Markets were on the decline last week, further exacerbated after inflation data (PCE) data came in hot on Friday.

Treasury yields jumped on Friday, pushing the policy-sensitive 2-year rate further into its highest levels since July 2007, after the Federal Reserve’s preferred inflation gauge came in strong for January.

The 2- and 10-year yields ended the New York session higher for the fifth straight week, while the 30-year yield scored its third consecutive weekly gain.

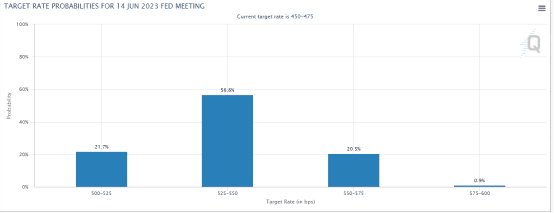

According to the CME Fed Watch tool, all bets off after this reading for a cut in December.

Market is even factoring in a higher probability for another hike in June (though just over 50% right now)

This is a tale of two markets

I encourage you to read two threads on Twitter

Moving on to Energy

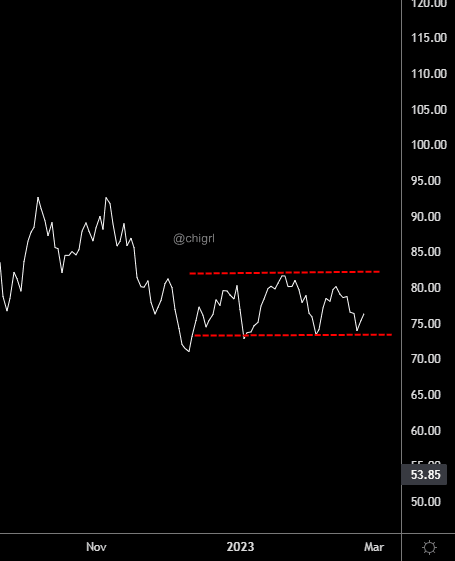

Crude oil remains stubbornly in the ~ $72-82 range

Annoying for investors but great for traders.

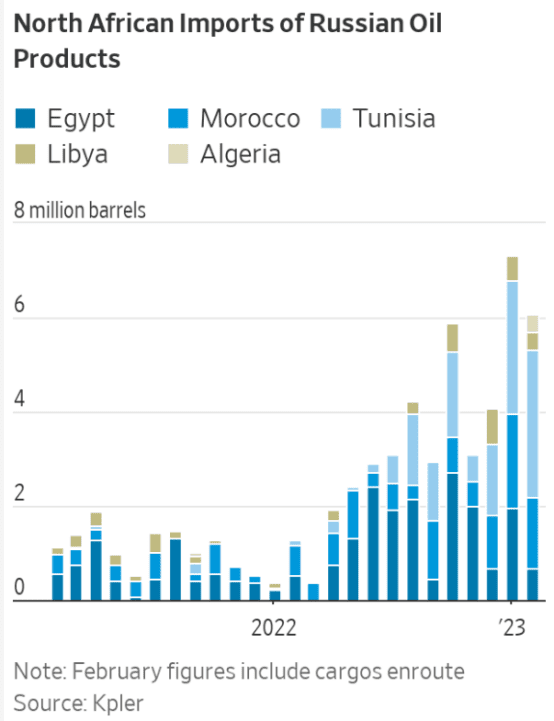

I expect this range to hold as the Biden administration has basically put a floor under the contract between $68-$72 and we are waiting still waiting for China data to fully filter in, along with the effects of the Russian oil and product embargo from the EU. I have discussed this many times, but these barrels are already finding new homes, as I expected. Studying any oil sanctions, history tells us that there is always a way around sanctions. Iran is a prime example. In addition, OPEC+ is VERY comfortable with Brent trading in the $80-90 range.

Even MSM is catching up

Via the Wall Street Journal

North African Countries Snap Up Russian Oil Products Shunned by West

Some Russian cargo is being exported back to Europe

“With Russia cut off from the European market, North African countries have stepped forward to become voracious buyers of its diesel and other refined oil products.

The rise in trade has offered a lifeline of sorts for Moscow, providing a healthy new revenue stream, but also raised concerns about whether it is undermining Western efforts to remove Russian fossil fuels from their economies.”

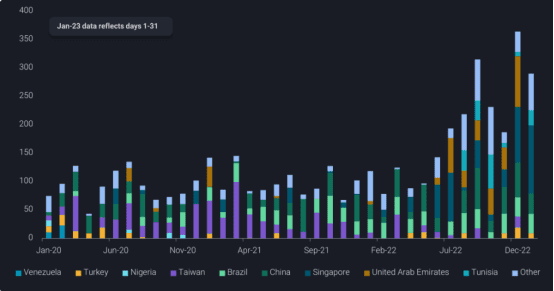

Vortexa added more color on light distillates as Naphtha exports make up Russia’s second largest clean product exports after diesel. On February 5th, the EU embargo of Russian seaborne product exports was in effect.

