October 6th 2023

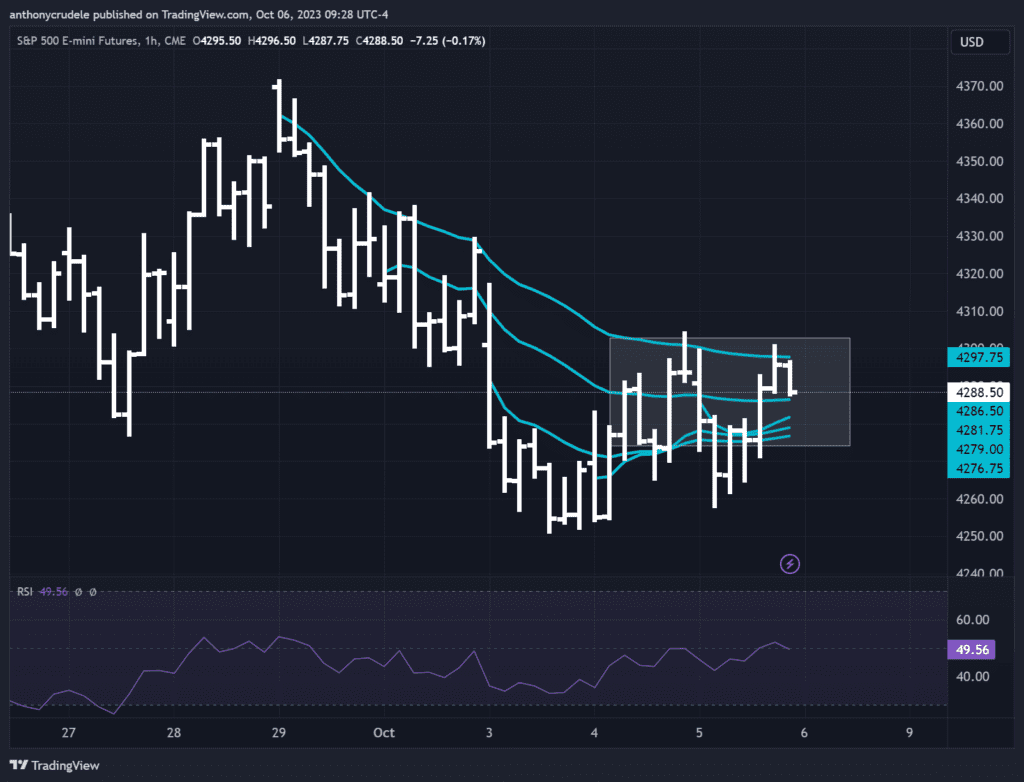

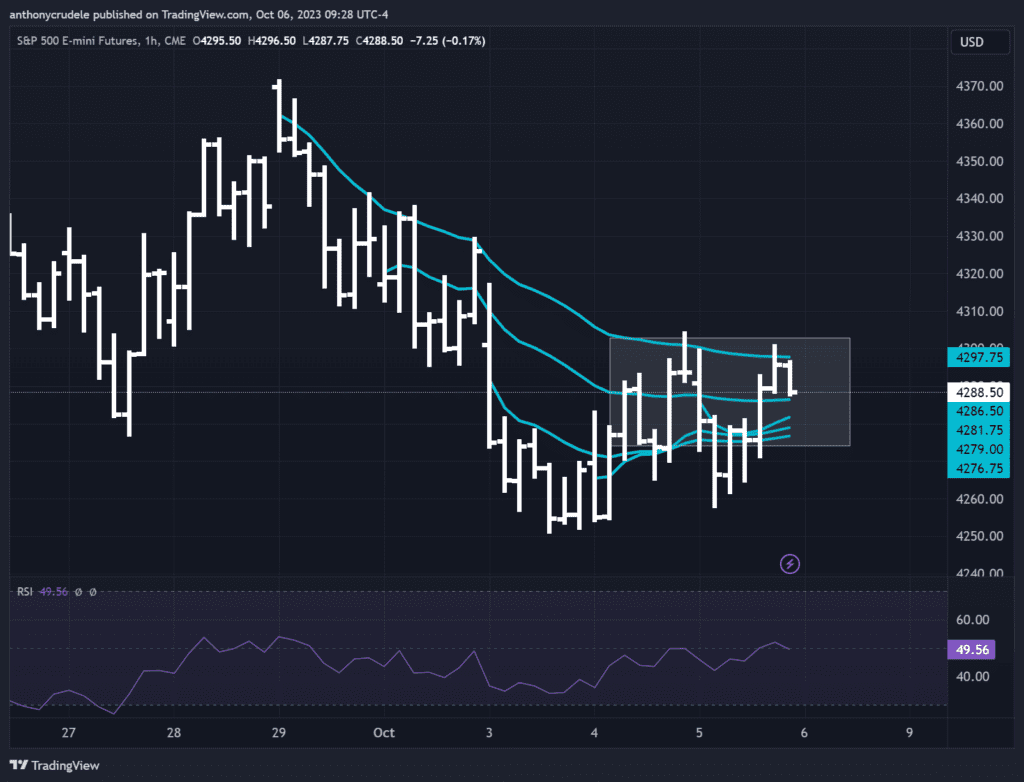

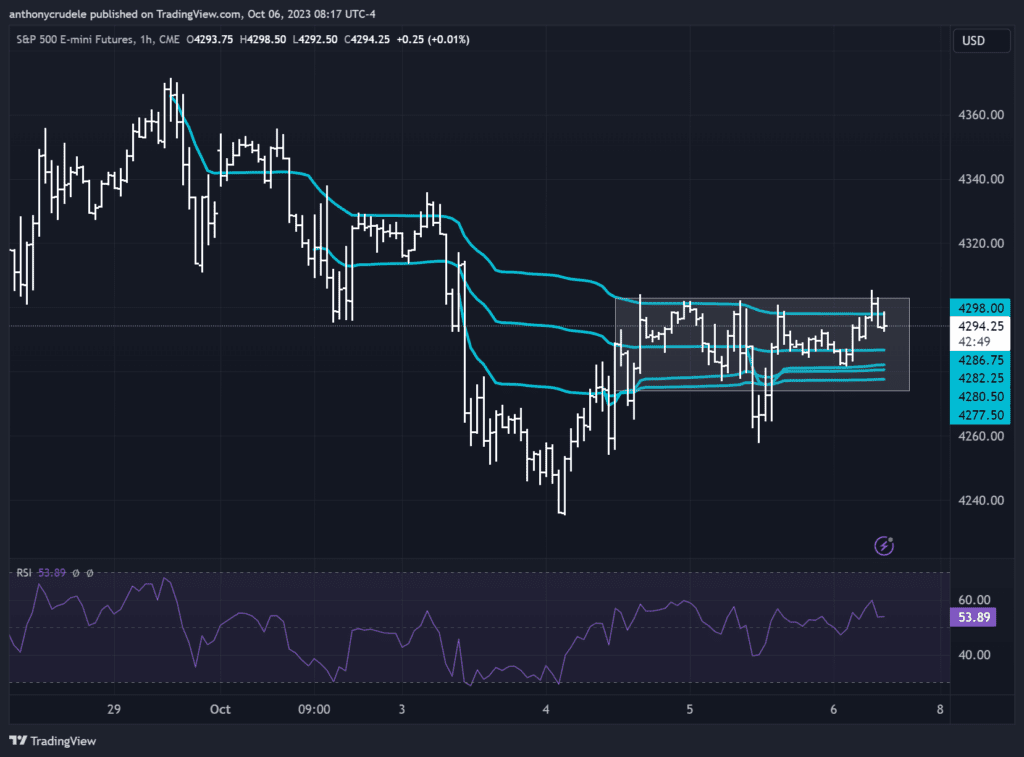

I’ve got some trading thoughts for after the NFP numbers release. Throughout the week, I anchor VWAPs to the opening bars of the RTH. By Friday, we have several to show us potential pressure points. As indicated in the chart, the chop zone of the market lies between the top VWAP of 4298 and the bottom one of 4280.50. If a move occurs outside either of the VWAPs, I’d proceed with caution before fading that move. I’d follow the move, only trading very small. The key will be what the rates do. A rate spike could be bearish for ES, while lowering rates might be bullish for ES. Even if the number aligns with expectations, I believe the market will overreact given the high anticipation for this number. Previous 187K, forecast 170K. Don’t let FOMO get the best of you.

Only looking at shorts right now.

