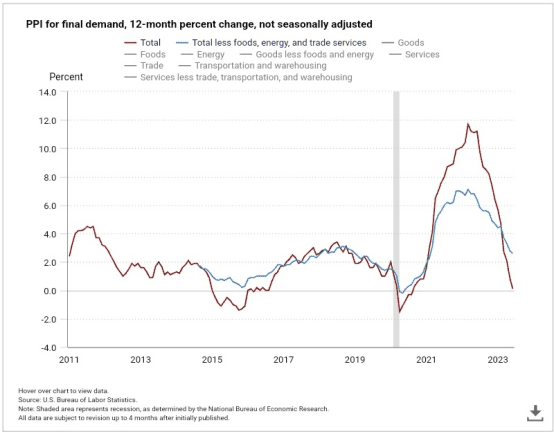

DISINFLATION?

CPI last week triggered a lot of headlines: “Disinflation has become a buzzword across trading desks, even though core inflation is still running above the central bank’s 2% target.” BBG

According to Edward Jones there is a lot to like at June CPI:

Headline inflation for June came in at 3%, cooler than expected, and sharply lower from the previous month’s 4% reading. This is the slowest pace in more than two years and the 12th straight month of improvement since inflation peaked in June of last year at 9.1%. Excluding food and energy, CPI rose 4.8% from a year ago, the slowest since October 2021, but still way above the Fed’s target.

A look under the surface reveals that inflation is slowing across a growing number of categories, making the June reading likely a pivotal one in helping shape views about how far the Fed must push.

- Goods – Even with only a modest drop in used-vehicle prices, goods inflation declined 0.1% month-over-month. The good news here is that based on timely industry data, used-car prices will likely come down more. The Manheim Used Vehicle Value Index, which tends to lead the used-car price component of the CPI by a couple of months, fell 4.2% in June from the previous month and 10.3% from a year ago. That was the biggest monthly drop since early in the pandemic, suggesting further easing in price pressures in this key driver of core inflation1.

- Shelter (housing) – Housing was once again the largest contributor to the increase in core CPI, but the June monthly rise was the smallest increase in rents since the end of 20211. Based on the historical lags between when inflation of newly signed rental contracts falls and when it shows up in the official data, we would expect housing inflation to continue to improve in the months ahead.

- Services excluding shelter – This “supercore” measure that the Fed has highlighted, which is largely a function of the labor market, continued to improve in June, falling to 4%, also the smallest increase since December 20211. The easing in this bucket of inflation was helped by a decline in airfares, likely driven by lower jet fuel prices, which probably won’t be repeated. Nevertheless, the fact that services inflation continues to cool, even with unemployment near historic lows, is noteworthy.

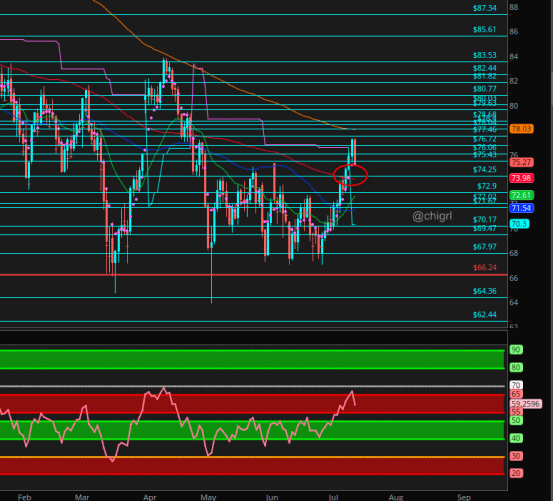

COMMENTARY: In my opinion, we really need to be watching energy, as this could derail this trend. As we know, energy costs factor into everything and we are facing some steep deficits

Oil Surge to $80 Shows Long-Awaited Market Tightening Is Here-BBG

OPEC+ cuts and rising demand will drain fuel inventories

Price rally would have major political, economic consequences

“We’re expecting a sharp tightening of the market,” Toril Bosoni, head of oil markets at the International Energy Agency in Paris, said in an interview with Bloomberg television. “As demand increases seasonally, we do think there’s a risk that prices will continue to increase into the third quarter.”

