Pretty RED out there

- Hong Kong: Hang Seng closed down -0.90%

- China CSI 300 -2.30% !!!!!

- Taiwan KOSPI -0.40%

- India Nifty 50 -0.61%

- Australia ASX +0.33%

- Japan Nikkei MARKET CLOSED DUE TO HOLIDAY

- European bourses all in negative territory so far this morning

- USD FLAT

TOP STORIES OVERNIGHT

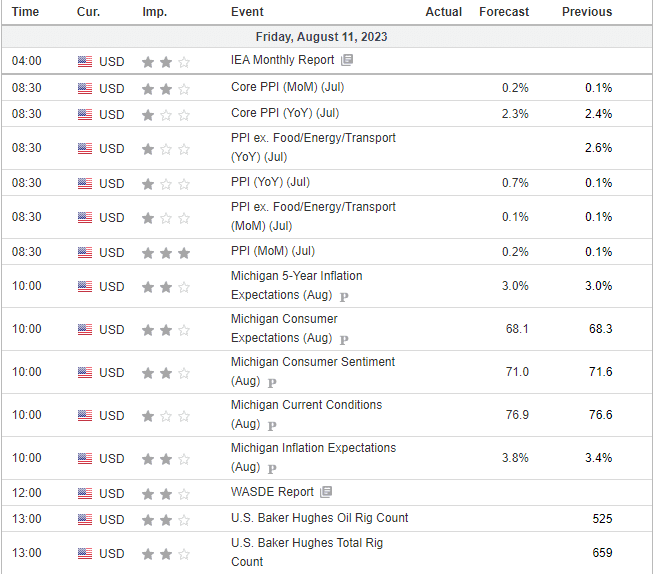

China Loans Plunge to 14-Year Low, Adding to Deflation Risk-BBG

The plunge in loans is another sign of weak demand in China, and adds to a raft of negative data recently showing deflation in the economy, plunging exports and a slump in manufacturing activity. On top of that, the property market crisis is worsening, with fears mounting of another default of a major developer.

The offshore yuan extended a decline shortly after the data, dropping as much as 0.2% to 7.2558 per dollar, the weakest since July 7.

The gloomy economic news is adding pressure on policymakers to boost monetary and fiscal stimulus. However, the PBOC has been proceeding cautiously, held back by several factors, including a weak yuan and financial stability risks, given high debt levels in the economy.

The plunge in loans is another sign of weak demand in China, and adds to a raft of negative data recently showing deflation in the economy, plunging exports and a slump in manufacturing activity. On top of that, the property market crisis is worsening, with fears mounting of another default of a major developer.

The offshore yuan extended a decline shortly after the data, dropping as much as 0.2% to 7.2558 per dollar, the weakest since July 7.

The gloomy economic news is adding pressure on policymakers to boost monetary and fiscal stimulus. However, the PBOC has been proceeding cautiously, held back by several factors, including a weak yuan and financial stability risks, given high debt levels in the economy.

This is why China market is down so much (investors fleeing) and European markets are sour

Global Oil Demand Hits Record and Prices May Climb, IEA Says-BBG

Consumption reaches 103 million barrels a day for first time

Saudi-led supply cuts pose a ‘risk of driving prices higher’

Global oil demand has surged to a record amid robust consumption in China and elsewhere, threatening to push prices higher, the International Energy Agency said.

World fuel use averaged 103 million barrels a day for the first time in June and may soar even higher in August, the agency said in a report. As Saudi Arabia and its partners constrict supplies, oil markets are tightening significantly.

“Oil demand is scaling record highs, boosted by strong summer air travel, increased oil use in power generation and surging Chinese petrochemical activity,” the Paris-based IEA said. “Crude and products inventories have drawn sharply” and “balances are set to tighten further into the autumn.”

The energy transition looks set to have an impact next year, when global demand growth will roughly halve to 1 million barrels a day due to improved vehicle efficiency and the adoption of electric cars, the IEA said.

But in the meantime, world markets are tightening, leaving oil inventories in developed nations about 115 million barrels below their five-year average, according to the report. Global stockpiles are set to deplete by a hefty 1.7 million barrels a day in the second half of the year, and preliminary data appears to confirm declines in July and August, the IEA said.

