Mixed Markets

PBOC on a mission to devalue the Yuan

Debt ceiling passes House and goes to Senate

- Hong Kong: Hang Seng closed DOWN -0.10%

- China CSI 300 +0.22%

- Taiwan KOSPI -0.31%

- India Nifty 50 -0.26%

- Australia ASX -1.54%

- Japan Nikkei +1.75%

- European bourses in all in positive territory so far this morning

- US indices in positive territory so far in pre-market, USD up -0.29%

Overnight Data/News

- PBoC Fixes USDCNY Reference Rate At 7.0965 (prev fix 7.0821 prev close 7.1090)

- Chinese Caixin Manufacturing PMI May: 50.9 (exp 49.5; prev 49.5)

- South Korean S&P Global Manufacturing PMI May: 48.4 (prev 48.1)

- Japanese Jibun Bank Manufacturing PMI May F: 50.6 (prev 50.8)

- Russian S&P Global Manufacturing PMI May: 53.5 (prev 52.6)

- Swedish Swedbank/Silf PMI Manufacturing PMI May: 40.6 (exp 45.0; prev 45.5)

- Swiss Manufacturing PMI May: 43.2 (exp 44.5; prev 45.3)

- Italian HCOB Manufacturing PMI May: 45.9 (exp 45.8; prev 46.8)

- Turkish S&P Global/ICI Manufacturing PMI May: 51.5 (prev 51.5)

- Spanish HCOB Manufacturing PMI May: 48.4 (exp 48; prev 49.0)

- French HCOB Manufacturing PMI May F: 45.7 (exp 46.1; prev 46.1)

- German HCOB Manufacturing PMI May F: 43.2 (exp 42.9; prev 42.9)

- Greek S&P Global Manufacturing PMI May: 51.5 (prev 52.4)

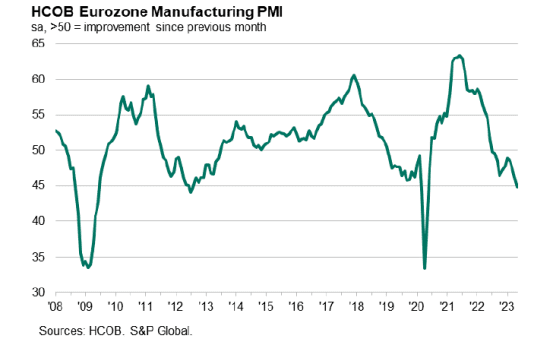

- Eurozone HCOB Manufacturing PMI May F: 44.8 (exp 44.6; prev 45.8)

- UK S&P Global/CIPS Manufacturing PMI May F: 47.1 (exp 46.9; prev 46.9)

- Netherlands CPI (Y/Y) May P: 6.1% (prev 5.2%) – CPI EU Harmonised (Y/Y) May P: 6.8% (exp 6.1%; prev 5.8%) – CPI EU Harmonised (M/M) May P: 0.2% (exp -0.1%; prev 1.6%)

- UK Nationwide House PX (M/M) May: -0.1% (exp -0.5%; prevR 0.4%) – UK Nationwide House PX NSA (Y/Y) May: -3.4% (exp -3.7%; prev -2.7%)

- German Retail Sales (M/M) Apr: 0.8% (exp 1.0%; prevR -2.2%) – German Retail Sales NSA (Y/Y) Apr: -8.6% (exp -5.8%; prevR -6.2%)

- Austria CPI (M/M) May P: 0.1% (prev 0.8%) – Austria CPI (Y/Y) May P: 8.8% (prev 9.7%)

- Eurozone CPI (M/M) May P: 0.0% (exp 0.2%; prev 0.6%) – Eurozone Estimate (Y/Y) May: 6.1% (exp 6.3%; prev 7.0%) – Eurozone Core CPI (Y/Y) May P: 5.3% (exp 5.5%; prev 5.6%)

- Eurozone Unemployment Rate Apr: 6.5% (exp 6.5%; prevR 6.6%)

- US House Approves Bill To Suspend $31.4Tln Debt Ceiling Until 2025 – Sending Measure To Senate

- IMF Urges BoJ To Keep Ultra-Low Rates, But Be Ready To Shift Course – RTRS

- UK House Prices Fall Again With Warning Of Increasing Headwinds – BBG

- US Defence Chief Warns Incidents With China’s Military Could ‘Spiral Out Of Control’ – FT

- China New Home Prices, Sales Fall On Soft Demand In May – RTRS

- Bearish Bets On Asian FX Pile, Chinese Yuan Shorts At Seven-Month High – RTRS Poll

- OPEC has not invited Reuters, Bloomberg to report on weekend policy meets

- OPEC And Allies Unlikely To Deepen Output Cuts At June 4 Meeting – RTRS Citing Four OPEC+ Sources

- China, India To Receive Record Russian Crude Oil In May – RTRS

- Eurozone Inflation Falls To Lowest Level Since Russia Invaded Ukraine – FT

- Asian Gas Premium Puts Europe In Competition For LNG This Summer – BBG

- Eurozone Manufacturing PMI fell to 44.8 in May (April: 45.8) to signal the steepest decline in the health of the region’s manufacturing sector for 3 years. Production fell amid a sustained drag from new orders.

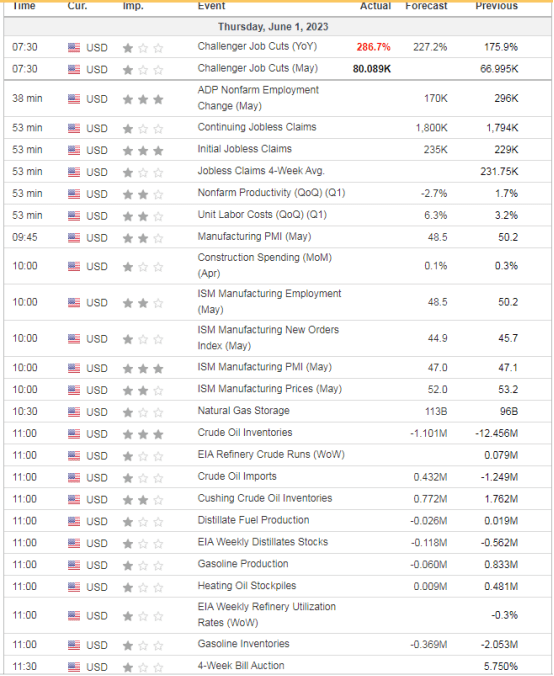

US DATA TODAY