Price differentials for crude grades chemically similar to those shipped by Riyadh are climbing in the cargo market. The kingdom gave markets another boost last week by announcing that an extra, unilateral cut of 1 million barrels a day launched this month would continue into August.

Even Russia, after much delay, appears to be playing a part. For much of this year, Moscow was boosting crude exports and maximizing sales in order to fund its war against Ukraine, even as it was pledging to cut production. Tanker tracking data compiled by Bloomberg shows that, in the four weeks to July 9, the country pared exports by roughly 25%.

The balance of supply and demand already swung from surplus to deficit in June, according to Standard Chartered Plc. The shortfall will more than double in coming months, draining oil inventories by a hefty 2.8 million barrels a day in August, the bank estimates.

“All the micro-fundamental factors are finally turning bullish,” said Trevor Woods, chief investment officer at commodities hedge fund Northern Trace Capital LLC. “I mean, these draws are gonna be huge.”

I can not stress enough to keep an eye on this. Everyone seems very complacent here.

Some headlines this week:

BlackRock’s Rieder Says US Doesn’t Have to Fall Into Recession -BBG

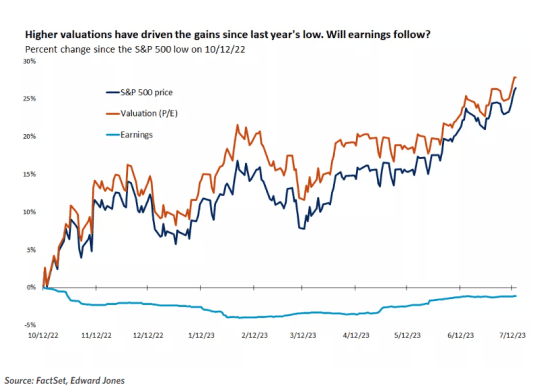

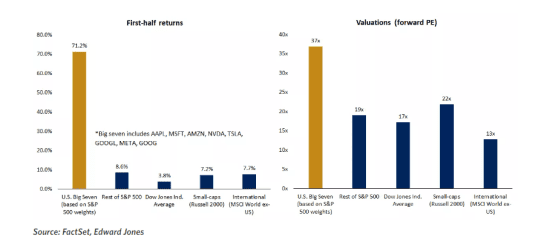

Corporate America’s Profit Engine Is Just Starting to Rev Up -BBG

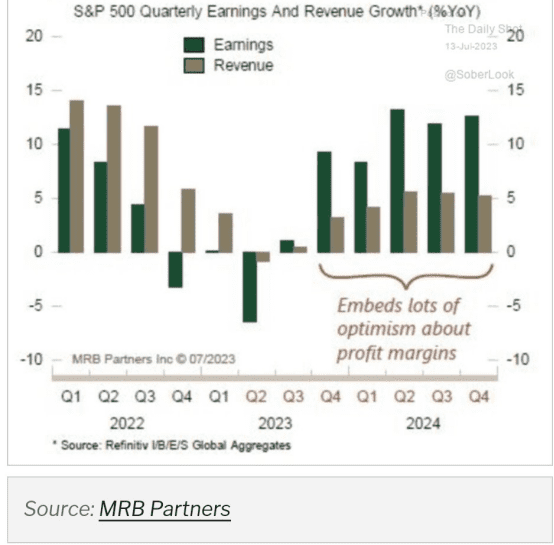

MRB Partners point out that analysts expect increased profits as inflation is behind us

