FOMC LAST WEEK WITH AN UNSURPRISING RATE HIKE …BUT WHAT DOES IT ALL MEAN?

According to Edward Jones:

The Fed and markets will digest two additional CPI inflation readings and two U.S. jobs reports between now and the Sept. 20 meeting. This will help determine the path of interest rates going forward.

Powell did acknowledge, however, that inflation is now well off its peak. Headline CPI inflation has come down year over year from 9.1% in June 2022 to 3.0% in this past June1. Nonetheless, core inflation remains elevated at 4.8%, as services demand remains robust and wage growth has yet to meaningfully ease1. The Fed is likely to continue its hawkish rhetoric, keeping the idea of an additional rate hike alive until core inflation cools further.

Interestingly they think this is the last:

In our view, however, this rate hike may well have been the last one in this cycle. The Fed has raised rates by over 5% in the past year and half, and will likely pause to assess the impacts on inflation and the economy. We also see a credible scenario where inflation can cool further. Leading indicators — such as the ISM prices paid indexes for manufacturing and services — have moved lower, and a moderation in housing and rental prices has yet to show up in the core CPI basket.

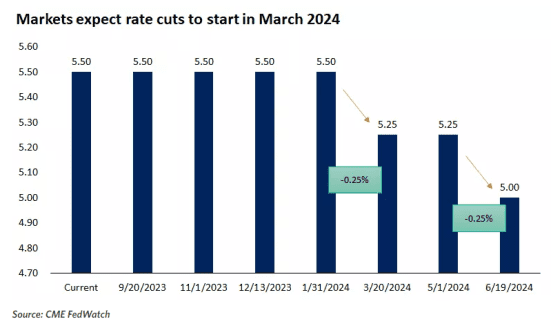

CME Fed Watch tool agrees with this, in fact it starts pricing in cuts by end of Q1 2024:

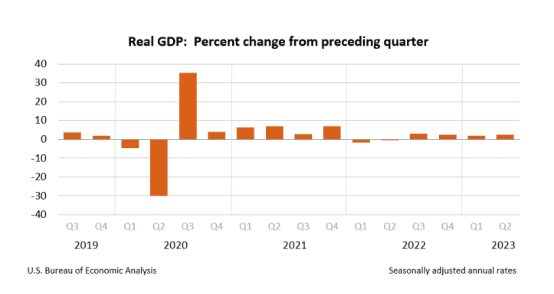

US GDP THIS PAST WEEK:

GDP via BEA

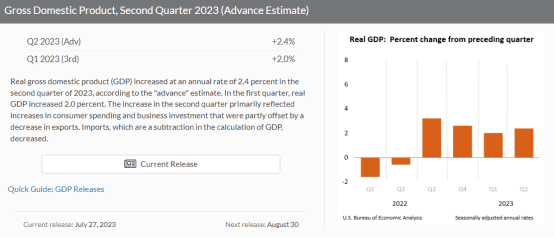

Real gross domestic product (GDP) increased at an annual rate of 2.4 percent in the second quarter of 2023 (table 1), according to the “advance” estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP increased 2.0 percent.

The GDP estimate released today is based on source data that are incomplete or subject to further revision by the source agency (refer to “Source Data for the Advance Estimate” on page 2). The “second” estimate for the second quarter, based on more complete data, will be released on August 30, 2023.

COMMENTARY: Overall, markets seem to be embracing a goldilocks type scenario, with “soft landing” appearing more and more among bank analysts and economists.

The only ones that are not buying this theory are the economists at Vanguard.

Vanguard’s Economists Aren’t Buying Talk of a Soft Landing: Q&A-BBG

A rallying stock market, cooling inflation and better-than-expected economic data are causing more investors to bet that the Federal Reserve can achieve a “soft landing” in which consumer prices normalize without triggering a recession. Vanguard Group’s economists aren’t buying it.

