November 2nd, 2023

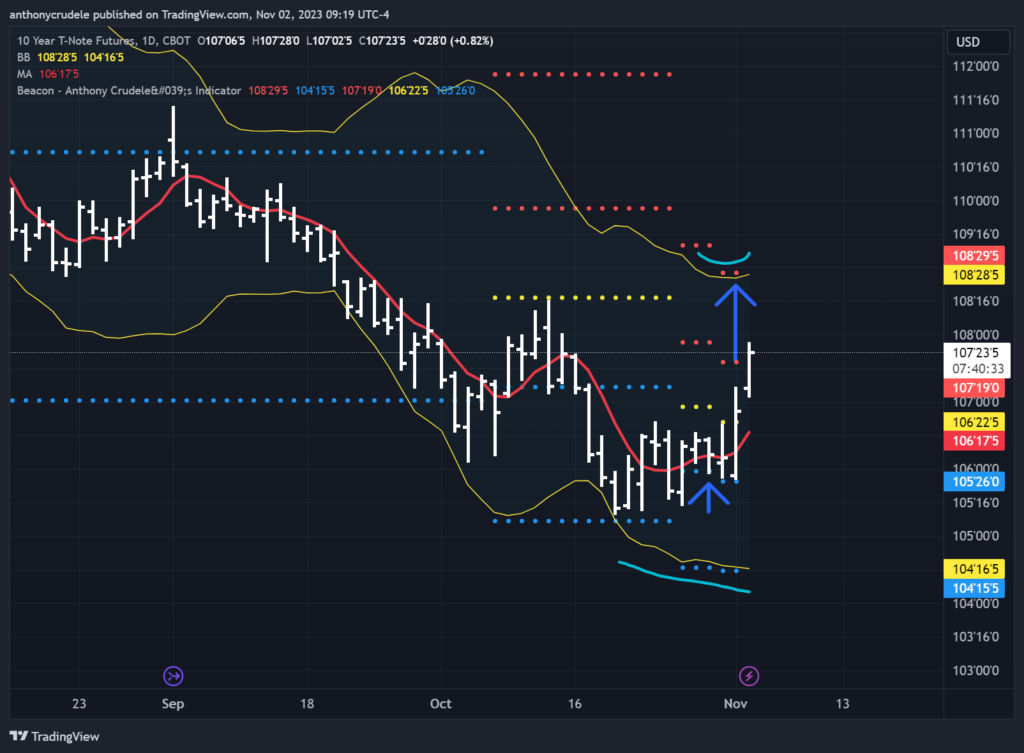

The bulls are back? For now, they are, and they have the Bond Market Bulls, which is why we’re seeing so much momentum to the upside. Equity traders looking at the bond market are saying to themselves, ‘We have to get in now because maybe rates have peaked?’ Not sure about that. I’ll leave it for the Macro Traders to sort through that. For us as day traders, it’s important to understand that momentum can shift on a dime in markets. It’s why we have to be so picky with our trades. Trying to make sense of everything going on right now with so many crosswinds is not for the faint of heart. We have to be able to shift our bias as the market dictates change. Just look at the last 8 days of trading: Major Company Earnings, FOMC, Unemployment (this Friday), Last & First Days of the month! Not typically my favorite times to trade.

