December 14th, 2023

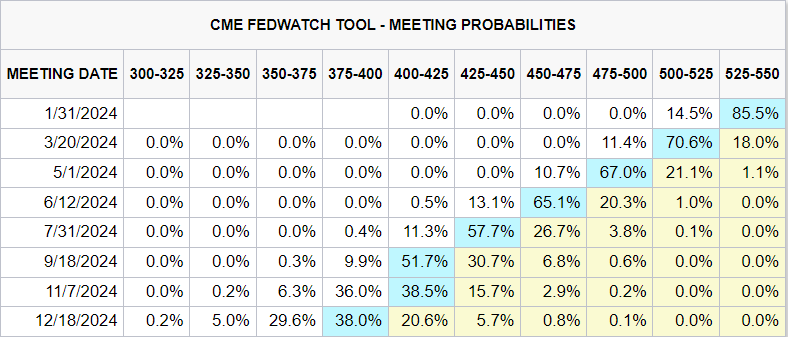

Six Rate Cuts A Laying. Some of you may know the song ‘The 12 Days of Christmas’, and yesterday the FOMC gave the market six Rate Cuts a laying for Christmas. Why six rate cuts? CME Fed Watch tool is now showing six rate cuts in 2024. I think this is a major overreaction, and I’m not sure there’s a Macro Trader out there that thinks six is the number (most probably think 3-4), but the CME Fed Watch tool prices them in through the Fed Fund Futures. Due to Powell’s Dovish comments, the Rates market is overreacting. CME FedWatch Tool: https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

Now, are Equity Indexes overreacting? Because this is all about Roll (which is mostly done now), Triple Witching OpEx (which is tomorrow), and year-end, I don’t think that Indexes are overreacting. I don’t think so because remember I have said that this time of year is about what large traders and institutions have to do, not what they want to do, and they have to be buyers. So, when you have bullish news that coincides with what the big players have to do, you get very strong moves.

Now, do I think the market is getting ahead of itself, and that early in 2024 we may come back to these areas? Most likely, yes. Yesterday in chat, I said that this move is starting to feel like capitulation, meaning that we’re capitulating higher. Capitulation can happen on rallies just as it happens on sell-offs. I say this because the market is single ticking higher. There is not much of an auction at these prices. Anytime we have a linear move like this, the market leaves single ticks (Market Profile single letters), and we tend to come back to these prices at a later date. I also said this doesn’t mean we’re done rallying; it just means that we’re getting into the later stages of this rally, and we’re closer to the end now than the beginning. That could still mean 200 more points in ES because we’ve rallied over 500 in the past month.

So, it’s not a sign to short; it’s a sign to me that if you’re long, you start to peel off some of your exposure. I am slowly starting to sell some of my long-term portfolio, which is currently IWM (Russell 2000) and tech stocks. I am using this ‘capitulation’ to take my risk down.

As far as day trading goes, this tape remains a one-way steam train that I won’t touch. I have no edge in trading this market in the short term. This is a time where long term portfolio’s do great, and day trading is not favorable. I will be back to day trading once I start to see my strategy working well again. Until then, I’m an observer, learning from what the market is telling us. Small and smart. Don’t ruin Christmas.

Cheers, DELI