This week is a chartfest bonanza of what I think is worth noting over the past week and looking at Q2 data

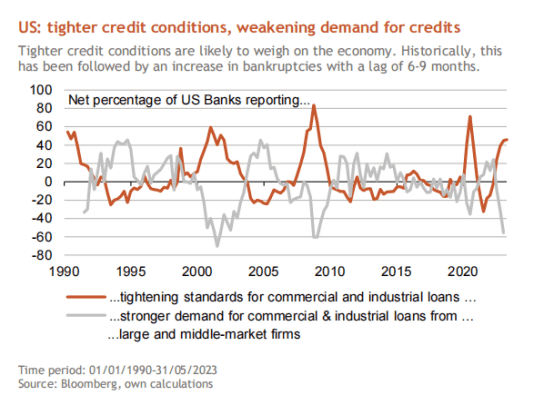

US: tighter credit conditions, weakening demand for credits Tighter credit conditions are likely to weigh on the economy. Historically, this has been followed by an increase in bankruptcies with a lag of 6-9 months (Bernberg)

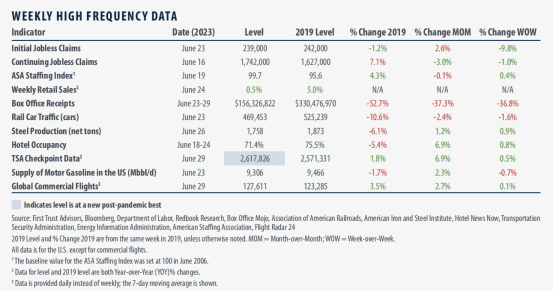

US WEEKLY HIGH FREQUENCY DATA

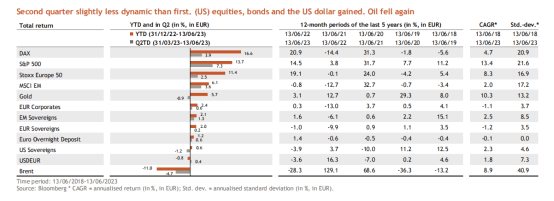

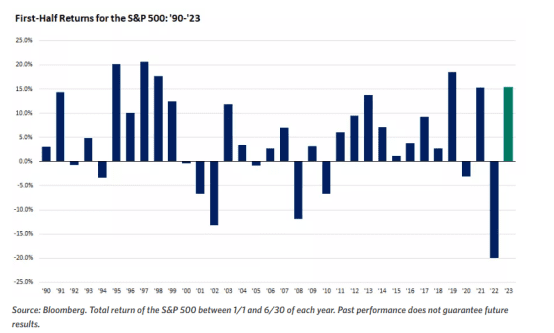

Strong first-half gains have often carried through to healthy full year returns.

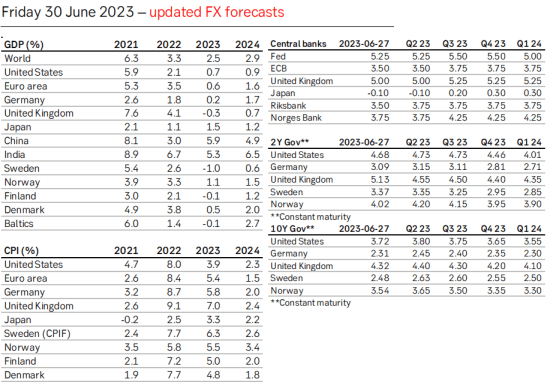

SEB updated forecasts

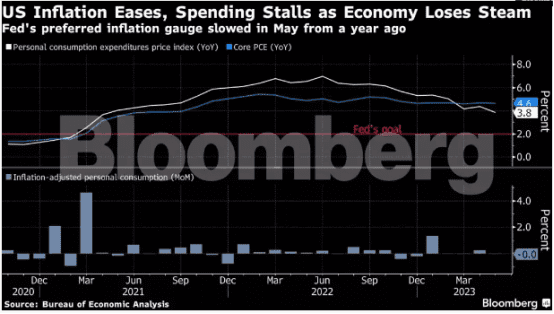

US Inflation

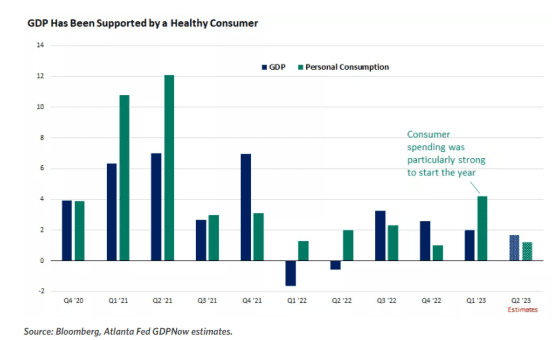

US consumer spending — the economy’s main engine — has lost steam for most of this year, portending weaker growth ahead while also helping to cool inflation. That weakness contrasts with recent data that have otherwise painted a picture of a resilient economy rather than one on the brink of recession.

