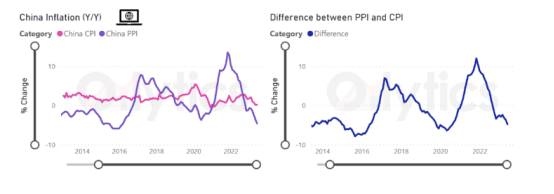

Another set of bearish macro numbers out of China as softening demand continues to plunge PPI (factory gate inflation) to the lowest level in 7 years. Chinese CPI (consumer price index) continues to hover near 2-year lows at 0.2% y/y. Both numbers came in lower than expectations. (Source: NBS Statistics)

Takeaway: IMHO, it is this China data that is spooking the market, in addition to the fact that the Eurozone entered a technical recession last week after Q2 GDP data came out. It is going to be hard for crude to rally unless we see some improving macro data from China and the EU, as deteriorating data has this market spooked. That said, fundamentals remain strong and this market continues to tighten. Will we have a bullwhip effect over the summer? Entirely possible.

Longest bear-market rally, or one of the weakest starts to a bull market in history?

Via Edward Jones:

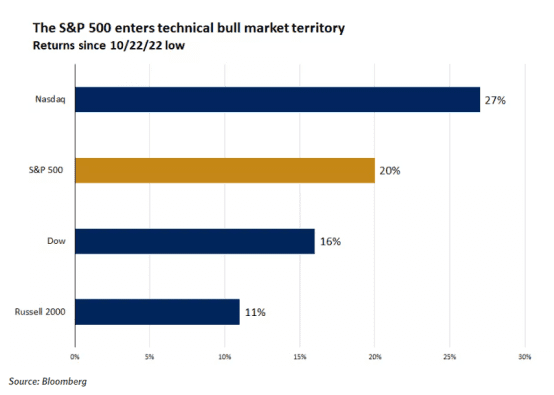

Equity markets reached a new high for the year, adding to their recent gains ahead of the likely market-moving inflation reading and Fed rate announcement this week. While stocks are still a ways off their record highs, the S&P 500 is up about 20% from its mid-October lows, a threshold that could indicate a new bull market1.

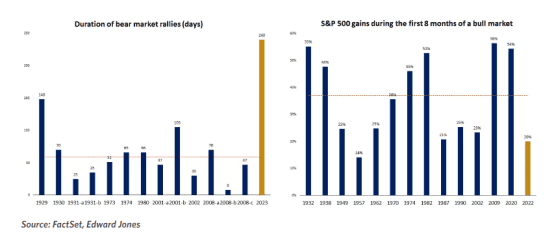

The path that markets have followed since October appears different from what tends to happen around major inflection points when looking at duration and strength. If we remain in a bear market, at eight months since last year’s low, the rise in equities would mark the longest bear-market rally in history (the average bear market rally has lasted about two months)

On the flip side, if we have entered a new bull market, the 20% rally would mark the second-weakest start to an upcycle going back 100 years (the S&P 500 has gained 38% on average during the first eight months of a new bull). Also, this would be the only bull market since 1980 that small-cap stocks have not outperformed large-cap stocks.

Takeaway: Everyone is waiting for the left shoe to drop, yet markets keep powering higher. Best not fight the trend for now.

TGA Account and a market liquidity drain?

My friend @concodanomics offered some great information on this on Twitter.

Let’s take a look, I will try an consolidate the information, but if you want to check the whole thread, you can find it HERE.

This looks difficult to absorb at first, but do not give up…read to the end!

The much-anticipated liquidity drain is in motion, with many headlines predicting turbulence ahead for markets. Yet, its effects may not deliver the impact that many believe. Numerous hidden forces have emerged, acting against a liquidity squeeze. The “Transitory Pause” is here.

The consensus is concerned over two effects of the “TGA refill”: a large issuance of government debt prompting market instability, and the subsequent draining of bank deposits and reserves reducing liquidity. The outcomes of both, however, aren’t as scary as they appear

First, it’s believed that issuing such a large quantity of t-bills in a short space of time will be difficult for markets to absorb, blowing out spreads and provoking turmoil. But as history shows, bond markets absorb huge issuances, even within a month, without much hassle.

