Pretty GREEN out there

- Hong Kong: Hang Seng closed UP +0.75%

- China CSI 300 -0.47%

- Taiwan KOSPI +1.81%

- India Nifty 50 +0.83%

- Australia ASX +0.82%

- Japan Nikkei +0.37%

- European bourses ALL in POSITIVE territory so far this morning

- USD -0.66%

TOP STORIES OVERNIGHT

Powell Hints Fed Is Done With Hikes in Pivot Cheered by Markets-BBG

Federal Reserve Chair Jerome Powell hinted the US central bank may now be finished with the most aggressive tightening cycle in four decades after it held off on raising interest rates for a second consecutive policy meeting.

“The question we’re asking is: Should we hike more?” Powell told reporters during a press briefing after the decision. “Slowing down is giving us, I think, a better sense of how much more we need to do, if we need to do more.”

The central bank’s policy-setting Federal Open Market Committee left its benchmark rate unchanged Wednesday in a range of 5.25% to 5.5%, following a two-day meeting in Washington. Officials signaled in a post-meeting statement that a recent rise in longer-term Treasury yields reduces the impetus to hike again, though they left open the door to another increase.

Powell’s dovish pivot cheered markets, with the S&P 500 index closing more than 1% higher on the day. The 10-year US Treasury yield tumbled below 4.75% for the first time in two weeks, extending moves initially triggered in the morning by the Treasury Department’s plans to slow the pace of increase in its long-term debt sales.

COMMENTS: Markets still cheering overnight

Dollar lower as traders see US rates peaking-CNA

The dollar fell broadly on Thursday, with risk-sensitive Asia-Pacific currencies leading gains as investors grew more convinced of a likely peak in U.S. interest rates after the Federal Reserve left them on hold.

Fed Chair Jerome Powell left the door open to another hike, but with the funds rate target ceiling at 22-year high of 5.5 per cent he said the risks of doing too much or too little were now balanced.

Markets took that as a green light to stick with a sub 20 per cent chance that rates will rise in December. Ten-year Treasury yields are down 23 basis points from Wednesday’s highs, equities rallied and risk-sensitive currencies bounced.

“Powell had the opportunity to raise a bit of concern with the latest rise in short-term inflation expectations but he chose not to do that,” said Kristoffer Lomholt, head of FX research at Danske Bank.

“There was a possibility of sending a much more hawkish signal but he chose not to and I think that’s what markets are reacting to.”

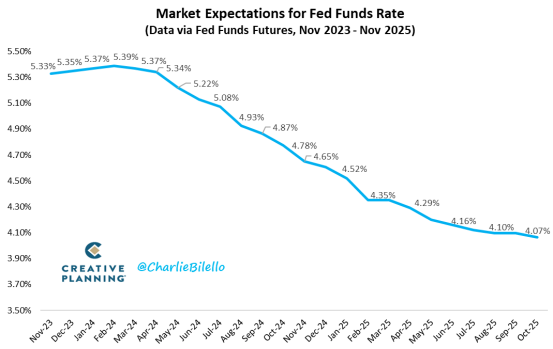

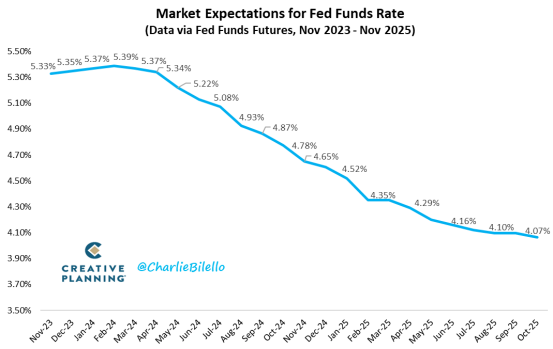

Current market expectations for path of the Fed Funds Rate

Nov 1, 2023: Pause

Dec 13, 2023: Pause

Jan 31, 2024: Pause

Mar 20, 2024: Pause

May 1, 2024: Pause

Jun 12, 2024: 25 bps cut to 5.00-5.25%

Additional cuts to 4.07% by Nov 2025

US offshore wind sector ‘fundamentally broken’ – BP exec-Reuters

BP’s renewables boss said on Wednesday the U.S. offshore wind industry is “fundamentally broken” as BP and its partner Equinor (EQNR.OL) study options to develop huge projects off the coast of New York after writing down $840 million of their value.

