Sea of GREEN

- Hong Kong: Hang Seng closes UP +4.21% !!!

- China CSI 300 +1.41%

- Taiwan KOSPI +0.42%

- India Nifty 50 +0.85%

- Australia ASX +0.52%

- Japan Nikkei+0.20%

- All European bourses in positive territory so far this morning

- US indices all in positive territory this morning in pre-market, USD -0.56%

Overnight Data/News

- China Manufacturing PMI Feb: 52.6 (est 50.6, prev 50.1) – China Non-Manufacturing PMI Feb: 56.3 (est 54.9, prev 54.4)

- Caixan China PMI Manufacturing Feb: 51.6 (est 50.7, prev 49.2)

- PBoC Sets Yuan Mid-Point At 6.9400 / Dlr VS Last Close 6.9335

- Japan BoJ’s Nakagawa: It Is Important To Keep Supporting Economy With Easy Policy For Time Being (LOL)

- UK Nationwide House Prices (M/M) Feb: -0.5% (exp -0.5%; prev -0.6%) – Nationwide House Prices NSA (Y/Y) Feb: -1.1% (exp -0.9%; prev 1.1%)

- UK S&P Global Manufacturing PMI Feb F: 49.3 (exp 49.2; prev 49.2)

- Spanish S&P Global Manufacturing PMI Feb: 50.7 (exp 49.0; prev 48.4)

- Swiss Manufacturing PMI Feb: 48.9 (exp 50.3; prev 49.3)

- Italian S&P Global Manufacturing PMI Feb: 52.0 (exp 51.0; prev 50.4)

- Italian GDP Annual (Y/Y) 2022: 8.0% (prev 7.2%) – Italian Deficit to GDP 2022: 3.7% (prev 6.6%)

- French S&P Global Manufacturing PMI Feb F: 47.4 (exp 47.9; prev 47.9)

- German S&P Global/BME Manufacturing PMI Feb F: 46.3 (exp 46.5; prev 46.5)

- German Unemployment Change Feb: 2.0k (exp -10.0k; R prev -11.0k) -Unemployment Claims Rate SA Feb: 5.5% (exp 5.5%; prev 5.5%)

- Eurozone S&P Global Manufacturing PMI Feb F: 48.5 (exp 48.5; prev 48.5)

- Goldman Sachs Expects ECB To Deliver 50 Bps Hike In May Vs Prior Estimate Of 25 Bps; Raises Peak Rate To 3.75% In June Vs 3.5% Previously

- Goldman’s Currie: Still See Oil Above $100/Bbl In Q4 – BBG TV -High Confidence Of Oil Price Spike In 12-18 Months

- Russia has no intentions to sell its oil cheaply, March oil production cut aims to balance pricing, price on Russian oil has to be determined by market, will monitor oil market before deciding on potential further production cuts – deputy energy minister Pavel Sorokin

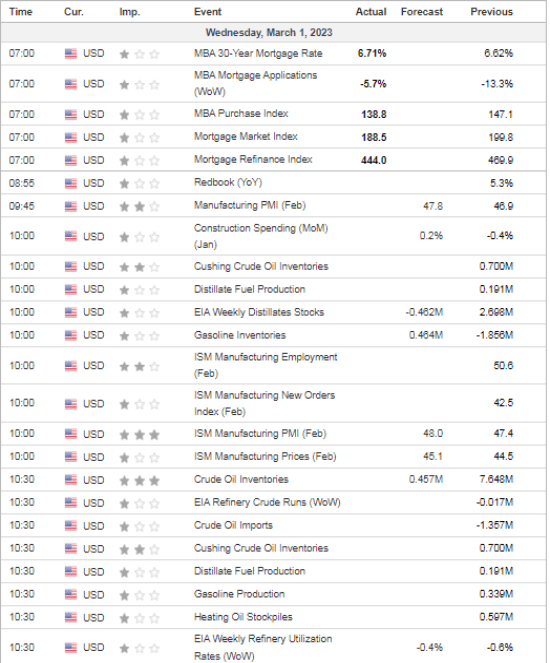

US DATA TODAY

OVERNIGHT COMMODITY HEADLINES

Metals

Gold regains shine, price rises over 1% in Pakistan

India: Gold jumps Rs 475; silver plummets Rs 1,225

METALS-Copper rises as China manufacturing data lifts demand hope

Energy

ESPO crude differentials soar on fresh buying from India, China (ESPO is Russian crude)

India intensifies oil supply talks with US ahead of further Russian sanction moves

Petroperu returns to crude production at major discontinued oil block

Biden administration to move on Midwest ethanol-blended gasoline rule this week -sources

Platts to exclude Russian oil from Asia fuel oil, bunker assessments (this is just going to make it harder to track)

Another bearish US gas storage report expected from EIA as the end of winter approaches

Dow and X-energy to build U.S. Gulf Coast nuclear demonstration plant