Pretty RED out there

- Hong Kong: Hang Seng closed down -1.76%

- China CSI 300 -0.73%

- Taiwan KOSPI -0.72%

- India Nifty 50 +0.24%

- Australia ASX +0.23%

- Japan Nikkei -0.21%

- European bourses in NEGATIVE territory so far this morning

- USD -0.03%

Stocks Retreat on Powell Interest Rate Warning-BBG

Global equities retreated after Federal Reserve Chair Jerome Powell’s warning that interest rates may have to climb further.

The Stoxx 600 shed 0.6%, undermined also by a set of poor corporate announcements. Shares in Diageo Plc fell more than 8% on a surprise outlook cut from the drinks maker, while Richemont sank as much as 6% after the Swiss group posted an unexpected drop in earnings. Energy shares outperformed as the WTI crude oil benchmark rose for the second day in a row.

Nasdaq 100 index futures slipped 0.2%, while 10-year Treasury yields held steady around 4.63%, after surging on Thursday on renewed concern about higher interest rates. Earlier, Asian shares fell, tracking Wall Street’s lower close.

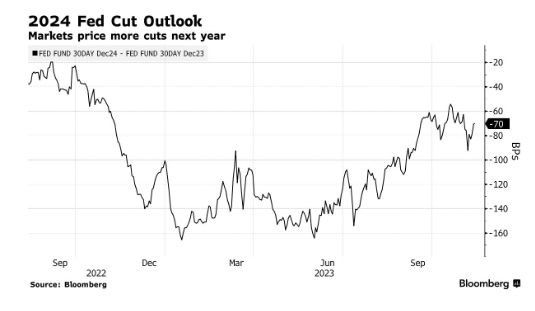

Powell said officials would move carefully but won’t hesitate to tighten policy further if needed to contain inflation. A weak auction of 30-year notes also fueled the drop in Treasuries, rekindling concerns investors will struggle to soak up the swelling supply of new debt.

“Powell’s statement moved the trading consensus that the US 10-year yield has peaked for the year. Hence risk-assets that rallied in the last few weeks are re-assessing ‘what if’ the US 10-year yield is back to 5%,” said Manish Kabra, a strategist at Societe Generale SA in London.

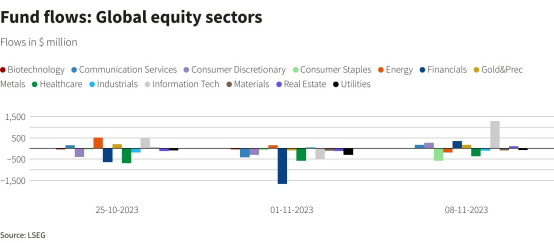

Global equity funds draw massive inflows as rate worries ease-Reuters

Global equity funds saw a significant uptick in demand in the week through Nov. 8 as investor sentiment improved following the decision of major central banks to keep policy rates unchanged.

Investors poured a net $5.63 billion into global equity funds during the week, registering their biggest weekly net purchase since Sept. 13.

European, and U.S. equity funds had purchases of $2.92 billion and $1.9 billion respectively. Asia drew just $708 million, the smallest amount since Aug. 16.

The technology sector stood out, securing $1.3 billion in inflows, its highest since early July. Financials also saw positive movements with $354 million in inflows, but consumer staples experienced outflows of about $571 million.

Money market funds continued to attract investors for the third consecutive week, with net inflows of about $53.75 billion.

Global bond funds broke a three-week streak of outflows, registering $6.73 billion in net purchases.

Reflecting improved risk appetite, high yield bond funds saw substantial inflows of around $6.43 billion, the biggest weekly gain since mid-June 2020.

Government bond funds also experienced net purchases of about $2.76 billion. In contrast, global short-term bond funds faced approximately $4.44 billion in outflows.

In the commodities sector, precious metal funds continued to attract interest, garnering $73 million in net purchases for a second consecutive week. Energy funds also maintained their appeal with $54 million in inflows, marking three weeks of consecutive gains.

Emerging market data, encompassing 29,633 funds, indicated a net sell-off of $1.73 billion in EM equity funds, extending a 13-week withdrawal streak. In contrast, EM bond funds received $592 million – their first weekly inflow in 15 weeks.

COMMENTS: That accounts for the everything rally last week

China’s Property Risks ‘Manageable,’ PBOC Governor Says-BBG

China’s property sector risks are under control, central bank Governor Pan Gongsheng said, amid heightened concern over the financial health of another major developer in the troubled industry.

“We’re closely watching financial risks in certain sectors,” Pan said in an interview with state broadcaster China Central Television published on Friday. “Overall, financial risks of the property sector are manageable.”

The comments underscore efforts by Chinese authorities to ease market worries over the property crisis, which is hindering an economic rebound. China Vanke Co., the country’s second-largest developer by contracted sales, said earlier this week it would repay its debts on time after getting signals of support from a local regulator and its biggest shareholder.

COMMENTS: Clearly China markets were not convinced overnight

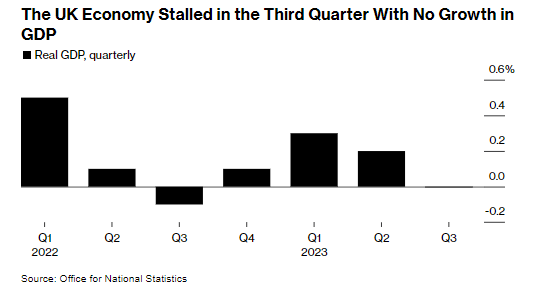

UK Staves Off Recession Threat for Now With Stagnant Quarter-BBG

The UK economy flatlined in the third quarter, defying forecasts of a small contraction and ensuring a recession is avoided this year, as strong trade came to the rescue of poor domestic activity.

Gross domestic product was unchanged from the second quarter, the Office for National Statistics said Friday. Economists surveyed by Bloomberg had forecast a 0.1% decline on average. In September alone, GDP rose 0.2%.

A quarter of stagnation had been predicted by the Bank of England, which expects the economy to register no growth at all next year. Consumer spending, business investment and government spending all fell in the third quarter, leaving the economy underpinned by a better trade performance as exports rose and imports declined.

World’s Biggest Bank Forced to Trade Via USB Stick After Hack-BBG

On Thursday, trades handled by the world’s largest bank in the globe’s biggest market traversed Manhattan on a USB stick.

Industrial & Commercial Bank of China Ltd.’s US unit had been hit by a cyberattack, rendering it unable to clear swathes of US Treasury trades after entities responsible for settling the transactions swiftly disconnected from the stricken systems. That forced ICBC to send the required settlement details to those parties by a messenger carrying a thumb drive as the state-owned lender raced to limit the damage.

The workaround — described by market participants — followed the attack by suspected perpetrator Lockbit, a prolific criminal gang with ties to Russia that has also been linked to hits on Boeing Co., ION Trading UK and the UK’s Royal Mail. The strike caused immediate disruption as market-makers, brokerages and banks were forced to reroute trades, with many uncertain when access would resume.

“This is a true shock to large banks around the world,” said Marcus Murray, the founder of Swedish cybersecurity firm Truesec. “The ICBC hack will make large banks around the globe race to improve their defenses, starting today.”

The incident underscores the benefits of central clearing in the $26 trillion market, said Stanford University finance professor Darrell Duffie.

“I view it as one example of why central clearing in the US Treasuries market is a very good idea,” he said, “because had a similar problem occurred in a not-clearing firm, it’s not clear how the default risk that might result would propagate through the market.”

US DATA TODAY