Sea of RED

- Hong Kong: Hang Seng closes down -2.01%

- China CSI 300 -0.59%

- Taiwan KOSPI -0.48%

- India Nifty 50 -0.21%

- Australia ASX -0.58%

- Japan Nikkei -0.05%

- European bourses in the red across the board

- US indices also in the red across the board, USD up +0.20%

Overnight News/Data

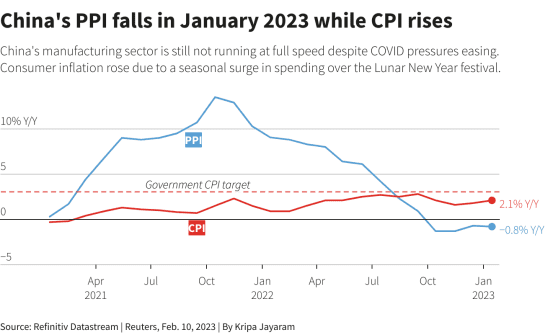

- China’s factory prices fall as manufacturing struggles to recover

Jan PPI -0.4% m/m -0.8% y/y vs. expected -0.5% y/y

– Raw Materials PPI -0.1% y/y vs. prior 1.2%

– Consumer Goods 1.5% y/y vs. prior 1.8%

– Jan CPI 0.8% m/m 2.1% y/y as expected

– Jan Food CPI 6.2% y/y vs. prior 4.8%; Non-food 1.2% y/y vs. 1.1%

– Jan core CPI 1.0% y/y vs. prior 0.6%

– Monetary easing more likely than tightening – analysts

– China’s PPI falls in January 2023 while CPI rises

- UK economy shows zero growth in Q4, narrowly avoiding recession

- Japan Govt set to appoint academic Ueda as next BOJ governor – Nikkei

Jan PPI flat m/m 9.5% y/y vs. expected 0.3%/9.7%

- Turkey Rescues provide glimmer of hope among Turkey quake ruins as toll tops 20,000

Death toll is over 17,000 in Turkey, more than 3,000 in Syria

Hundreds of thousands homeless in the middle of winter

First U.N. aid convoy enters northwest Syria from Turkey

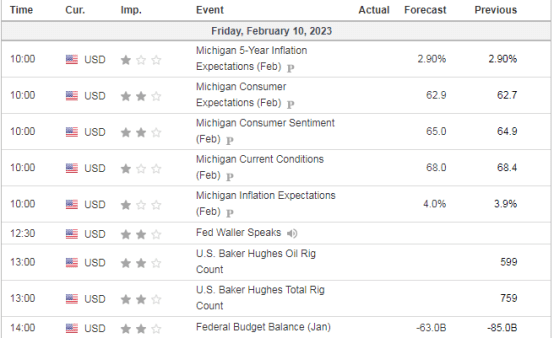

US DATA TODAY

COMMODITY HEADLINES OVERNIGHT

Metals

Copper slips on demand concerns; Shanghai nickel jumps

Energy

**Russia said it plans to cut March production by 500,000 barrels a day

TC Energy says stress, weld fault caused Keystone oil spill

Aramco to supply full crude contract volumes to at least 4 Asia refiners in March

US targets Iranian petrochemicals, petroleum in fresh sanctions

Exxon to merge some business units as part of cost-cutting plan

Oil spills hit PDVSA’s operations in eastern Venezuela -sources

US natgas up 1% on rising LNG exports, big storage withdrawal

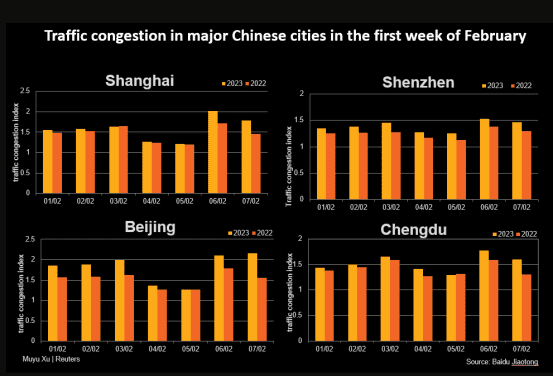

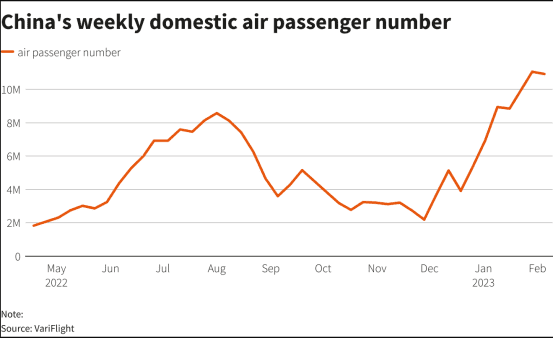

Traffic congestion and air passenger numbers in major Chinese cities in the first week of

February