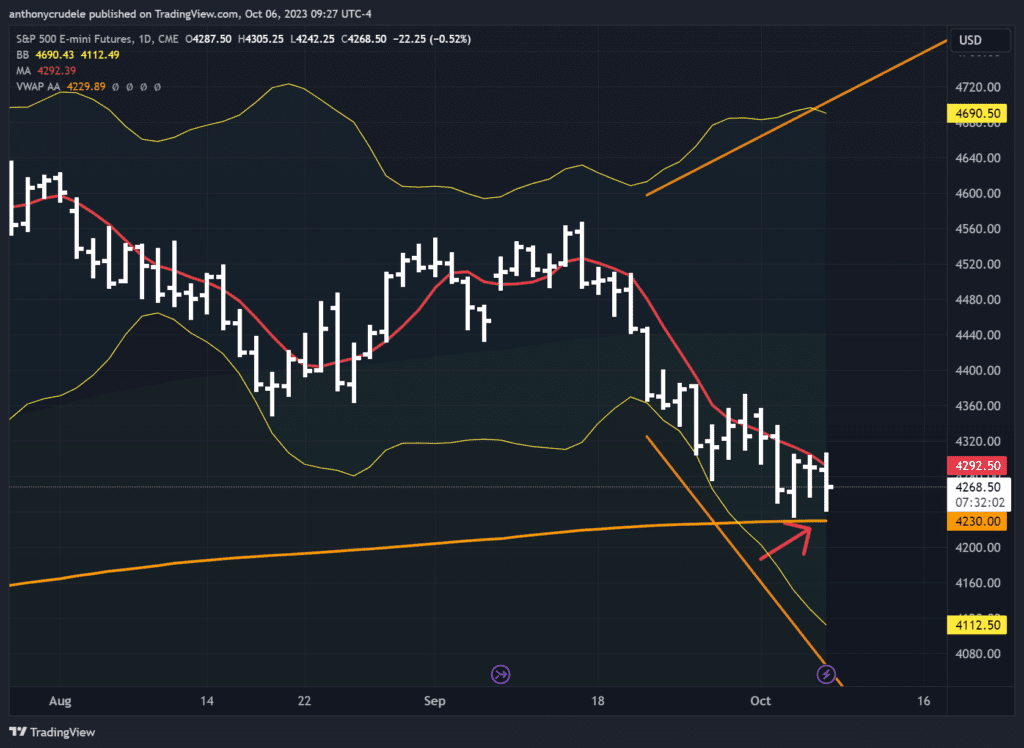

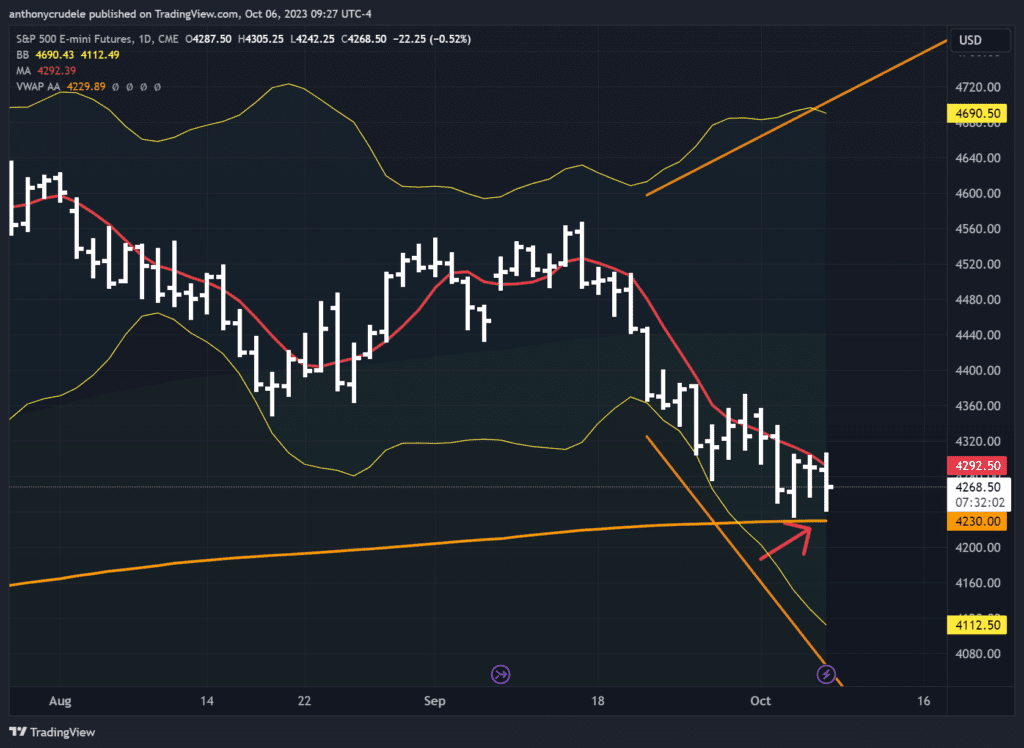

Markets faced a significant selloff on NFP without creating a new low. We stayed above the YTD VWAP, squeezing late-coming shorts, though it doesn’t make me bullish. My primary check is the daily chart. It’s unchanged; we held the YTD VWAP, the Bollinger bands are expanding, signifying potential range expansion, & we remain below the 5-day moving average.

There’s a tug of war; VWAP holds yet other technicals are bearish. I next check my hourly charts; the 4280-98 range is a chop zone.

Finally, I examine rates where once again the long end sits near recent highs in yields, dictating the stock narrative. Higher yields mean lower stocks. Maintaining a chart of rates is critical to grasp the real story.

My trading strategy for today: a rally near 4280 looks like a good short area (confirmed via short term charts). If it holds, we could reach overnight lows again. A breach above 4280 simply means I won’t trade. Brace for volatility, the market has much to digest today.