Although markets ended lower this week, the pervasive question seems to be “Can the market rally continue?”

Let us take a look at what banks are saying and some data.

Goldman Sachs

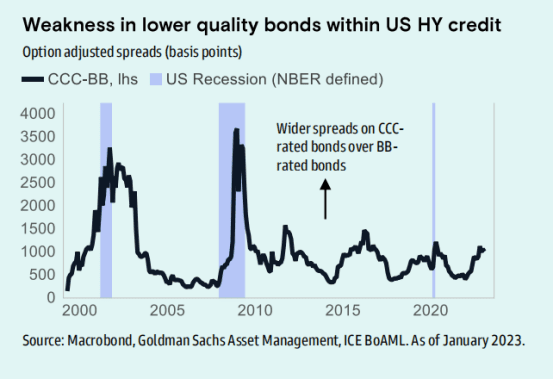

Beyond curve inversion in interest rate and credit markets, and rating divergence within US high-yield credit, we think most financial assets reflect limited recession risk. Looking ahead, we are mindful that recent performance in financial assets creates less room for further gains (absent a reacceleration in growth and sharper deceleration in inflation) and more room for a selloff should downside growth risks re-emerge, or inflation reaccelerate.

Danske Bank

Following a period where the discussion was not about if we would have a recession

but how long and how deep it would get, focus has now turned to whether we will avoid recession and in fact could be seeing a mild re-acceleration of global growth. The main reason is 1) economic data has not been quite as bad as feared, 2) China has reopened earlier and faster than expected and 3) mild winter weather has pushed down gas and electricity prices. The change in sentiment has underpinned a rally in equity and credit market since October with emerging markets and euro risk assets taking the lead.

A strong US labour market report on Friday last week added to the sense that the global economy may actually be bottoming out going into the new year. It is supported by an increase in global PMI for January, a decent rise in some of the most leading surveys in the euro area (Euro Sentix, ifo expectations) and a broad improvement of what we call the “growth tax”, which is a summary of the change in financial conditions and energy prices. Order-inventory balances have also turned higher in for example US, the euro area and China. Hence, after a year with heavy clouds over the global economy, we start to see some rays of light.

The flip side is, though, that central banks will have to err on the hawkish side for longer. We did indeed see more signals over the past week from both the ECB and the Fed that more rate hikes will be needed to get inflation down – and keep it down. It led to a rebound in bond yields and in the middle of the week caused some headwinds to risk assets and metal prices.

ING

This week’s speech by Federal Reserve Chair Jerome Powell did not include the hawkish surprise some had feared. Ultimately, Powell probably delivered the minimum amount of pushback against dovish speculation required by the strong January jobs report. As we observed yesterday, there was ample room to surprise on the hawkish side, but it clearly seems that Powell is reluctant to drop his relatively sanguine stance on the disinflation narrative. Risk assets probably dodged a bullet yesterday, and the dollar momentum softened for the first time in three days. So, what now for the dollar? We think markets may feel relatively comfortable with the current pricing for a 5.15% peak rate for now, even though risks are skewed towards another 10bp of tightening being added into the curve. This means that the dollar’s upward correction may have a bit more to run, but we doubt this will morph into a sustained USD uptrend from this point on. If nothing else because Powell and other Fed speakers indicated that more evidence from the data is needed to shift to more hawkish guidance.

My Comments:

**ALL EYES WILL BE ON JANUARY CPI THIS WEEK.

Although the market rally this year has been impressive, it is the laggards of last year have particularly outperformed (tech). The questions we need to be asking is if this is just a relief rally or if the data has fundamentally changed.

