27 March> overnight HUGE protests erupted in Israel over Netanyahu judicial reforms -sparking international concerns from governments across the globe > live updates > https://www.middleeasteye.net/live/israel-shut-down-strikes-mass-protests-live

Roller Coaster Ride Last Week

This past week it was all about FOMC, Yellen

And…then Deutsche Bank (yes seems contagion fears)

Federal Reserve

Per Edward Jones:

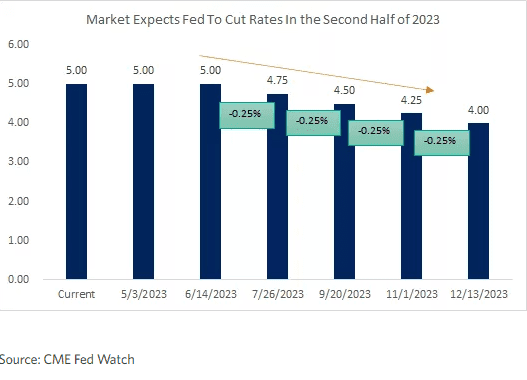

As expected, the Federal Reserve raised rates by 0.25% in its March meeting, but now seems closer to the end of its rate-hiking cycle. The FOMC maintained its outlook for a peak fed funds rate of 5.1%, implying that perhaps one more rate hike of 0.25% may be ahead of us. The statement released by the Fed shifted to a softer tone on rate hikes as well, from “ongoing rate increases will be appropriate” to “some additional policy firming may be appropriate.” This messaging is sharply different than just two weeks ago, when Fed Chair Jerome Powell hinted in his testimony to Congress that a 0.50% rate hike was being considered and that rates may move higher than the Fed previously anticipated.

Meanwhile, the Fed also acknowledged that the recent volatility in the U.S. banking system may weigh on the economy. The FOMC statement noted that “recent developments are likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring, and inflation. The extent of these effects is uncertain.” This was also reflected in the Fed lowering its projections for economic growth in 2023 and 2024. Powell did note that the tightening in credit conditions has a similar impact as a rate hike, and thus the Fed may not need to do as much on rate hikes if the banking sector continues to tighten financial conditions. However, if conditions improve and the crisis eases, the Fed likely remains poised to act as needed.

The Market is now pricing in RATE CUTS!!

Yellen

The markets held up pretty well on Wednesday after the FOMC rate decision and the presser, until Yellen testified before the Senate appropriations committee later that day.

Via Reuters:

U.S. Treasury Secretary Janet Yellen told lawmakers on Wednesday that she has not considered or discussed “blanket insurance” to U.S. banking deposits without approval by Congress as a way to stem turmoil caused by two major bank failures this month.

Her comments before a Senate Appropriations subcommittee hearing dashed industry hopes for a quick government guarantee to stem the threat of further bank runs and contributed to a 15.5% fall in the shares of struggling First Republic Bank on Wednesday.

Yellen said she believed it was “worthwhile” for Congress to look at changes to FDIC deposit insurance, but declined to say what changes she thought were warranted.

But when asked whether insuring all U.S. deposits required congressional approval, Yellen said she was not considering such a move and was reviewing banking risks on a case-by-case basis.

“I have not considered or discussed anything having to do with blanket insurance or guarantees of deposits,” she said.

The market then preceded to tank into the close. By Thursday, she changed her tone. Leaving markets confused.

For the fourth time in a week, U.S. Treasury Secretary Janet Yellen took a microphone on Thursday aiming to reassure Americans that the U.S. banking system is safe, each time with a subtle shift in message.

But bankers and Wall Street never heard what they fervently wanted: That the government would guarantee all $19.2 trillion in U.S. bank deposits until the banking crisis that erupted two weeks ago calms down.

Her comments on Thursday more clearly indicated than previously that further guarantees for uninsured deposits would come in the form of rescues for depositors of individual failing banks where problems threaten to spark runs on other banks.

