Sea of GREEN

- Hong Kong: Hang Seng closed UP +1.07%

- China CSI 300 -0.52%

- Taiwan KOSPI +1.34%

- India Nifty 50 +1.26%

- Australia ASX +0.30%

- Japan Nikkei -1.15%

- European bourses in POSITIVE territory so far this morning

- USD -0.46%

TOP STORIES OVERNIGHT

Wall Street Traders Go All-In on Great Monetary Pivot of 2024-BBG

After clashing in recent years, Wall Street traders and the Federal Reserve are – for once – broadly in sync: The great monetary pivot is near as central bankers engineer a once-unthinkable soft landing in the world’s largest economy.

That’s the big-picture takeaway after the Fed gave its clearest signal yet that its historic policy tightening campaign is over by projecting more aggressive interest-rate cuts in 2024 – in the process igniting one of the biggest post-meeting rallies in recent memory.

Virtually no corner of financial markets was left out of a cross-asset advance which began Wednesday and extended into Thursday trading: Global shares spiked higher. Front-end Treasuries posted their best day since March. World currencies surged against the dollar and corporate bonds rallied.

In all, it was the best Fed day across assets in almost 15 years, according to data compiled by Bloomberg. In their exuberance, traders largely declared victory for Fed Chair Jerome Powell’s bid to secure a disinflationary trajectory in a still-expanding business cycle. They also ramped up bets European central banks will change tack too.

Powell’s remarks have “basically added fuel to the fire,” former New York Fed President and Bloomberg Opinion contributor William Dudley said on Bloomberg TV. “Powell talks about the long lags of monetary policy, but financial conditions are much, much more accommodative than they were just a few months ago.”

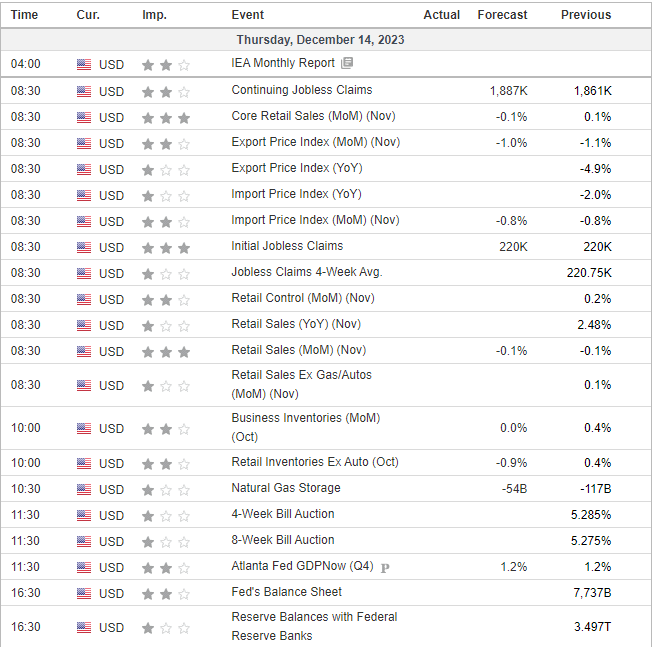

COMMENTS: Investors are now pricing in six quarter-point rate reductions in 2024 by the Fed, twice the three penciled in by the central bankers. Shorts squeezed out of this market, CTA momo traders likely jump on…stay nimble going in to expiry tomorrow $3.13T in notional value expiring tomorrow

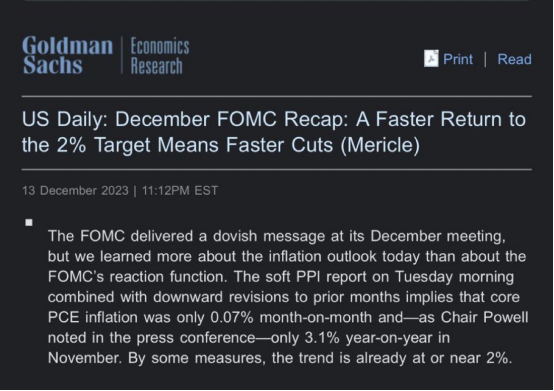

Goldman Revises Fed Call, Seeing ‘Earlier and Faster’ Cuts-BBG

Goldman Sachs Group Inc. economists revamped their outlook for the Federal Reserve, seeing a steady course of interest-rate cuts that begins in March.

