Big week last week!!

OPEC + Holds steady

OPEC + met on February 1 and decided to hold policy steady. This was one of the least surprising events of last week. JMMC reaffirmed its commitment to the DoC which extends to the end of 2023 as agreed in the 33rd OPEC and non-OPEC Ministerial Meeting (ONOMM) on 5th of October 2022. This was a 2 million barrel per day cut.

OPEC+ Statement: “The Committee reviewed the crude oil production data for the months of November and December 2022 and noted the overall conformity for participating OPEC and non-OPEC countries of the Declaration of Cooperation (DoC).

The Members of the JMMC reaffirmed their commitment to the DoC which extends to the end of 2023 as agreed in the 33rd OPEC and non-OPEC Ministerial Meeting (ONOMM) on 5th of October 2022 and urged all participating countries to achieve full conformity and adhere to the compensation mechanism.

The Committee thanked the OPEC Secretariat for their contribution to the meeting.

The next meeting of the JMMC (48th) is scheduled for 3 April 2023”

This group does reserve the right to hold an emergency meeting in the event that market conditions change before the next meeting. With the uncertainties surrounding Russian barrels on the market after the EU embargo of seaborne deliveries and China reopening, I believe this was the right decision, although the market reacted negatively.

In addition, seasonally this is one of the weakest times of year given it its is build season with refineries in maintenance. Something to keep an eye on is that many refineries that went down mid-December due to Storm Elliot went into early maintenance which accounts for 2 million barrels per day of refining capacity. So, we could see shortened maintenance season this year, which typically lasts until April/May.

Also notable via Reuters:

Warning from KSA energy minister this weekend: “Saudi Energy Minister Prince Abdulaziz bin Salman warned on Saturday that sanctions and under-investment in the energy sector could result in a shortage of energy supplies.

In response to a question on how the sanctions environment would affect the energy market, bin Salman told an industry conference in Riyadh: “All of those so-called sanctions, embargoes, lack of investments, they will convolute into one thing and one thing only, a lack of energy supplies of all kinds when they are most needed”.”

Federal Reserve

25 bps hike

This was also unsurprising, but it was presser after that proved to turn this market on its head. Stocks rallied last week following the Fed’s latest meeting.

The message heard around the world

Taking a queue for other CB’s?

Before the FED, the Bank of Canada indicated a slowing of its pace of rate hikes, reflecting the decline in domestic inflation pressures. The Bank of England raised 50 bps but also indicated they were more cautious after and said they did not want to get too ahead of themselves.

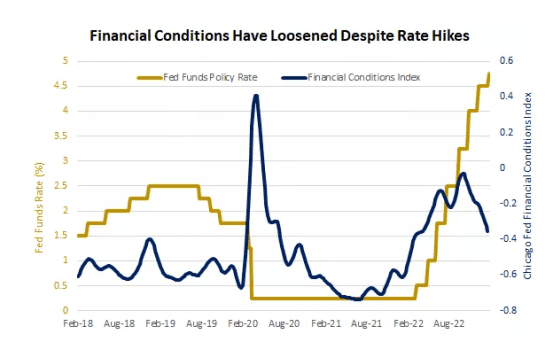

As for the Fed, markets are pricing in an end to rate hikes by the end of the year. On Thursday, Fed swaps were actually pricing in rate cut by the end of the year. Fridays, sell off, altered this curve a bit.

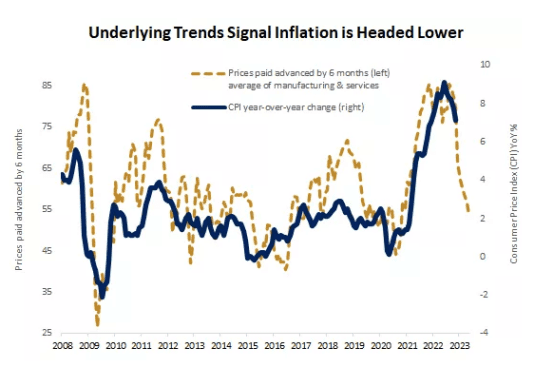

Notable Charts

Are markets getting ahead of themselves? Is Powell’s message being misinterpreted? Soft landing? Time will tell.….