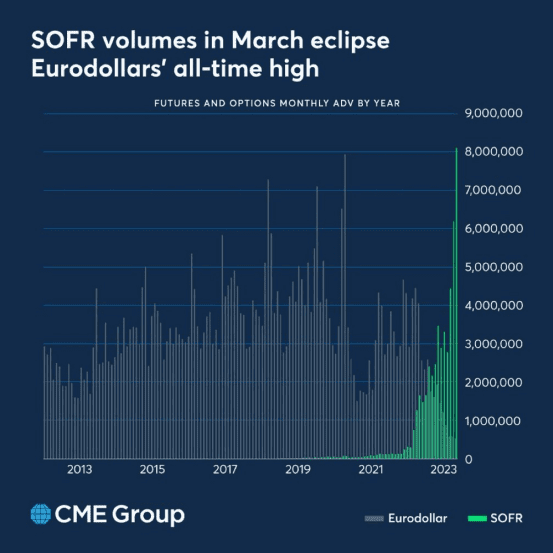

As for demand, with yields offering the highest return in decades, plus the switch from an unsecured (LIBOR) to a “secured” (SOFR) monetary standard in full swing, the world is eager to chomp on America’s ever-increasing debt load.

We also know in advance that major market players are willing to consume a large batch of sovereign debt by referring to the Fed’s latest survey of its primary dealers, specific entities the Fed mandates to make markets in Treasuries. Expected supply is in line with demand.

Instead, it’s not whether market participants will be able to absorb trillions in new issuance but who buys the majority of Treasuries issued that will influence liquidity. The real concern is the subsequent liquidity drain from the banking system.

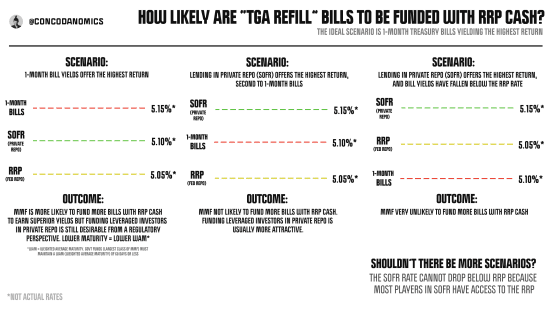

The most bullish scenario for liquidity is if most t-bills are bought with cash stored mostly by money market funds (MMFs) and some banks in the Fed’s RRP (reverse repo) facility.

For the uninitiated, repo (short for repurchase agreements) is a market for borrowing securities, usually Treasuries, for a fee overnight or over another short period. An RRP (reverse repo) is the opposite perspective: cash is lent, secured by collateral, and earns interest.

It’s not as easy for MMFs, however, to simply pull money from the RRP to fund new t-bills. They have to be incentivized to do so. MMFs, after all, are investment vehicles looking to maximize their returns while under the watch of regulators.

For a sizeable “RRP drain” to even have a chance of occurring, 1-month Treasury yields must rise not only above the RRP rate but also SOFR (the Secured Overnight Financing Rate)

Silently, the Fed has temporarily withdrawn from signaling tightness. With the “Fed skip” in play, the Transitory Pause is now in session…

A Transitory Pause is a combination of the Fed’s inaction and silence around enforcing an adequate tightening of financial conditions. The market has been repressed by heightened volatility and uncertainty for so long, that when it sniffs out dovishness, risk assets respond

(Previous measures the Fed has implemented to quell financial conditions have proven ineffective, or even defunct, and fail to discourage animal spirits. QT (quantitative tightening), which on its own has failed to achieve actual tightening, is even offset by other forces.

Fed QT inception to date, the “plan” was $750bn QT. The “end result” is $100bn QE instead- via Steve Donzé)

With the Transitory Pause in play, the world’s natural long bias has awoken.

Retirement funds, no longer weighing increased vol (volatility) and rate hike intensity, have stopped rebalancing out of stocks into bonds, while entities that load up on stocks solely on falling vol have been buying like crazy.

If the “Not-QE” era persists, front-running the Fed’s silence and inaction to tighten will become a regular window in which risk assets soar. The “Transitory Pause” will eventually become a defining theme in markets.

Takeaway: I hope this did not lose you and make your eyes glaze over, but there is a lot to learn in this thread. But the key to all this is that the refilling of the TGA account is likely not to be as bearish as most are portending.

