November 13th, 2023

First off, I want to touch base on the Moody’s downgrade on Friday. Fintwit got lit up with the news that Moody’s downgraded its outlook on the U.S. credit rating. As bad as that news sounds, the U.S. credit remains at AAA; it’s not a full downgrade. The firm indicated the rating could slip in the future, and honestly, who could see this coming? 😉

The news sounds bad, and for Americans, it is bad. But for markets, I don’t think that news derails the bulls. I’m not even sure it slows their momentum down.

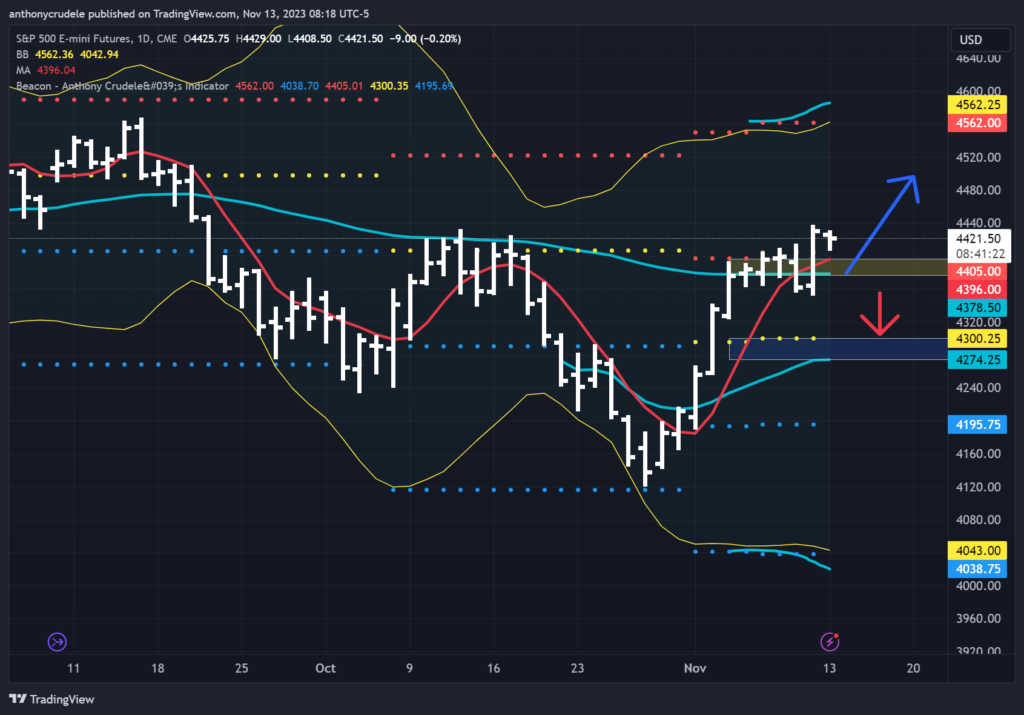

My plan for today: The daily charts in ES still scream bullish to me. We’re above the 5-day moving average (4398), sloping higher. Bollinger Bands are expanding outward, indicating range expansion, and we’re above key AVWAPs. When we take it down to the 60-minute timeframe where I can hone in a bit on what I think the market will do today, it looks a little different. 4421.50 is a sell signal that I received overnight, indicating a test of 4390.75. Which means to me that 4421.50 is very important for me this morning. However, the first hour closes (above or below 4421.50) will be my favored direction for today.

If we cannot sustain trade above it, then I am looking short (small) for a test of 4403.50 (a key AVWAP). And if that fails to hold, we could see 4390.75. If we sustain trade above 4321.50 this morning, then I think the rally continues, and we’re headed up to 4468 in the coming sessions. I think that rally will be a tough trade, so I will be taking my position sizing down so I can withstand the potential chop.

NQ screams bullish on the daily. I see no signs of bearishness on the charts, and maybe that’s a concern that I don’t see any bearishness. But I wouldn’t even consider looking at an NQ short today. As long as the NQ remains above the 15,398-15,289 range, I am bullish, looking for 16,000 to test in the coming sessions.

RTY is a big no-trade for me. The range between 1719-1694 is a chop zone. Until I see a firm hold above or below that zone, it’s chop city. I’ve said this before: I don’t love the divergence between RTY and NQ, but I don’t think the ES bulls care about it right now. Until they do, neither do I. To be continued…

Mondays are known for one-way tapes. If you miss the move, so what? Don’t look to fade the morning moves without strong confirmation. Stay small and smart. Cheers, DELI