The offshore wind industry, one of the fastest growing energy sectors, has recently suffered a string of major setbacks due to equipment reliability issues, supply chain problems and sharp cost increases.

“Ultimately, offshore wind in the U.S. is fundamentally broken,” Dotzenrath told an FT Energy Transition conference in London.

COMMENTS: Hot off the heels of the Orested write-down yesterday.

Sunrun Takes $1.2 Billion Charge in Latest Blow to Solar-BBG

The promise of the renewable energy industry, underscored by Sunrun Inc.’s acquisition of Vivint Solar three years ago, had investors rushing to jump in. Now, solar stocks are facing a major sell-off, spurring Sunrun to take a $1.2 billion charge to write down the value of its purchase.

The move at the biggest US rooftop solar company comes on the heels of a string of bad news across the sector. SunPower Corp. tumbled 5.6% Wednesday after cutting its full-year guidance due to weaker demand for its rooftop solar systems. SolarEdge Technologies Inc., which makes inverters that allow homes to use solar power, saw its stock plunge more than 20% in late trading Wednesday.

COMMENTS: Solar struggling as well

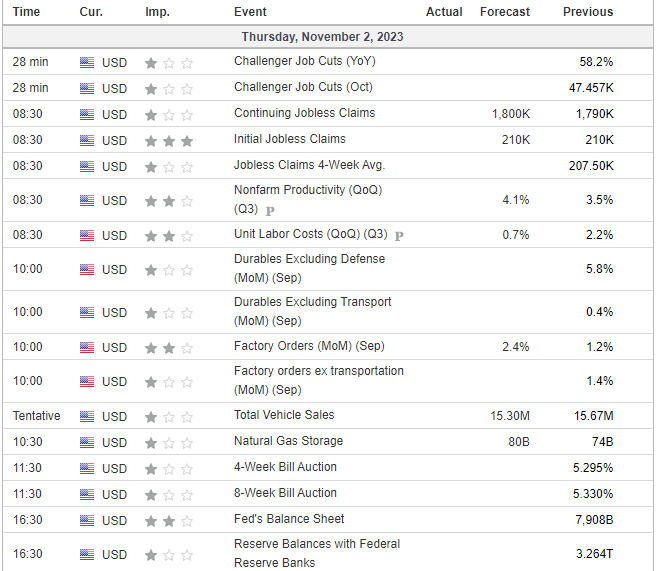

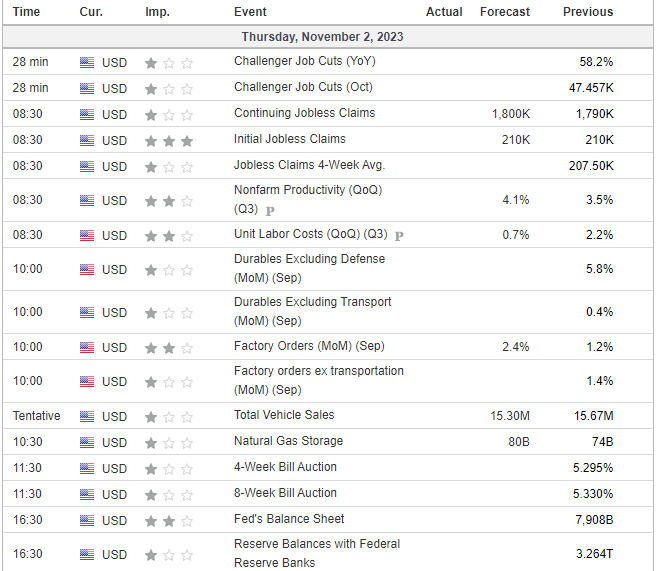

US DATA TODAY