GREEN as far as the eye can see

- Hong Kong: Hang Seng closed UP +2.38%

- China CSI 300 -0.31%

- Taiwan KOSPI +0.76%

- India Nifty 50 +1.26%

- Australia ASX +0.61%

- Japan Nikkei +0.85%

- European bourses in POSITIVE territory so far this morning

- USD +0.05%

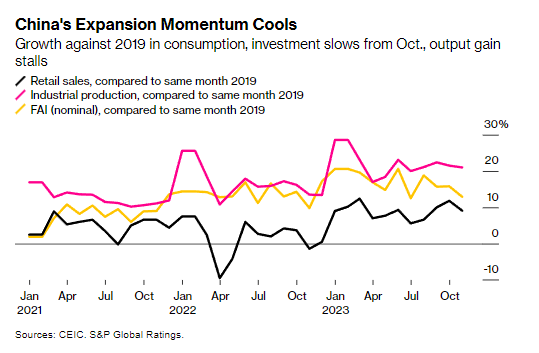

China’s Gloomy Economic Data Paints ‘Dire’ Growth Picture-BBG

China’s economic recovery remained beleaguered by weak demand and a lingering property crisis last month, putting more pressure on Beijing to roll out supportive policies to juice growth.

While industrial output and retail sales expanded in November, according to the official data released Friday, those numbers were distorted by favorable comparisons to a year ago when Covid lockdowns throttled activity.

In reality, analysts said both measures of economic activity weakened last month, when compared to more typical periods. Turmoil in the property sector continued to weigh on the overall outlook, as indebted developers struggle to sell enough new homes.

COMMENTS: Industrial production is still supportive of natural resources, note for commodities traders.

A $6 trillion cash hoard could fuel more U.S. stock gains as Fed pivots-Reuters

Investors wondering whether markets can continue their torrid rally are eyeing one important factor that could boost assets: a nearly $6 trillion pile of cash on the sidelines.

Soaring yields have pulled cash into money markets and other short-term instruments, as many investors chose to collect income in the ultra-safe vehicles while they awaited the outcome of the Federal Reserve’s battle against surging inflation. Total money market fund assets hit a record $5.9 trillion on Dec. 6, according to data from the Investment Company Institute.

The Fed’s unexpected dovish pivot on Wednesday may have upended that calculus: If borrowing costs fall in 2024, yields will likely drop alongside them. That could push some investors to deploy cash into stocks and other risky investments, while others rush to lock in yields in longer-term bonds.

Cash has returned an average of 4.5% in the year following the last rate hike of a cycle by the Fed, while U.S. equities have jumped 24.3% and investment grade debt by 13.6%, according to BlackRock data going back to 1995.

“We are getting calls … from clients who have a significant level of cash and are realizing they need to do something with it,” said Charles Lemonides, portfolio manager of hedge fund ValueWorks LLC. “This is the beginning of a cycle that will start to feed on itself.”

Recent market action shows the scramble to recalibrate portfolios may have already kicked off. Benchmark 10-year Treasury yields, which move inversely to bond prices, have fallen around 24 basis points since Wednesday’s Fed meeting to 3.9153%, the lowest since late July

COMMENTS: If you did not listen to Cem Karsen on Anthony’s spaces last week, I would encourage you to catch the replay.

Projectile fired from Yemen hits German-owned ship-U.S. official-Reuters

A projectile launched from Houthi-controlled Yemen struck the Liberia flagged, German-owned, Al Jasrah ship on Friday causing a fire but no injuries, a U.S. defence official said.

In a second incident, maritime security company Ambrey reported that a Liberia-flagged container ship, MSC ALANYA, was ordered to alter course towards Yemen by people aboard a small craft assessed to be members of Yemen’s Houthi movement.

COMMENTS: I have been stressing all week watch shippers and insurance…shippers up big this week.

Global coal use at all-time high in 2023 – Reuters

Global coal use is expected to reach a record high in 2023 as demand in emerging and developing economies remains strong, the International Energy Agency (IEA) said in a report on Friday.

Demand for coal is seen rising 1.4% in 2023, surpassing 8.5 billion metric tons for the first time as usage in India is expected to grow 8% and that in China is seen up 5% due to rising electricity demand and weak hydropower output, the IEA said.

In the European Union and United States, however, coal use is set to drop by around 20% each in 2023, the report said.

COMMENTS: Emerging markets want/need cheap energy and energy security

US awards up to $890 million to carbon capture projects at gas, coal plants-Reuters

Natural gas and coal plants in Texas, California and North Dakota will share up to $890 million in U.S. funding for projects to demonstrate the viability of carbon capture technologies, the U.S. Energy Department said on Thursday.

Carbon capture and storage, or CCS, is an emerging technology that the administration of President Joe Biden says is vital to help fight climate change. CCS plants aim to pull carbon dioxide emissions from fossil fuel plants before they reach the atmosphere for storage underground.

Many environmentalists oppose CCS, saying it has a history of failure and could extend reliance on fossil fuels.

Project Tundra, in Center, North Dakota, which is adjacent to the Milton Young lignite coal plant got $350 million. Senator Kevin Cramer, a Republican, said in a release it will be a “major feather in the cap for North Dakota’s innovative energy system, keeping miners on the job while putting clean, reliable electricity on the grid.”

COMMENTS: Although I believe CCUS is a total sham…might be worth looking up who got money…stock prices will likely react favorably.

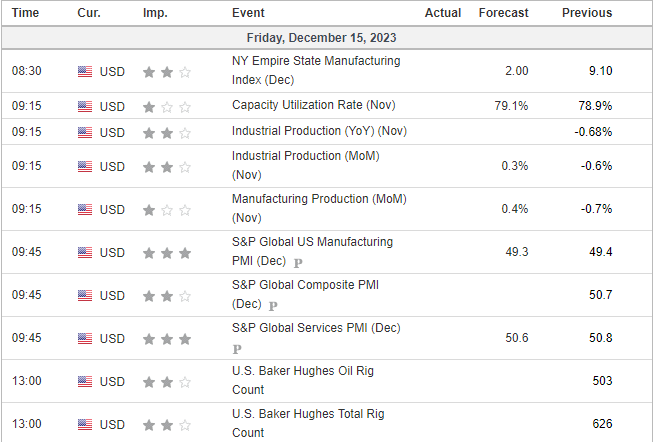

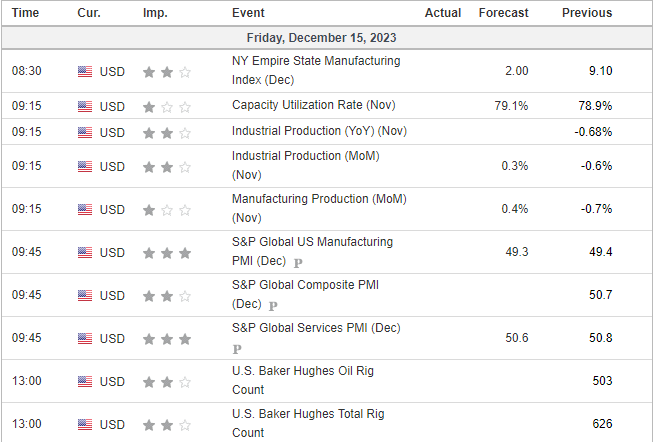

US DATA TODAY