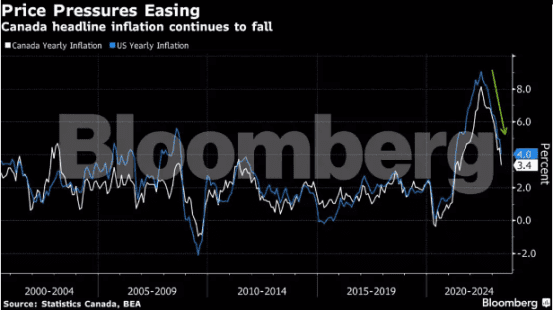

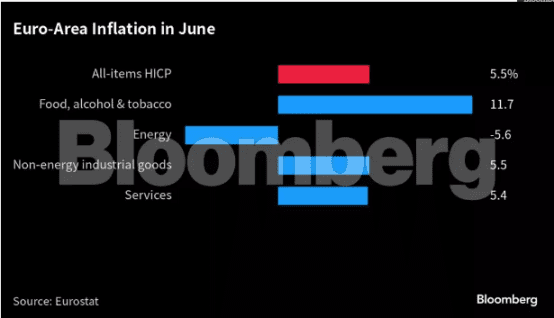

Europe inflation

Germany -I have been noting this for a while now deindustrialization

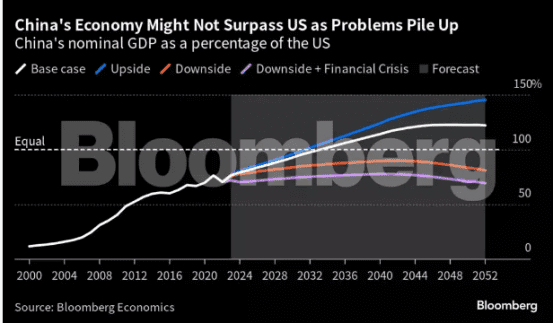

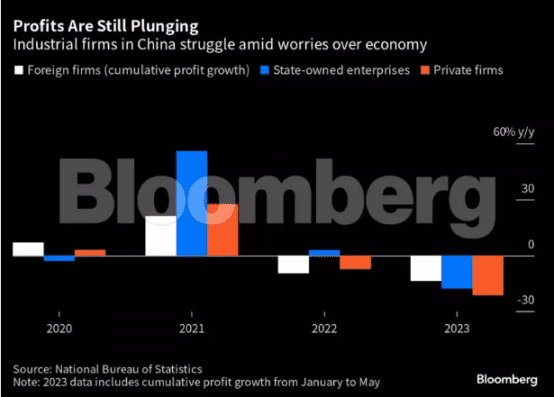

Moving on to China data

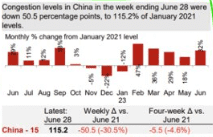

According to BBG NEF data, China mobility is still “meh”

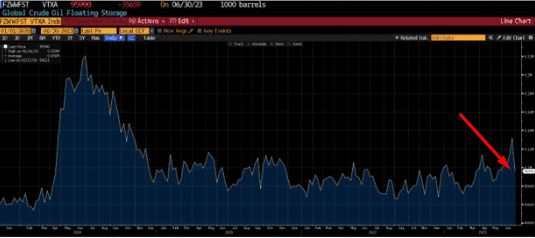

Regarding Oil-oil on water is falling via Vortexa (OPEC voluntary cuts do not start until July 1)

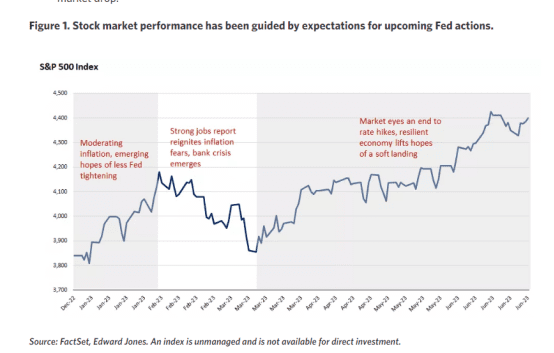

Midyear Performance Check via Edward Jones

Last week closed the books on the first half of 2023. The headliner: it was a strong start. Though gains so far may have flown somewhat under the radar for some investors as the scars of 2022 may not yet have fully healed. At the midway point last year, stocks were down 20% and bonds had lost 10%, on their way to full year returns of -18% and -13%, respectively.