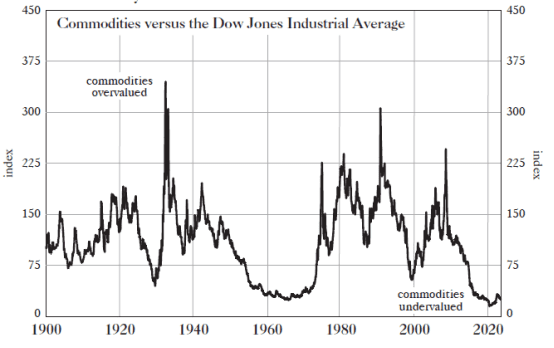

Again, I am going to stress, watch commodities, this could put a ringer into the deflation narrative. Two weeks ago I said to watch oil, so far we are now trading $10 higher and gasoline prices in the US are starting to rise again. Not to mention the fact, that base and industrial metals have only just started to react to positive stimulus news from China. I believe after the massive sell off after the 2022 spike, these prices are set to rise again for several reasons:

- Markets are starting to believe China stimulus will work (we saw this in a HUGE rally in the Hang Seng and China CSI stocks last week)

- Everyone seems convinced of a soft landing (markets and GDP, at least in the US, has remained resilient—I will argue this is due to fiscal spending (ie IRA Act) counteracting monetary tightening …but that is another discussion entirely)

- The west seems complacent that the energy crisis is over and is moving full steam ahead with green transition plans, which quite frankly leave us in severe deficit of many battery, solar, wind minerals. This means higher prices as demand outstrips supply as well as higher prices due to higher energy inputs )mining is extremely energy intensive).

If you missed my Place Your Trades Spaces last week, I highly recommend listening and pay close attention to what Chris Berry says about transition metals when I asked him about supply/demand.

Link to PYT spaces if you missed it

Long/short: This whole deflation narrative could get derailed very quickly. Keep an eye on this.

TWO CHARTS THAT CAUGHT MY EYE LAST WEEK

The first

(this has no source and ha been published by multiple people…so not sure who attribute this to)

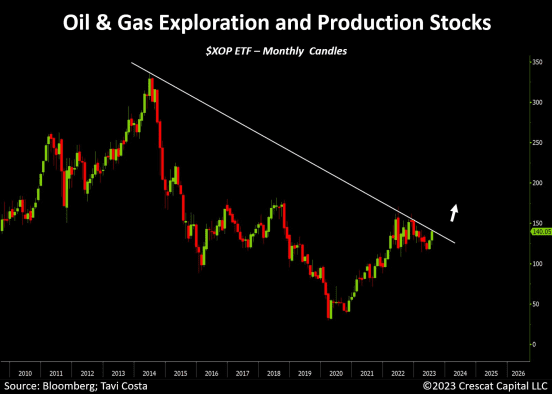

The second is from Tavi Costa of Crescat Capital

The energy sector is poised for another major move to the upside with E&P stocks likely to break through this multi-year resistance level on the monthly chart.

Operating rig count falling

SPRs already at 1980s levels

Ongoing deglobalization trends

Overall capex for the sector remains historically depressed

After being down 45% from its recent highs, the risk/reward to buy oil and energy stocks today continues to be heavily skewed towards the upside.

COMMENTARY: Obviously these charts are echoing what I have been saying for some time now.