Goldman’s economics team, led by Jan Hatzius, anticipates that the Fed’s preferred inflation gauge — the core PCE price index, which excludes volatile food and energy costs — will slow to 2.1% by the end of next year, effectively meeting the policy-setting Federal Open Market Committee’s 2% target.

“In light of the faster return to target, we now expect the FOMC to cut earlier and faster,” Goldman’s team wrote in a note Wednesday.

Goldman is now predicting 25 basis-point rate reductions for March, May and June, with further moves on a quarterly basis. The Wall Street bank previously forecast the Fed to start lowering rates only in the fourth quarter of 2024, with just one move next year.

The economists expect the Fed’s easing will end when the benchmark rate hits a target range of 3.25% to 3.5%. The current range, retained in Wednesday’s Fed policy decision, is 5.25% to 5.5%.

On Wednesday, Fed policymakers projected three rate cuts for 2024 — one more than Goldman’s team had anticipated before the meeting. In its note, Goldman’s team highlighted Chair Jerome Powell’s assessment from earlier this month describing rates as being “well into restrictive territory,” rather than just “restrictive.”

Powell on Wednesday said that lowering rates is something that “begins to come into view and is clearly a topic of discussion out in the world and also a discussion for us at our meeting today.”

COMMENTS: This market is drunk

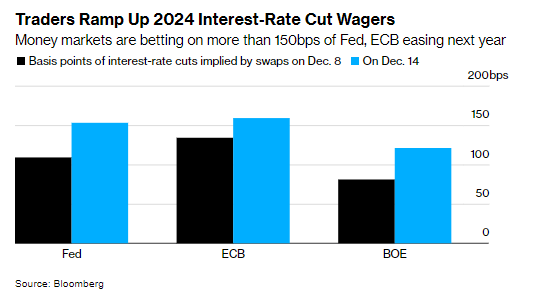

Traders Boost Global Rate-Cut Wagers After Fed’s Dovish Pivot-BBG

Traders ramped up bets on interest-rate cuts around the world ahead of European Central Bank and Bank of England policy decisions later Thursday, as global markets adjust to the Federal Reserve’s pivot toward looser policy.

Investors are now pricing in at least six quarter-point cuts in 2024 by both the Fed and the ECB, and five for the BOE. The moves follow the US central bank’s signal that its historic policy-tightening campaign is over, with officials projecting aggressive monetary easing to come.

The repricing is part of a broader shift that’s touched all corners of financial markets, as global stocks surged, bond yields tumbled and currencies rallied versus the US dollar. Yet there are risks the wagers have gone too far — and ECB and BOE officials could push back against the rapid moves.

“I think the markets are playing a dangerous game here, extrapolating from Fed messaging to the ECB and BOE,” said James Rossiter, head of macro strategy at TD Bank. “There’s no reason we should think that just because the Fed pivoted messaging a bit that the others will too.”

COMMENTS: I think we *could* see a massive short squeeze in UST as money managers have an a massive $800B short on

