OPEC MEETING WAS THIS WEEKEND!

Let us get into the long and short of it.

Most of this meeting was focused on 2024.

That said let’s breakdown it into the simplest terms:

Saudi agreed to another 1M cut in July, this is on top of the 500k bpd cut announced in April. Saudi’s Prince Abdulaziz says he will keep the market guessing on what their next move might be when asked if the 1M bpd might be extended beyond July.

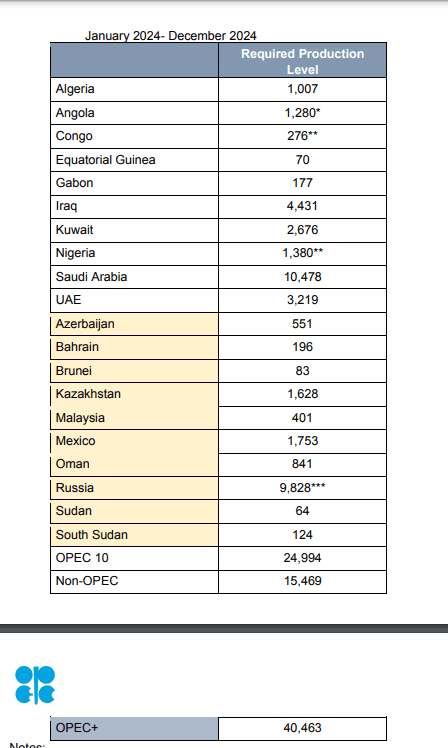

All countries agreed that volunteered cut of 1.6M bpd in April would extend through December 2024 (initially it was to the end of 2023). The exception is UAE which gets an increase of 200K bpd in January of 2024, but baselines will be lowered for smaller countries to counterbalance this.

Here it’s the 2024 breakdown

In addition, Russia (part of the “plus” group) agreed to extend its 500K bpd cut announced in March of 2023 to the end of 2024. Lots of talk about Russia flooding the market and not really cutting.. This was addressed at this meeting.

Asked about Russian cuts… Prince Abdulaziz says “we trust them because we have seen them delivering” -via Amena Bakr

In the press conference, Saudi Energy Minister Prince Abdulaziz also said, and I am paraphrasing here: What we have seen just does not add up from independent sources and we will be reaching out to these sources ….to find out about their numbers …we need to look at what these numbers are ….not accusing independent sources but they are not looking at it from the Russian/ “our”side.

We do not want politics involved with how we look at the numbers.

In my opinion, I think he believes the media is sensationalizing this because of politics, rather than facts.

In sum for OPEC: 2 million bpd cut officially announced in October 2022 plus 1.6M bpd voluntary cuts in April will be extended to the end of 2024 as will Russia’s 500K bpd cut. On top of that Saudis will cut another 1M bpd in July.

On to last week…..

JOBS JOBS JOBS

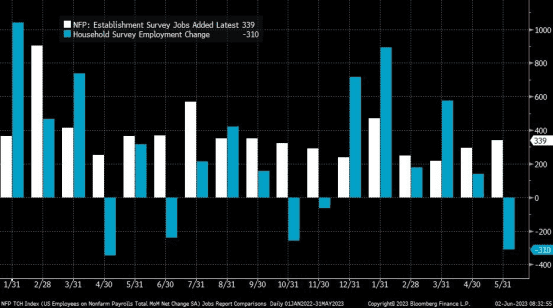

Blowout number on NFP

339,000 new payrolls were added in May, nearly double consensus expectations and up from the prior month

But lets dig deeper…was this a blowout???

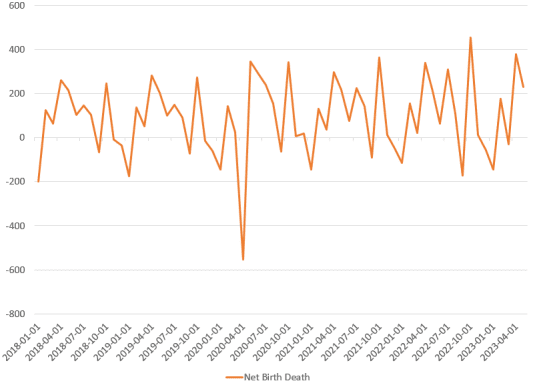

Unemployment rate jumped 0.3% to 3.7%, the largest m/m rise since COVID, while average work week hours (hours worked) also shrank. The houshold survey indicated that almost more jobs were lost than gained. (The devil is in the details…and this does not even include the birth-death adjustment which further paints a dismal picture)

@deerpointmacro on twitter also pointed out that

231,000 jobs came from the birth-death for the month of May. Yet, everyone seems to ignore this.

