NFP DAY!!

Asia GREEN ..Europe Mixed

- Hong Kong: Hang Seng -Market closed due to typhoon

- China CSI 300 +0.70%

- Taiwan KOSPI +0.29%

- India Nifty 50 +0.88%

- Australia ASX +0.15%

- Japan Nikkei +0.61%

- European bourses in mixed territory so far this morning

- USD FLAT

TOP STORIES OVERNIGHT

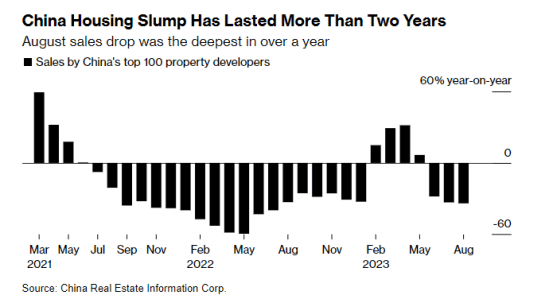

China Ramps Up Campaign to Boost Fragile Economy, Currency-BBG

China intensified efforts to stimulate the economy and support its currency, as investor concerns over the growth outlook persist.

The central bank will trim the amount of foreign currency deposits banks are required to hold as reserves for the first time this year, the People’s Bank of China said Friday. The move came hours after authorities announced fresh stimulus for the beleaguered property sector and unveiled plans to expand tax breaks for child and parental care and education.

The steps are the latest efforts to shore up confidence in the world’s second-largest economy, which is sagging under the weight of the persistent housing crisis, waning global demand and rising unemployment. Authorities have so far resorted to a drip-feed of targeted measures, avoiding the big-bang stimulus approach they deployed during the 2008 global financial crisis amid concerns over elevated debt levels.

China is also proposing to lift home-purchasing curbs in non-core districts of major cities such as Beijing, Shanghai and Shenzhen, Reuters reported. Such restrictions, including on the number of properties people can buy, have been in place in many cities since 2010, it said.

Base metals and energy getting a boost from this today

India August factory activity hits three-month high-Reuters

India’s factory growth accelerated at the fastest pace in three months in August, driven by strong growth in new orders and output, according to a private survey that however also showed job creation was at a four-month low.

That is good news for Asia’s third-largest economy, which grew 7.8% in April-June, slightly above a Reuters forecast of 7.7%, led by robust demand, and was expected to remain a bright spot in the global economy.

The Manufacturing Purchasing Managers’ Index (INPMI=ECI), compiled by S&P Global, jumped to 58.6 last month from 57.7 in July, the highest since May and confounding a Reuters poll expectation for a drop to 57.5.

This marked a sustained expansion, with 26 months above the 50-mark separating growth from contraction, the longest stretch since March 2020 when pandemic-induced lockdowns were imposed.

Also good news for energy

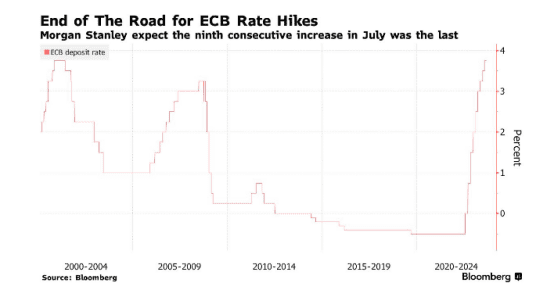

Morgan Stanley Says ECB Rate Hikes Are Over-BBG

Morgan Stanley thinks the latest economic figures mean the European Central Bank will not hike interest rates any further.

Data this week showing services inflation slowing in the euro area followed on from signs of a rapidly deteriorating economy, which is likely to tip the balance for policymakers in favor of a pause this month, economists at the US investment bank said. They previously saw one more increase in September, but now expect July’s ninth consecutive rate hike to have been the final one.

“We change our ECB call and expect a pause in September,” wrote economists including Jens Eisenschmidt in a client note. “We now see the terminal rate at 3.75%.”

A halt this month in a historic hiking cycle chimes with the latest bets in money markets, where traders have cut the odds of a quarter-point move to about one-in-four. But it contrasts with market wagers still favoring another increase later this year to a peak of 4%.

Chevron LNG Workers Reject Company Offer, Prepare For Strikes-Oilprice

The union representing workers at two Chevron LNG projects in Australia have rejected a company offer for new pay and conditions, and are now preparing to start industrial action next week unless an improved offer is made.

“Ballot results show that they (Chevron) are out of touch with OA members and haven’t listened to a word spoken in their discussions with members, Reps and the Offshore Alliance,” the Alliance—a coalition of two trade unions representing workers in the energy industry—said in a Facebook post cited by Reuters.

Keep an eye on nat gas

Treasuries set for worst streak since U.S. independence, as investors bag tech stocks-Reuters

Bullish investors poured money into tech stocks for the 10th straight week, the longest streak in two years BofA Global Research said, while U.S. Treasuries are set for their worst yearly performance since the Declaration of Independence.

There were a net $10.3 billion of inflows into equity funds in the week to Wednesday, with investors putting $5.1 billion into tech stocks, the most since May, and $4.9 billion into emerging market stocks, BofA said on Friday, citing data from provider EPFR.

Investors have been buying stocks on increasing hopes that the U.S. economy will achieve a soft landing – slowing enough to bring inflation back to the Federal Reserve’s target, but not dramatically.

However, the aggressive pace of Fed rate hikes that has helped slow inflation along with pandemic-era stimulus, has weighed heavily on U.S. Treasuries, which are set to decline in value for the third straight year, something that “has never occurred in the 250-year history of the U.S. republic,” according to BofA’s calculations.

The flows into equities have also been narrowly based, with tech stocks accounting for $34 billion of inflows year to date, vastly ahead of the next largest sector, consumer stocks, with $4 billion in inflows.

This means, the breadth in global markets is “breathtakingly bad” BofA said, with MSCI’s All Country World index at its narrowest since 2003.

Well I guess that says it all

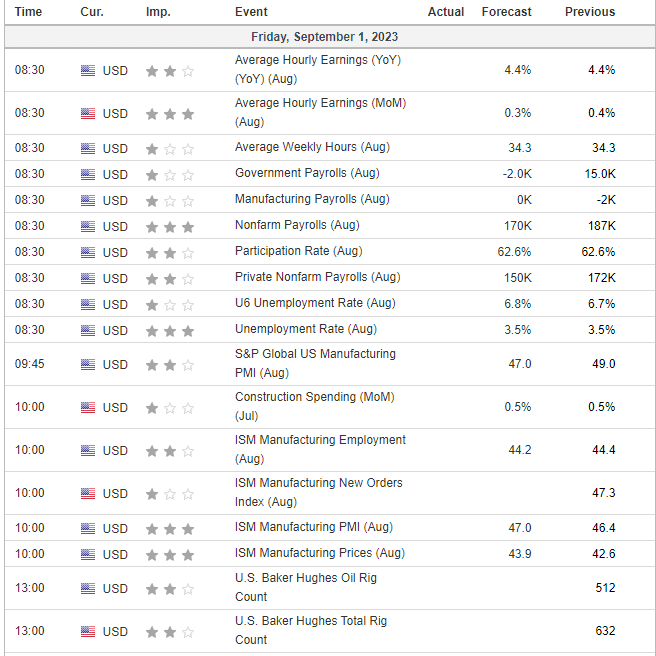

US DATA TODAY