Mixed markets overnight -strong comeback in China

- Hong Kong: Hang Seng closes up +1.05%

- China CSI 300 +0.94%

- Taiwan KOSPI +1.02%India Nifty 50 +0.07%

- Australia ASX -0.19%

- Japan Nikkei -0.80%

- European bourses broadly up across the board and in positive territory

- US indices slightly down across the board this morning, DOW the weakest in pre-market, USD down -0.21%

Overnight data/news

- UK Jan BRC Food prices +13.8% y/y vs Dec. +13.3% y/y

Jan Nationwide House Prices -0.6% m/m 1.1% .vs. f’cast -0.4%/1.9% -more than expected

UK set for biggest strike action for years as teachers, civil

servants walkout

Up to 500,000 people expected to join UK strikes

- South Korea slides toward a recession as Jan exports plunge

Recession looms after -0.4% fall in Q4 2022 GDP

- Japan Jan final Manufacturing PMI unrevised at 48.9, shrinks for third month

Japan’s factory activity at 26-mth low

BOJ buys record $182 billion worth of bonds in Jan

- China’s Jan factory activity contracts at a slower pace – Caixin PMI

Jan Caixin PMI edges upto 49.2 from 49.0

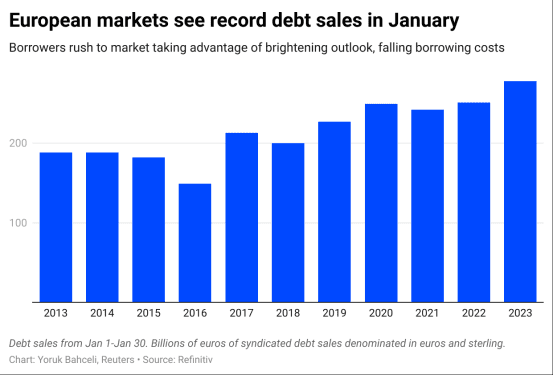

- EZ European borrowers sell a record amount of debt in Jan – data

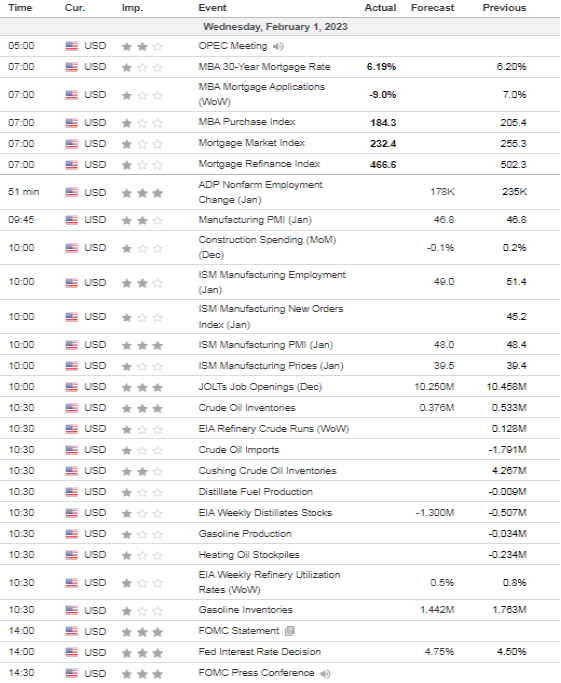

US DATA TODAY

Packed day today…stay nimble!

COMMODITY HEADLINES OVERNIGHT

Metals

Gold flat as traders focus on Fed decision

Copper inches higher ahead of Fed outcome; traders eye China demand pick-up

Glencore 2022 copper output falls, sticks to 2023 outlook

Energy

Marathon Petroleum tops profit estimates on high demand, tight supplies

OPEC oil output falls as Nigerian rebound falters -Reuters survey

Mexico’s Pemex places $2 bln bond to refinance debt

US crude and petroleum products demand rises in November -EIA

US EPA’s move to block Pebble project in Alaska ‘unlawful’ – CEO

US natgas posts second-biggest monthly drop ever, holds near 21-month low

Exxon smashes Western oil majors’ profits with $56 billion in 2022