October 23, 2023

The talk of a Black Monday on social media this weekend was trending on X, and I have to say it’s not a ridiculous thought. Not saying we’re going to have a 1987-style crash by any stretch, but the market is set up for a strong potential downward move. That also doesn’t mean that we’ll get one. I go to the charts as my guide for the day.

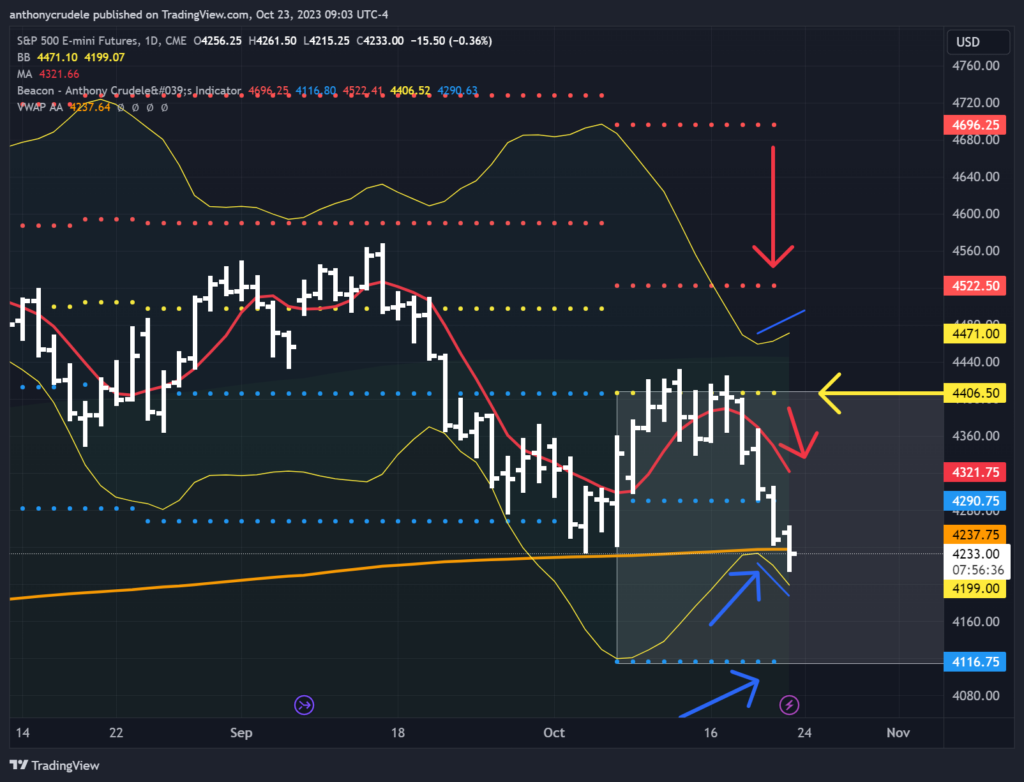

The daily ES chart is where I start; we’re below the 5-day moving average (4321 and sloping down), we closed below my daily support of 4290, the Bollinger Bands are opening up, indicating range expansion, and we’re below the YTD VWAP of 4237. Nothing about that is bullish.

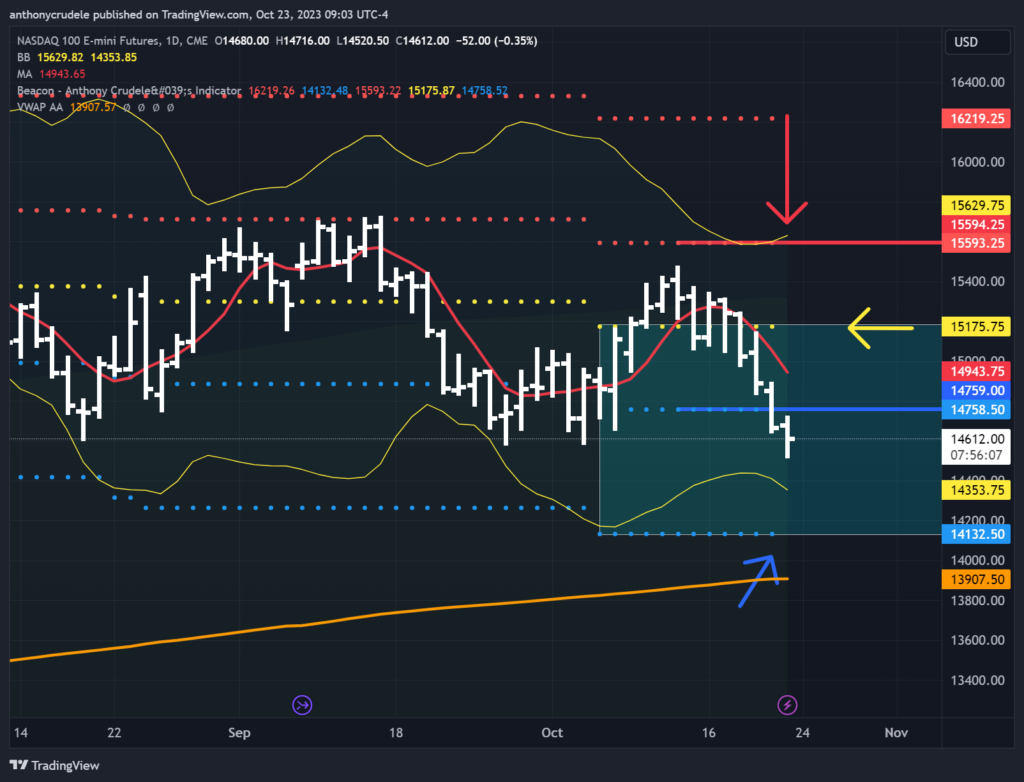

On the other hand, the daily NQ chart isn’t broken down the way ES is. NQ is below its 5-day moving average (14943 sloping down), closed below daily support 14,758, the Bollinger bands are opening up for range expansion, but not as sharply as the ES is, and NQ is way above YTD VWAP of 13,907. What the NQ does is going to play a major role in what ES does in the coming sessions.

Will NQ catch up to the downside and lead this next leg lower? Will NQ start to firm up and bring confidence back to the ES bulls and turn us back up? I don’t know, but I will be watching closely.

My plan for today: As usual, I will watch the 3-minute opening range and see how the RTH VWAP trades around it. If the VWAP goes below the opening range, then we’re set up for a trend-down day, and I look to go short. If the VWAP remains in the 3-minute opening range, we have a sideways day, and I probably do nothing. If the VWAP goes above the opening range, we may have a trend-up type day, and I look to get long (small). All the while, I will be keeping a close eye on the NQ as they will be the tell for market leadership.

Let the day be what it is off the short-term charts, don’t let your big picture bias get in the way of what today is. Don’t have FOMO, be forced to trade.