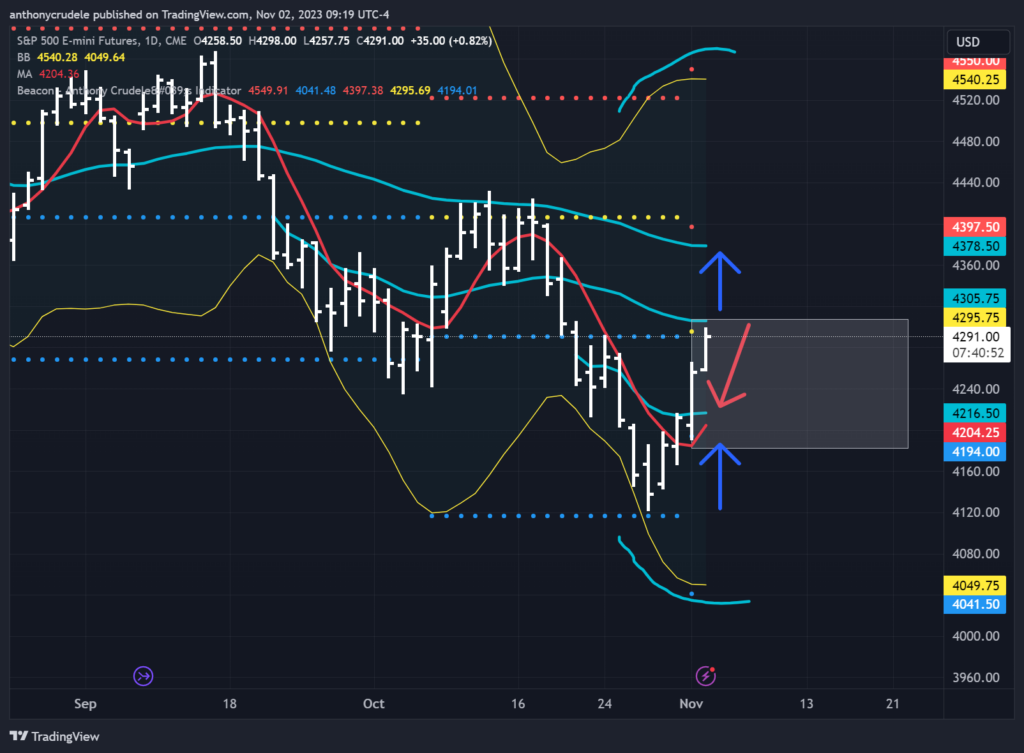

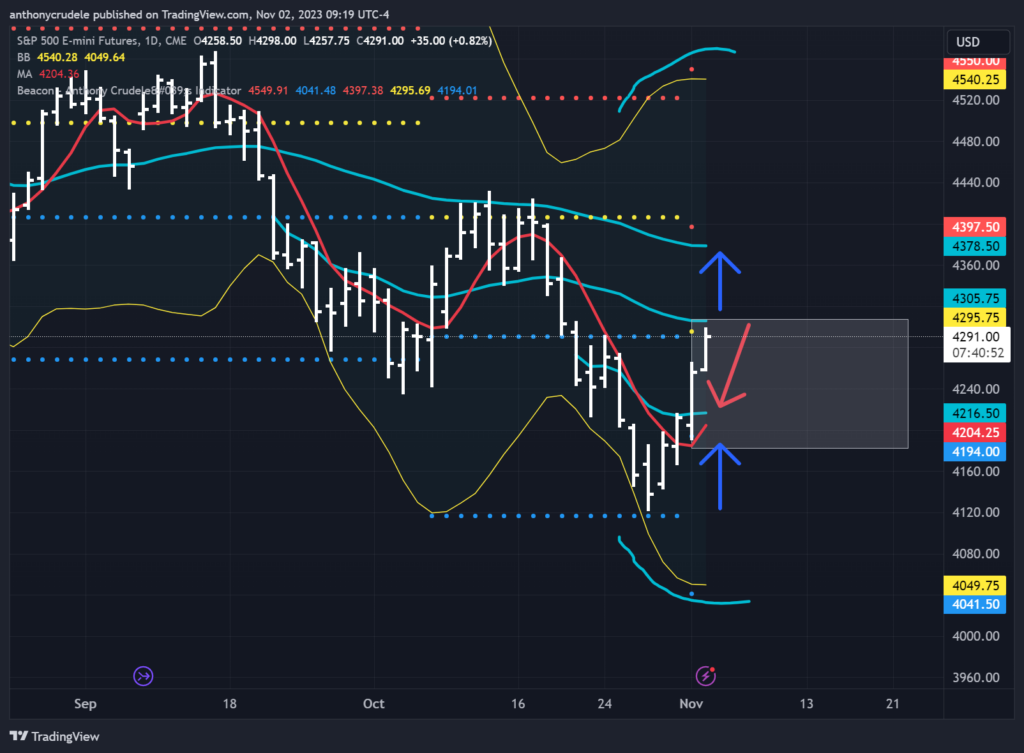

The daily chart in ES has officially confirmed the trend reversal, but we’re so much higher there’s really nothing I can do about it. That happens sometimes. You stay patient and miss the long opportunity; all we can do is move forward.