Speaking of earnings season, let us look at that

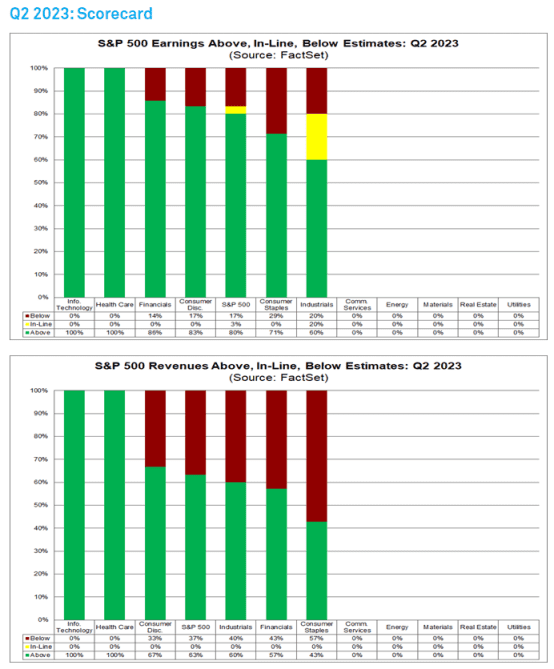

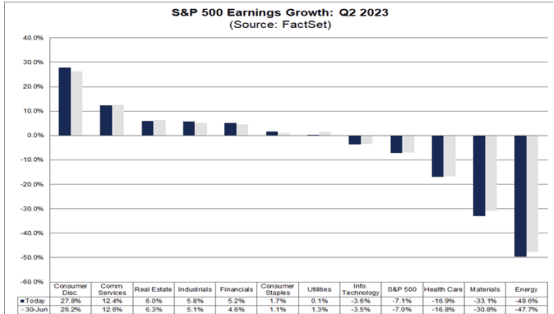

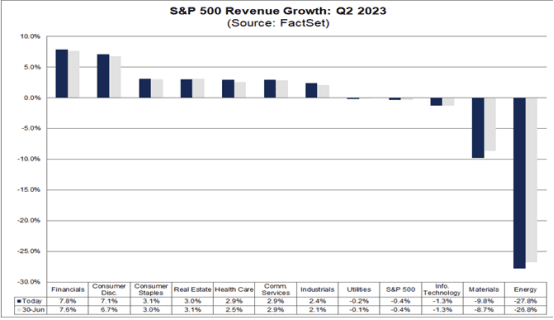

Q2 earnings season has just kicked off…let us take a look at what that looks like

Via Factset:

At this very early stage, the second quarter earnings season for the S&P 500 is off to a strong start. Both the number of positive earnings surprises and the magnitude of these earnings surprises are above their 10-year averages. As a result, the index is reporting higher earnings for the second quarter today relative to the end of last week. However, the index is still reporting its largest year-over-year decline in earnings since Q2 2020.

Overall, 6% of the companies in the S&P 500 have reported actual results for Q2 2023 to date. Of these companies, 80% have reported actual EPS above estimates, which is above the 5-year average of 77% and above the 10-year average of 73%. In aggregate, companies are reporting earnings that are 8.8% above estimates, which is above the 5-year average of 8.4% and above the 10-year average of 6.4%.

The index is reporting higher earnings for the second quarter today relative to the end of last week, but slightly lower earnings relative to the end of the quarter. The blended (combines actual results for companies that have reported and estimated results for companies that have yet to report) earnings decline for the second quarter is -7.1% today, compared to an earnings decline of -7.4% last week and an earnings decline of -7.0% at the end of the second quarter (June 30).

Positive earnings surprises reported by companies in the Financials sector have been the largest contributor to the decrease in the overall earnings decline for the index over the past week.

If -7.1% is the actual decline for the quarter, it will mark the largest earnings decline reported by the index since Q2 2020 (-31.6%). It will also mark the third straight quarter in which the index has reported a decrease in earnings.