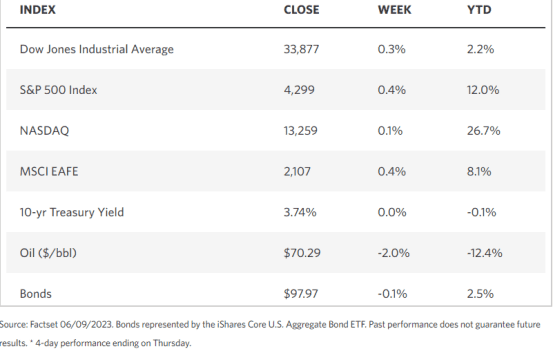

WEEKLY MARKET STATS

TECHNICALS

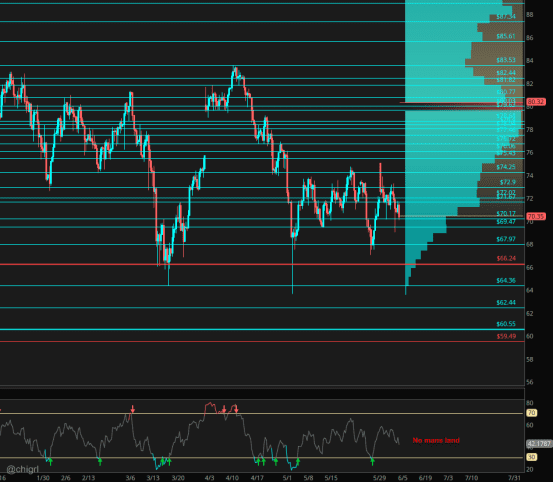

Crude oil

Still in no man’s land. Although this looks like it is about to fall out of bed, I still think there is a floor under this and we do not see below the recent low (May 3)

Selling rallies, for now, is better than shorting in the hole, but keep an eye on data as cuts from OPEC+ filter in. A bullwhip effect may be coming.

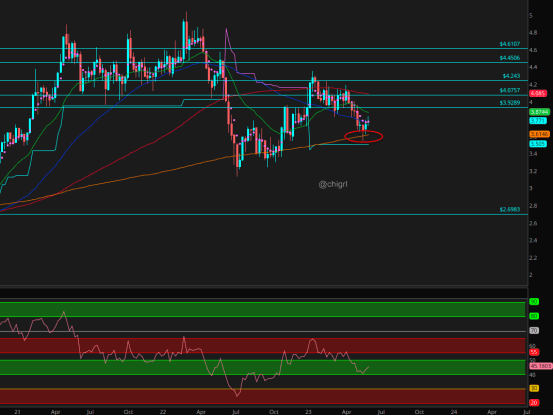

Nat Gas

Still no change to my view.

Nat gas is still waffling in a supply zone.

I want to see a clear break over $3.40/75 for the futures or over $11.70 in UNG to get bullish this market over the longer term, we just are not even close yet.

TTF (European nat gas did stage a rally of 20% on Friday as hot weather kicked in and air conditioners were on full force… let’s see how big of a draw in stocks they get and if they have to order early, additional supplies in the spot market from the US)

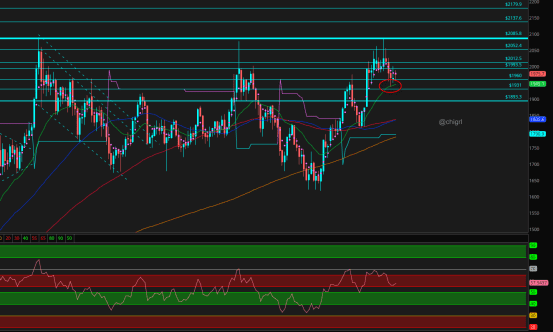

Gold

20 week still holding.

*If * the Fed does pause this week, that could send the dollar lower and help gold. This market is all about FOMC this week.

A pause could also spook gold higher as it would signify a change in Fed stance.

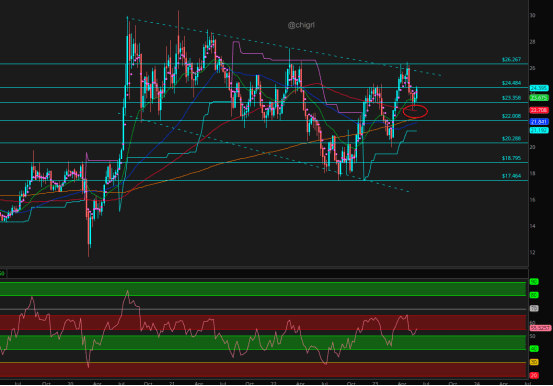

Silver

Macro wise this market is still bullish with a long-term weekly bullish pattern, 100 day is holding so far.

This market will also be affected by FOMC this coming week.

Copper

Still holding 200 day, a positive for the market.

Long term= bullish.

Short term=sideways

$DXY

Bearish candle formation before it even reached 105/106 area, where I was looking for a significant retrace.

If the Fed pauses this coming week, we could see further declines and I would be looking for it to break that double bottom.

Financial Disclaimer: This material has no regard for specific investment objectives, financial situations, or particular needs of any user. This material is presented solely for informational and entertainment purposes and is not to be construed as a recommendation, solicitation, or an offer to buy or sell / long or short any securities, commodities, or any related financial instruments. Nor should any of its content be taken as investment advice. The views expressed here are completely speculative opinions and do not guarantee any specific result or profit. Trading and investing are extremely high risk and can result in the loss of all of your capital. Any opinions expressed here are subject to change without notice. We may have an interest in the securities, commodities, and/or derivatives of any entities referred to in this material. We accept no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this material. We recommend that you consult with a licensed and qualified professional before making any investment or trading decisions.