Side note:

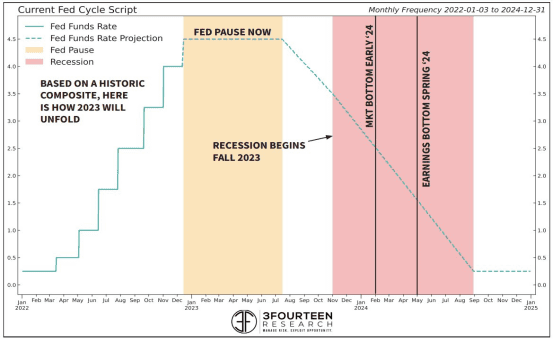

Interesting from Warren Pies of 3 Fourteen Research (he was on my PYT spaces talking about this on January 4…this episode was amazing, if you missed it, you can catch it HERE), their models suggest we will see a recession until H2 of 2023.

Nancy Lazar, Chief Global Economist at Piper Sandler was also on FOX business last week reiterating this same sentiment of an H2 2023 recession:

“People are too focused on ‘08 and 2020. This is more like 1973, 74 and 2021,” Piper Sandler chief global economist Nancy Lazar said

Lazar predicted feeling the full impact of a recession in the second half of 2023 as lag effects from the Federal Reserve’s rate hikes take hold.”

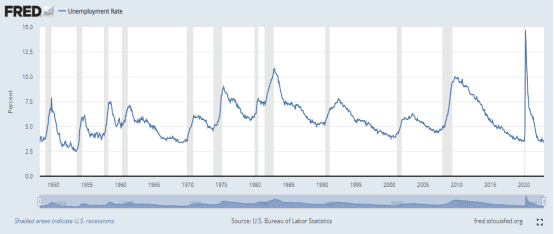

Unemployment

517K jobs created?!?!

The U.S. unemployment rate fell to 3.4%, a number last seen in 1969. 1951-1953 is the only post-war period in which unemployment was lower

That is the headline anyway.

I think we need to be careful a bit of this data.

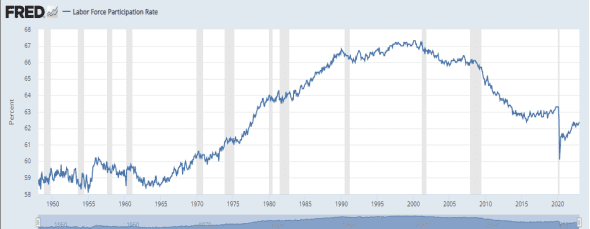

Labor force participation rate is still woefully low …in fact at 1977 levels

Perhaps the most important figure from this report, however, was the latest read on wages. Average hourly earnings growth slowed again in January, to an annualized pace of 4.4%, down from 4.8% in December.. While any moderation in wages may not sound like a positive thing, this should offer some comfort to the Fed that wages are not exerting upward pressure on inflation. This should satiate the Fed a bit.

My take: This latest read on the US labor market is positive for a “soft landing” scenario, but it is premature to consider a potential recession canceled. We \are not out of dangerous waters yet.

Other interesting employment tidbits

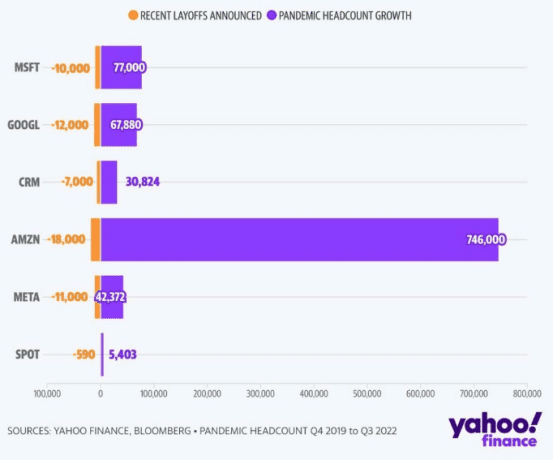

We have had announcements of substantial tech layoffs, but they are relatively small compared to hiring over the last two years