COMMENTARY: We still have a long way to go, but so far earnings are tracking anlysts expectations of -9.0%

DOLLAR DECLINES

I have no idea what happened with Yellen’s meeting in China, but as suspected, something big did, because the dollar started falling and the Yuan rising right after her trip

USD/CHN

COMMENTARY: (Read my daily overnight blog)

Also Big news last week

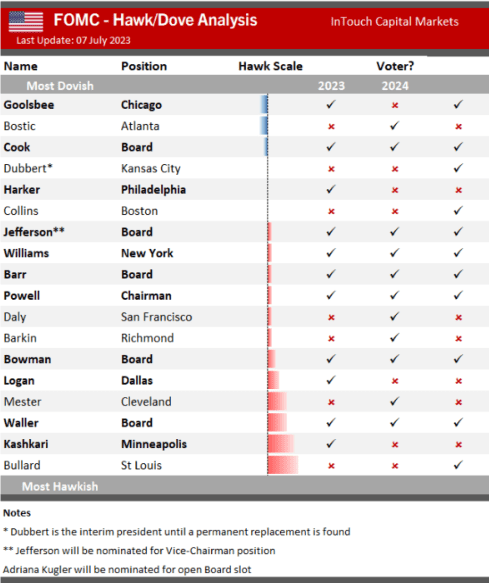

Bullard is leaving the Federal Reserve in august as he has accepted a position as Dean at Prudue

Although he is a non-voter, he was the most Hawkish of the bunch

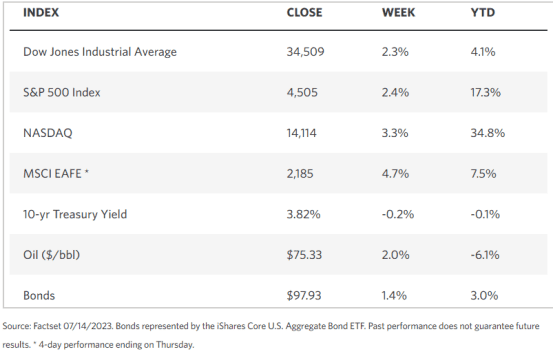

Weekly market stats

TECHNICALS

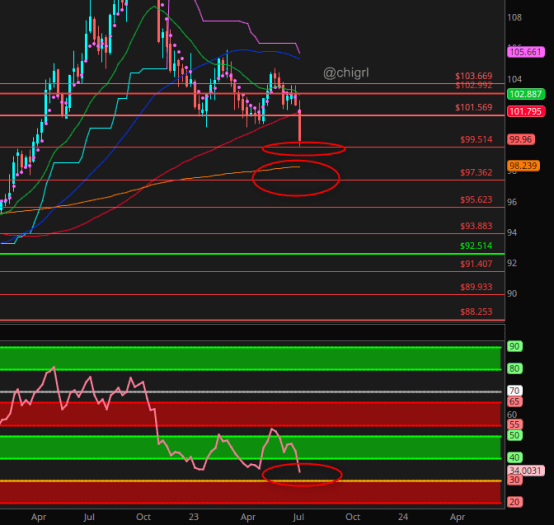

Crude Oil

Libya has release a political prisoner that caused shut downs of 250K bpd last week

I would not be surprised if we opened down, that said, I think the downside its limited

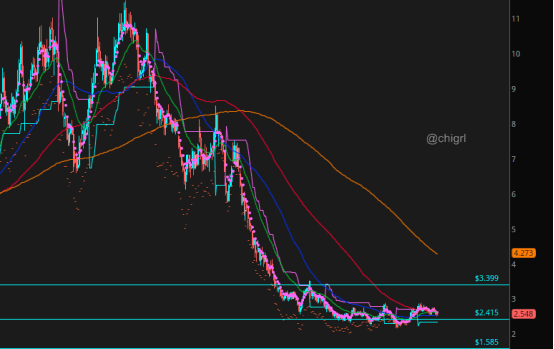

Nat Gas

Do I still need to cover this?

