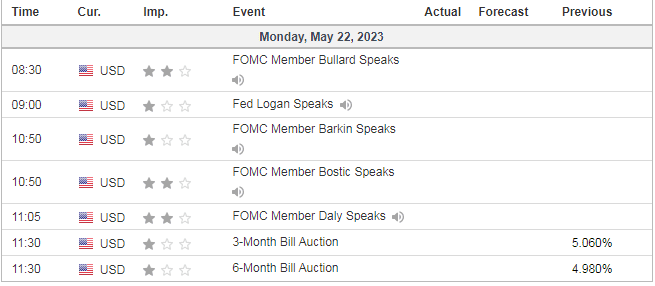

Monday update: US DATA TODAY …..HOLY FED SPEAKERS BATMAN!

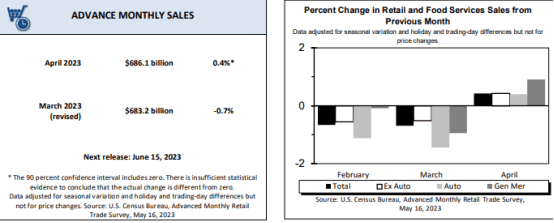

RETAIL SALES

Last week’s data showed “some” signs of consumer spending fatigue.

U.S. retail sales increased less than expected in April, but the underlying trend was solid, suggesting that consumer spending likely remained strong early in the second quarter, despite growing risks of a recession this year.

Retail sales rose 0.4% last month, the Commerce Department said on Tuesday. Data for March was revised slightly lower to show sales dropping 0.7% instead of 0.6% as previously reported. Economists polled by Reuters had forecast sales rebounding 0.8%.

Retail sales are mostly goods, which are typically bought on credit, and are not adjusted for inflation. Food services and drinking places are the only services category in the retail sales report.

The rise in retail sales added to strong job growth in April in suggesting that the economy was experiencing a spring revival after activity slowed in February and March. Spending is being underpinned by strong wage gains thanks to a tight labor market.- Reuters

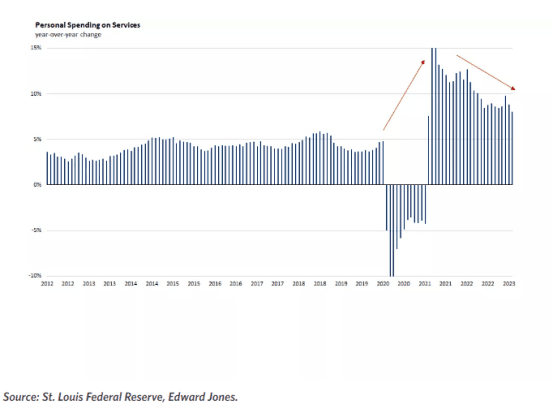

POWELL LOOKING AT SERVICES

We ALL know Powell had his hairy eyeball, particularly on services ..this trend has been waning overall since the COVID reopen, yet remains historically persistently high.

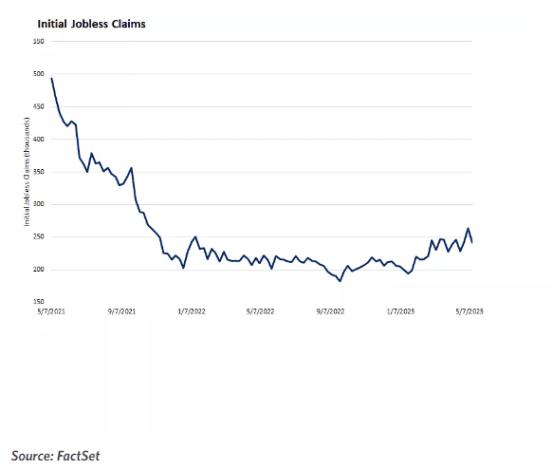

JOBLESS CLAIMS

Via BLS:

Unemployment rates were lower in April in 14 states and stable in 36 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today. Sixteen states had jobless rate decreases from a year earlier, 10 states had increases, and 24 states and the District had little change. The national unemployment rate, 3.4 percent, was little changed from March but was 0.2 percentage point.

South Dakota had the lowest jobless rate in April, 1.9 percent. The next lowest rate was in Nebraska, 2.0 percent, followed by New Hampshire and North Dakota, 2.1 percent each. The rates in Alabama (2.2 percent), Arizona (3.4 percent), Arkansas (2.8 percent), Kentucky (3.7 percent), Maine (2.4 percent), Maryland (2.5 percent), Mississippi (3.4 percent), Ohio (3.7 percent), West Virginia (3.3 percent), and Wisconsin (2.4 percent) set new series lows. (All state series begin in 1976.) Nevada had the highest unemployment rate, 5.4 percent. In total, 17 states had unemployment rates lower than the U.S. figure of 3.4 percent, 8 states and the District of Columbia had higher rates, and 25 states had rates that were not appreciably different from that of the nation.