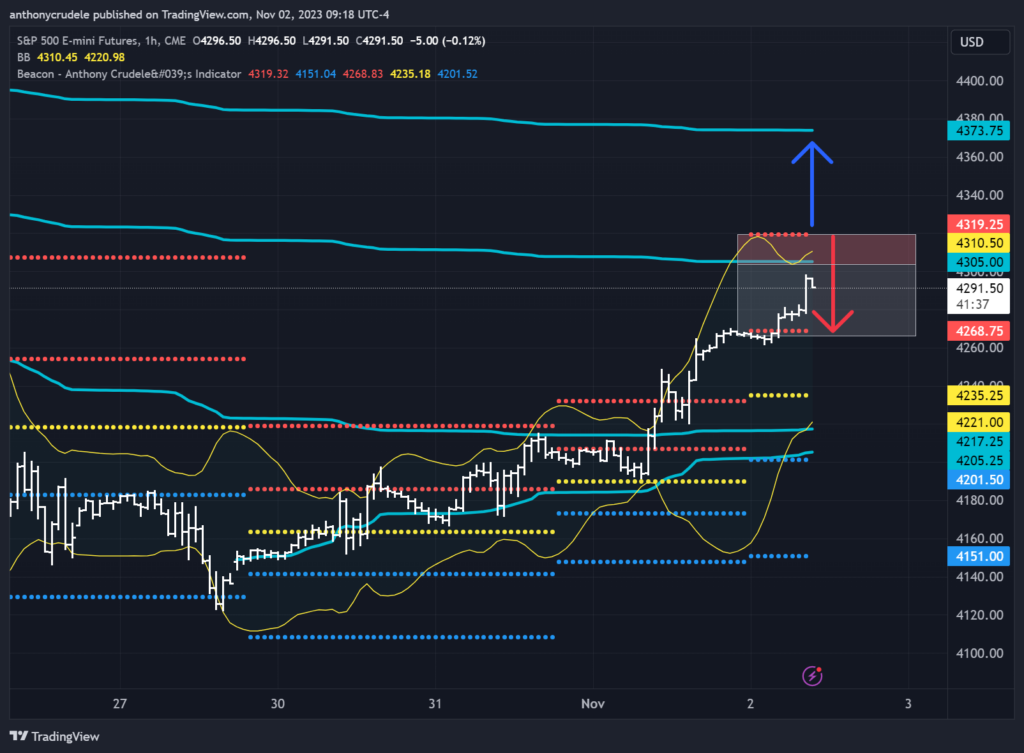

My plan for today: initially, I will look for short setups from 4305-19. That area can be a short-term top for the market to trade back down to 4268. Even though I’m bullish on ES, the play this morning is to look for shorts. If we get into that range, I will be a seller with a stop above the 4322ish area.

If we start to push above 4319-22, I could see a move up to 4373 in the coming sessions, but for today, I will just walk away from the market. I will not buy into that rally.

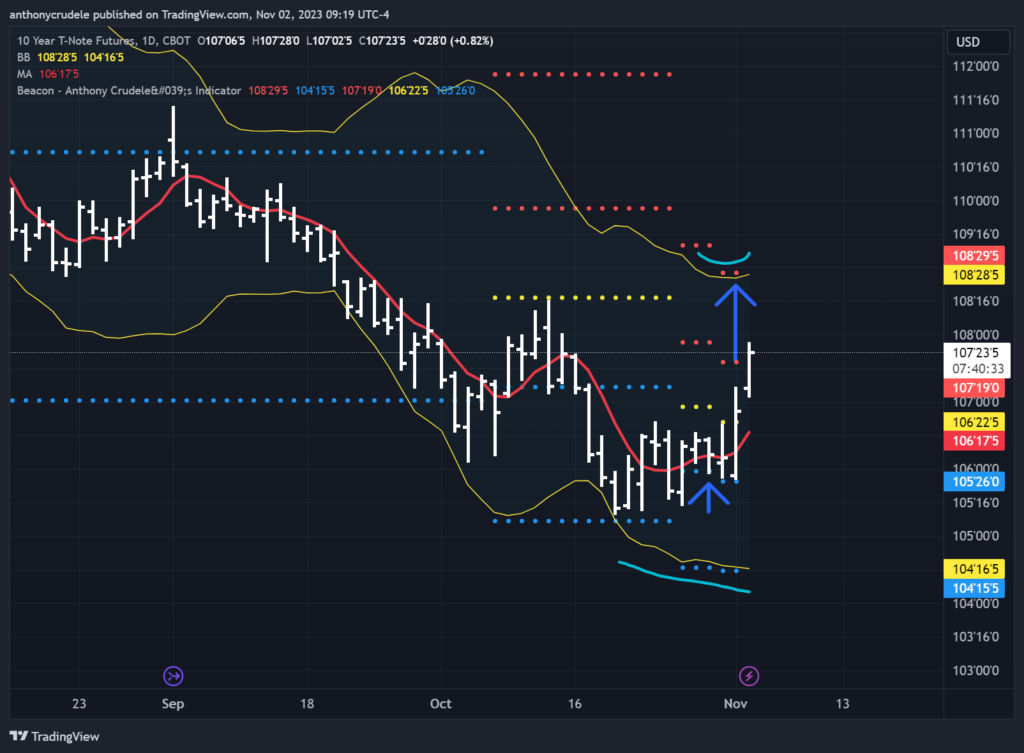

Keep one eye on the Bond market at all times right now. 10 YR Futures ZN can still rip higher from here, and that could mean Equities continue to rip higher as well. Keep it light and tight. Cheers, DELI.