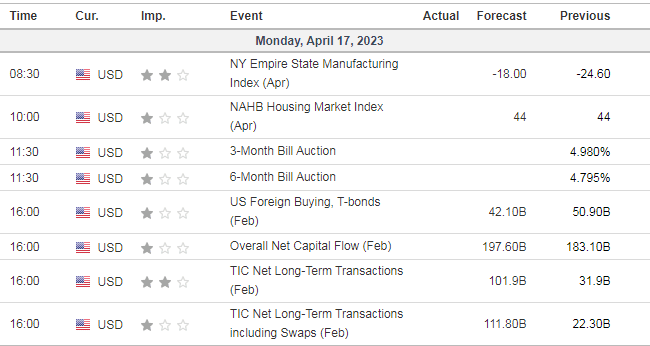

UPDATE 17 April: Quiet overnight…not much data today

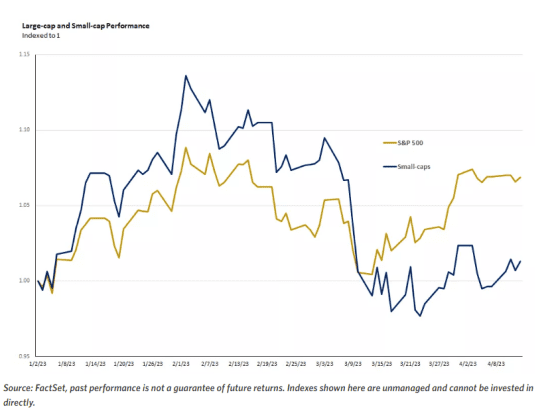

Market Wrap this week via FactSet:

US equities close lower: Dow (0.42%), S&P 500 (0.21%), Nasdaq (0.35%), Russell 2000 (0.86%)

- US equities ended lower in Friday afternoon trading, though stocks came off worst levels from the early afternoon. Major indices still logged gains the week. Managed care (UNH), A&D (BA), insurers (HIG), industrial metals, oil services, media, REITs, utilities were among today’s laggards. Moneycenter banks outperformed on better-than-feared earnings, though regionals were broadly weak. There were some pockets of relative strength in E&Ps, machinery, multis, road/rail, IBs, apparel, and auto suppliers. Treasuries came under meaningful bear-flattening pressure, adding to big yield increases for the week. Hawkish Fedspeak was flagged as a big overhang. Dollar index was up 0.6% and reversed much of its weekly pullback. Gold finished down 1.9%. Bitcoin futures up 0.3%. WTI crude settled up 0.4% to notch a fourth-straight weekly gain.

- Disinflation traction remained the big positive for risk sentiment, with upside also chalked up to positioning dynamics. However, still a lot more bearish than bullish talking points. Despite the cooler inflation prints, bond yields still up for the week and Fed still expected to go another 25bp in May before (possibly) pausing. Also concerns about the big divergence between market and Fed on pivot expectations, with the market pricing in ~200bp in rate cuts over a roughly 18-month stretch starting in June. Earnings arguably the biggest source of downside risk for the market with some strategists expecting consensus estimates to fall another 10-20% on a softer macro backdrop and sticky wage pressures on margins.

- The first group of bank earnings was fairly well received, with JPM, WFC, and C all beating expectations. Follows recent turmoil in the space surrounding deposits and broader fallout from Fed’s aggressive tightening cycle. Nothing particularly concerning in terms of provisions or qualitative commentary. In other corporate news, BA warned it will slow deliveries of the 737 MAX due to a problem with a part made by SPR. Former did not reiterate full-year delivery guidance and both stocks under pressure on the news. HIG negatively preannounced for Q1, flagging elevated cat losses from winter storms on both coasts. LCID hit after its Q1 production update showed a sequential decline.

- Retail sales declined more than expected in March. Fits with thoughts risk was to the downside given read-throughs from credit card spending data (some focus on lower tax refunds). However, some sense control-group sales not as bad as feared. Some focus on notable jump in year-ahead inflation expectations from UMich April consumer sentiment. Fedspeak was also on the radar . Fed Governor Waller and Atlanta’s Bostic signaled support for 25bp hike in May, though Chicago’s Goolsbee again said Fed should be mindful of not being too aggressive. Elsewhere, banks reduced borrowings from two Fed backstop lending facilities for a fourth straight week as liquidity pressures on the sector eased further following last month’s bank collapses. Inflows to money market funds slowed but remained elevated. Republicans reportedly planning to unveil one-year debt ceiling expansion in exchange for spending concessions.