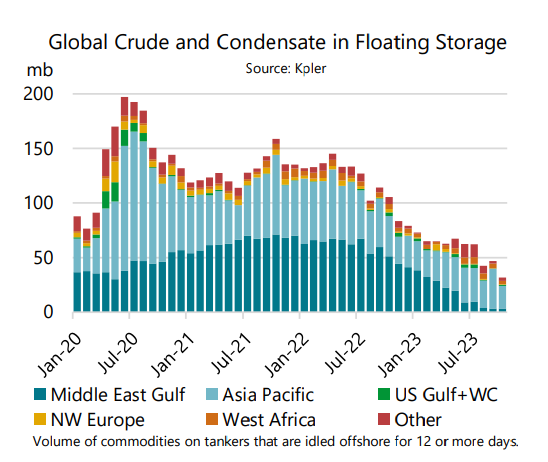

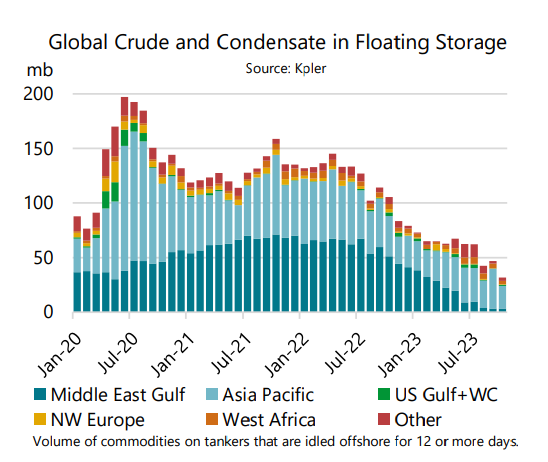

Global crude oil and condensates in floating storage fell in October to a 5-year low-KPLR

COMMENTS: Iran running out of floating storage, I expect their exports to rapidly decrease over the next few months…would be a positive for oil prices

Oil Gains From Five-Month Low as Dollar Weakens Amid Fed Signal-BBG

Oil advanced from a five-month low as the dollar slid following the clearest sign yet that the Federal Reserve’s aggressive hiking campaign is over.

Brent topped $75 a barrel — after climbing 1.4% on Wednesday — as the Bloomberg Dollar Spot Index tumbled to its lowest since August, making commodities priced in the currency more attractive. West Texas Intermediate futures also rose by almost 2%.

The meeting “might just mean that the latest move to the downside has been completed,” said Tamas Varga, an analyst at broker PVM Oil Associates Ltd. “Lowering borrowing costs should weaken the dollar against other currencies, which in turn, is encouraging for oil in the physical as well as in the futures markets.”

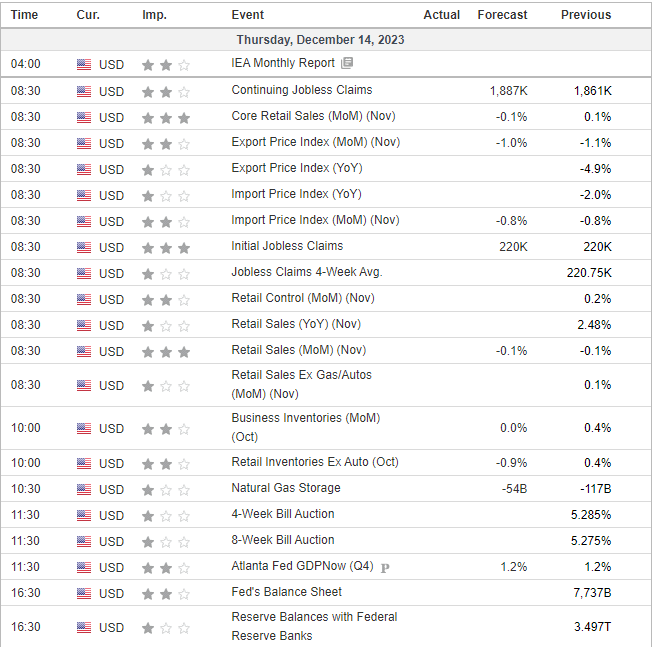

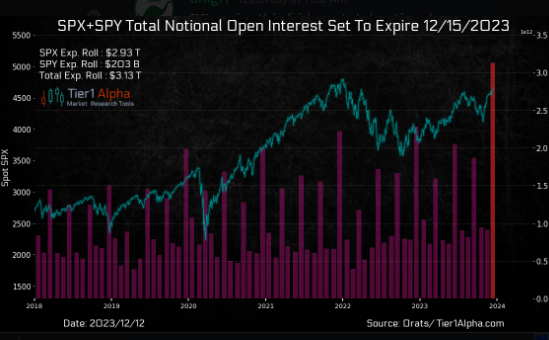

US DATA TODAY