HAPPY NFP DAY!

Asia GREEN ..Europe Mixed

- Hong Kong: Hang Seng closed UP +2.52%

- China CSI 300 +0.84%

- Taiwan KOSPI +1.08%

- India Nifty 50 +0.49%

- Australia ASX +1.00%

- Japan Nikkei +0.24%

- European bourses in mixed territory so far this morning

- USD -0.16%

TOP STORIES OVERNIGHT

US October Jobs Report to Mark End of Blowout Payroll Gains-BBG

The monthly US jobs report is set to show that the blowout gain in September was only temporary, according to Bloomberg Economics.

Employers likely added 157,000 workers to payrolls last month, less than half the pace of September, Bloomberg economists Anna Wong and Stuart Paul wrote Thursday in a preview. The pace will reflect “payback” from a pop in hospitality and leisure job gains in September, the impact of the United Auto Workers strike and cooler demand for workers, they said about the data due Friday.

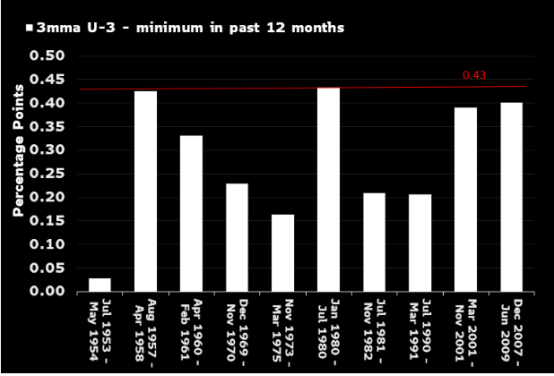

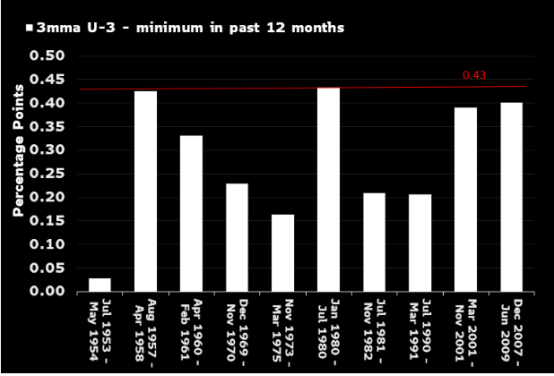

The economists expect the unemployment rate to nudge up to 3.9% from 3.8%, large enough of an increase that they say it would signal a recession is due by year-end, based on historical data. Because the unemployment rate doesn’t count striking workers as unemployed and isn’t subject to big revisions, it offers a better measure of labor market conditions than the headline figure, they wrote.

“Even before the UAW strikes began, household survey data already showed the number of people becoming unemployed growing faster than the number transitioning out of unemployment — which usually foreshadows a jump in the unemployment rate,” Wong and Paul wrote.

BofA’s Hartnett Says Technicals No Longer Impede S&P 500 Rally-BBG

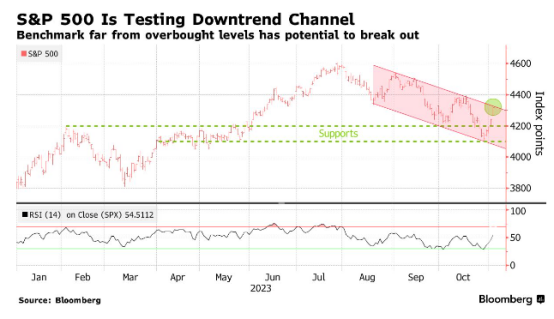

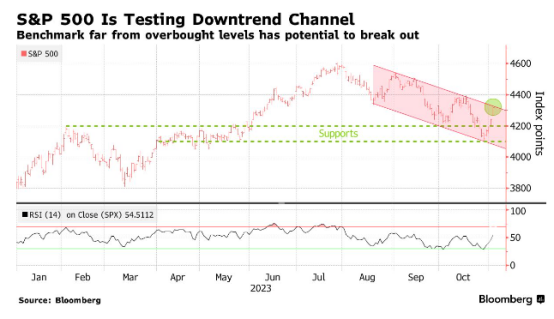

Technical factors no longer stand in the way of a year-end rally in the S&P 500 index, according to Bank of America Corp.’s Michael Hartnett.

