Asia Mixed, Europe Green

- Hong Kong: Hang Seng closed down 1.05%

- China CSI 300 +0.37%

- Taiwan KOSPI +1.12%

- India Nifty 50 -1.34%

- Australia ASX -0.84%

- Japan Nikkei -0.14%

- European bourses all in positive territory so far this morning

- USD +0.31%

NOTABLE EARNINGS THIS TODAY

$SNAP $PACW $TDOC $SMPL $LRN $ENVA $UMBF $CHX $SPOT $XRX $MTDR $TRU $MSFT $GOOGL $SNAP $V $TDOC $TXN $FFIV $KO $VZ $GE $MMM

TOP STORIES OVERNIGHT

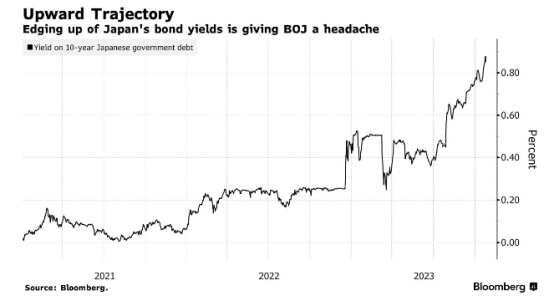

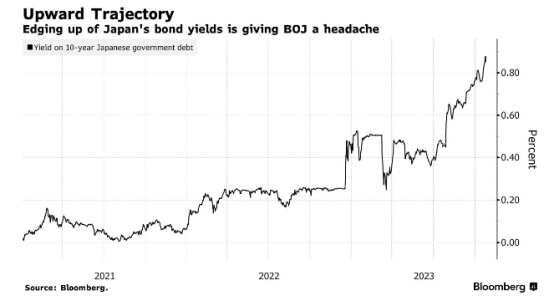

BOJ to Watch Yields Till Last Minute to Decide YCC Tweak, Sources Say-BBG

Bank of Japan officials are likely to monitor bond yield movements until the last minute before making a decision on whether to adjust the yield curve control program at a policy meeting next week, according to people familiar with the matter.

Officials see the possibility of adjusting the ceiling for 10-year bond yields among other options in response to rising pressure stemming from a selloff in US Treasuries, according to the people.

Some feel it might be better to tweak YCC preemptively rather than wait until the policy comes under attack in the market, forcing the bank to undertake a massive amount of bond buying, the people said.

Still, many of them indicated that any decision at the two-day meeting that concludes on Oct. 31 would have to be made with an abundance of caution due to the risk that the BOJ’s action itself could push yields higher even without any dramatic shift in economic fundamentals to justify such moves, the people said.

COMMENTS: We just talked about this on last Wednesday spaces. You can download my PDF highlights or catch the whole episode on the place your trades website.

Xi Makes Unprecedented PBOC Visit in Sign of Focus on Economy-BBG

Xi Jinping made his first known visit to China’s central bank since he became president a decade ago, according to people familiar with the matter, underscoring the government’s increased focus on shoring up the economy and financial markets.

Xi, along with vice premier He Lifeng and other government officials, visited the People’s Bank of China and the State Administration of Foreign Exchange in Beijing on Tuesday afternoon, said the people, asking not to be identified discussing private information. The vice premier also visited the nation’s sovereign wealth fund, the people added.

While details of the visits weren’t immediately clear, Xi’s movements are closely monitored by investors for potential policy signals. The most powerful Chinese leader since Mao Zedong has never appeared at the PBOC, according to public records, and his visit would highlight recent Communist Party rhetoric on its “centralized and unified” leadership over the financial industry. Previous such inspections were often led by the nation’s premiers or their deputies.

Xi’s presence reinforces a string of recent moves by the government to boost growth and stabilize markets. It could help ease concerns among some investors that the president had been neglecting the economy amid a purge of senior ministers and a volatile relationship with the US.

His visit to the foreign exchange regulator is partly aimed at better understanding China’s $3 trillion of foreign-exchange reserves, one of the people said. It comes as state leaders, regulators and top bankers are set to gather at a closed-door financial policy meeting early next week to set medium-term priorities for the $61 trillion industry and prevent risks.

COMMENTS: Mainland China stocks up today

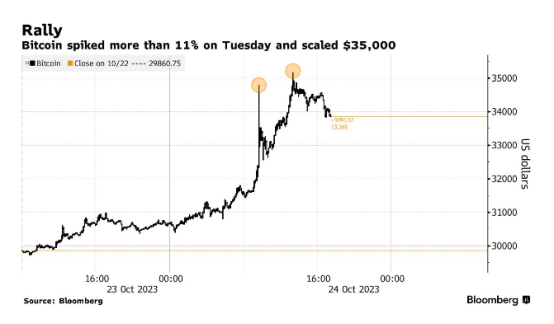

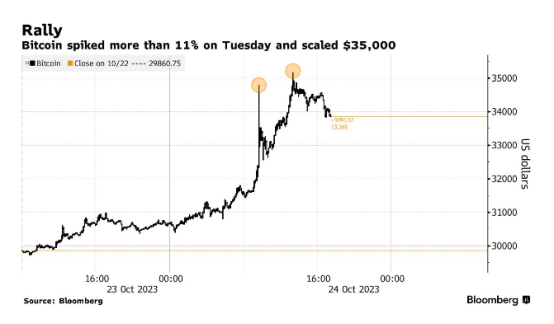

Bitcoin Hits $35,000 for First Time Since 2022 on ETF Optimism-BBG

Bitcoin extended a rally fueled by expectations of fresh demand from exchange-traded funds, reaching the highest price since May last year.

The largest digital asset rose as much as 11.5% to top $35,000 before paring some of the gain to trade at $33,918 as of 7:25 a.m. in London on Tuesday, taking its year-to-date rebound from 2022’s digital-asset rout to 105%.

