CPI DAY!

Pretty Green out there

- Hong Kong: Hang Seng closed up +0.01%

- China CSI 300 +0.21%

- Taiwan KOSPI -0.14%

- India Nifty 50 -0.41%

- Australia ASX +0.32%

- Japan Nikkei +1.24%

- European bourses in positive territory so far this morning

- USD -0.35%

TOP STORIES OVERNIGHT

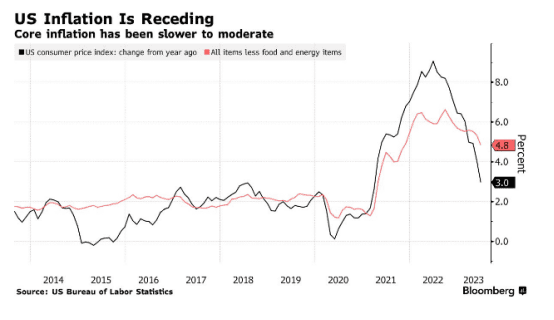

US CPI DAY

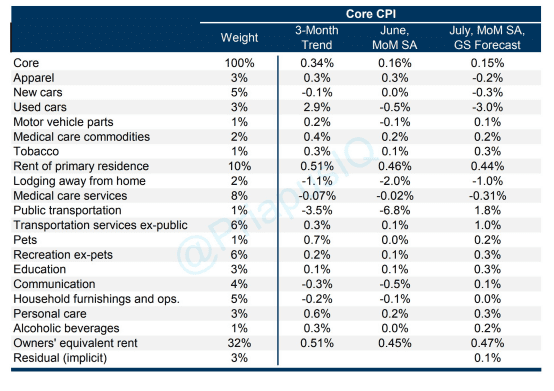

Goldman Sachs forecast on CPI (via @priapusIQ)

Core

MoM 0.15% (vs. 0.2% consensus)

YoY 4.66% (vs. 4.8% consensus)

Healine

MoM 0.16% (vs. 0.2% consensus)

YoY 3.17% (vs. 3.3% consensus)

We expect monthly core CPI inflation to remain in the 0.2-0.3% range in the next few months

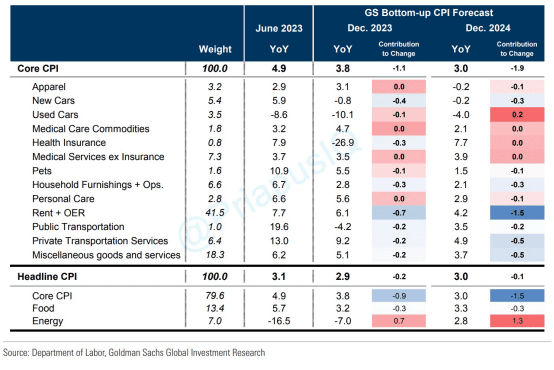

We forecast year-over-year core CPI inflation of 3.8% in December 2023 and 3.0% in December 2024

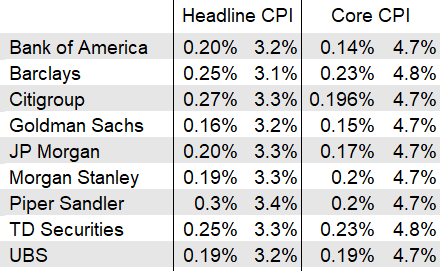

Other forecasts

Germany to Face Risk of Gas Shortages Until Early 2027, Storage Operators Warn-BBG

Germany will continue to face a risk of severe gas shortages until early 2027 unless it adds more fuel infrastructure to smooth out potential strains from cold weather.

Additional liquefied natural gas terminals, storage capacity or pipeline connections are needed to ensure sufficient supply sooner, the country’s gas storage operators group INES said Thursday. For now, stockpiles are “developing positively” and are nearly 90% full, but a cold winter could still put Germany’s energy security at risk.

“The danger of gas shortages during cold temperatures remains and will continue to accompany us until winter of 2026/2027 unless further infrastructure measures are taken,” said INES’s head Sebastian Bleschke.

Fear of Australian strike action spooks global LNG markets-Upstream

Woodside and Chevron in talks with workers, hoping to avert industrial action

Any strikes would be expected to mostly impact operations at the North West Shelf (NWS) project and Chevron’s Gorgon and Wheatstone projects in Australia, that account for about 11% of global exports.

Nat gas futures globally spiking on this

Stocks Rally as China Eases Travel Restrictions -BBG

Global stocks advanced, with France’s equity benchmark jumping 1%, after China lifted travel curbs.

The mood in markets was positive ahead of the key US inflation data, which may provide clues on the Federal Reserve’s next steps. European travel and luxury companies were among the biggest gainers in the Stoxx 600 Index on speculation that companies will benefit an increase in Chinese tourism spending. The dollar weakened and S&P 500 futures added 0.5%.

LVMH and Hermes International added at least 2%. China’s Ministry of Culture and Tourism said it would lift a group travel ban to countries including the US, UK, Australia, South Korea and Japan. Buyers from China account for about 25% of European luxury-goods sales, including purchases made by tourists, according to latest estimates from Goldman Sachs Group Inc.

Major fire under control at grain silos in French port of La Rochelle-Alarabiya

A fire that broke out on Thursday at grain silos in the French port of La Rochelle was under control and had not reached the stored grain, silo operator SICA Atlantique said.

Local authorities had said earlier that a major fire was underway in four grain silos at La Rochelle, adding that 70 fire fighters were at the site, with reinforcements under way.

rance is the European Union’s biggest grain producer and La Rochelle on France’s Atlantic coast one of the country’s largest grain export terminals.

This is the third such incident in three weeks. First Brazil at the end of July, Turkey two days ago, now France

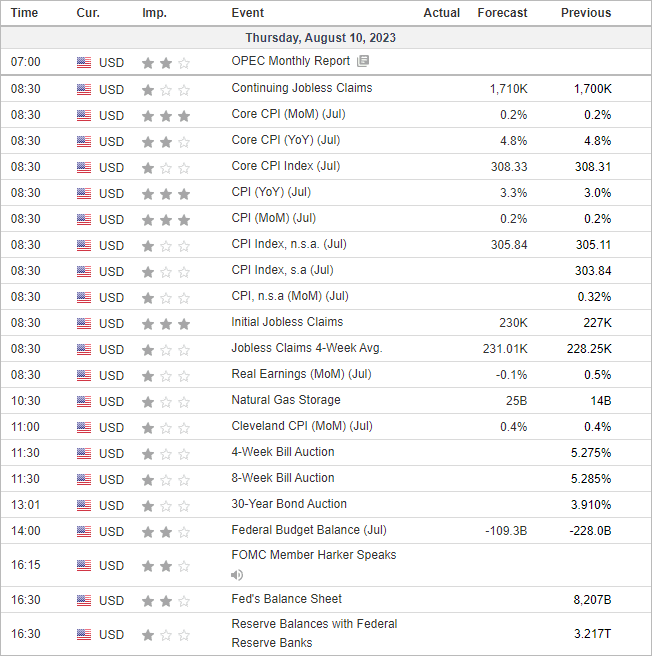

US DATA TODAY