She told U.S. lawmakers that bank regulators and the Treasury were prepared to make comprehensive deposit guarantees at other banks as they did at failed Silicon Valley Bank and Signature Bank

“These are tools we could use again, for an institution of any size, if we judge that its failure would pose a contagion risk,” she told a U.S. House of Representatives Appropriations subcommittee hearing. -Reuters

Enter Deutsche Bank on Friday

In the overnight…..panic spread to Deutsche bank

Deutsche Bank shares slid Friday while the cost of insuring against its default spiked, as the German lender was engulfed by market panic about the stability of the European banking sector.

However, many analysts were left scratching their heads as to why the bank, which has posted 10 consecutive quarters of profit and boasts strong capital and solvency positions, had become the next target of a market seemingly in “seek and destroy” mode.

Deutsche Bank underwent a multibillion-euro restructure in recent years aimed at reducing costs and improving profitability. The lender recorded an annual net income of 5 billion euros ($5.4 billion) in 2022, up 159% from the previous year.

Its CET1 ratio — a measure of bank solvency — came in at 13.4% at the end of 2022, while its liquidity coverage ratio was 142% and its net stable funding ratio stood at 119%. These figures would not indicate that there is any cause for concern about the bank’s solvency or liquidity position.

Some of the concerns around Deutsche Bank have centered on its U.S. commercial real estate exposures and substantial derivatives book.

However, research firm Autonomous, a subsidiary of AllianceBernstein, on Friday dismissed these concerns as both “well known” and “just not very scary,” pointing to the bank’s “robust capital and liquidity positions.” -CNBC

Deutsche Bank credit default swaps blew out on Friday

During US session markets seemed to calm and ended up 32.50 pts.

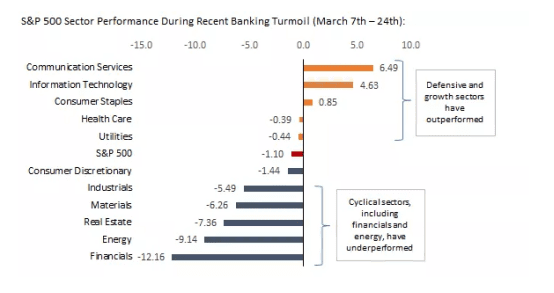

Looking ahead to this week it could be another wild ride, until the markets get a sense that the banking crisis is “contained”. Markets will also be looking for signs that deposit outflows at smaller banks have at least slowed.

Adam Kobeissi pointed out on twitter:

New Fed data shows banks lost ~$100 billion in deposits last week.

Here’s the breakdown:

1. Large U.S. Banks: +$67 billion

2. Small U.S. Banks: -$120 billion

3. Foreign-Related Banks: -$45 billion

Overall borrowing from banks is up a record $475 BILLION. The worst part? SVB is counted as a large bank in this calculation, and large banks still ADDED $67 billion.

Sector performance during this recent banking turmoil

Yellen speaks again on Thursday…stay Nimble!!

MOVING ON TO ENERGY

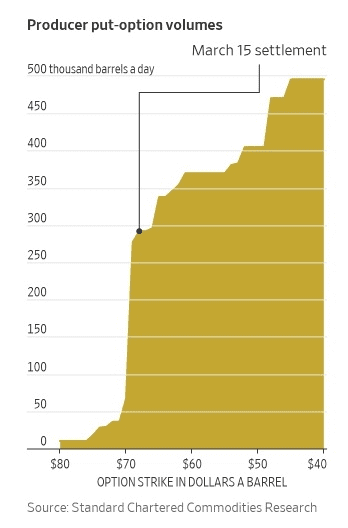

Notable article from WSJ this weekend:

How Options-Hedging Turbocharged Oil Volatility

Earlier this month, oil’s steepest weekly slide in almost three years accelerated as futures approached levels where many producers owned derivatives designed to lock in prices. As declines mounted, banks and trading firms on the other side of those trades had to unload crude to mitigate potential losses, investors said, dragging benchmark prices to 15-month lows.

Now, many expect similar dynamics could add momentum to any rebound if the economic outlook improves—leading to more expensive oil that could increase the cost of gasoline and diesel later this year. It is the latest example of how volatility in financial markets can spill into the real world, shaking an oil industry stretching from the shale basins of Texas to refineries in China.