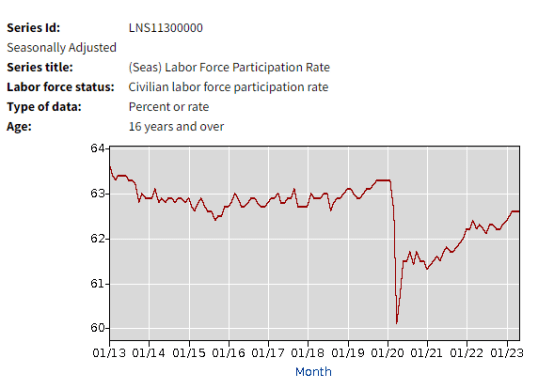

Labor force participation rate was stagnant at 62.6% according to BLS with the employment-population ratio at 60.3%

If you want to read the entire BLS report, link is HERE

DEBT CEILING

Debt Ceiling passes…what does this mean for markets??

The treasury is now going to have to start issuing bonds to refill the TGA account to pay debts…this actually draws liquidity from the system in the short term.

The theory is that buyers of those treasuries will have to pull money from the market to buy them

Yellen is going to have to sell at least $15 billion in US treasuries right away starting Monday.

Trillion-Dollar Treasury Vacuum Coming for Wall Street Rally-BBG

JPMorgan Chase & Co. strategist Nikolaos Panigirtzoglou estimates a flood of Treasuries will compound the effect of QT on stocks and bonds, knocking almost 5% off their combined performance this year. Citigroup Inc. macro strategists offer a similar calculus, showing a median drop of 5.4% in the S&P 500 over two months could follow a liquidity drawdown of such magnitude, and a 37 basis-point jolt for high-yield credit spreads.

The sales, set to begin Monday, will rumble through every asset class as they claim an already shrinking supply of money: JPMorgan estimates a broad measure of liquidity will fall $1.1 trillion from about $25 trillion at the start of 2023.

“This is a very big liquidity drain,” says Panigirtzoglou. “We have rarely seen something like that. It’s only in severe crashes like the Lehman crisis where you see something like that contraction.”

Moving on

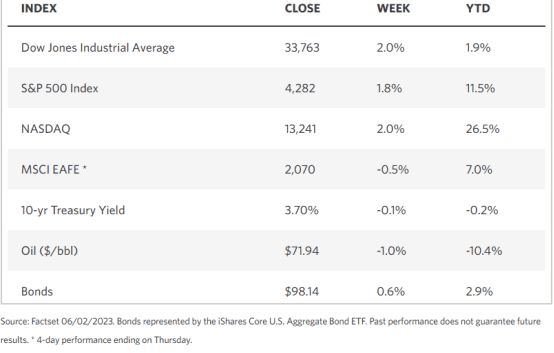

Weekly Market Stats

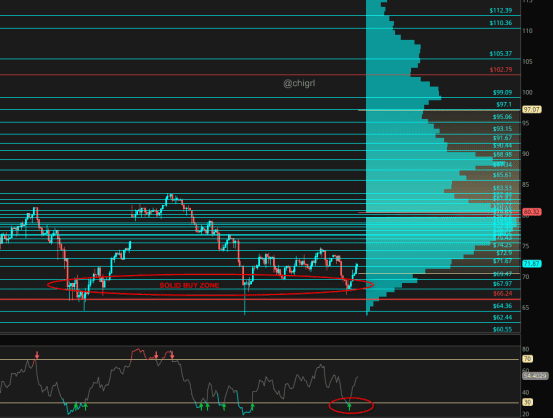

Crude Oil

I think the futures market will open up tonight due to this OPEC meeting, that said tomorrow’s 9AM ET market open will be the real tell …to see if hedge funds, MM’s, CTA’s etc believe this cut will override these recession fears, given poor manufacturing data out of the EU, US, and China last week.

I think addressing Russian barrels was also KEY at this meeting, as most of the media via secondary sources have been reporting that Russia is flooding the market–which is also weighing on sentiment.