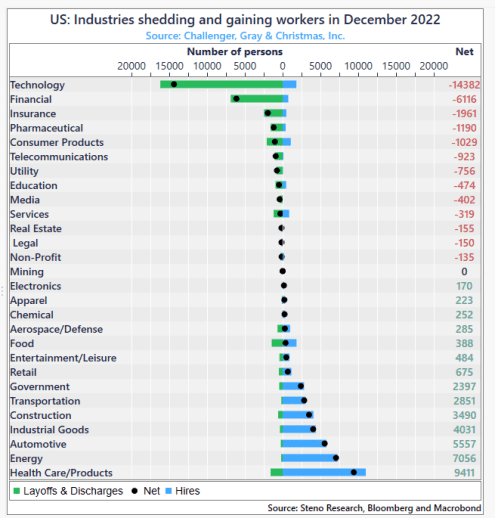

Industries are gaining where others are losing

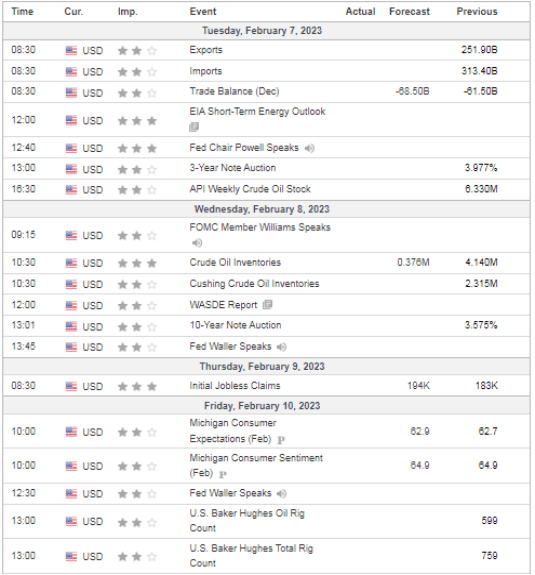

US DATA THIS WEEK

THINGS TO KEEP AN EYE ON THIS WEEK

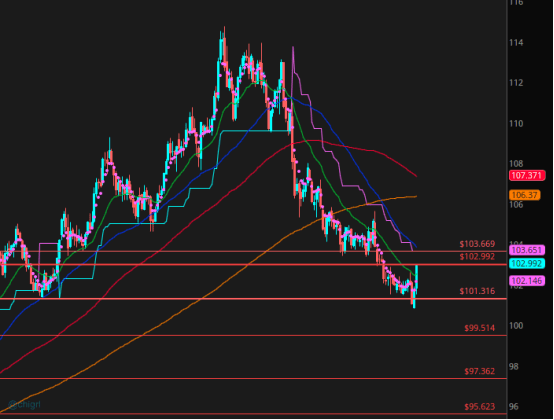

$DXY (USD)

Keep an eye on that $103 area …it will matter for commodities. We could see some rejection from that area. (If not, the higher we go, all the recent money that just poured into emerging markets is fooked (technical term))

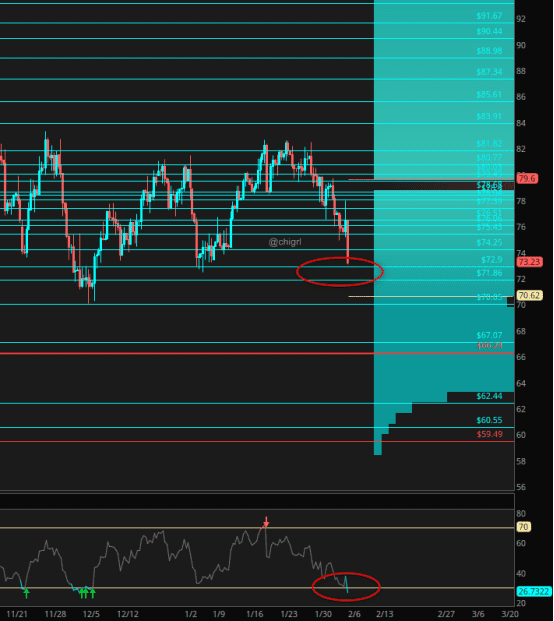

Crude Oil

OPEC says that it does not want to see Brent drift into the $70’s ….we are there …taking a look at WTI ..we may see a bounce here soon (I am thinking some jawboning will happen this week with regards to an emergency OPEC+ meeting or some headlines about cuts or some geopolitical escalation)

Financial Disclaimer: This material has no regard for specific investment objectives, financial situations, or particular needs of any user. This material is presented solely for informational and entertainment purposes and is not to be construed as a recommendation, solicitation, or an offer to buy or sell / long or short any securities, commodities, or any related financial instruments. Nor should any of its content be taken as investment advice. The views expressed here are completely speculative opinions and do not guarantee any specific result or profit. Trading and investing are extremely high risk and can result in the loss of all of your capital. Any opinions expressed here are subject to change without notice. We may have an interest in the securities, commodities, and/or derivatives of any entities referred to in this material. We accept no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this material. We recommend that you consult with a licensed and qualified professional before making any investment or trading decisions.

2 Responses

I know you didn’t touch on this yet, but it probably won’t be long until the term “oil-laundering” becomes the hot new buzzword LOL!

Thanks Chicago Girl! Could you suggest some Yes/No EC Strikes to trade in this daily blog? Might make some money.