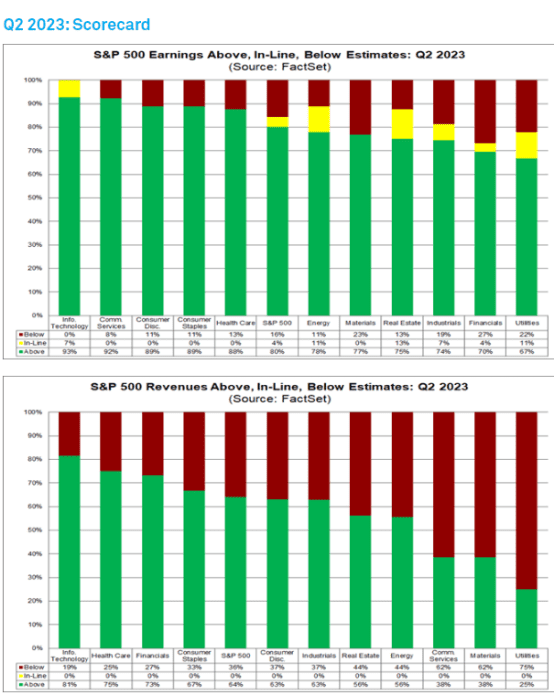

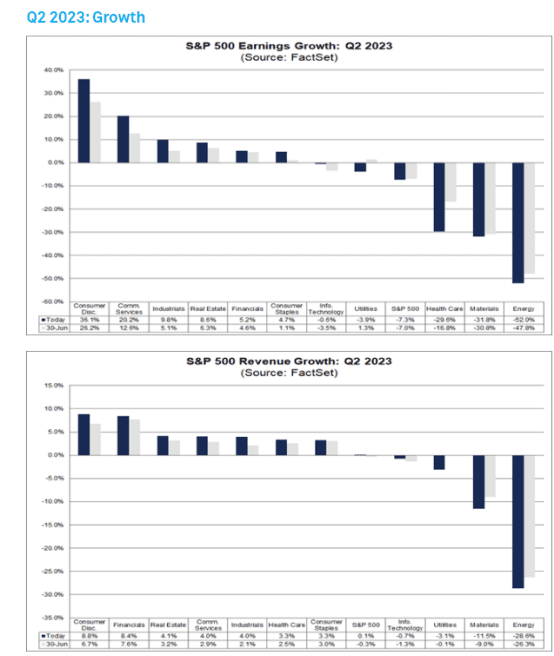

FACTSET EARNINGS SEASON UPDATE

Overall, 51% of the companies in the S&P 500 have reported actual results for Q2 2023 to date. Of these companies, 80% have reported actual EPS above estimates, which is above the 5-year average of 77% and above the 10-year average of 73%. In aggregate, companies are reporting earnings that are 5.9% above estimates, which is below the 5-year average of 8.4% and below the 10-year average of 6.4%.

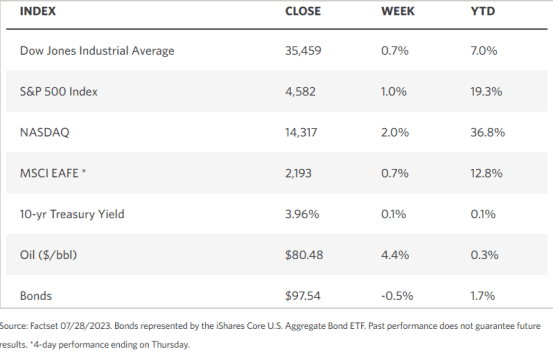

WEEKLY MARKET STATS

TECHNICALS

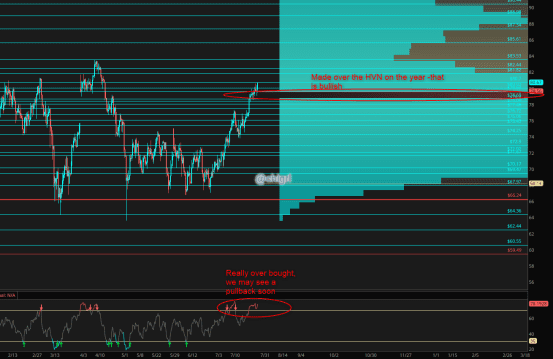

Crude Oil

I thought last week would be more volatile due to the Fed, and we did consolidate a bit, but no where near the volatility I expected. -this market is strong.

We made it over the yearly HVN which is very positive, but are in over bought territory.

