Mostly GREEN

- Hong Kong: Hang Seng closed up +0.84%

- China CSI 300 -0.75%

- Taiwan KOSPI -0.26%

- India Nifty 50 +0.92%

- Australia ASX +0.20%

- Japan Nikkei +1.89%

- European bourses in positive territory so far this morning

- USD -0.18%

TOP STORIES OVERNIGHT

China Mulls New Stimulus, Higher Deficit to Meet Growth Goal-BBG

China is considering raising its budget deficit for 2023 as the government prepares to unleash a new round of stimulus to help the economy meet the official growth target, according to people familiar with the matter.

Policymakers are weighing the issuance of at least 1 trillion yuan ($137 billion) of additional sovereign debt for spending on infrastructure such as water conservancy projects, said the people, asking not be identified discussing a private matter. That could raise this year’s budget deficit to well above the 3% cap set in March, one of the people said. An announcement may come as early as this month, another person said, though deliberations are ongoing and the government’s plans could change.

The discussions underscore mounting concerns among China’s top leadership over the trajectory of the world’s second-largest economy and how growth compares to the US. It would also mark a shift in Beijing’s stance as the government has so far avoided broader fiscal stimulus despite a deepening property crisis and rising deflationary pressure that have put the growth goal of around 5% for the year at risk.

The offshore yuan erased a loss to trade 0.1% higher on the news, while the yield on 10-year government bonds climbed 1.5 basis points to 2.68%. Hang Seng China Enterprises Index futures expiring in October extending gains to 1.7%.

COMMENTS: Global markets liking this

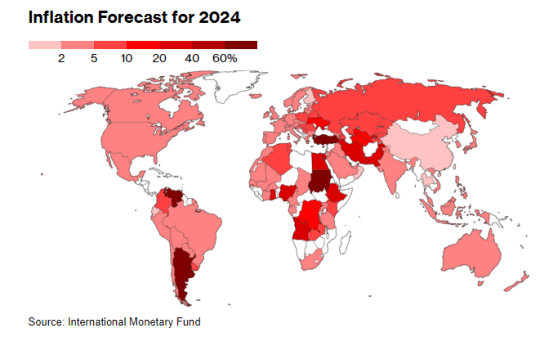

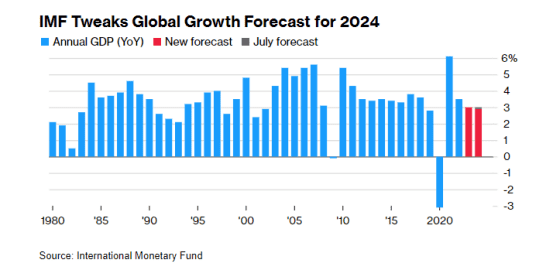

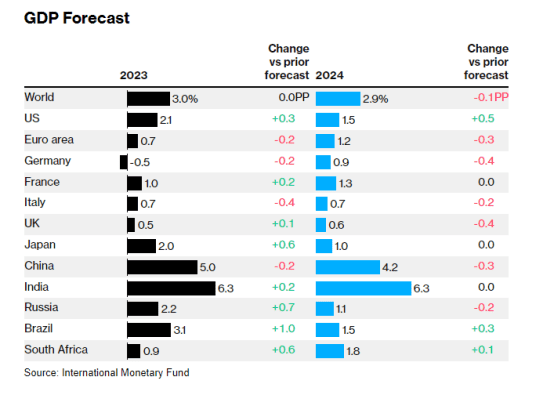

IMF Warns of Stubborn Inflation and Weaker Global Growth in 2024-BBG

The International Monetary Fund lifted its global inflation forecast for next year and called for central banks to keep policy tight until there’s a durable easing in price pressures.

The IMF boosted its projection for the pace of consumer price increases across the world to 5.8% for next year in its World Economic Outlook released Tuesday, up from 5.2% seen three months ago. The call for vigilance on inflation comes as it also trimmed the forecast for economic growth in 2024.

In most countries, the IMF, an institution charged with monitoring the health of the global economy, foresees inflation remaining above central bank targets until 2025.