Note: This does not account for people that left the workforce for good and can no longer claim unemployment. Given that the boomers are leaving the workforce in droves, I believe this is notable.

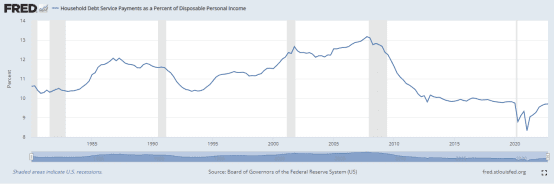

ANOTHER CHART OF INTEREST REGARDING CONSUMERS

Household-consumption weakness during prior economic downturns was often fueled by consumer deleveraging (reducing debt). This was most acute following the housing market crash that led to the Great Recession in 2008-2009, as the household debt was at a historical high. Debt-service payments as a percent of income have risen recently, owed primarily to higher interest rates, but currently sit at 9.7%. This compares with an average of 12.5% at the beginning of the recessions in the 1990s and 2000s. Total household debt to GDP has declined from 79% to 77% over the last three years- Edward Jones

Household Debt Service Payments as a Percent of Disposable Personal Income are still historically low

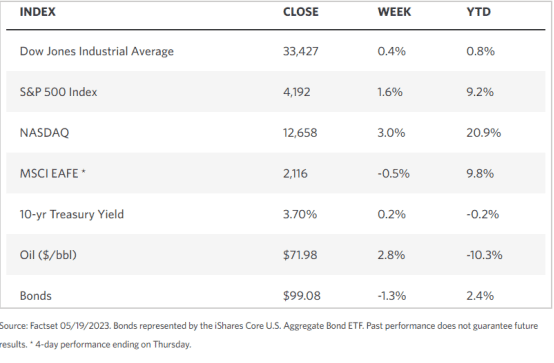

WEEKLY MARKET STATS

POWELL ON FRIDAY AND THE DEBT CEILING

Via Factset on Powell on Friday and the debt ceiling:

- There was very little of note from Powell’s comments today, with remarks largely echoing past statements. Reiterated commitment to getting inflation back to target and discussed the risks and social costs of this taking too long. Talked about economic headwinds from tighter credit conditions and the possibility Fed will not need to raise rates as high. Added labor-market slack is more important to inflation than in the recent past. Remarks may be viewed as a contrast to some hawkish comments from Fed’s Bullard and Logan yesterday that pushed up market-based expectations for a 25bp June hike (these retreated again during Powell’s appearance). Not much else on the Fed front other than NY Fed’s Williams said there’s no evidence the era of very low natural rates of interest is over.

- Debt-ceiling talks received some attention after GOP negotiators walked out of talks at midday, accusing the White House of being unreasonable. Said talks were on a “pause” with no indication when they might resume. The major sticking point seems to be the size of discretionary spending caps. Unclear what this might mean for the rough goal of getting a bill to the House next week. Followed some more upbeat reporting overnight that the White House might be ready to give some ground on work requirements for safety-net programs. Elsewhere Fed’s latest balance sheet update showed no meaningful change in emergency bank lending. Flow data highlighted a continued inflow to money market funds and Treasuries, while equities saw outflows led by financials and REITs (though tech inflows continued).