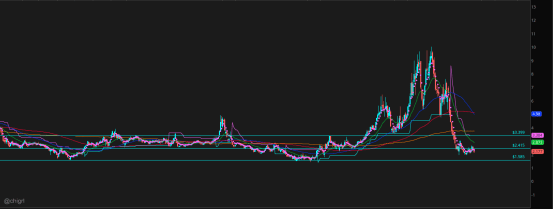

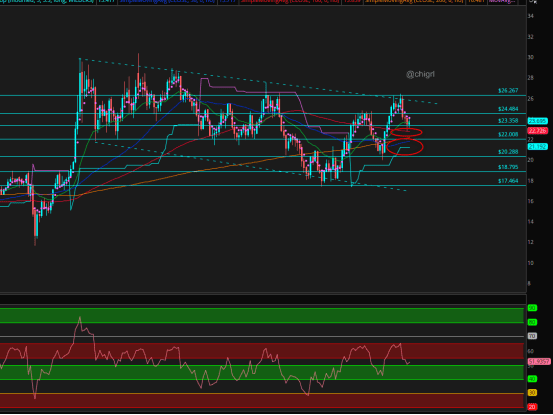

Nat Gas

I mean it is what it is…

No change to my view ..

That said, Nat gas is still waffling in a supply zone.

I want to see a clear break over $3.40/75 for the futures or

over $11.70 in UNG to get bullish this market over the longer term, we just are not even close yet.

Really you should listen to last week’s Place Your Trades Spaces (HERE) on why this market is struggling.

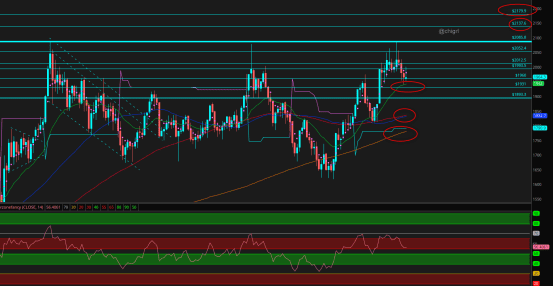

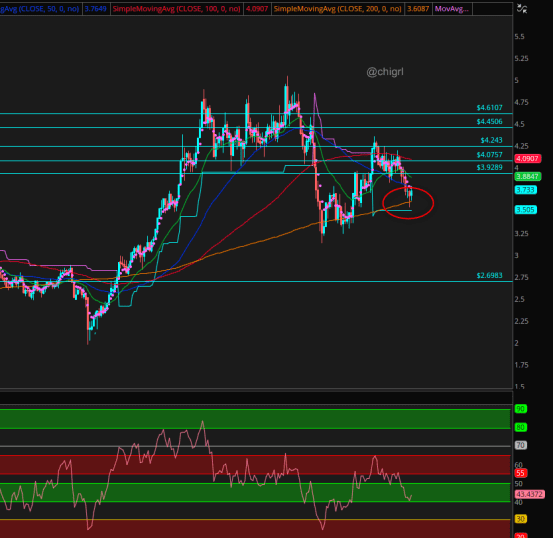

Gold

Levels above and below…I want to see how gold reacts to Yellen flooding the market with treasury issuance to refill the TGA account.

Silver

Same as gold, it bounce where it should have …over alll this market still looks very bullish even if we have some short-term downside (which is limited IMHO)

Copper

Given the horrific manufacturing data out of the EU, US, and China, this market was able to stage a rebound last week. Telling.

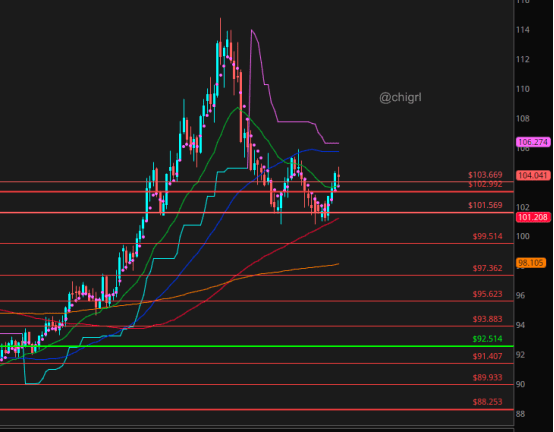

USD

$DXY

USD was flat on the week and put in an indecision candle. Still watching that 105/106 area

Financial Disclaimer: This material has no regard for specific investment objectives, financial situations, or particular needs of any user. This material is presented solely for informational and entertainment purposes and is not to be construed as a recommendation, solicitation, or an offer to buy or sell / long or short any securities, commodities, or any related financial instruments. Nor should any of its content be taken as investment advice. The views expressed here are completely speculative opinions and do not guarantee any specific result or profit. Trading and investing are extremely high risk and can result in the loss of all of your capital. Any opinions expressed here are subject to change without notice. We may have an interest in the securities, commodities, and/or derivatives of any entities referred to in this material. We accept no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this material. We recommend that you consult with a licensed and qualified professional before making any investment or trading decisions.