The bank’s in-house sentiment gauge, the Bull & Bear Indicator, is flashing a contrarian buy signal for a third straight week amid poor equity market breadth — a reference to the number of stocks rising — and large outflows from high-yield and emerging-market bonds, the strategist wrote in a note. The indicator has slid to 1.4, below the 2 level that BofA says implies a buy signal.

With oil under $100 a barrel, yields below 5% and S&P 500 trading above the 4,200 level, positioning could pick up again, said Hartnett, who has been pessimistic on risk assets throughout this year. “But note, everyone now expects a big year-end rally,” he added.

Another team of BofA strategists earlier this week said a contrarian indicator from the bank is also close to offering a buy signal, with its current level implying a 15.5% price return for the S&P 500 over the next 12 months.

After slumping over the past three months, the S&P 500 is set for the best week in a year, lifted by an oil price retreat and hints from Federal Reserve Chair Jerome Powell that the US central bank may be finished with the most aggressive tightening cycle in four decades. Last week, the index briefly dipped below 4,200, seen as a key support level by traders, before a pullback in bond yields allowed it to rebound.

“Lower oil a huge win for central banks, now cutting rates at fastest pace since Aug 2020,” Hartnett wrote, referring to 30 rate cuts from global central banks over the past 3 months. Oil being flat since the start of the Israel-Hamas war is “telling you the world is closer to recession,” he added.

Nonetheless, investors continued to pour money into safe-haven cash funds during the week through November 1. Flows of more than $64 billion in the latest week took annualized inflows to $1.3 trillion, according to EPFR Global data cited by Hartnett. Equity funds had $3.4 billion pulled out while bonds enjoyed inflows for the fourth straight week, absorbing $4.5 billion.

COMMENTS: Bold call!

Russia has no plans to lift restrictions on fuel exports right now – RIA cites Novak

Russia had no plans to lift restrictions on exports of fuel in the near future and easing the export limits will be possible only when the volumes have nowhere else to go, Deputy Prime Minister Alexander Novak was quoted as saying by RIA on Friday.

The Russian government introduced the ban in September and later partially softened it by lifting restrictions on pipeline diesel supplies.

COMMENTS: This will further tighten diesel supplies, we already have a global distillate problem. Watch those crack spreads

Russia sees oil and fuel exports down by more than 300,000 bpd in November-Reuters

Russia’s energy ministry said on Friday it expects the country’s exports of crude oil and petroleum products to fall in November by more than 300,000 barrels per day (bpd), compared to the average level in May-June.

The ministry also said that Russia is continuing to participate fully in voluntary efforts by OPEC+, the group of leading oil producers, to stabilise the energy market.

Saudi Arabia and Russia have agreed to continue with voluntary oil supply cuts totalling a combined 1.3 million barrels of oil per day, or more than 1% of global demand, until the end of the year.

Russian Deputy Prime Minister Alexander Novak first mentioned last month that oil products were included in the country’s decision to reduce oil exports by 300,000 bpd.

COMMENTS: This is a bit of change from earlier, as fuel was not included in the 300K cuts agreed upon. Slightly negative for oil, depending how these numbers come out.

Sam Bankman-Fried Convicted of Fraud in Stunning FTX Crash-BBG

Sam Bankman-Fried was convicted of a massive fraud that led to the collapse of his FTX exchange, following a month-long trial that pitted the testimony of the former crypto king against that of some of his closest friends.

Bankman-Fried was found guilty of seven counts of fraud and conspiracy after jurors in Manhattan deliberated for less than five hours Thursday. He faces as much as 20 years in prison on each of the most serious charges. Judge Lewis Kaplan set a sentencing date in March.

Bankman-Fried “perpetrated one of the biggest financial frauds in American history,” Williams said after the verdict. “A multibillion dollar scheme designed to make him the King of Crypto.”

COMMENTS: Justice is served

US DATA TODAY