TECHNICALS

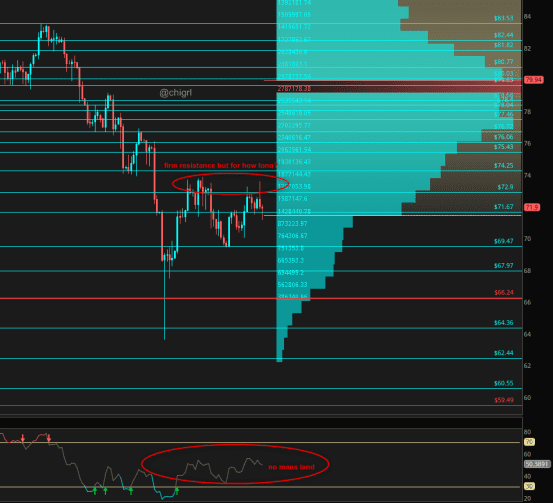

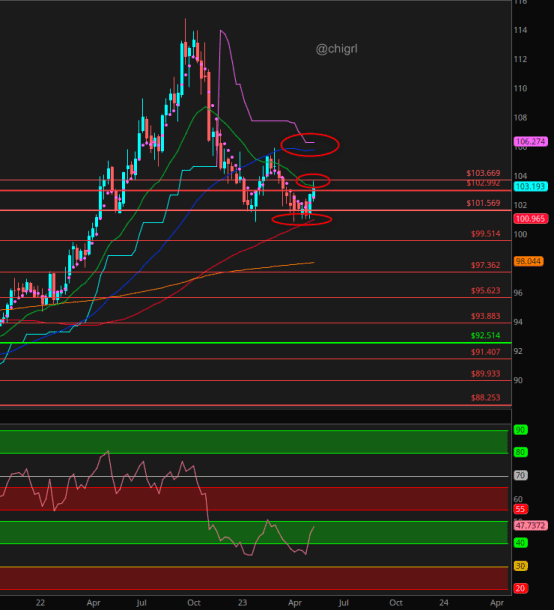

Crude Oil

Those $69’s were saved again.

Baker Hughs showed a reduction of 11 oil rigs on Friday, 9 of those from the Permian, the strongest basin. This could be a catalyst to propel this higher.

Other than that, the chart speaks for itself.

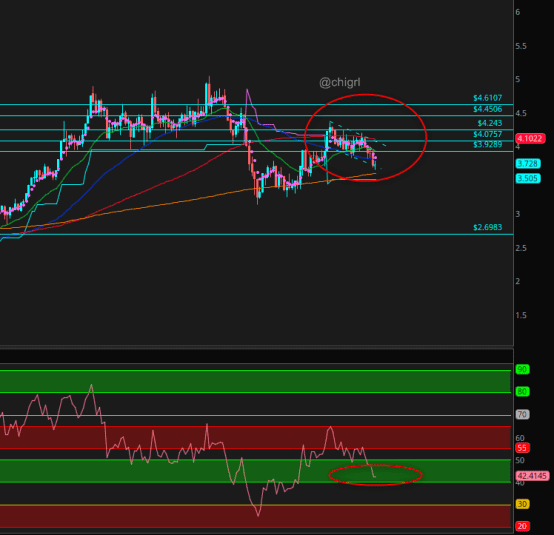

Nat Gas

Nat gas staged a rally last week after Baker Hughs showed a 17-rig reduction of gas rigs on Friday the 12th of May.

That said, Nat gas is still waffling in a supply zone but has regained a critical area.

I want to see a clear break over $3.40/75 for the futures or over $11.70 in UNG to get bullish this market over the longer term, we just are not even close yet.

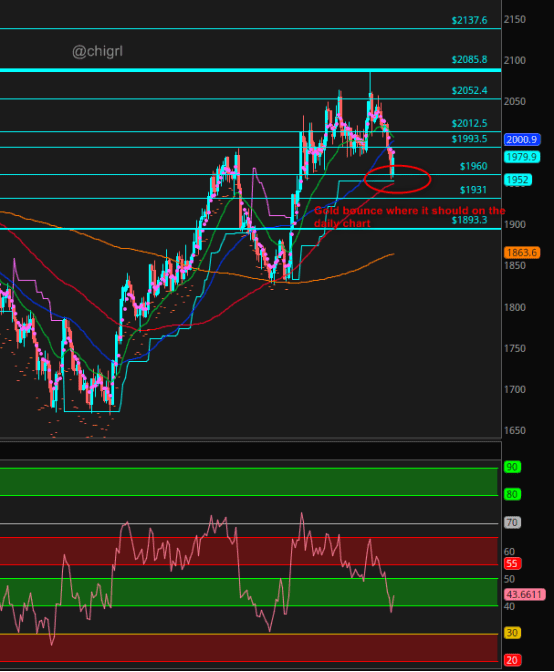

Gold

Gold bounced where it should on the daily chart. It will all be about rates, debt ceiling, and econ data for next week.

Copper

Still holding.

Last but not least: USD $DXY

Last week I noted: We could have some further upside, but may be limited, especially if we see a pause in the next FOMC.

We did indeed see more upside.

We could still see some further upside, but it is limited…for now.

Financial Disclaimer: This material has no regard for specific investment objectives, financial situations, or particular needs of any user. This material is presented solely for informational and entertainment purposes and is not to be construed as a recommendation, solicitation, or an offer to buy or sell / long or short any securities, commodities, or any related financial instruments. Nor should any of its content be taken as investment advice. The views expressed here are completely speculative opinions and do not guarantee any specific result or profit. Trading and investing are extremely high risk and can result in the loss of all of your capital. Any opinions expressed here are subject to change without notice. We may have an interest in the securities, commodities, and/or derivatives of any entities referred to in this material. We accept no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this material. We recommend that you consult with a licensed and qualified professional before making any investment or trading decisions.