Gasoline prices are rising again in the US …perhaps a statement from the Biden administration my send this to a retest of the lower bound of the HVN before a resumption higher.

Overall this chart is bullish and US exports should be HUGE in August due to China buying from the US.

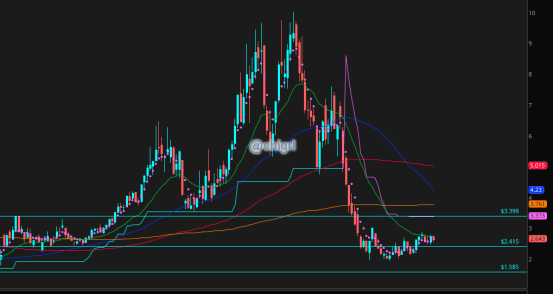

Nat Gas

Nat Gas is looking a little better if you squint.

That said, Nat gas is still waffling in a supply zone, but has regained a critical area.

I want to see a clear break over $3.40/75 for the futures or over $11.70 in UNG to get bullish this market over the longer term, we just are not even close yet.

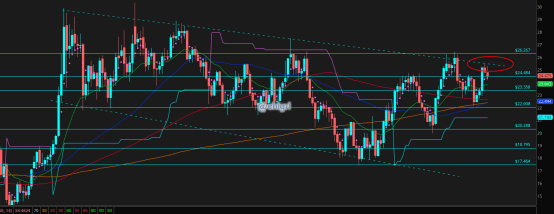

Gold

This chart is still constructively bullish, though that solid break above $2000 once again is sticky

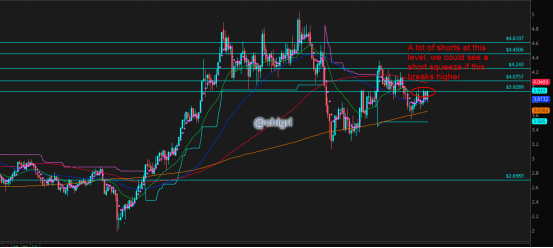

Silver

I am bullish this market due to mostly fundamentals (see last week report), the chart supports this thesis.

However, his multi year bullish wedge keeps holding.

That said, when this thing breaks out, It may be monumental.

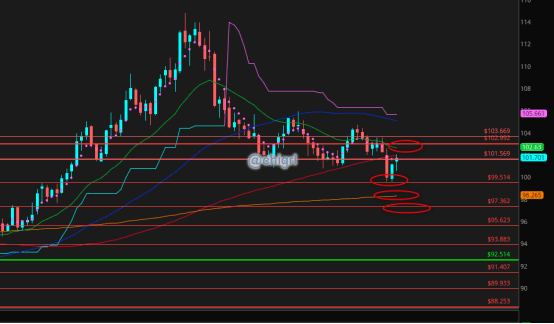

Copper

Chart says everything

$DXY USD

Last week I noted that we were very oversold and we may see a bounce (much due to the Fed raising rates), but that the upside would be limited.

Indeed we did see a bounce, but not that strong which leads me to reiterate that *for now*, I think the upside will be limited.

Levels noted on chart.

And with that …hope everyone has a great trading week and thank you for reading to the end!

Financial Disclaimer: This material has no regard for specific investment objectives, financial situations, or particular needs of any user. This material is presented solely for informational and entertainment purposes and is not to be construed as a recommendation, solicitation, or an offer to buy or sell / long or short any securities, commodities, or any related financial instruments. Nor should any of its content be taken as investment advice. The views expressed here are completely speculative opinions and do not guarantee any specific result or profit. Trading and investing are extremely high risk and can result in the loss of all of your capital. Any opinions expressed here are subject to change without notice. We may have an interest in the securities, commodities, and/or derivatives of any entities referred to in this material. We accept no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this material. We recommend that you consult with a licensed and qualified professional before making any investment or trading decisions.