The possible approval in coming weeks of the first US spot Bitcoin ETFs is stoking speculative ardor for the token. Asset managers BlackRock Inc. and Fidelity Investments are among those in the race to offer such products. Digital-asset bulls argue the ETFs would widen adoption of the cryptocurrency.

A US federal appeals court on Monday also formalized a victory for Grayscale Investments LLC in its bid to create a spot Bitcoin ETF over objections from the US Securities and Exchange Commission.

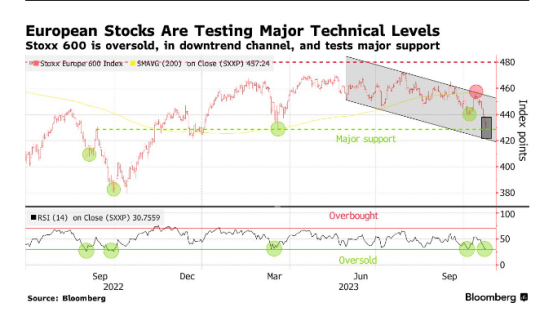

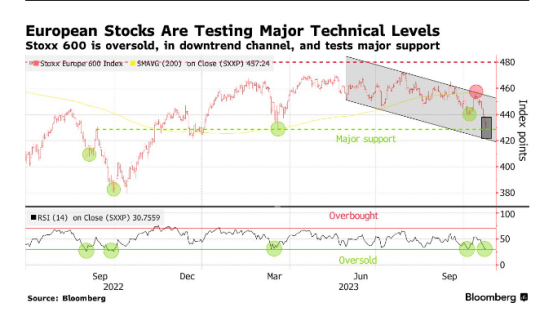

Goldman Sees Risk to European Stocks as Long-Term US Yields Rise-BBG

Any year-end rally in European equities faces an additional challenge from the rise in longer-term Treasury yields, according to Goldman Sachs Group Inc. strategists.

While the curve between the US two- and 10-year bonds is still inverted, the gap has shrunk to the smallest this year on bets that central banks won’t increase policy rates further. However, the Goldman team including Lilia Peytavin and Peter Oppenheimer said the advance in longer-term bond yields doesn’t necessarily reflect better growth expectations.

That’s in contrast to previous instances that occurred after the global financial crisis, where the steepening in the curve was a sign of lower deflation risks and was typically a boost to stocks, they wrote in a note.

Moreover, “the level from which rates are rising is already quite high, and a further increase in interest rates would likely weigh on equities and cyclicals,” the strategists said. Finally, equity valuations “do not look very attractive,” with the risk premium at a 15-year low. “This means that there appears to be much less cushion for equities to digest higher rates,” they said.

COMMENTS: European markets green today, perhaps a relief rally from well oversold levels and a retreat in global yields.

HCOB Flash Eurozone PMI®

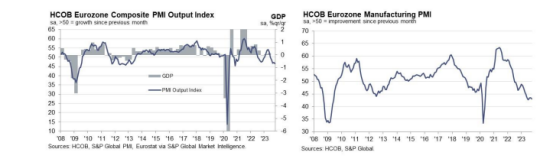

HCOB Flash Eurozone Composite PMI Output Index (1) at 46.5 (September: 47.2). 35-month low.

HCOB Flash Eurozone Services PMI Business Activity Index(2) at 47.8 (September: 48.7). 32-month low.

HCOB Flash Eurozone Manufacturing PMI Output Index(4) at 43.1 (September: 43.1). Unchanged rate of decline.

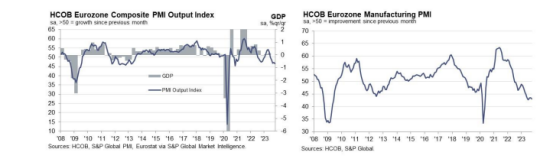

HCOB Flash Eurozone Manufacturing PMI(3) at 43.0 (September: 43.4). 3-month low

COMMENTS: WOOF!

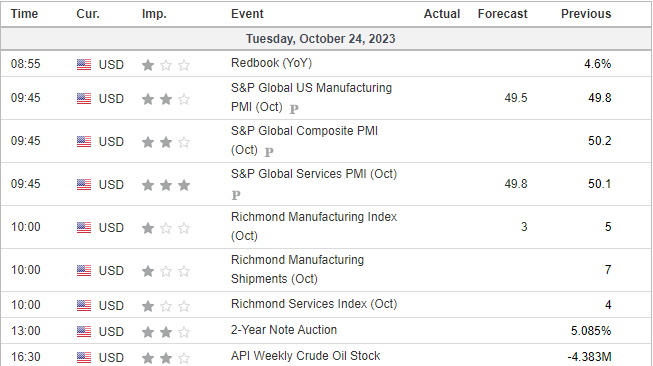

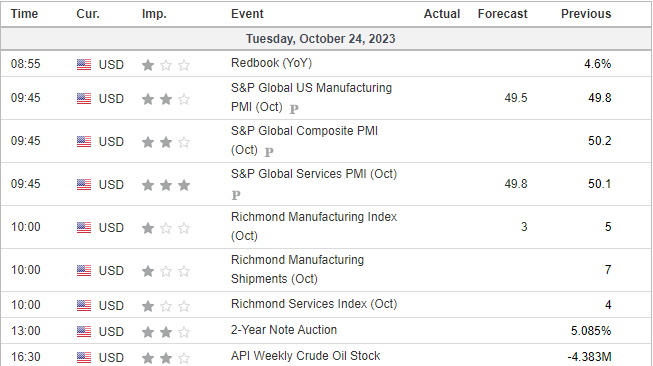

US DATA TODAY