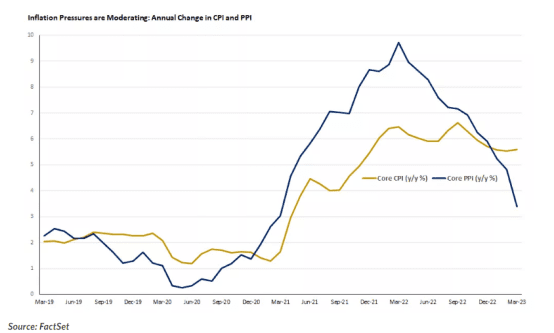

PPI was this past week …so let us talk about inflation a bit.

Last week’s release of the March CPI report revealed that inflation remains on its downward path. Headline inflation has dropped materially, falling from 9% last summer to 5% in March, driven in large part by a drop in oil and food prices. Gasoline prices were down 4.7% in March versus February while food-at-home costs declined thanks in part to an 11% month-on-month drop in egg prices.

Core inflation, which excludes volatile energy and food costs and serves as the more structural measure of inflation upon which the Fed bases monetary policy, rose by an expected 0.4% versus the prior month, putting inflation at a 5.6% annual rate. This is down from last September’s peak of 6.6%, but still a long way from the Fed’s 2% long-term target.

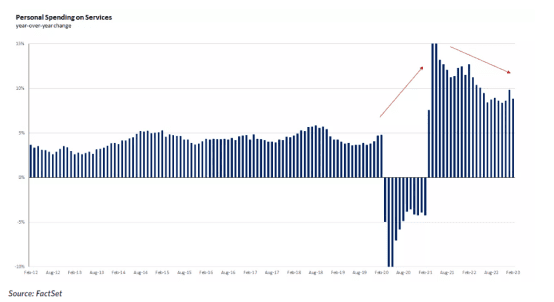

Looking under the hood, used vehicle prices fell sharply from the prior month while upward pressure from shelter costs eased. On the other hand, elevated service prices persist, notably in the leisure categories such as hotels and airfare. (Edward Jones)

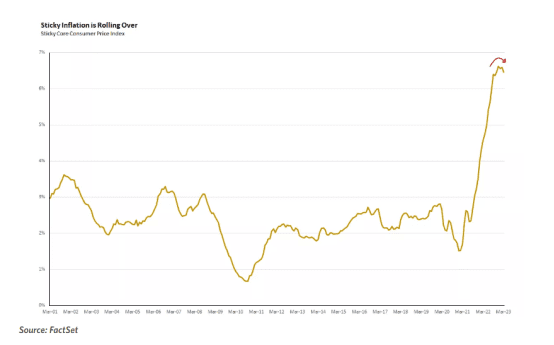

Services inflation what the Fed has been fighting as it has remained persistent…so some positive news on that

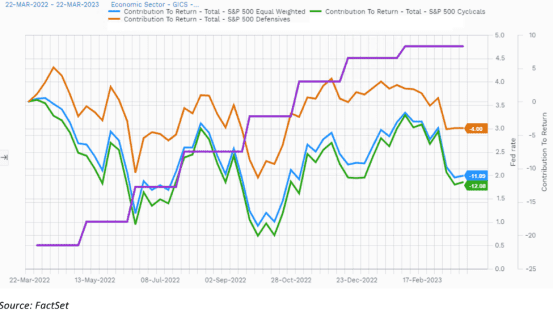

RANDOM OTHER INTERESTING CHARTS

The hypothetical defensive portfolio outperformed the hypothetical cyclical portfolio throughout the past 12 months

S&P 500 Defensives Equal Weighted index:

Healthcare, Utilities, Consumer Staples, Energy

S&P 500 Cyclicals Equal Weighted index:

Utilities and Telecom, Materials, Consumer Discretionary, Financial, Information Technology, Industrials

TECHNICALS

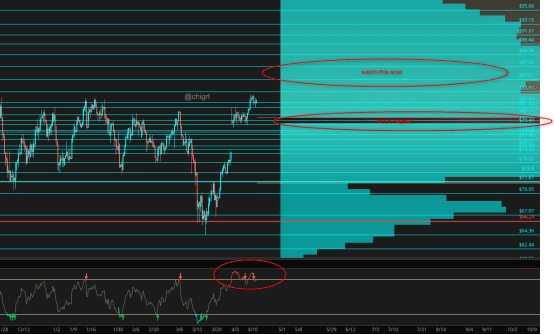

Crude Oil

Last week I said: That said we are well overbought, I would like to see some of this bullishness worked off to continue higher. So far the Biden administration has been fairly quiet about these new cuts. We may hear some announcements this week. It could be they bring up NOPEC (bad idea) again, another SPR release (help us all), export controls (another terrible decision), or perhaps nothing, but just be on the lookout for news that may drive this down a bit.