TECHNICALS

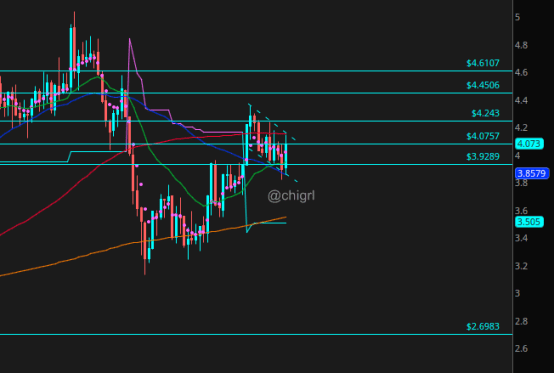

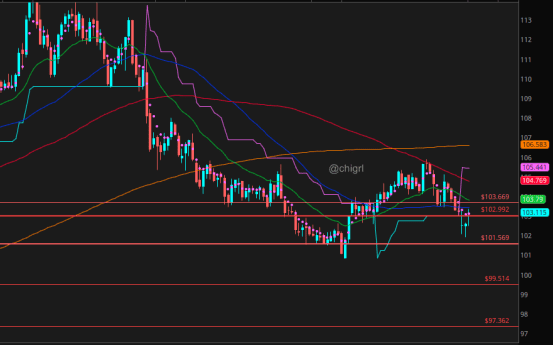

Crude oil

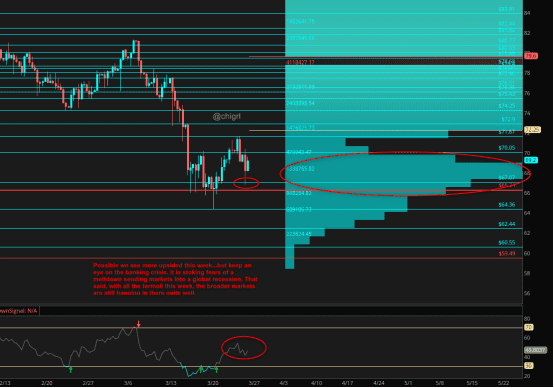

Last week I noted that: “Crude is obviously very oversold, but my swing chart did finally get a buy signal on Friday …a rebound here soon likely”

And a nice rebound indeed from the 64.36 low to Thursday high of 71.57, until market/banking fears spooked the markets again.

Possible we see more upside this week as we bounce in that HVN..if the market can make it over in its second attempt, that would be a very positive sign. BUT keep an eye on the banking crisis. It is stoking fears of a meltdown sending markets into a global recession. That said, with all the turmoil this week, the broader markets are still hanging in there quite well.

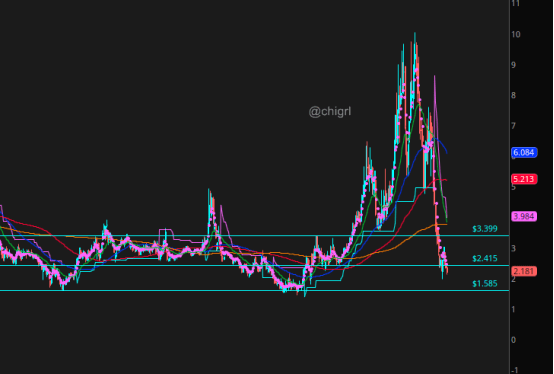

Nat Gas

No change to my view from last week:

“Nat gas is still waffling in a supply zone, again, really hard for me to get excited about this market.