We will not know the full reality of the situation as cargos already in transit have until April 1, to reach their destination in Europe.

That said, we can already see Russian naphtha flows finding a home elsewhere.

According to Vortexa:

“Looking forward, there is a strong case for strengthening gasoline cracks in the coming months, while the upside for naphtha hinges on China’s speed in re-opening its economy and overall regional petchem demand. This and Europe’s long-haul distillate import needs will likely give LR2s a good reason to enter or stay in the middle distillate market until a stronger recovery in long-haul naphtha trade flows is materialising.”

Looking forward

I would look for this market to break out to the upside sometime in late Q2 or early Q3, as the West heads into high-demand

season, refinery maintenance season concludes, and we get a better handle on China data.

NATGAS

I know a lot will be asking about NatGas. I just do not see a bullish case at this juncture (near term) until at least these four items are met:

- Freeport fully re-opens (supposedly may)

- We see a meaningful decline in US production (at $2 nat gas is not feasible for most producers…Cheniere mentioned production cuts in their earnings call… let’s see what comes to fruition. As of Friday’s rig count, we did see a decline of rigs)

- We see a meaningful uptick in European consumption (would have to be weather-related as industrial production is fleeing)

- We see a meaningful uptick in Asian demand (primarily from China)

So far, it just does not look fantastic right now …hard for me to get bullish here.

Note: I would advise against trying to go long here via these single and doubled levered ETS (i.e. UNG, BOIL). How they are settled daily and how they roll contracts is working against you right now—just my 2 cents)

I would also encourage you to listen to my Place Your Trades Twitter spaces from Thursday if you are trading this market where we covered the nat gas market in depth.

These CME Group daily event option contracts via the Tradovate app are literally PERFECT for trading this kind of market right now. Not kidding.

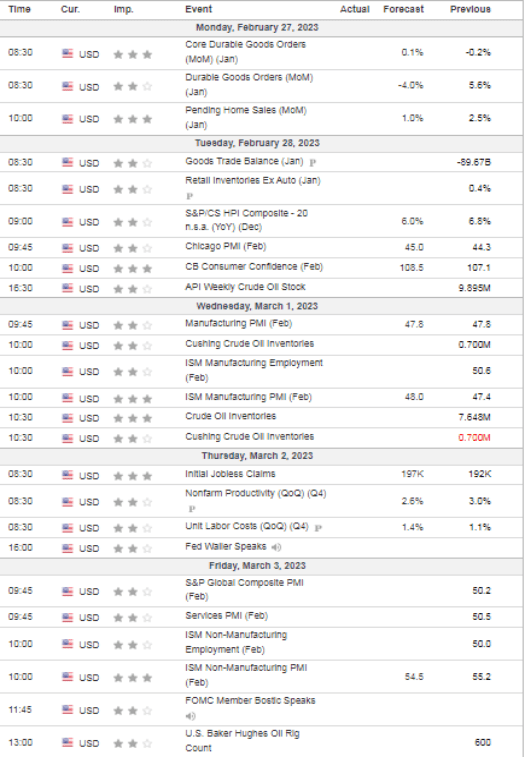

US DATA THIS WEEK

THINGS TO KEEP AN EYE ON THIS WEEK

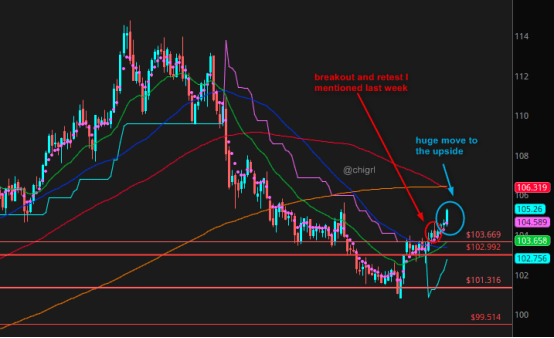

$DXY (USD)

$DXY (USD)

$DXY (USD)

(yes I feel like a broken record on this)

106/107 area to watch next (this will pressure equities and precious metals in particular)

Financial Disclaimer: This material has no regard for specific

investment objectives, financial situations, or particular needs of any user. This material is presented solely for informational and entertainment purposes and is not to be construed as a

recommendation, solicitation, or an offer to buy or sell / long or short any securities, commodities, or any related financial instruments. Nor should any of its content be taken as investment advice. The views expressed here are completely speculative opinions and do not guarantee any specific result or profit. Trading and investing are extremely high risk and can result in the loss of all of your capital. Any opinions expressed here are subject to change without notice. We may have an interest in the securities, commodities, and/or derivatives of any entities referred to in this material. We accept no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this material.

We recommend that you consult with a licensed and qualified professional before making any investment or trading decisions.