This market has remained much more resilient than I thought. That said, see the chart below for areas to watch.

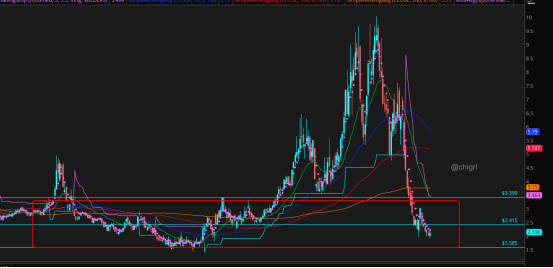

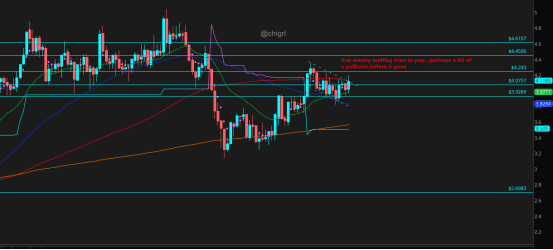

Nat Gas

No change to my view from last week: This market still looks terrible. Honestly, I do not think we see much movement until summer (weather depending).

Nat gas is still waffling in a supply zone, again, really hard for me to get excited about this market.

I want to see a clear break over $3.40/75 for the futures or over $11.70 in UNG to get bullish this market over the longer term, we just are not even close yet

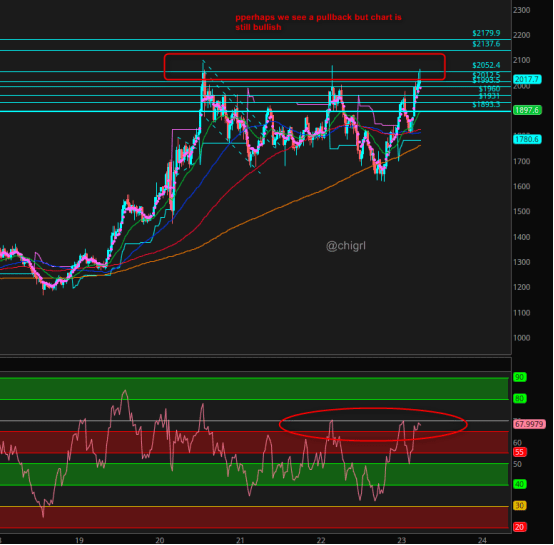

Gold

Last week I noted we broke to the upside and may see a pullback…not surprisingly, we did …

We could see a larger pullback, but still, overall chart is still bullish

Copper

LAST BUT NOT LEAST

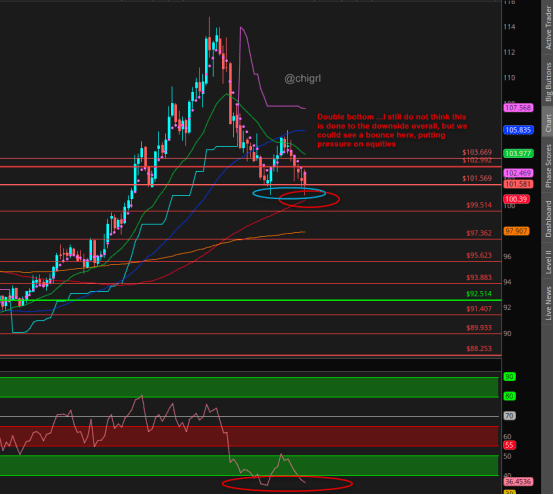

USD $DXY

Last week I noted:It still looks as though we have a bigger pullback in store.

We did indeed get a bigger pullback

We double-bottomed so far…perhaps a bounce early in the week….I still do not feel we have seen the extent of a pullback overall..let’s see

Financial Disclaimer: This material has no regard for specific investment objectives, financial situations, or particular needs of any user. This material is presented solely for informational and entertainment purposes and is not to be construed as a recommendation, solicitation, or an offer to buy or sell / long or short any securities, commodities, or any related financial instruments. Nor should any of its content be taken as investment advice. The views expressed here are completely speculative opinions and do not guarantee any specific result or profit. Trading and investing are extremely high risk and can result in the loss of all of your capital. Any opinions expressed here are subject to change without notice. We may have an interest in the securities, commodities, and/or derivatives of any entities referred to in this material. We accept no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this material. We recommend that you consult with a licensed and qualified professional before making any investment or trading decisions.