Pretty ugly out there..US Jobs Day!!

- Hong Kong: Hang Seng closes down -3.04% !!

- China CSI 300 -1.31%

- Taiwan KOSPI -1.01%

- India Nifty 50 -1.00%

- Australia ASX +0.14%

- Japan Nikkei -0.18%

- All European bourses all in negative territory this morning so far with the exception of Greece

- US indices also in negative territory this morning in pre-market with NASDAQ slightly green, USD FLAT

Overnight News/Data

- China’s Xi Wins Unanimous Votes For Third Term As President (shocker)

- PBoC Fixes USDCNY Reference Rate At 6.9655 (prev fix 6.9666 prev close 6.9630)

- China’s Consumer Spending Is Showing Signs Of Strong Rebound – BBG

- China February Aggregate Financing 3.16TB Yuan (est 2.3TB) – February New Yuan Loans 1.81BB Yuan (est 1.5TB) – February M2 Money Supply Rises 12.9% Y/Y (est 12.5%)

- BoJ Maintains Short-Term Interest Rate Target At -0.1% -Maintains 10-Year JGB Yield Target Around 0%

- BoJ Made Decision On YCC By Unanimous Vote -Leaves Unchanged Forward Guidance On Interest Rates

- Investors Nervously Watch For Impact Of ECB Shrinking Its Bond Holdings – FT

- EU Plans Joint Navy Patrols To Combat Russian Threat To Infrastructure – FT

- German CPI (M/M) Feb F: 0.8% (exp 0.8%; prev 0.8%) – German CPI (Y/Y) Feb F: 8.7% (exp 8.7%; prev 8.7%) – German CPI EU Harmonised (M/M) Feb F: 1.0% (exp 1.0%; prev 1.0%) – German CPI EU Harmonised (Y/Y) Feb F: 9.3% (exp 9.3%; prev 9.3%)

- Norwegian PPI Including Oil (M/M) Jan: -2.9% (prev -17.3%) – Norwegian PPI Including Oil (Y/Y) Jan: -5.4% (prev -0.6%)

- Turkish Industrial Production (M/M) Jan: 1.9% (exp 0.7%; prevR 1.7%) – Turkish Industrial Production (Y/Y) Jan: 4.5% (exp 2.1%; prevR -0.4%)

- Turkish Unemployment Rate Jan: 9.7% (prevR 10.2%)

- UK Monthly GDP (M/M) Jan: 0.3% (exp 0.1%; prev -0.5%) – Monthly GDP (3M/3M) Jan: 0.0% (exp 0.0%; prev -0.3%)

- UK Industrial Production (M/M) Jan: -0.3% (exp 0.0%; prev 0.3%) – Industrial Production (Y/Y) Jan: -4.3% (exp -4.1%; prev -4.0%)

- UK Manufacturing Production (M/M) Jan: -0.4% (exp 0.1%; prev 0.0%) – Manufacturing Production (Y/Y) Jan: -5.2% (exp -5.0%; prev -5.7%)

- UK Index of Services (M/M) Jan: 0.5% (exp 0.3%; prev -0.8%) – Index of Services (3M/3M) Jan: 0.0% (exp -0.1%; prev 0.0%)

- UK Construction Output (M/M) Jan: -1.7% (exp 0.0%; prev 0.0%) – Construction Output (3M/3M) Jan: 0.6% (exp 2.5%; prev 3.7%)

- French Trade Balance Jan: -12.3B (prevR -14.7B) French Current Account Balance: -3.6B (prevR -7.6B)

- Spanish Retail Sales SA (Y/Y) Jan: 5.5% (prev 4.0%) – Retail Sales (Y/Y) Jan: 7.1% (prev 3.5%)

- Wall Street Examines Risks Around Short-Dated Options As Warnings Rise – RTRS Sources

- Morgan Stanley: Funding Pressures Facing SVB Financial Group Are “Highly Idiosyncratic”, Should Not Be Viewed As Read-Across To Other Regional Banks

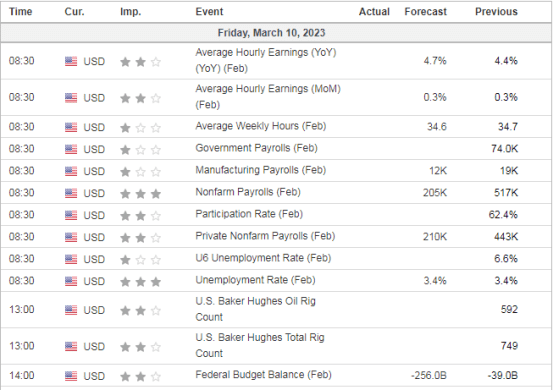

US DATA TODAY

OVERNIGHT COMMODITY HEADLINES

Metals

METALS-Copper falls, set for weekly decline amid Fed rate-hike fears, rising supplies

Gold Rises Amid SVB Nervousness and NFP Data

Energy

Russia exporting diesel to Saudi via ship-to-ship loadings-traders, Refinitiv data

Sudden spurt of Russian crude flows to India calls for better price discovery

Singapore’s oil product stocks dip to six-week low

French downstream strikes extend to a fourth day

India’s Efforts to Avoid a Power Crisis Set to Boost LNG Imports

OPEC+ crude oil production drops in February despite uptick in Russia: Platts survey

Russia Feb diesel exports to Turkey hit record high -traders, Refinitiv data

The LNG price slump is rekindling long-delayed plans to begin importing LNG across Asia

Brazil’s Petrobras, Shell to look for joint drilling opportunities

India’s Energy Security Rests on Fossil Fuels

EU agrees to push for fossil fuel phaseout ahead of COP28 (this failed last year)