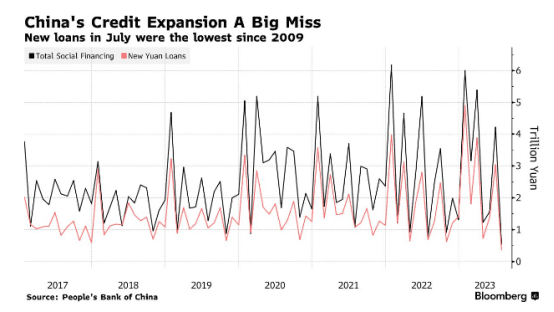

Yen Within Sight of 145 Per Dollar on Wide Japan-US Yield Gap-BBG

The yen hovered just short of the psychological 145 level versus the dollar on Friday as a persistently wide interest-rate gap with the US weakens the Japanese currency.

Investors are on guard for any sharp moves amid a holiday in Japan, which has reduced trading volumes and increased the risk of volatility.

The currency hasn’t breached 145 since June 30 and any depreciation past 145.07 would take it to levels seen in late 2022, when Japanese authorities intervened in the market. It was steady at 144.70 at 12:48 p.m. Tokyo time.

The yen has been under pressure all week and continued to slide during Thursday’s session as Treasury yields rose following a poorly received US 30-year bond auction. Benchmark 10-year Japanese government bond yields sit below 0.6%, versus about 4.1% for similar maturity Treasuries. Neither JGBs nor Treasuries were trading during Asian hours Friday due to the holiday in Japan.

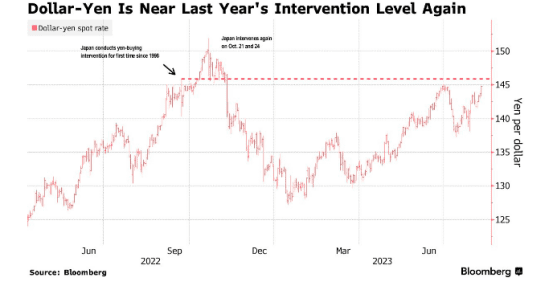

UK Economy Surprises With Strongest Growth in More Than Year-BBG

The UK economy delivered its strongest quarterly growth in more than a year, a surprising show of resilience that will keep pressure on the Bank of England to raise rates further.

Gross domestic product rose 0.2% from the first quarter, the biggest increase since the start of 2022, the Office for National Statistics said Friday. The Bank of England had expected a 0.1% expansion. Output in June jumped 0.5%, more than double the 0.2% pace expected by economists.

Manufacturing and construction output were both stronger than expected in June, rebounding from the loss of a working day in May for King Charles III’s coronation. The figures point to momentum in the economy that’s likely to fan upward pressure on wages and prices, underpinning the case for more rate hikes.

Case of good news is bad (fears of higher rates), FTSE down -0.52%

Russia Oil Breaches Price Cap as Export Revenue Hits 2023 High-BBG

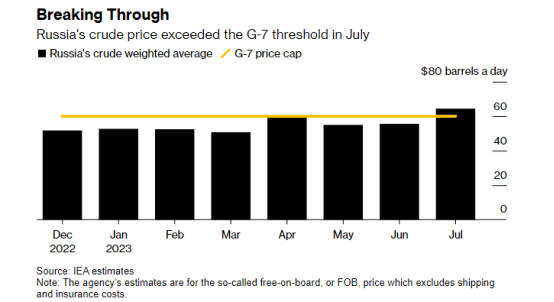

Russia’s crude breached the price cap set by the Group of Seven nations in July, while revenue from oil exports soared to an eight-month high, according to the International Energy Agency.

The price of the country’s seaborne crude shipments last month jumped to $64.41 a barrel on a weighted average, “smashing” the $60 price limit set last year by the G-7, the IEA said in latest monthly report.

The Western alliance imposed the cap to limit the stream of petrodollars to Moscow amid the war in Ukraine — all while keeping Russian oil flowing in global markets. Russia is one of the world’s top oil producers and too-severe restrictions risked causing a broader spike in prices. As pricing data has emerged in recent weeks, however, the response from Washington and Brussels has been muted.

If you listen to my Place Your Trades spaces on Wednesdays you already knew this weeks ago🙂 That said with oil prices this eye, there is little the West will do about it.

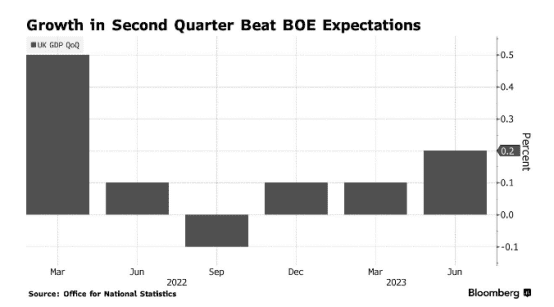

US DATA TODAY

Big Grain Report Today (WADSE)