Asia Mixed…Europe RED

- Hong Kong: Hang Seng closed down -0.41%

- China CSI 300 -0.41%

- Taiwan KOSPI +1.31%

- India Nifty 50 -0.08%

- Australia ASX +0.08%

- Japan Nikkei +0.13%

- European bourses in negative territory so far this morning

- USD +0.26%

TOP STORIES OVERNIGHT

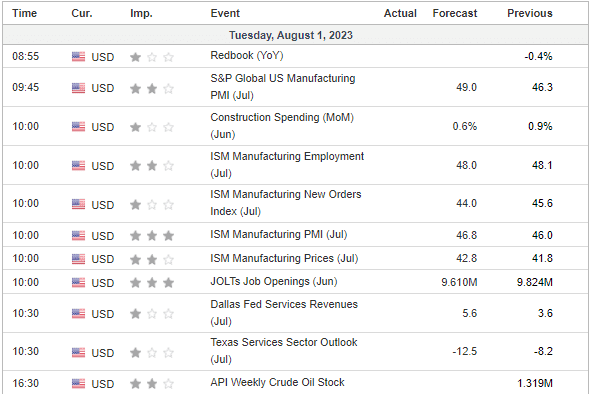

China Caixin Manufacturing PMI

China Caixin Manufacturing PMI Jul: 49.2 (est 50.1; prev 50.5)

Manufacturing conditions in China moderated slightly in July, according to latest PMI survey data. Firms signalled a marginal fall in production amid a fresh decline in overall new business. Muted foreign demand was a key factor weighing on total sales, with new export orders down noticeably in July. Subdued market conditions prompted firms to scale back their purchasing activity and trim their staffing levels slightly. At the same time, cost pressures continued to subside, as average input prices fell for the fourth straight month, which in turn supported a further reduction in selling charges.

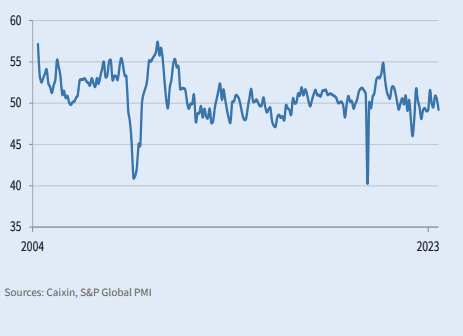

China Vows More Loan Support for Businesses to Spur Economy-BBG

China has pledged to boost credit to private companies and extend other funding measures to small firms as policymakers seek ways to shore up confidence and support the recovery.

The nation will expand a bond credit enhancement tool that is backed by financial institutions to all qualified private companies, the National Development and Reform Commission said in a notice posted Tuesday on its website. In the past the policy has mainly been used to help cash—strapped property developers raise funds from the bond market.

The notice included 28 points aimed at broadening market access, enhancing financial support and promising to meet demand among firms for land, strengthening legal protections, and cracking down on negative commentary about the private sector.

China’s Home Sales Drop Most in a Year as Slowdown Worsens-BBG

Sales by biggest developers dropped 33.1% from a year earlier

China’s home sales tumbled the most in a year in July, underscoring why policy makers are seeking to address a property slowdown that’s weighing on the economic recovery.

The value of new home sales by the 100 biggest real estate developers fell 33.1% from a year earlier to 350.4 billion yuan ($49 billion), according to preliminary data from China Real Estate Information Corp. The drop was the second in a row, after four months of gains. Sales slid 33.5% month-on-month.

The slump in transactions is a blow to developers who need cash to alleviate a multiyear credit crisis that is showing no sign of easing. Country Garden Holdings Co., which faces $2.9 billion in debt payments for the rest of the year, canceled a share placement overnight, according to IFR.

“The weak sales trend, if continued, will lead to more developers, especially private ones, to default in the near future,” Raymond Cheng, head of China and Hong Kong research at CGS-CIMB Securities, said before the figures were released.

Suffice to say all this news from China is putting a damper on global markets this morning

‘Ugly figures’ as German manufacturing slumps in July -PMI-Reuters

The downturn in Germany’s manufacturing sector deepened at the start of the third quarter as goods producers recorded sharper declines in new orders, factory gate prices and output in July, a survey showed on Tuesday.

The HCOB final Purchasing Managers’ Index (PMI) for manufacturing, which accounts for about a fifth of Germany’s economy, fell to 38.8 in July from 40.6 in June.

July’s reading, the sixth consecutive monthly decline and the lowest since May 2020, confirmed a flash estimate and was well below the 50 level that separates growth from contraction.

“These are ugly figures,” said Cyrus de la Rubia, chief economist at Hamburg Commercial Bank AG, particularly new orders, which saw one of the most pronounced falls in roughly three decades, and employment, which dropped into contraction territory for the first time since 2021.

Deindustrialization in Germany continues…obviously this is putting a damper on European markets this morning

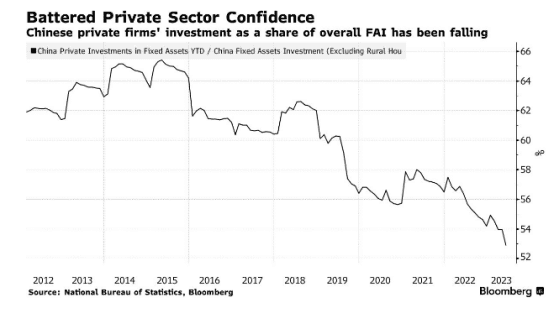

Hedge Funds ‘Throwing In Towel’ on Stocks as Rally Forces Unwind-BBG

For stock-picking hedge funds coping with 2023’s loopy markets, risks are starting to outweigh the rewards.

Pro managers who make both bullish and bearish equity wagers last week slashed positions on both sides of their book, also known as de-grossing, according to data compiled by JPMorgan Chase & Co.’s prime brokerage unit. The rush to tweak positions was frantic enough to push total client stock flows to the highest level since the retail-fomented short squeeze in 2021.

“While the equity rally might be good for those who are long the market, it’s been quite challenging for HF shorts and the rally seems to be inducing broad capitulation in the form of de-grossing,” JPMorgan’s team including John Schlegel wrote in a note titled Throwing in the Towel … De-grossing Accelerates Amidst Busy Earnings Week.

It’s the latest dose of pain that 2023’s rally has inflicted. Rather than sinking like most forecasters predicted, stocks have instead surged as the economy stood up to the Federal Reserve’s aggressive inflation-fighting campaign. Along the way, fast-money managers were compelled to cover shorts and chase gains, while strategists scrambled to raise their year-end price targets for the S&P 500.

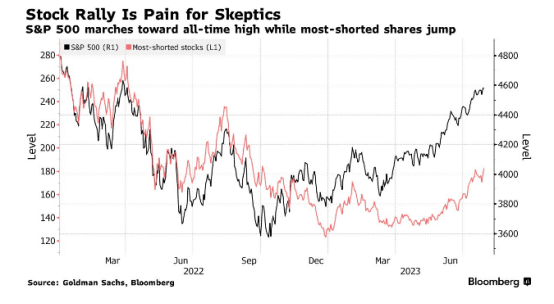

US DATA TODAY