Some key data points to keep an eye on

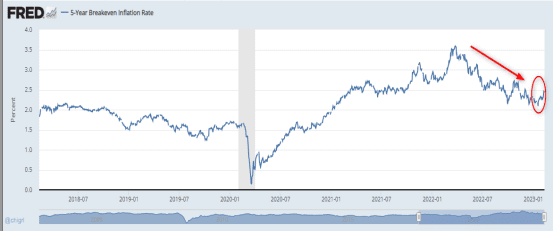

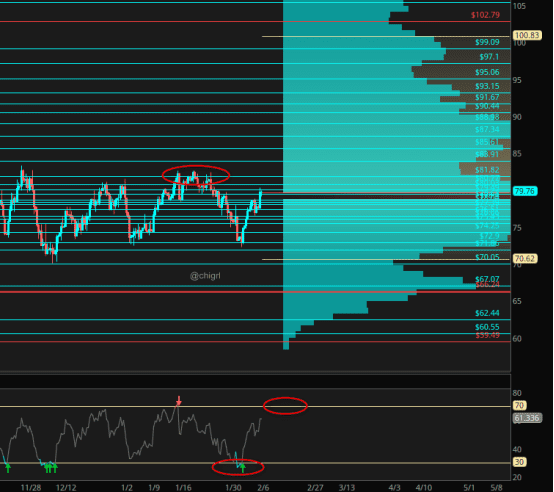

Inflation

Although inflation has continued to moderate, we are seeing a slight uptick again…I am not alarmed *yet* but something to keep your eye on. Especially as we start to enter a traditionally strong seasonal uptrend in oil prices. I should also mention that as refineries rotate to producing summer grade gasoline, prices are generally higher as summer blends contain much less (cheap) butane than winter grades.

Crude oil 20/30 year seasonal chart

US labor market

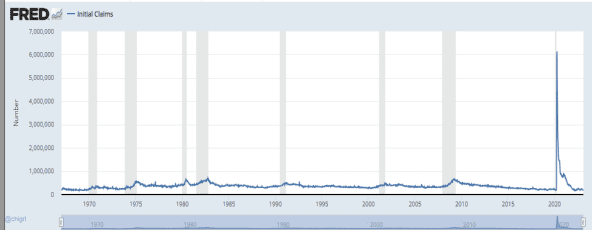

US weekly jobless claims remain at pre-pandemic levels

But ….

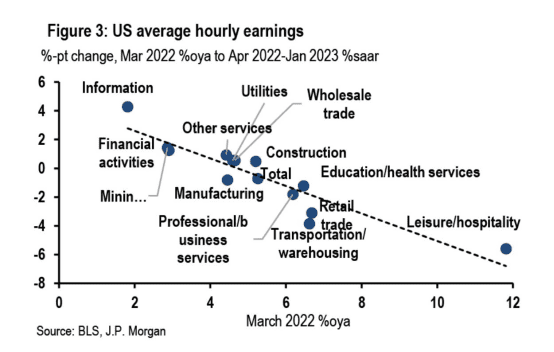

US wage growth remains negative in real terms in all sectors and negative in nominal terms as well in a few as Daniel Lacalle pointed out today on Twitter.

Fed rate hikes

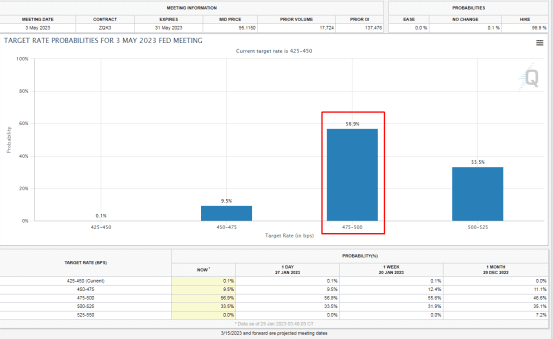

The market is pricing in 2 more rate hikes this year after this week after employment data.

The given is March but look at May at 74.2%

Versus just 56.9% two weeks ago

Earnings

Factset noted that:

“Q1 bottom-up EPS estimate (which is an aggregation of the median EPS estimates for Q1 for all the companies in the index) decreased by 3.3% (to $52.41 from $54.20) from December 31 to January 31.

