CPI DAY!!! 8:30 AM ET !!!

Bank estimates

- JP MORGAN 4.9%

- SCOTIABANK 4.9%

- NOMURA 4.9%

- BARCLAYS 5%

- BLOOMBERG 5%

- BANK OF AMERICA 5%

- CREDIT SUISSE 5%

- HSBC 5%

- TD SECURITIES 5%

- UBS 5%

- WELLS FARGO 5%

- VISA 5.1%

- GOLDMAN SACHS 5.1%

- CIBC 5.1%

- CITI 5.1%

- MORGAN STANLEY 5.1%

MEDIAN 5%

Kinda RED out there

- Hong Kong: Hang Seng closed down -0.53%

- China CSI 300 -0.77%

- Taiwan KOSPI -0.54%

- India Nifty 50 +0.25%

- Australia ASX -0.21%

- Japan Nikkei -0.58%

- All European bourses all in negative territory so far this morning except Spain and German tech

- US indices in very slight negative territory, USD +0.12%

Overnight Data/News

- PBoC Sets Yuan Mid-Point At 6.9299 / Dlr VS Last Close 6.9200

- German CPI (M/M) Apr F: 0.4% (est 0.4%; prev 0.4%) – German CPI (Y/Y) Apr F: 7.2% (est 7.2%; prev 7.2%) – German CPI EU Harmonised (M/M) Apr F: 0.6% (est 0.6%; prev 0.6%) – German CPI EU Harmonised (Y/Y) Apr F: 7.6% (est 7.6%; prev 7.6%)

- Swedish Industrial Orders (M/M) Mar: -1.0% (prev 3.6%) – Swedish Industrial Orders (Y/Y) Mar: -9.3% (prev -4.7%)

- Norwegian CPI (M/M) Apr: 1.1% (est 0.7%; prev 0.8%) – Norwegian CPI (Y/Y) Apr: 6.4% (est 6.1%; prev 6.5%) – Norwegian CPI Underlying (M/M) Apr: 1.0% (est 0.8%; prev 0.6%) – Norwegian CPI Underlying (Y/Y) Apr: 6.3% (est 6.1%; prev 6.2%)

- Italian Industrial Production (M/M) Mar: -0.6% (est 0.3%; prev -0.2%) – Italian Industrial Production WDA (Y/Y) Mar: -3.2% (est -1.7%; prev -2.3%) – Italian Industrial Production NSA (Y/Y) Mar: -3.3% (prev -2.2%)

- US Trade Chief to Meet China Minister in Sign of Warmer Ties – BBG

- US Banks Generated Record First-Quarter Profits Despite Turmoil – FT

- China Bond Yields Fall As Economic Recovery Turns Patchy, Fuelling Bets On Rate Cuts – FP

- UK Financial Markets Price 100% Chance Of Bank Of England Rate Hike On Thursday

- US Oil Major Chevron Plans To Boost Its Venezuelan Output, Optimize Exports To Accelerate Debt Recovery – RTRS Sources – Chevron Recovers About $220 Mln Of Venezuela’s Outstanding Debt, Aims For All $3 Bln By End 2025

- US Department Of Justice Is Looking At Short Selling Activity In Regional Bank Shares – RTRS Sources

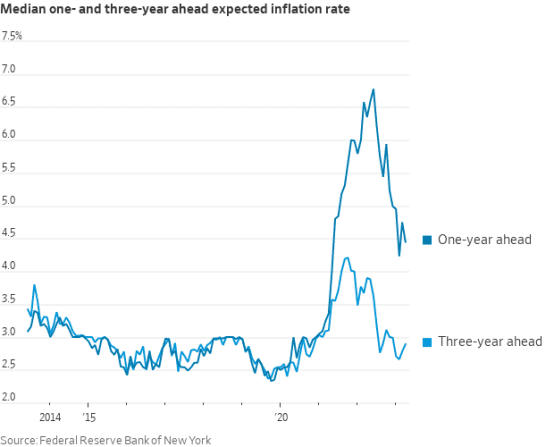

- The New York Fed’s survey of consumers found inflation expectations declined to 4.4% at the one-year-ahead horizon but increased slightly to 2.9% at the three-ahead horizon

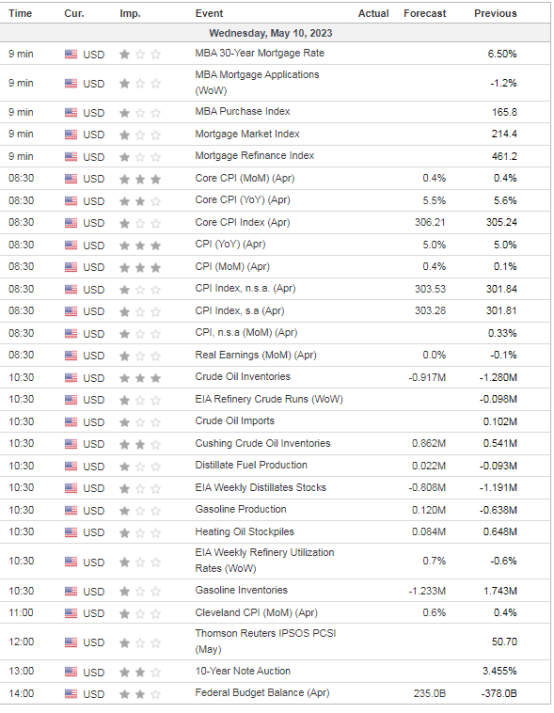

US DATA TODAY