This market has not changed for weeks, that said if you are a long term investor…this seems like a good place to be accumulating equity positions

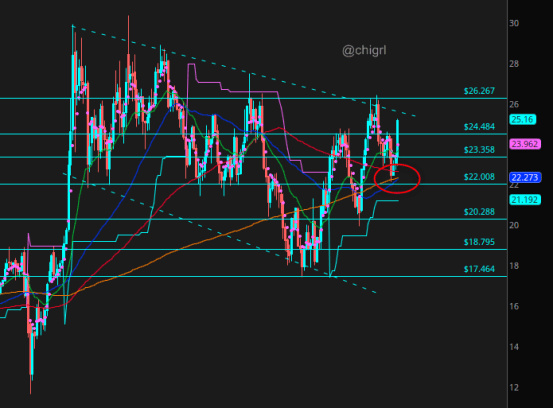

Silver

Two weeks ago I noted that we were in a major support area

Many do not think of the green economy when you mention silver, but in fact, silver has many uses in renewables- Industrial buyers were 51% of global demand in 2022

Led by end-uses in the green economy, industrial demand is forecast to rise yet again, by 4% to a new record high this year.

The drivers behind these gains include investment in PV, EV’s ,just as an example, In hybrid vehicles, silver use is around 18-34 grams per light vehicle, while battery electric vehicles (BEVs) consume in the range of 25-50 grams of silver per vehicle.

In addition silver is used in battery storage, power grids and 5G networks, and consumer electronics.

This chart remains bullish.

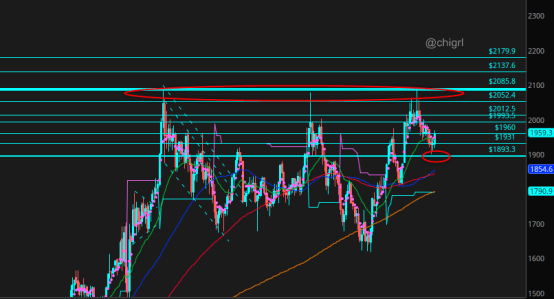

Gold

Gold is more a function of rate than anything.

Although that sold break above remain elusive, over the long term the chart is still bullish

Solid support is holding

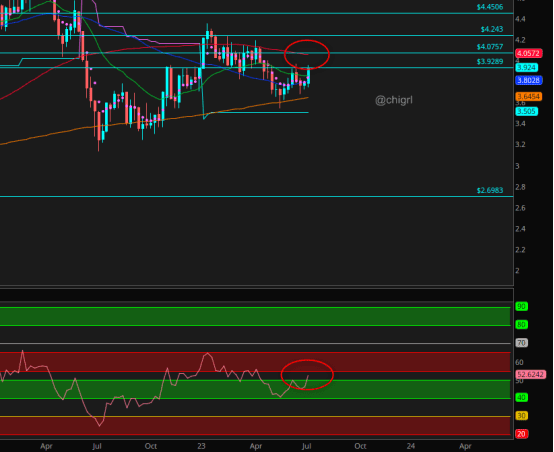

Copper

No mans land …watch China for clues (although I can argue that China is really no longer the barometer, it does not matter what I think)

USD $DXY

We never hit 105 the area I was looking at for a rejection down, this chart is oversold but remains bearish. Look for major supports below.

This weakens will help buoy commodities

Financial Disclaimer: This material has no regard for specific investment objectives, financial situations, or particular needs of any user. This material is presented solely for informational and entertainment purposes and is not to be construed as a recommendation, solicitation, or an offer to buy or sell / long or short any securities, commodities, or any related financial instruments. Nor should any of its content be taken as investment advice. The views expressed here are completely speculative opinions and do not guarantee any specific result or profit. Trading and investing are extremely high risk and can result in the loss of all of your capital. Any opinions expressed here are subject to change without notice. We may have an interest in the securities, commodities, and/or derivatives of any entities referred to in this material. We accept no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this material. We recommend that you consult with a licensed and qualified professional before making any investment or trading decisions.