In a typical quarter, analysts usually reduce earnings estimates during the first month of a quarter. The average decline in the bottom-up EPS estimate during the first month of a quarter has been:

1.5% during the past five years (20 quarters)

1.8% during the past 10 years (40 quarters)

2.2% during the past 15 years (60 quarters)

1.7% during the past 20 years (80 quarters)

Thus, the decline in the bottom-up EPS estimate recorded during the first month of the first quarter was larger than the 5-, 10-, 15-, and 20-year averages”

*Reminder: By lowering earnings expectations, we run the risk of beating expectations (just to keep in mind).

IN THE END: Expect volatility to continue, this continues to be a trader’s market and these CME daily option contracts are an ideal way to participate in this market with limited risk!

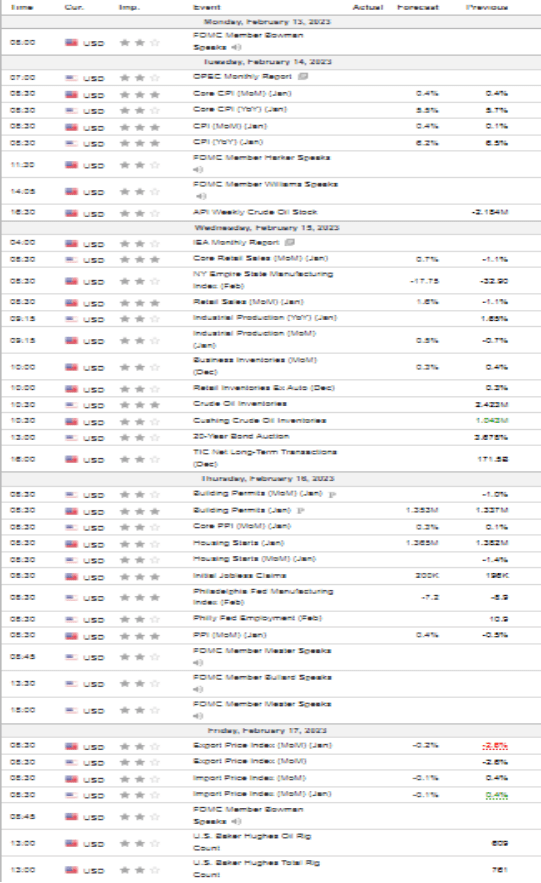

US DATA THIS WEEK

Warning: It is a ridiculously loaded week with a gaggle of Fed speakers

*ALL EYES ON CPI THIS WEEK

THINGS TO KEEP AN EYE ON THIS WEEK

$DXY (USD)

$DXY (USD)

$DXY (USD)

(clear enough?)

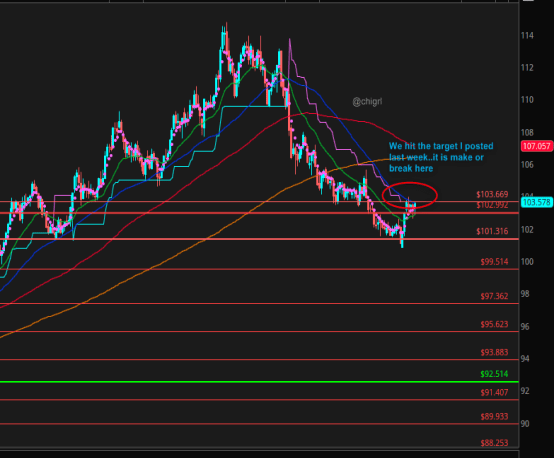

Crude oil

Chart is still constructive, we are not yet oversold, beware of the last recent high, if this gains traction we could see a squeeze above

Financial Disclaimer: This material has no regard for specific investment objectives, financial situations, or particular needs of any user. This material is presented solely for informational and entertainment purposes and is not to be construed as a recommendation, solicitation, or an offer to buy or sell / long or short any securities, commodities, or any related financial instruments. Nor should any of its content be taken as investment advice. The views expressed here are completely speculative opinions and do not guarantee any specific result or profit. Trading and investing are extremely high risk and can result in the loss of all of your capital. Any opinions expressed here are subject to change without notice. We may have an interest in the securities, commodities, and/or derivatives of any entities referred to in this material. We accept no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this material. We recommend that you consult with a licensed and qualified professional before making any investment or trading decisions.