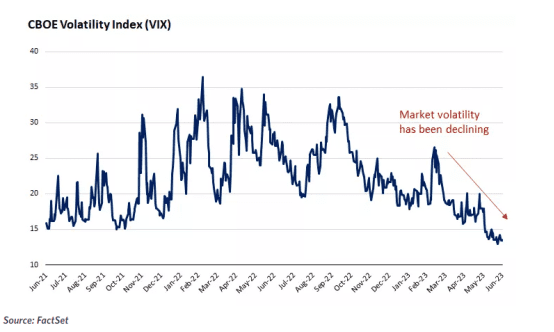

Fortunately, the first half of 2023 has been more rewarding, helped by a more favorable outlook for Fed policy and inflation as well as a surprisingly resilient economy. Overall market gains have been healthy, but trends playing out under the surface highlight unique drivers of that performance, a balance of risk and opportunity, as well as the value of a diversified strategy. Here are a few perspectives on first half moves and what they signal for what may lay ahead in the second half.

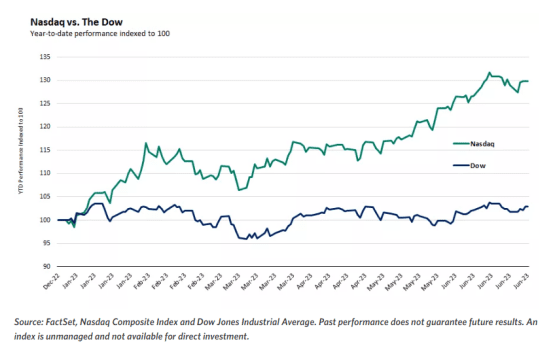

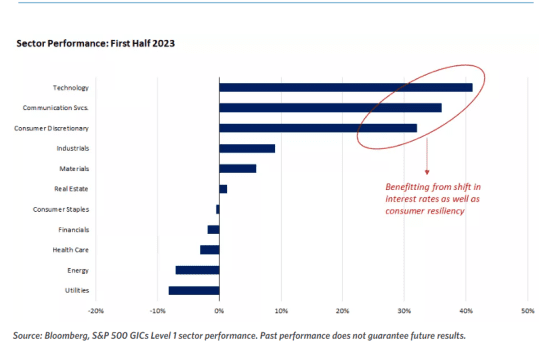

Tech sector outperformance has been a key theme so far this year.

I think this is about to change…but no one likes the DOW

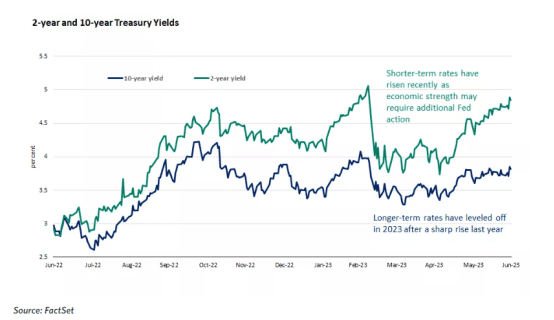

Longer-term rates have leveled off this year after rising sharply in 2022.

The economy has held up well in 2023 thanks to household spending

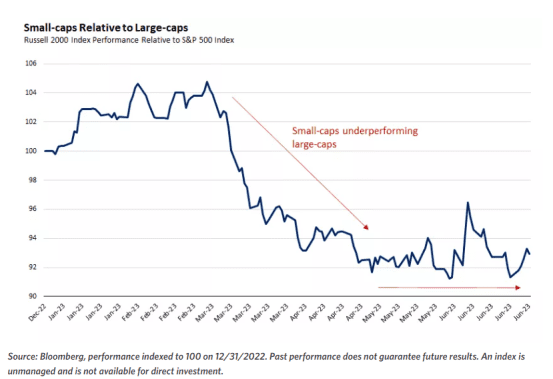

Small-cap stocks are signaling glimmers of hope for a soft landing in the economy.

Strong first-half gains have often carried through to healthy full year returns.

Sector performance H2

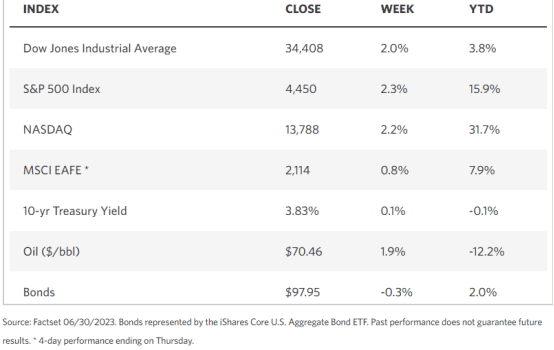

WEEKLY MARKET STATS

Financial Disclaimer: This material has no regard for specific investment objectives, financial situations, or particular needs of any user. This material is presented solely for informational and entertainment purposes and is not to be construed as a recommendation, solicitation, or an offer to buy or sell / long or short any securities, commodities, or any related financial instruments. Nor should any of its content be taken as investment advice. The views expressed here are completely speculative opinions and do not guarantee any specific result or profit. Trading and investing are extremely high risk and can result in the loss of all of your capital. Any opinions expressed here are subject to change without notice. We may have an interest in the securities, commodities, and/or derivatives of any entities referred to in this material. We accept no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this material. We recommend that you consult with a licensed and qualified professional before making any investment or trading decisions.