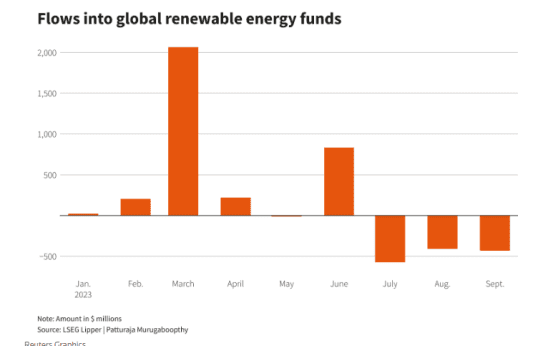

Renewables funds see record outflows as rising rates, costs hit shares-Reuters

Investors ditched renewable energy funds at the fastest rate on record in the three months to end-September as cleaner energy shares took a beating from higher interest rates and soaring material costs, which are squeezing profit margins.

Renewable energy funds globally suffered a net outflow of $1.4 billion in the July-September quarter, the biggest ever quarterly outflow, according to LSEG Lipper data.

Investors have been exiting traditional energy funds, too, but the rate has slowed – net outflows reached $438 million in the last quarter compared with $3.32 billion in the previous three months.

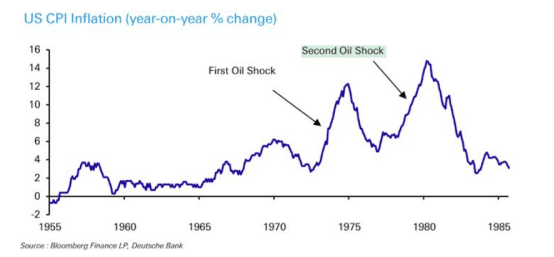

1970s-style stagflation may be at risk of repeating itself, Deutsche Bank warns-MarketWatch

A major Wall Street bank is warning about the risk that inflation expectations could become unanchored in a fashion similar to the 1970s stagflation era.

Weekend attacks on Israel by Hamas illustrate how geopolitical risks can suddenly return — adding to the surprise shocks of the current decade, such as the COVID-19 pandemic and Russia’s invasion of Ukraine, said macro strategist Henry Allen and research analyst Cassidy Ainsworth-Grace of Frankfurt-based Deutsche Bank DB, -1.40%.

Oil prices settled more than 4% higher on Monday as traders weighed the impact of the war in the Middle East on crude supplies. The spike in energy prices is adding to the growing list of similarities to the 1970s era — which also includes consistently above-target inflation across major economies and repeated optimism about how quickly it would fall; strikes by workers; and even increasing chances that this winter will be dominated by the El Niño weather pattern, similar to what took place in 1971 and which is historically tied to higher commodity prices, according to Deutsche Bank.

Inflation remains above central banks’ targets in every G-7 country — the U.S., Canada, France, Germany, Italy, Japan, and the United Kingdom. How long it will remain high is one of the most important questions facing financial markets, and a destabilization of expectations would make it even harder for policy makers to restore price stability.

COMMENTS: I literally just wrote about this in my weekend PYT blog

Stockholm Bans Diesel, Petrol Cars in City Center From 2025-BBG

Stockholm plans to ban petrol and diesel cars in part of the city starting in 2025 in a bid to crack down on pollution.

An area of about 20 blocks that straddles the Swedish capital’s finance area and main shopping drags will only allow electric cars, some hybrid trucks and fuel-cell vehicles, according to rules to be presented on Wednesday, SVT reported on its website. An expansion of the zone could be decided in the first half of 2025.

Stockholm could be the first major capital to introduce such a wide prohibition and goes further than plans by Paris, Athens and Madrid to ban diesel cars. Other cities, including London, have introduced low-emission zones that include daily fees for entering the city center in older combustion engines.

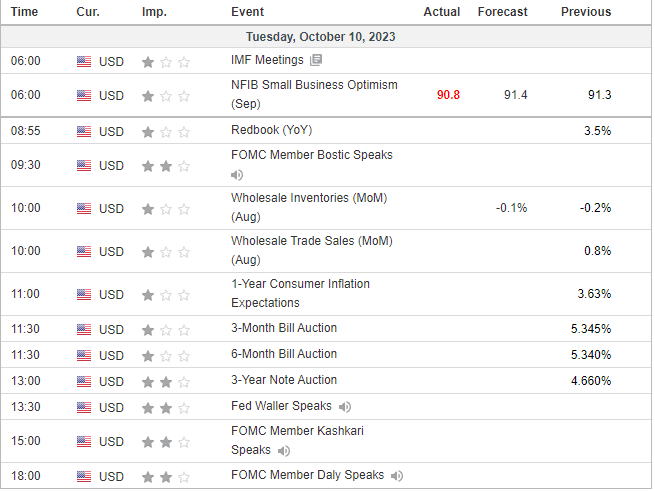

US DATA TODAY