I want to see a clear break over $3.40/75 for the futures or over $11.70 in UNG to get bullish this market over the longer term, we just are not even close yet.“

MOVING ONTO METALS

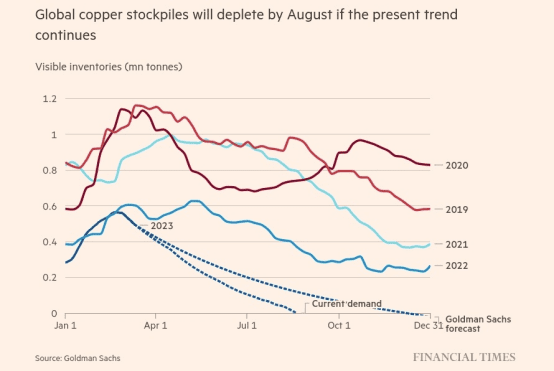

Copper

Copper ended the week higher, that weekly bull flag looks even better this week.

Also notable for longer term traders

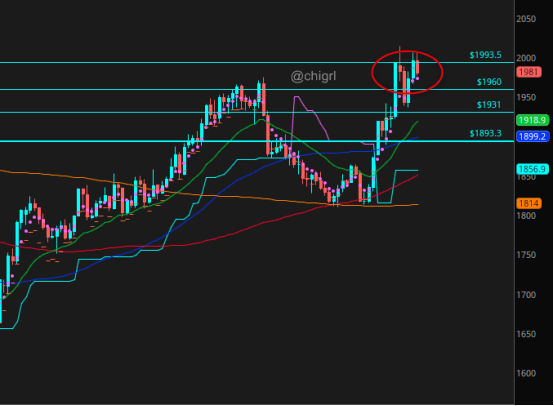

Gold

Last week I noted: “This week we are getting a bit overbought…gold could take a pause here this week“

And indeed we did get a pause. That said, overall this chart is bullish. It would not surprise me if we consolidated some more to work off this overbought territory, but again here, keep an eye on the banking sector, further crisis could send this up quickly.

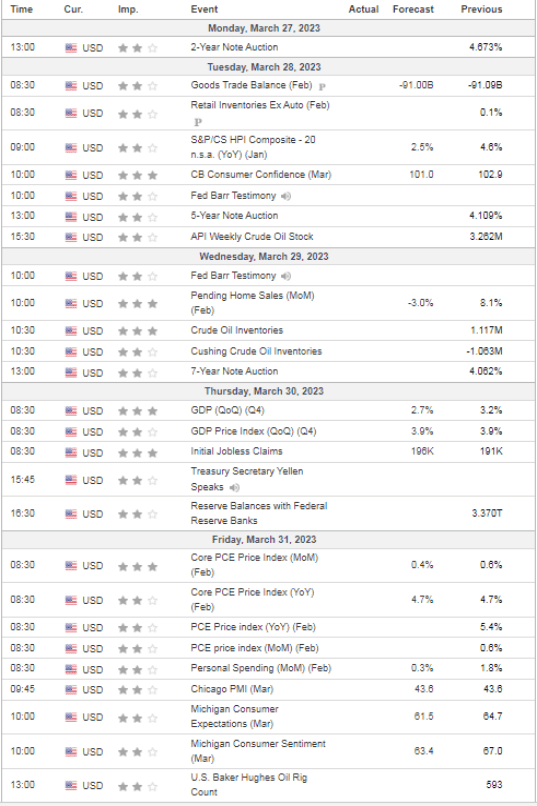

US DATA NEXT WEEK

THINGS TO KEEP AN EYE ON THIS WEEK

As always USD

Last week I notes: “It looks as though we could get a bigger pullback at least in the shorter term“

We did indeed. I suspect this week we may be sideways/slightly up, but it still looks as though we have a bigger pullback in store.

Financial Disclaimer: This material has no regard for specific investment objectives, financial situations, or particular needs of any user. This material is presented solely for informational and entertainment purposes and is not to be construed as a recommendation, solicitation, or an offer to buy or sell / long or short any securities, commodities, or any related financial instruments. Nor should any of its content be taken as investment advice. The views expressed here are completely speculative opinions and do not guarantee any specific result or profit. Trading and investing are extremely high risk and can result in the loss of all of your capital. Any opinions expressed here are subject to change without notice. We may have an interest in the securities, commodities, and/or derivatives of any entities referred to in this material. We accept no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this material. We recommend that you consult with a licensed and qualified professional before making any investment or trading decisions.